Web there are two components to payroll reconciliation—reconciling a payroll cycle before processing it and performing a balance sheet reconciliation to find errors. We’re going to walk you through everything you need to know to complete both and make payroll a little less stressful. This is especially true for salaried employees whose gross pay is consistent month to month. This step involves calculating the employee’s gross pay against the correct hourly pay rates for your business. Web the payroll reconciliation process is an important part of managing payroll.

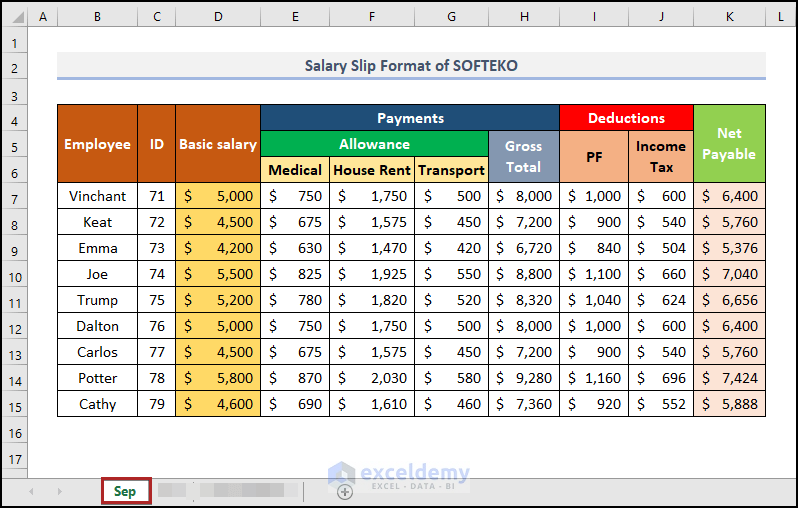

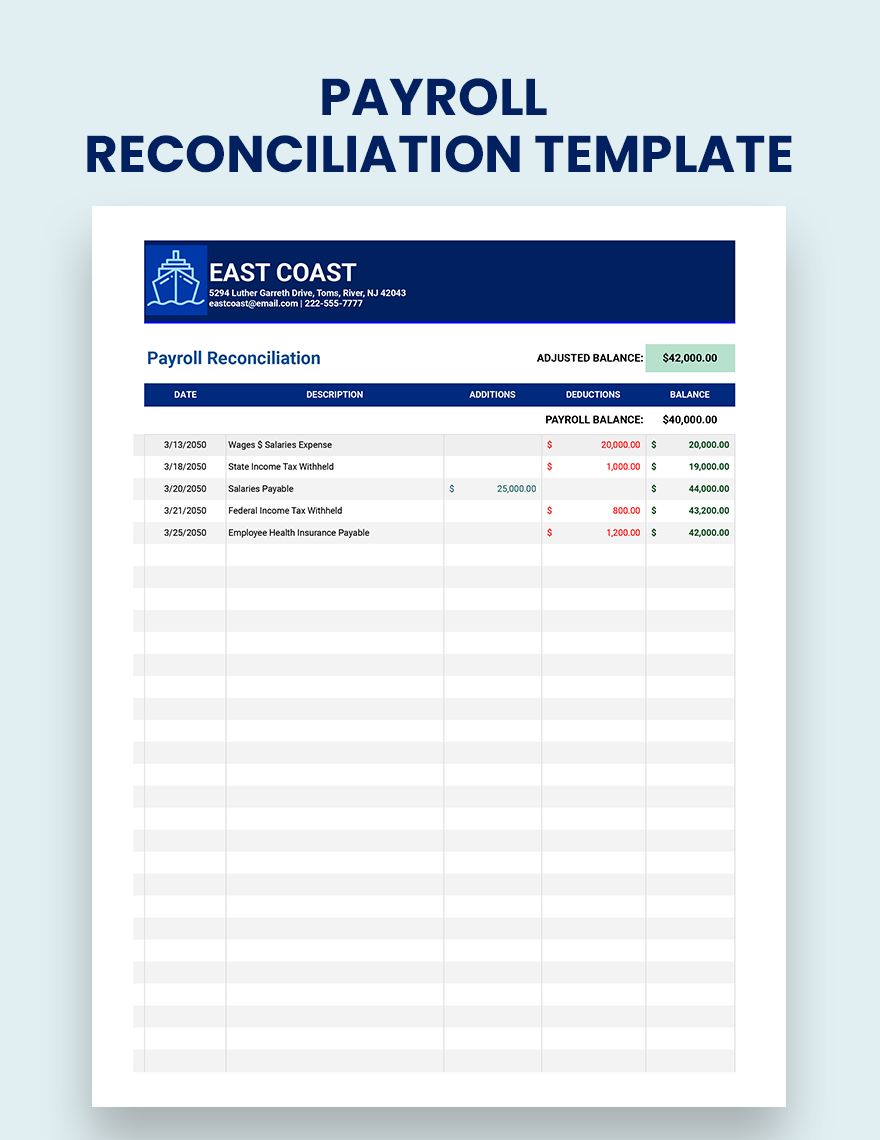

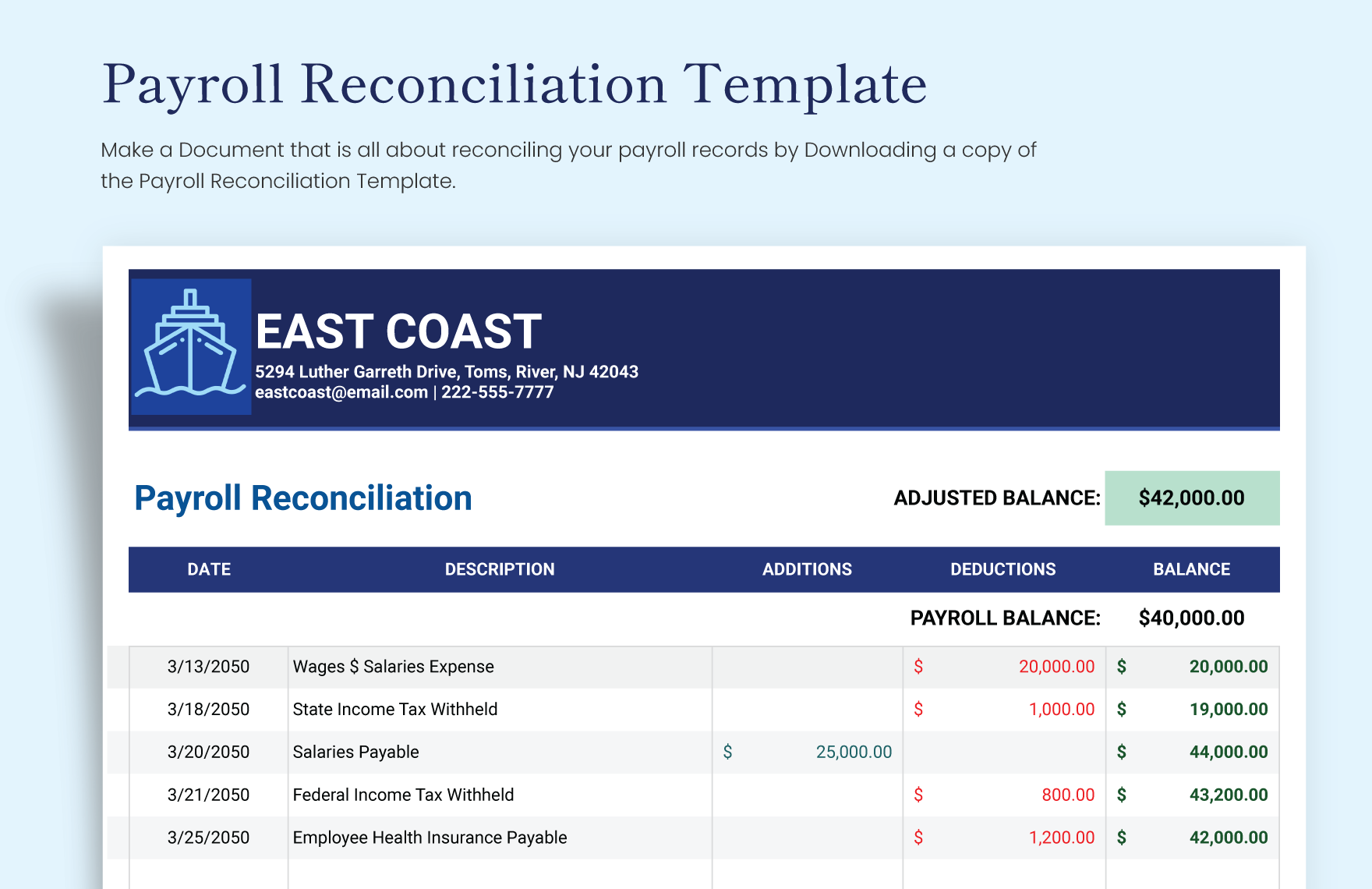

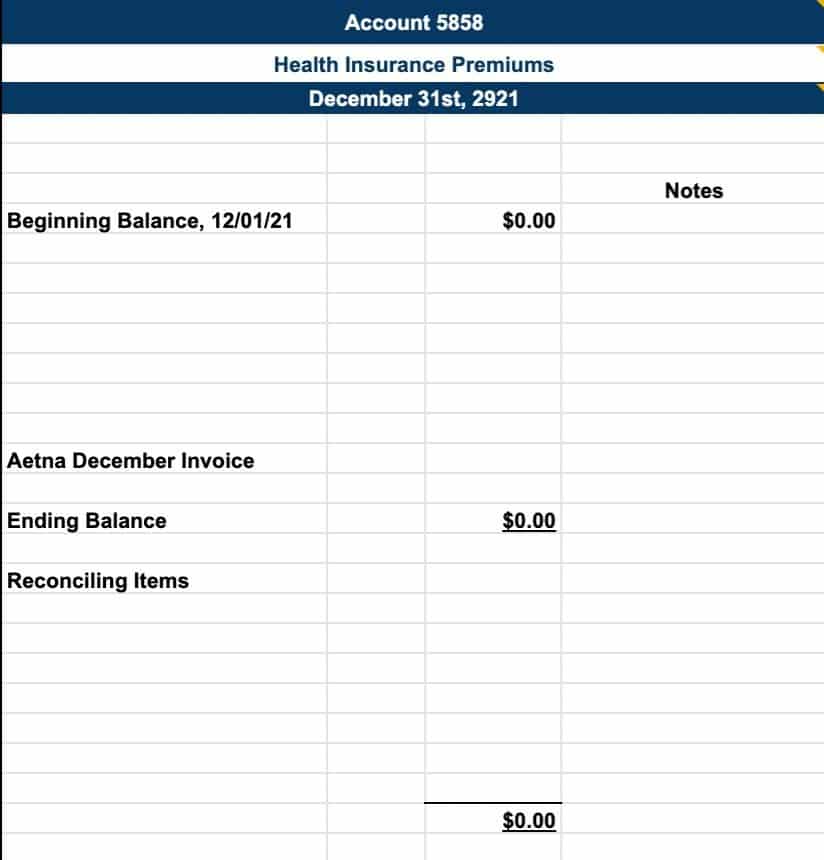

Web easily editable, printable, downloadable. Web whether it’s a microsoft excel spreadsheet or a register provided by your payroll service provider, your payroll register displays the information you’ve entered for the payroll period. Web a standardized excel template for payroll should have tabs for each month, with links to formulas that calculate employee taxes, deductions, and