This tutorial shows how to create a merger and acquisition financial model in microsoft excel, including synergies, debt, and valuation calculations. Merger model tutorial (m&a) how to build a merger model. How to interpret accretion / (dilution) analysis? Merger models analyze the financial impact of a merger or acquisition. Doesn't need to be the model to end all models, just looking for good precedent.

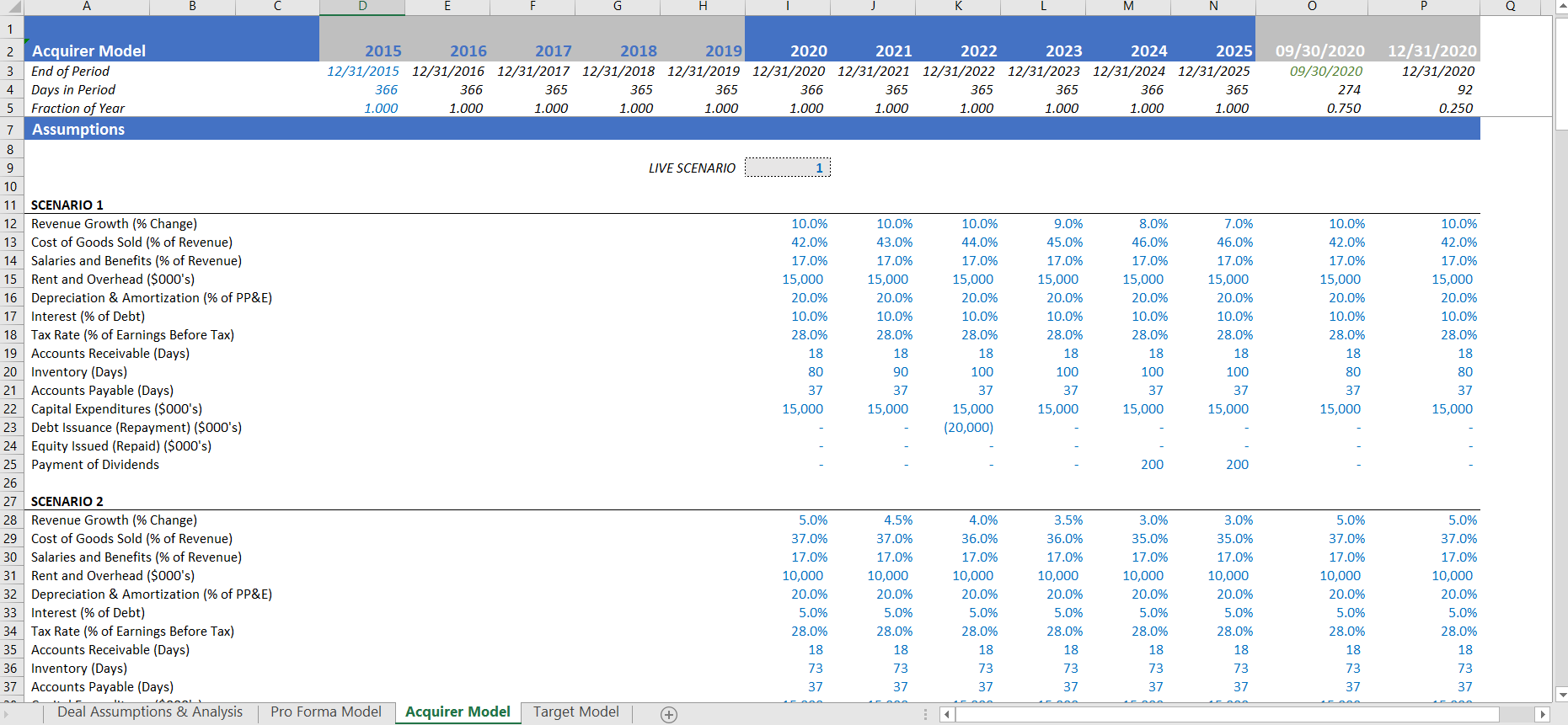

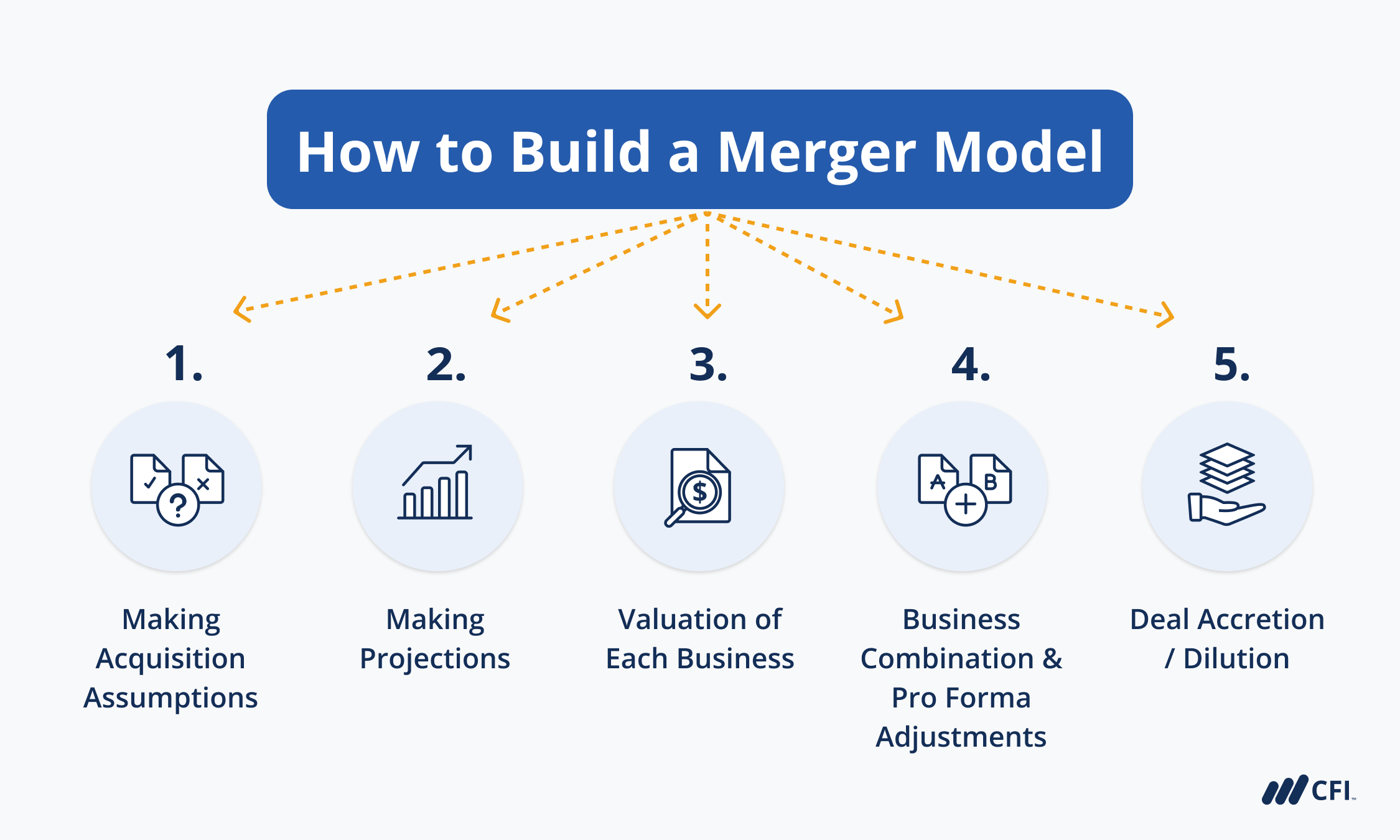

The modeling process involves assumptions, projections, and valuation techniques. The goal of a merger is to create synergies and improve productivity. How to interpret accretion / (dilution) analysis? The macabacus operating model implements key accounting and tax concepts and is a foundational building block for our merger and lbo models. The key steps involved in building a merger model are:

Doesn't need to be the model to end all models, just looking for good precedent. Learn how to structure an m&a model in the most efficient way. Each topic contains a spreadsheet with which you can interact within your browser to inspect cell equations and read comments or download and open in excel. How to interpret accretion / (dilution) analysis? The modeling process involves assumptions, projections, and valuation techniques.

