Web here's everything you need to know about standby letter of credit (sblc), the types, the advantages, and the costs, stating a difference with lc & bank guarantee. Web a standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment. Web here's everything you need to know about standby letter of credit (sblc), the types, the advantages, and the costs, stating a difference with lc & bank guarantee. Web what is a standby letter of credit (sblc) •in short (and very simply put) ; What a standby letter of credit is;

Web a standby letter of credit (sblc) refers to a legal instrument issued by a bank on behalf of its client, providing a guarantee of its commitment to pay the seller if its client (the buyer) defaults on the agreement. Web standby letters of credit (sloc) have become an integral part of the modern business world, providing companies with essential financial protection and security. It is a payment of last resort from the bank, and ideally, is never meant to be used. Web a standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment. A sblc can be utilized within a wide range of financial and commercial transactions.

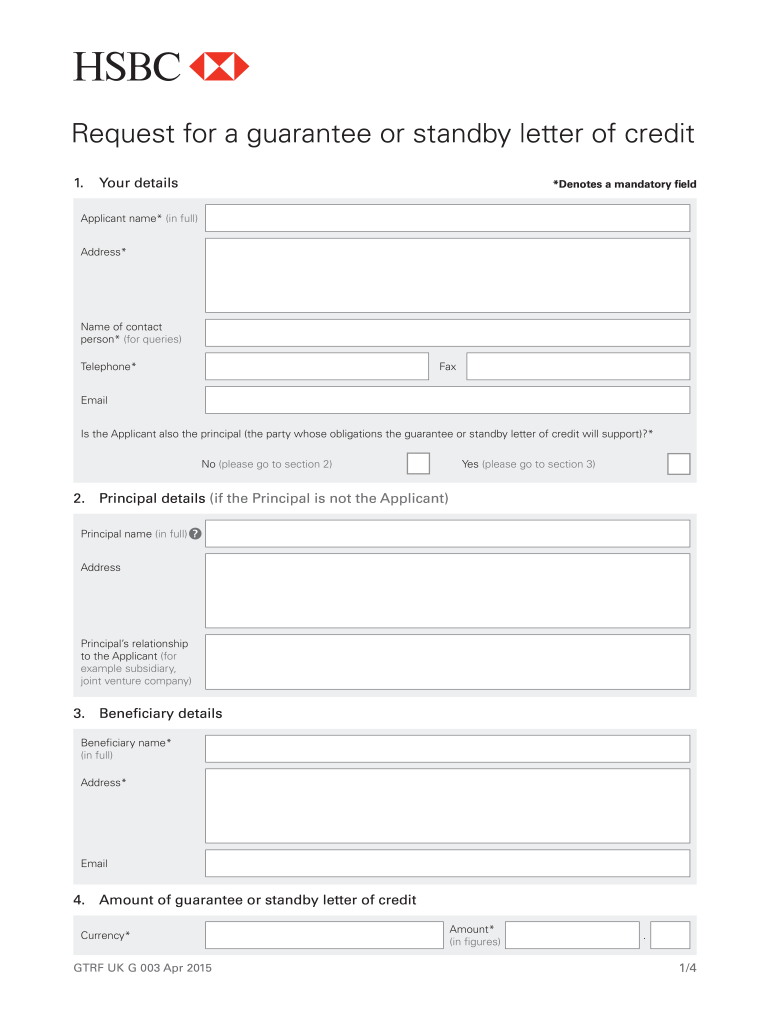

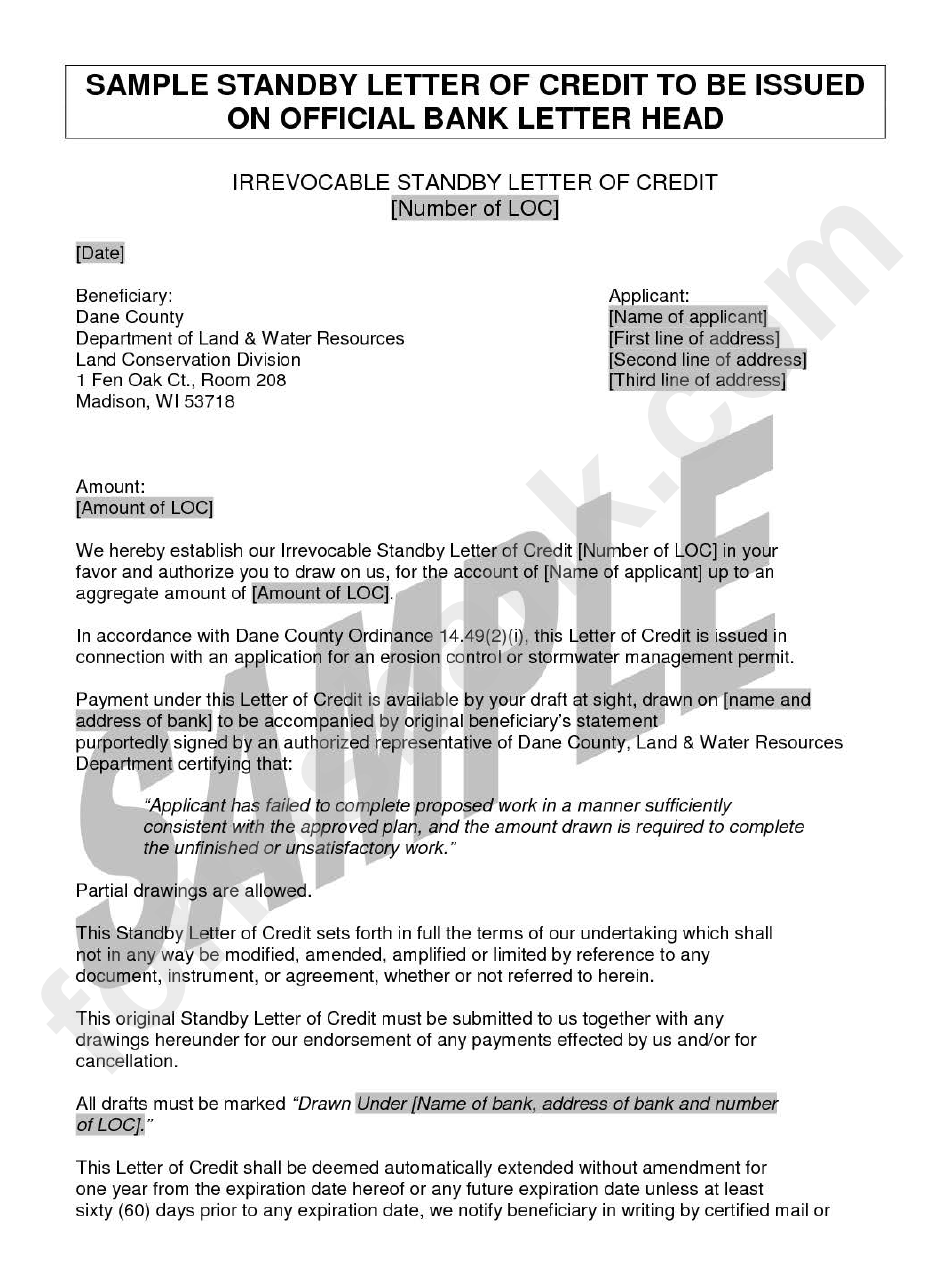

Web a standby letter of credit (sblc) refers to a legal instrument issued by a bank on behalf of its client, providing a guarantee of its commitment to pay the seller if its client (the buyer) defaults on the agreement. Web standby letter of credit (lc) is a globally accepted financial instrument where an issuing bank takes on its clients’ obligation to: A sblc can be utilized within a wide range of financial and commercial transactions. Web you can request a standby letter of credit from the bank that examines your creditworthiness and makes a decision within several days or weeks. Web application and agreement for standby letter of credit.

