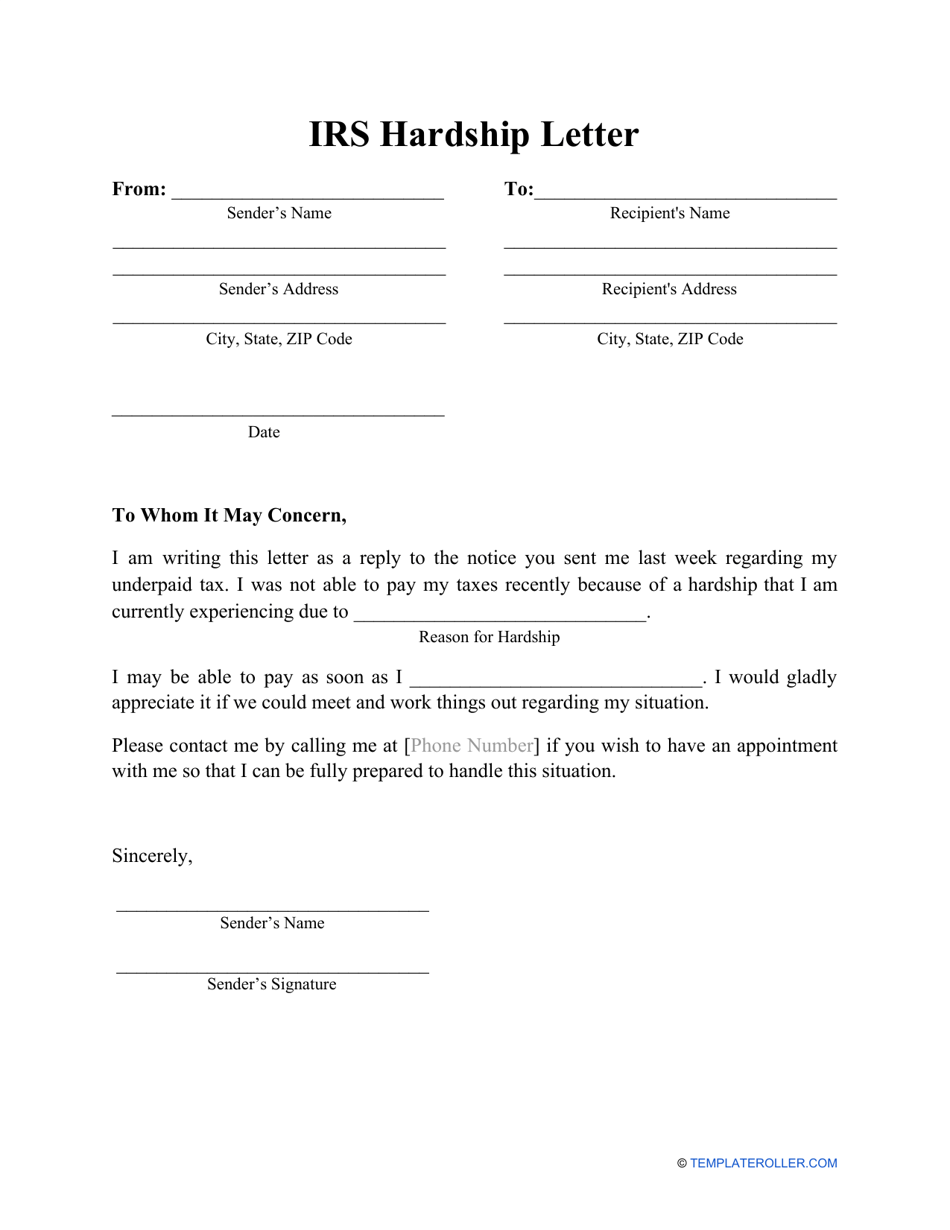

Here are sample letters to request irs penalty abatement. Web the irs is one of the most feared government agencies. However, you have nothing to fear when you need to write them a letter. You can use these two templates as a guide to help you write a letter depending on your situation. Web fill out the template.