pay. This editable template simplifies reconciliation processes, ensuring accuracy and efficiency. Here, we'll show 3 easy and quick step with proper illustrations regarding this case

Let’s look at how reconciliation works and how to do it in six easy steps: Includes pay stubs, timesheets, a payroll register template, and more. Seamlessly reconcile payroll accounts, identify discrepancies, and enhance financial control. Web the payroll reconciliation process is an important part of managing payroll. For most small businesses, reviewing wages and salaries is the easiest part of payroll reconciliation.

Web in finance terms, “reconciliation” is the process of ensuring all records of the same event are matching and accurate. This editable template simplifies reconciliation processes, ensuring accuracy and efficiency. Web whether it’s a microsoft excel spreadsheet or a register provided by your payroll service provider, your payroll register displays the information you’ve entered for the payroll period. We’re going to walk you through everything you need to know to complete both and make payroll a little less stressful. Web wages and salaries. This is especially true for salaried employees whose gross pay is consistent month to month. Here, we'll show 3 easy and quick step with proper illustrations regarding this case Seamlessly reconcile payroll accounts, identify discrepancies, and enhance financial control. You also need a “set up” tab from which your payroll calculations can pull standard information, such as pay rate and benefits enrolled. Streamline payroll precision with this payroll reconciliation template. Web the payroll reconciliation process is an important part of managing payroll. This step involves calculating the employee’s gross pay against the correct hourly pay rates for your business. Web a standardized excel template for payroll should have tabs for each month, with links to formulas that calculate employee taxes, deductions, and pay. For most small businesses, reviewing wages and salaries is the easiest part of payroll reconciliation. Let’s look at how reconciliation works and how to do it in six easy steps:

Web The Payroll Reconciliation Process Is An Important Part Of Managing Payroll.