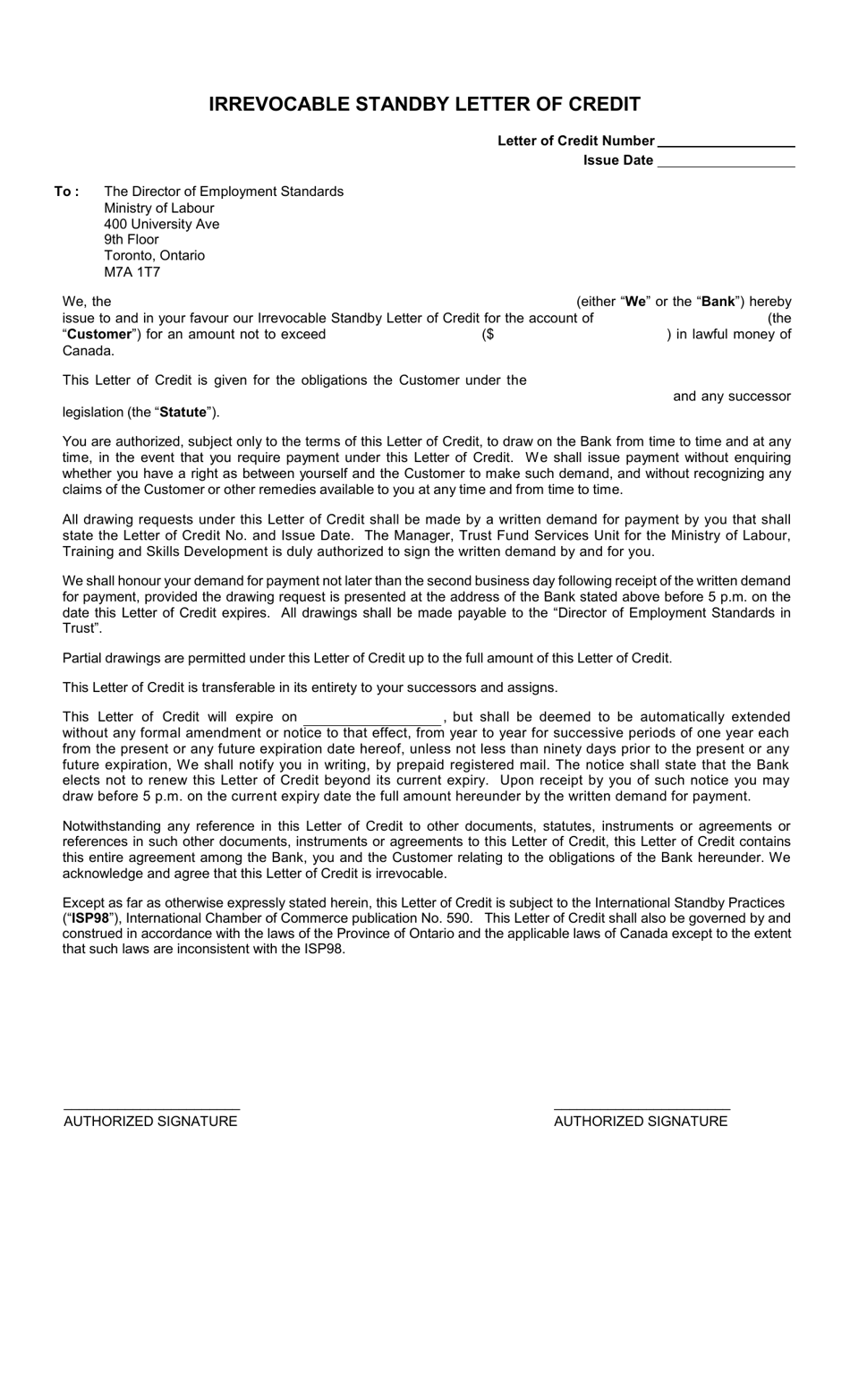

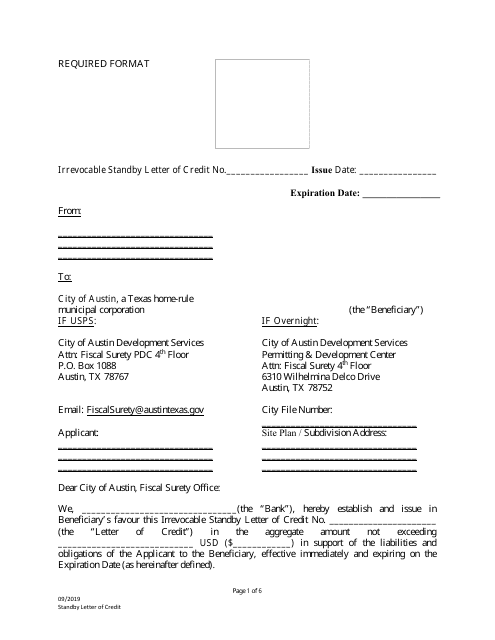

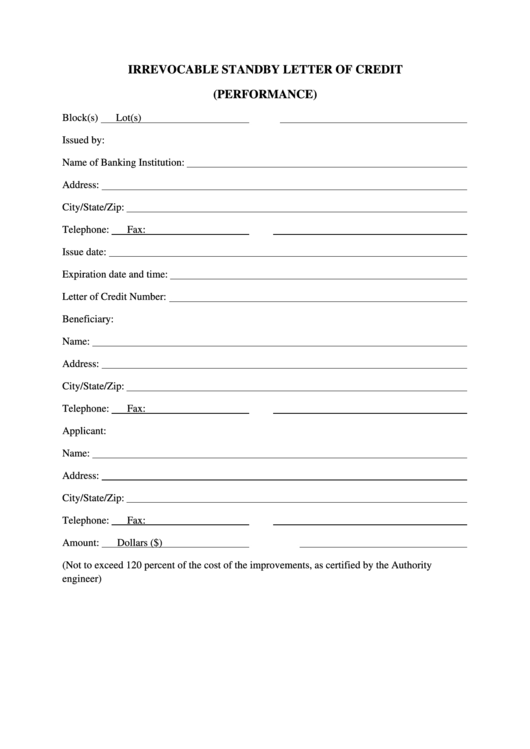

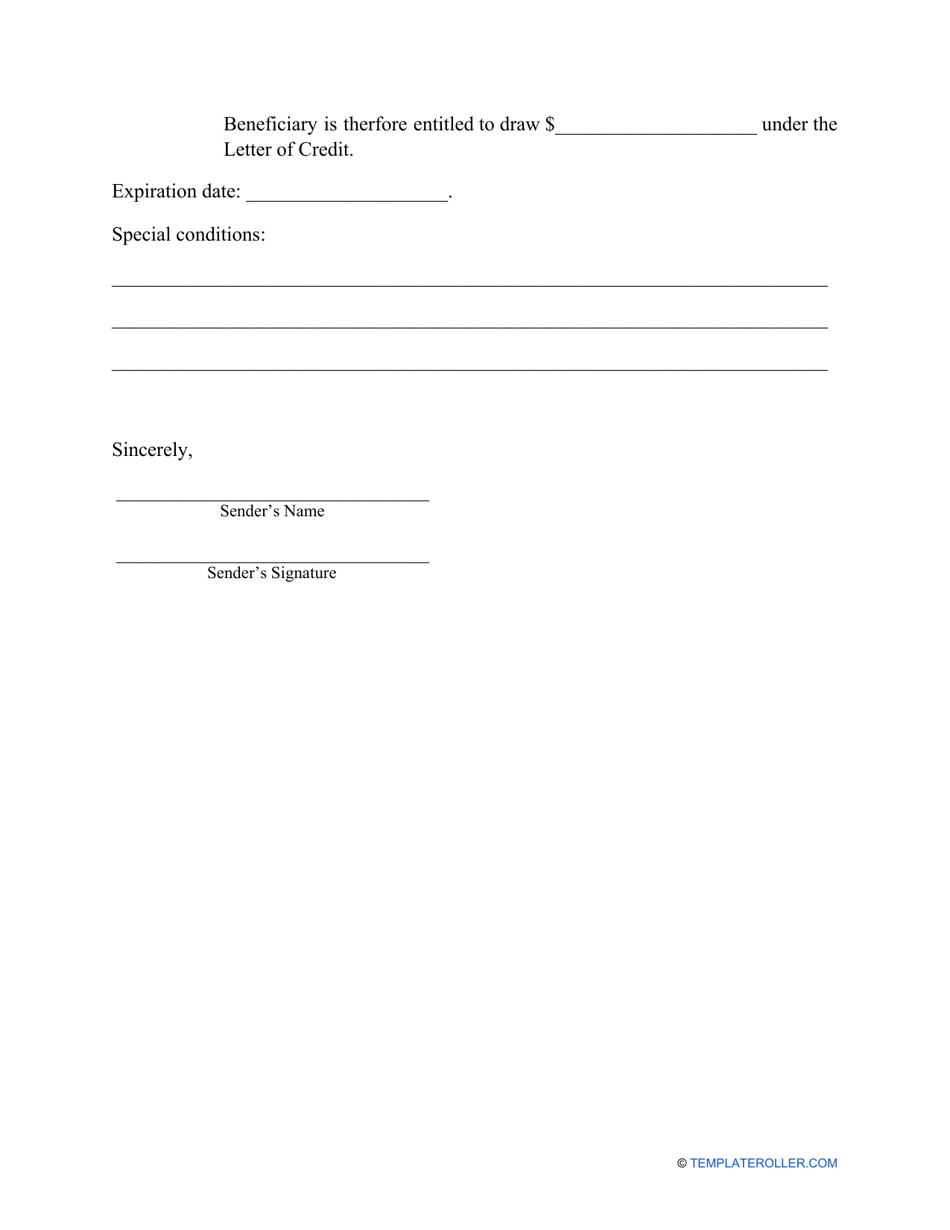

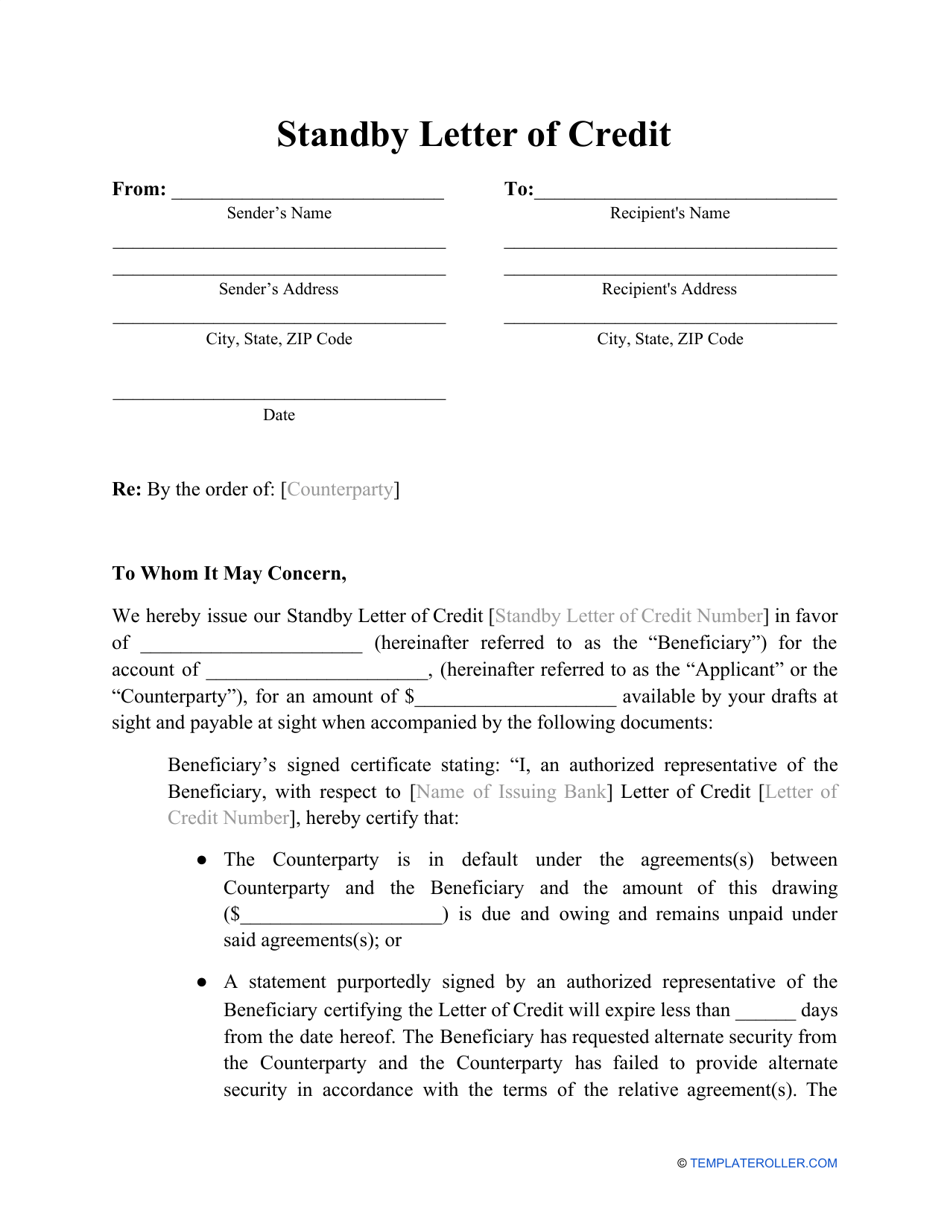

Repay money borrowed by or advanced to or for the account of the account party, make payment on account of any indebtedness undertaken by the account party, or. A bank guarantee in lc format •once upon a time banks in the us found out that they were not allowed to issue (bank) guarantees, however they also found that if they changed the format of the guarantee slightly they could adapt a letter of credit in such (bank use only) please issue an irrevocable letter of credit as set forth below and forward to your correspondent by: A sblc can be utilized within a wide range of financial and commercial transactions. With such an arrangement, a bank guarantees payment to a beneficiary if something fails to happen. Why sblcs are used more commonly in the usa; Web commercial lawyers can use this annotated template standby letter of credit to draft when, at a customer's request, a bank must honor drafts or other demands for payment by the beneficiary of the letter of credit. Web funds under this letter of credit are available to you by making a demand for payment by presentation to us