If you want to set up a revocable trust, texas has specific guidelines you must follow. You must identify the assets you wish to transfer and designate the trustee and beneficiaries. Web trustee shall transfer the trust estate, discharged of the trust, to the person or persons who would be entitled to inherit from grantor under the laws of the state of texas as unmarried, intestate and domiciled in that state, and possessed only of. The trustee is responsible for safeguarding the trust’s assets during the grantor’s lifetime. A revocable living trust form is a document that creates a legal entity (called a trust) to.

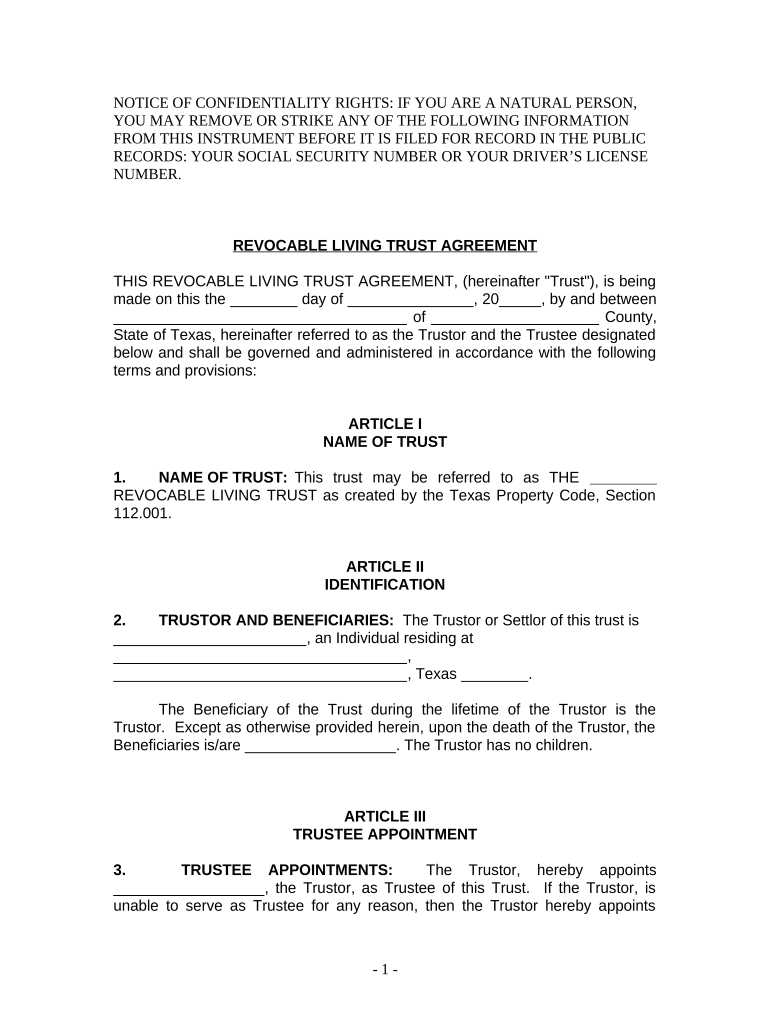

Web use our revocable living trust form to transfer your estate and other assets to your heirs easily and quickly, avoiding court processes. Web creating a living trust involves drafting a trust document in compliance with texas laws, transferring assets into the trust, and possibly impacting the grantor’s tax situation with no state inheritance or estate tax but subject to federal estate taxes. Web collect trust property and accept or reject additions to trust property from the grantor or any other person. Web a living trust is an estate planning tool that can make things easier for your family after you pass away, and ensure that your wishes are fulfilled. Web the texas living trust is an entity into which a person transfers their assets in order to maintain control of them during their lifetime and in the event that they become mentally incapacitated.

This guide will take you through the process of creating a living trust in texas, giving you all of the information you’ll need to complete this task as painlessly as possible. Web use our free living revocable trust template to ensure your assets are always managed correctly. Web the texas living trust is an entity into which a person transfers their assets in order to maintain control of them during their lifetime and in the event that they become mentally incapacitated. Acquire or sell trust property, for cash or on credit, at public or private sale. Web creating a living trust involves drafting a trust document in compliance with texas laws, transferring assets into the trust, and possibly impacting the grantor’s tax situation with no state inheritance or estate tax but subject to federal estate taxes.

