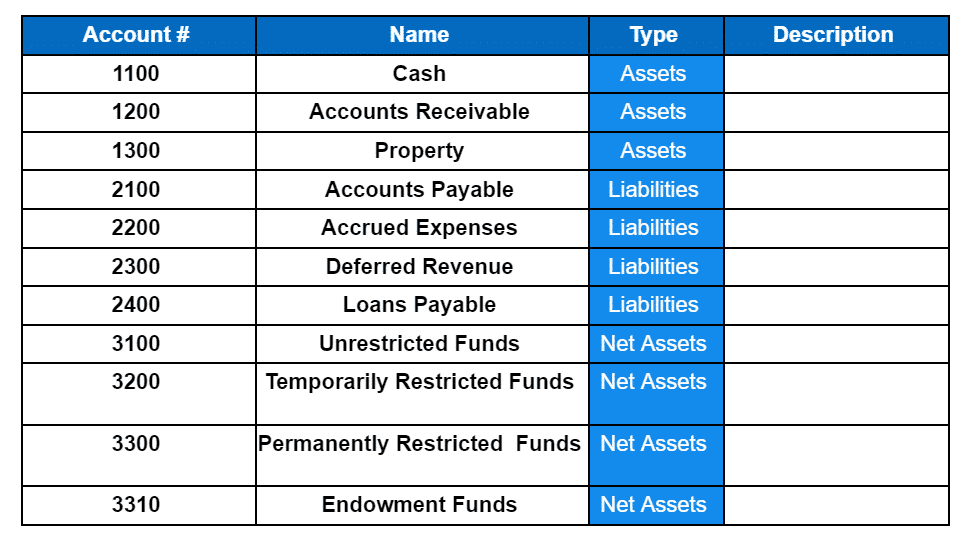

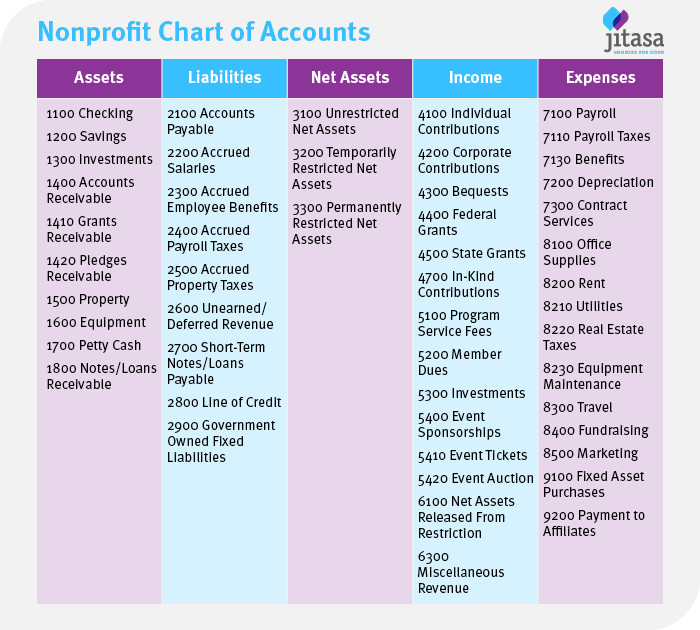

Web a chart of accounts actively lists all the accounts a company or nonprofit uses to record financial transactions. Now, let’s put each of those 5 required categories together to get a full look at a nonprofit chart of accounts. Use this as a guideline, and think carefully before you finalize your account numbers. Why your nonprofit needs a chart of accounts: This list does not include all financial transactions.

Each account in a coa represents a different type of financial transaction, such as revenue, expenses, assets, liabilities, and equity. Web the chart of accounts for a nonprofit organization is similar, but there are some key differences that should be taken into account when setting up the chart. Web download the nonprofit chart of accounts template! Instead, it breaks these accounts into categories like assets, liabilities, income, expenses, and equity. Why your nonprofit needs a chart of accounts:

The pdf file available for download below, will help you to produce your own nonprofit chart of accounts template. Web the chart of accounts for a nonprofit organization is similar, but there are some key differences that should be taken into account when setting up the chart. At a glance, the structure provided by the chart of accounts simplifies the accounting process and makes it easier to understand how the npo's finances are organized. Now, let’s put each of those 5 required categories together to get a full look at a nonprofit chart of accounts. Web the unified chart of accounts (ucoa) is a standardized nonprofit chart of accounts that aligns with the form 990 reporting requirements.

Web what is a nonprofit chart of accounts (coa) a chart of accounts (coa) is a list of financial accounts that helps nonprofits keep track of their transactions. If you’re ready to create a chart of accounts for your nonprofit, you can start with this template, made for you to customize by the charity cfo. Use this as a guideline, and think carefully before you finalize your account numbers. Web download the nonprofit chart of accounts template! A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501(c)(3) status to account for the money they receive and spend. It is the backbone of the financial management system of an organization, enabling accurate recording, reporting, and data analysis. Web a chart of accounts actively lists all the accounts a company or nonprofit uses to record financial transactions. Additionally, it provides a… sample nonprofit chart of accounts: Web a chart of accounts (coa) for nonprofit organizations is a comprehensive listing of financial accounts used to classify and track income, expenses, assets, liabilities, and equity. Your coa will include a. Web a non profit chart of accounts is used by a non profit organization, and is a list of the accounts found in the general ledger with an account code allocated to each account. Web the chart of accounts for a nonprofit organization is similar, but there are some key differences that should be taken into account when setting up the chart. At a glance, the structure provided by the chart of accounts simplifies the accounting process and makes it easier to understand how the npo's finances are organized. This list does not include all financial transactions. Now, let’s put each of those 5 required categories together to get a full look at a nonprofit chart of accounts.

Instead, It Breaks These Accounts Into Categories Like Assets, Liabilities, Income, Expenses, And Equity.

This list does not include all financial transactions. Use this as a guideline, and think carefully before you finalize your account numbers. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. Every organization's chart of accounts looks.

Each Account In A Coa Represents A Different Type Of Financial Transaction, Such As Revenue, Expenses, Assets, Liabilities, And Equity.

Web download the nonprofit chart of accounts template! Web what is a nonprofit chart of accounts (coa) a chart of accounts (coa) is a list of financial accounts that helps nonprofits keep track of their transactions. The pdf file available for download below, will help you to produce your own nonprofit chart of accounts template. In this article, we will outline what a chart of accounts is, how to create one for your nonprofit organization, and provide a template and example for reference.

Additionally, It Provides A… Sample Nonprofit Chart Of Accounts:

A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501(c)(3) status to account for the money they receive and spend. Web a chart of accounts (coa) for nonprofit organizations is a comprehensive listing of financial accounts used to classify and track income, expenses, assets, liabilities, and equity. Web a non profit chart of accounts is used by a non profit organization, and is a list of the accounts found in the general ledger with an account code allocated to each account. Web below is a sample chart of accounts for nonprofit organizations.

We Can View It As A Map That Helps Navigate An Organization’s Financial Landscape.

Why your nonprofit needs a chart of accounts: It is the backbone of the financial management system of an organization, enabling accurate recording, reporting, and data analysis. Web the unified chart of accounts (ucoa) is a standardized nonprofit chart of accounts that aligns with the form 990 reporting requirements. At a glance, the structure provided by the chart of accounts simplifies the accounting process and makes it easier to understand how the npo's finances are organized.