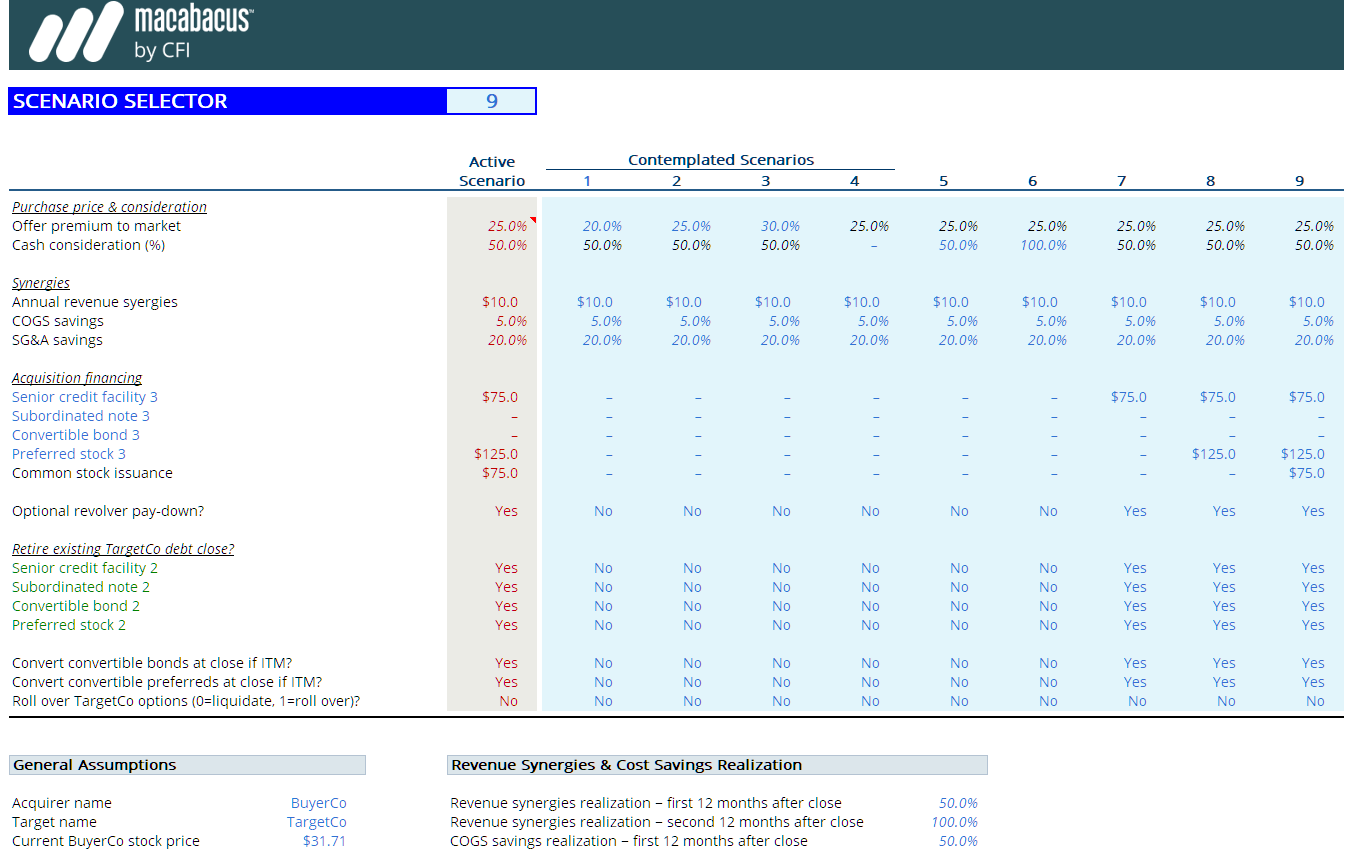

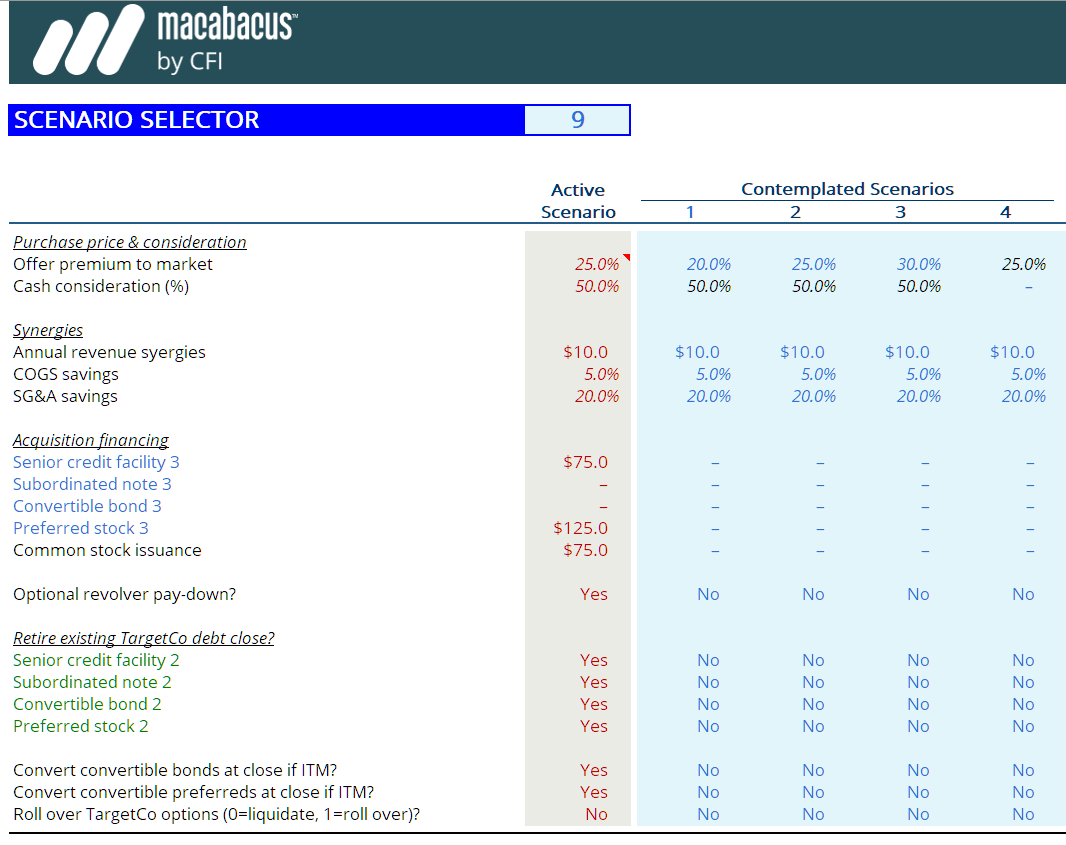

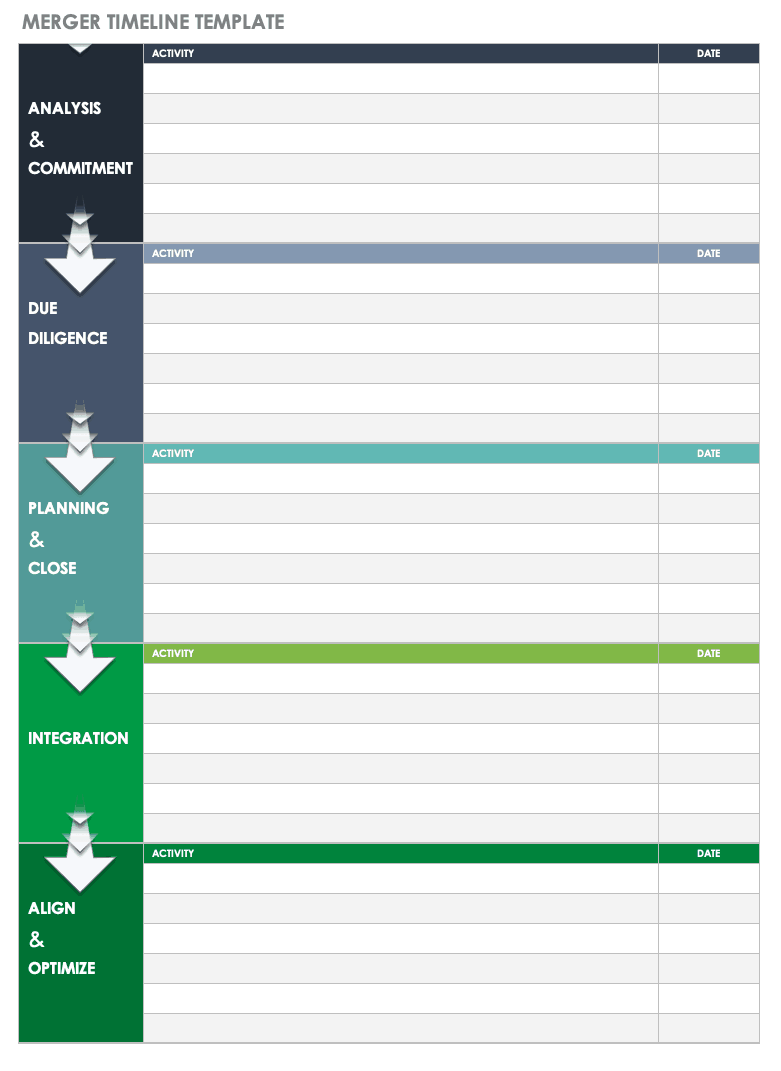

The macabacus merger model implements advanced m&a, accounting, and tax concepts, and is intended for use in modeling live transactions (with some. The macabacus operating model implements key accounting and tax concepts and is a foundational building block for our merger and lbo models. M&a and merger model examples. Merger model tutorials for investment banking: How to build a merger model. Our m&a integration planning tools and templates (more than 100) simplify and expedite work, and help teams produce it in common formats. Integrate the acquirer and the target into a pro forma model. Learn how to structure an m&a model in the most efficient way. You can view a few sample m&a and merger model tutorials below: The goal of a merger is to create synergies and