at our offices at [bank, address]. It is a payment of last resort from the bank, and ideally, is never meant to be used. Web a standby letter of credit (sloc) is a legal document that guarantees a bank's commitment of payment to a seller in the event that the buyer—or the bank's client—defaults on the agreement. Web we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit shall be duly honoured on due presentation and delivery of documents as specified, if presented to us on or before ____________________ in ____________________. Web standby letter of credit. Web this letter of credit shall be canceled and terminated upon receipt by us of the usac's certificate purportedly signed by two (2) authorized representatives of usac and countersigned by the fcc’s authorized signatory in the form attached as annex c. Web here's everything you need to know about standby letter of credit (sblc), the types, the advantages, and the costs, stating a difference with lc & bank guarantee. Our free templates and this guide can help you get started.

A Sblc Can Be Utilized Within A Wide Range Of Financial And Commercial Transactions.

Web this letter of credit shall be canceled and terminated upon receipt by us of the usac's certificate purportedly signed by two (2) authorized representatives of usac and countersigned by the fcc’s authorized signatory in the form attached as annex c. Web what is a standby letter of credit (sblc) •in short (and very simply put) ; __________ by order of, for the account of and on behalf of _____________________ (“account party”) and in favor of southwest power pool (“beneficiary” or. Web standby letters of credit (sloc) have become an integral part of the modern business world, providing companies with essential financial protection and security.

It Is A Payment Of Last Resort From The Bank, And Ideally, Is Never Meant To Be Used.

(bank use only) please issue an irrevocable letter of credit as set forth below and forward to your correspondent by: Web a standby letter of credit (sblc / sloc) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment. Web here's everything you need to know about standby letter of credit (sblc), the types, the advantages, and the costs, stating a difference with lc & bank guarantee. Web [signed] [name and title of authorized signatory] [name of issuing bank] [contact information of issuing bank] please note that this is a basic template, and the actual content and format of a standby letter of credit can vary depending on specific requirements and agreements between the parties involved.

With Such An Arrangement, A Bank Guarantees Payment To A Beneficiary If Something Fails To Happen.

Web we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit shall be duly honoured on due presentation and delivery of documents as specified, if presented to us on or before ____________________ in ____________________. Web a standby letter of credit secured by wells fargo deposits ensures that you have the products and resources you need to expand your small business. Swift air mail courier 'dwh. Web commercial lawyers can use this annotated template standby letter of credit to draft when, at a customer's request, a bank must honor drafts or other demands for payment by the beneficiary of the letter of credit.

Risks And Considerations To Be Aware Of When Using Standby Letters Of Credit;

Web a standby letter of credit (sloc) is a legal document that guarantees a bank's commitment of payment to a seller in the event that the buyer—or the bank's client—defaults on the agreement. Our free templates and this guide can help you get started. Web application and agreement for standby letter of credit. Web a standby letter of credit (sblc) refers to a legal instrument issued by a bank on behalf of its client, providing a guarantee of its commitment to pay the seller if its client (the buyer) defaults on the agreement.