Web when it’s tax season, you can look back on your spreadsheet to identify all of the costs that are deductible. We’ll discuss these common tax deductions in the next section, so be sure to keep reading! Business meals for employees, clients, and potential clients can be tax deductible, depending on the purpose of the meal. Create a table outline in the google sheets document. Web write it off using:

Name the google sheets document. In fact, users typically save $5,600 from their tax bill. We’ll discuss these common tax deductions in the next section, so be sure to keep reading! Create a new google sheets document for the tax deduction spreadsheet. If your home office is larger than 300 square feet you have two options.

Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by $5 per square foot. Web write it off using: Web scan all the documents if they are in paper form. If you hire freelancers or independent contractors to help in your business, you can deduct their fees as a business expense. Input each receipt data into a spreadsheet.

Web when it’s tax season, you can look back on your spreadsheet to identify all of the costs that are deductible. Web software (e.g., quickbooks, teletherapy service, ehr software, dropbox) typically, most of the items in this category relevant to private practice are online. Just click on the link above and make a copy in google sheets. In fact, users typically save $5,600 from their tax bill. Building a good credit score. From there, you can also download it to use as a 1099 excel template. Tax deductions are expenses, often for business, that can be subtracted from your gross taxable income—helping you lower your tax payments and invest in your work. Web scan all the documents if they are in paper form. The maximum square footage you can use is 300 square feet. As a freelance consultant, you can save significantly on your tax bill simply by writing off all the ordinary business expenses you encounter every day. This will give you the total amount of deductions that you can claim on your tax return. You can deduct expenses when traveling for work. Tax credits, a direct reduction of one's tax liability, cover a range of items from education to energy efficiency. That amount may change from time to time, but it's currently $5.00 per square foot. As a result, your maximum deduction amount is $15,000.

Tax Deductions Are Expenses, Often For Business, That Can Be Subtracted From Your Gross Taxable Income—Helping You Lower Your Tax Payments And Invest In Your Work.

From there, you can also download it to use as a 1099 excel template. Input details of each tax deduction in the table. Name the google sheets document. If your home office is larger than 300 square feet you have two options.

In Fact, Users Typically Save $5,600 From Their Tax Bill.

Web when it’s tax season, you can look back on your spreadsheet to identify all of the costs that are deductible. Web below are some of the expenses that should be tracked in an independent contractor expenses spreadsheet: Input each receipt data into a spreadsheet. You can deduct expenses when traveling for work.

Identify All Deductible Expenses For The Tax Year.

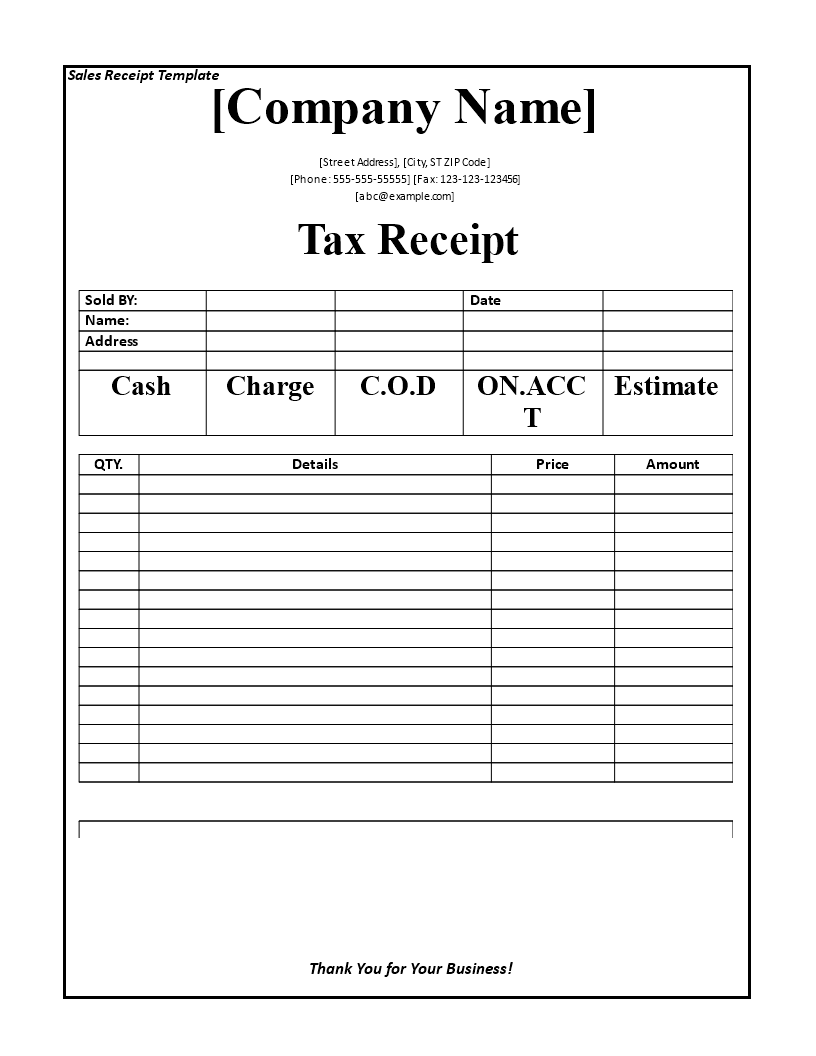

Web write it off using: We’ll discuss these common tax deductions in the next section, so be sure to keep reading! Web income & deduction overview your name current year income amount billed,taxes billed,total income freelance income,ca$ 0.00,ca$ 0.00,ca$ 0.00 tax deductions total deduction business,purchases during the year,ca$ 0.00,ca$ 0.00 subcontracts,ca$ 0.00 advertising,ca$ 0.00 meals & entertainment,ca$ 0.00 Check the compliance of each expense with irs rules.

It's Been Updated With All The Latest Info For You:

Use the provided form field to enter the overall total. Prepare a summary of the total deductions. File will be uploaded here. This will give you the total amount of deductions that you can claim on your tax return.