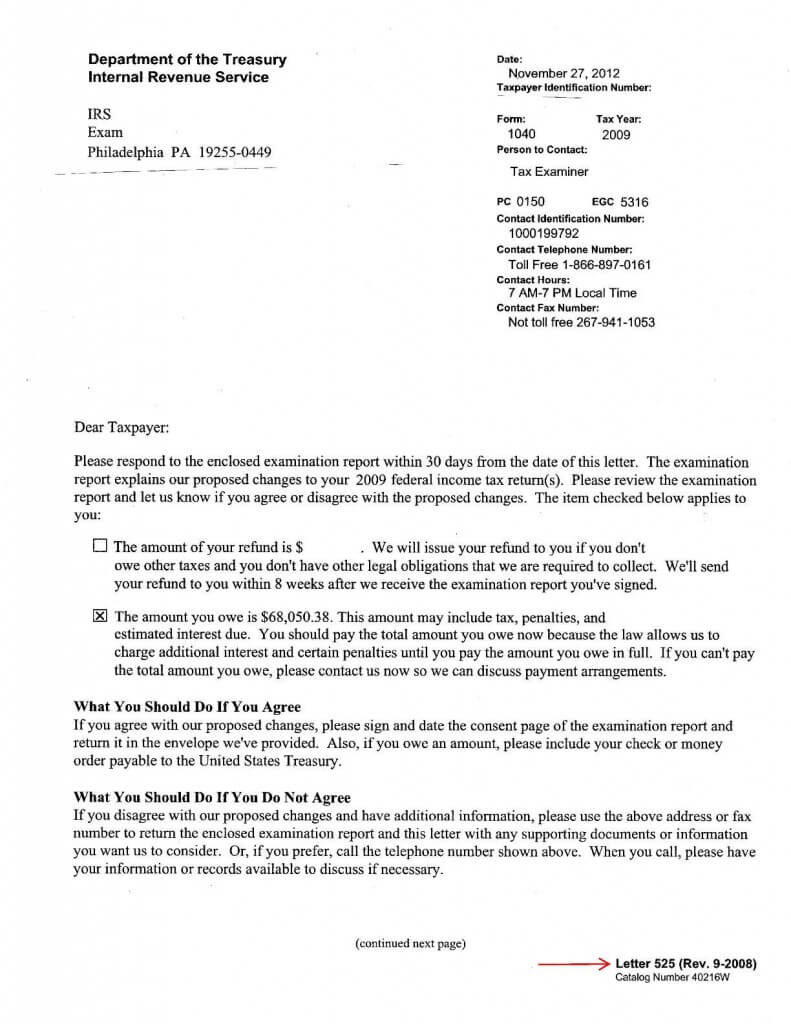

Web you can use this irs penalty response letter to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. However, you have nothing to fear when you need to write them a letter. The letter serves as your opportunity to explain your circumstances, provide supporting evidence, and make a compelling case for a. Different formats and samples are available based on specific circumstances, and truthfully stating personal reasons is crucial. Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled.

Web when writing a letter to the irs to request a penalty waiver, it is important to be clear, concise, and persuasive. Here are sample letters to request irs penalty abatement. You can use these two templates as a guide to help you write a letter depending on your situation. A response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically to add items of. Web you can use this irs penalty response letter to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled.