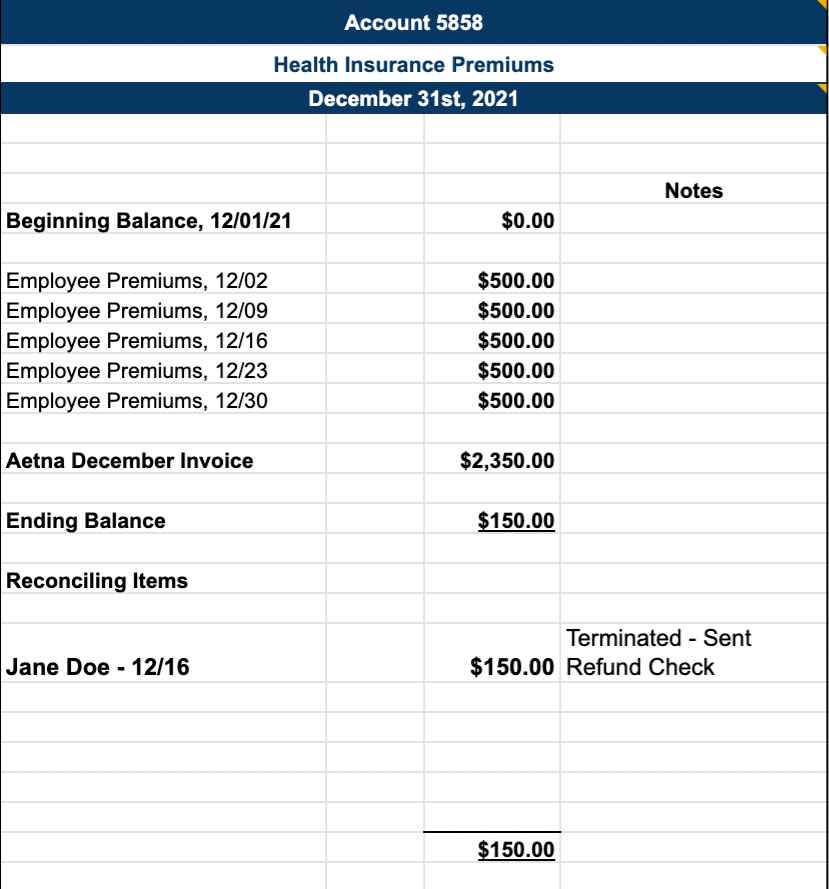

Includes pay stubs, timesheets, a payroll register template, and more. All of your bookkeeping records need to reflect the employee’s actual pay plus all of the deductions from their paychecks. Web in finance terms, “reconciliation” is the process of ensuring all records of the same event are matching and accurate. For payroll, this means you need to verify that your ledger matches the actual payments sent to employees.

Web Download Free Payroll Templates For Excel, Word, And Pdf.

Seamlessly reconcile payroll accounts, identify discrepancies, and enhance financial control. Web easily editable, printable, downloadable. You also need a “set up” tab from which your payroll calculations can pull standard information, such as pay rate and benefits enrolled. Web there are two components to payroll reconciliation—reconciling a payroll cycle before processing it and performing a balance sheet reconciliation to find errors.

Web A Standardized Excel Template For Payroll Should Have Tabs For Each Month, With Links To Formulas That Calculate Employee Taxes, Deductions, And Pay.

Let’s look at how reconciliation works and how to do it in six easy steps: Here, we'll show 3 easy and quick step with proper illustrations regarding this case Web whether it’s a microsoft excel spreadsheet or a register provided by your payroll service provider, your payroll register displays the information you’ve entered for the payroll period. For most small businesses, reviewing wages and salaries is the easiest part of payroll reconciliation.

This Is Especially True For Salaried Employees Whose Gross Pay Is Consistent Month To Month.

We’re going to walk you through everything you need to know to complete both and make payroll a little less stressful. This editable template simplifies reconciliation processes, ensuring accuracy and efficiency. This step involves calculating the employee’s gross pay against the correct hourly pay rates for your business. Streamline payroll precision with this payroll reconciliation template.