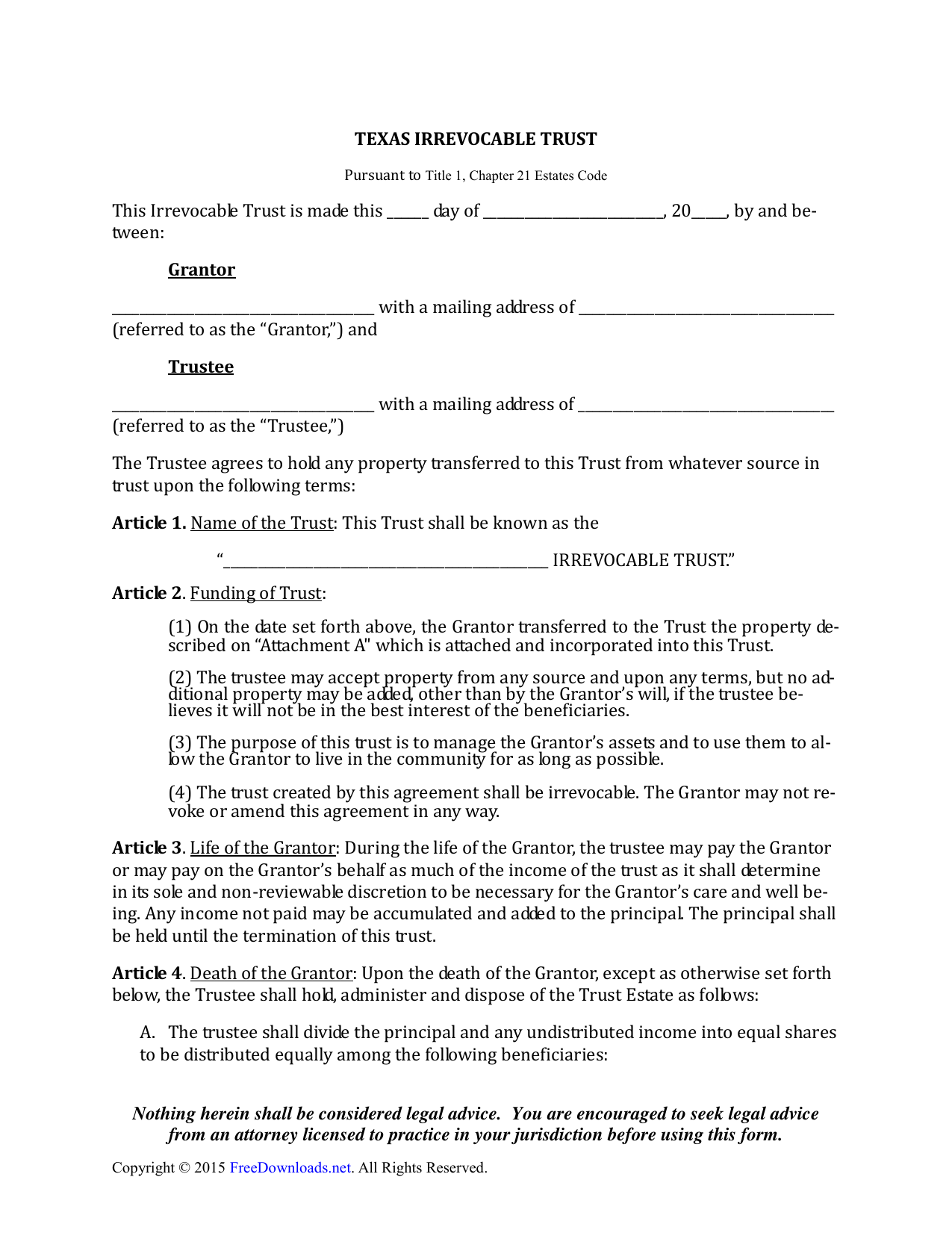

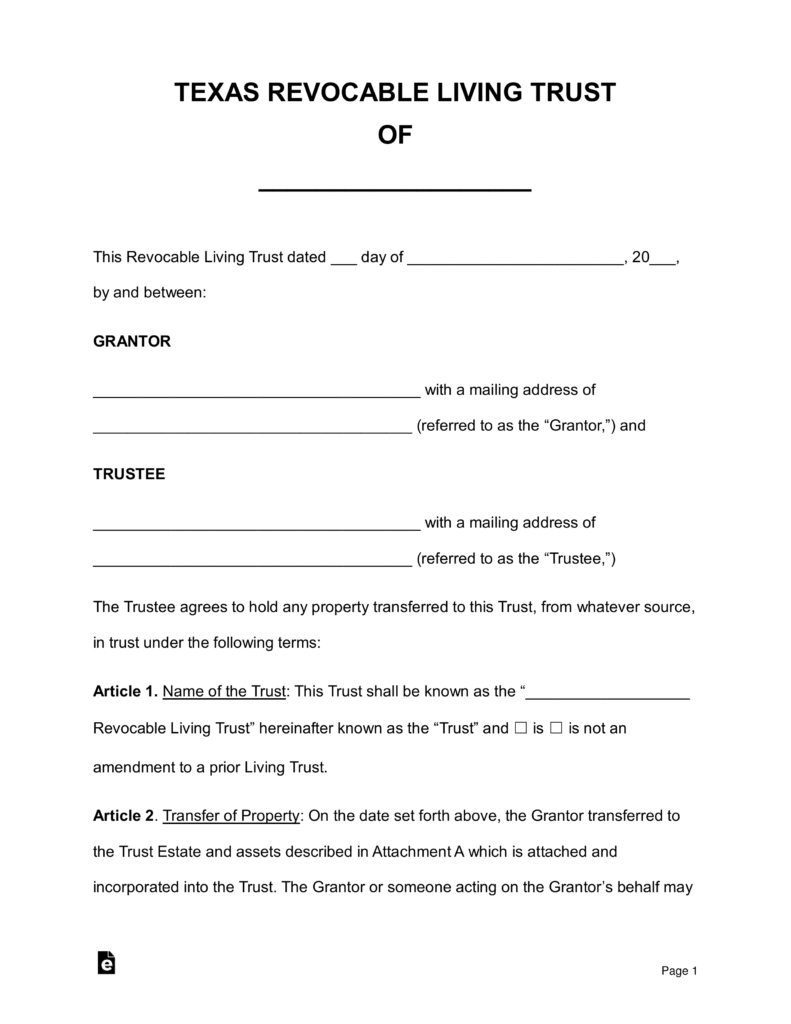

Create your document with ease and avoid going to court. Web creating a living trust involves drafting a trust document in compliance with texas laws, transferring assets into the trust, and possibly impacting the grantor’s tax situation with no state inheritance or estate tax but subject to federal estate taxes. Web use our free living revocable trust template to ensure your assets are always managed correctly. Web a living trust is an estate planning tool that can make things easier for your family after you pass away, and ensure that your wishes are fulfilled. If you want to set up a revocable trust, texas has specific guidelines you must follow. This guide will take you through the process of creating a living trust in texas, giving you all of the information you’ll need to complete this task as painlessly as possible. You must identify the assets you wish to transfer and designate the trustee and beneficiaries. Acquire or sell trust property, for cash or on credit, at public or private sale. Web use our revocable living trust form to transfer your estate and other assets to your heirs easily and quickly, avoiding court processes. A revocable living trust form is a document that creates a legal entity (called a trust) to. Web collect trust property and accept or reject additions to trust property from the grantor or any other person. Web a living trust is a legal document that allows an individual (grantor) to place assets under the management of a trustee, who can be the grantor or another party. Web trustee shall transfer the trust estate, discharged of the trust, to the person or persons who would be entitled to inherit from grantor under the laws of the state of texas as unmarried, intestate and domiciled in that state, and possessed only of. Web learn about the benefits of a living trust, how a trust differs from a will, and the steps you'll need to take to set up a living trust in texas. Web how to create a revocable living trust in texas?

Web A Living Trust Is A Legal Document That Allows An Individual (Grantor) To Place Assets Under The Management Of A Trustee, Who Can Be The Grantor Or Another Party.