improve productivity. How to interpret accretion / (dilution) analysis? The mergers & acquisition (m&a) model provides a projection for a company looking to potentially merge or acquire another company. Set up all the assumptions and drivers required to build out the m&a model. The first step in purchase price allocation, or ppa, is to determine the purchase price. Then, it looks into the combined performance after the acquisition.

The Mergers & Acquisition (M&A) Model Provides A Projection For A Company Looking To Potentially Merge Or Acquire Another Company.

In this tutorial, we will walk you through building an lbo model in excel. Steps in constructing a merger model. Full tutorial, video, written guide, and excel examples of how to estimate cost synergies in real m&a deals. Our m&a integration planning tools and templates (more than 100) simplify and expedite work, and help teams produce it in common formats.

How To Interpret Accretion / (Dilution) Analysis?

Learn how to structure an m&a model in the most efficient way. Cash, debt, and stock mix; Merger model tutorials for investment banking: In this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration.

You Can View A Few Sample M&A And Merger Model Tutorials Below:

Assessing accretion and dilution helps evaluate shareholder value. Download our free merger model template for excel. M&a and merger model examples. Included in the template, you will find:

The Modeling Process Involves Assumptions, Projections, And Valuation Techniques.

The goal of a merger is to create synergies and improve productivity. In this section, we demonstrate how to model a merger of two public companies in excel. Sample lessons, full model setups and walkthroughs, and common interview questions. How to build a merger model.