This guide will take you through the process of creating a living trust in texas, giving you all of the information you’ll need to complete this task as painlessly as possible. The trustee is responsible for safeguarding the trust’s assets during the grantor’s lifetime. If you want to set up a revocable trust, texas has specific guidelines you must follow. Web the texas living trust is an entity into which a person transfers their assets in order to maintain control of them during their lifetime and in the event that they become mentally incapacitated.

Web Use Our Revocable Living Trust Form To Transfer Your Estate And Other Assets To Your Heirs Easily And Quickly, Avoiding Court Processes.

Web collect trust property and accept or reject additions to trust property from the grantor or any other person. You must identify the assets you wish to transfer and designate the trustee and beneficiaries. Web a living trust is an estate planning tool that can make things easier for your family after you pass away, and ensure that your wishes are fulfilled. Web creating a living trust involves drafting a trust document in compliance with texas laws, transferring assets into the trust, and possibly impacting the grantor’s tax situation with no state inheritance or estate tax but subject to federal estate taxes.

A Revocable Living Trust Form Is A Document That Creates A Legal Entity (Called A Trust) To.

Web how to create a revocable living trust in texas? Create your document with ease and avoid going to court. Web learn about the benefits of a living trust, how a trust differs from a will, and the steps you'll need to take to set up a living trust in texas. Web use our free living revocable trust template to ensure your assets are always managed correctly.

Acquire Or Sell Trust Property, For Cash Or On Credit, At Public Or Private Sale.

Web trustee shall transfer the trust estate, discharged of the trust, to the person or persons who would be entitled to inherit from grantor under the laws of the state of texas as unmarried, intestate and domiciled in that state, and possessed only of.