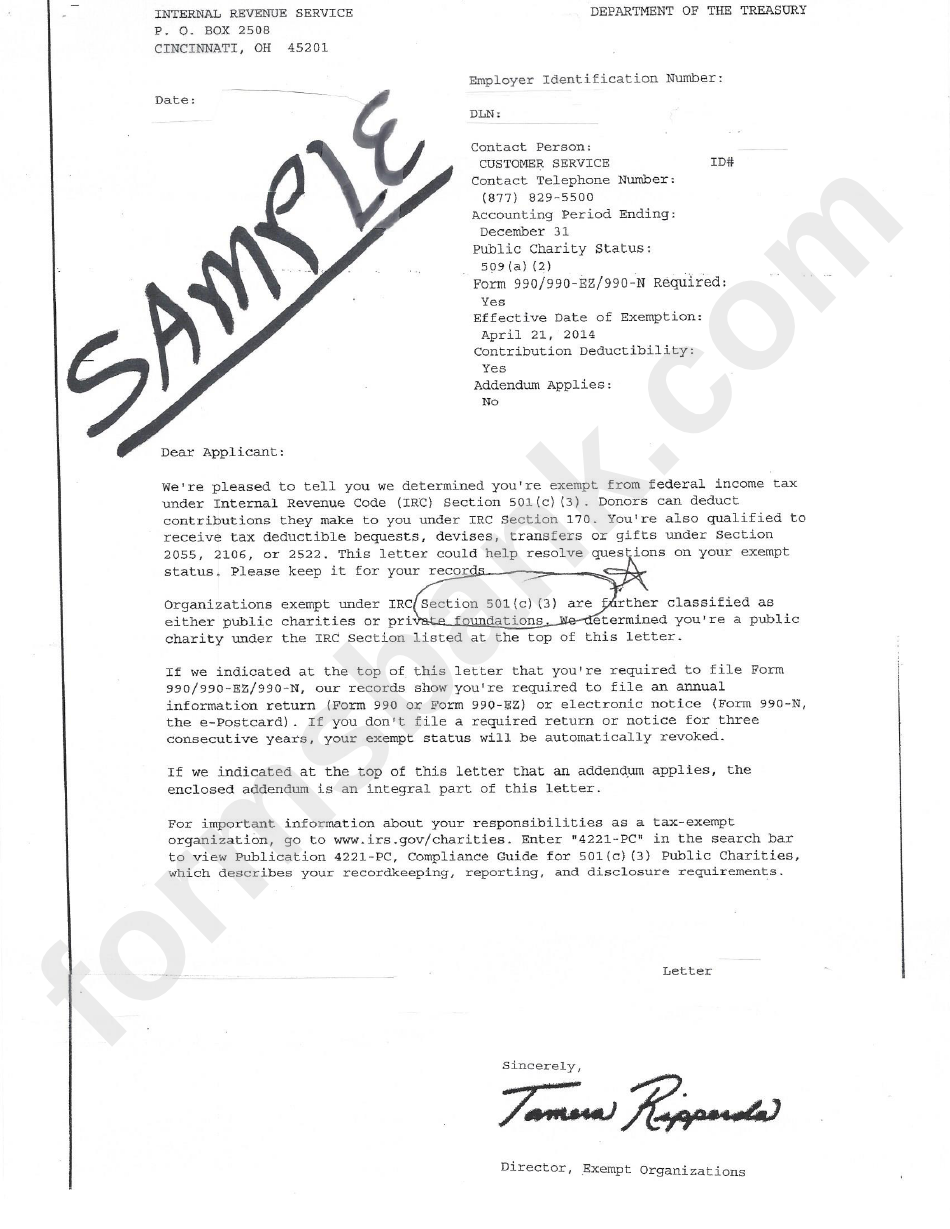

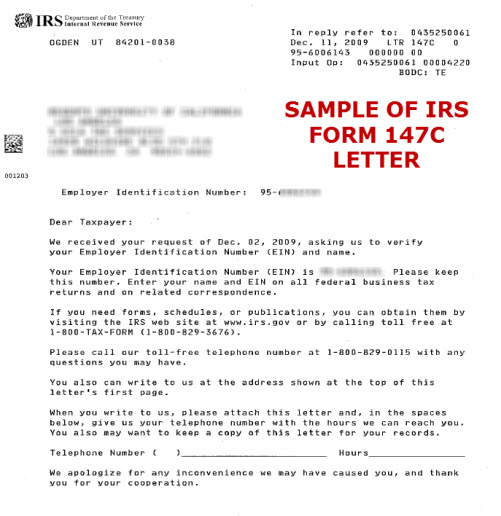

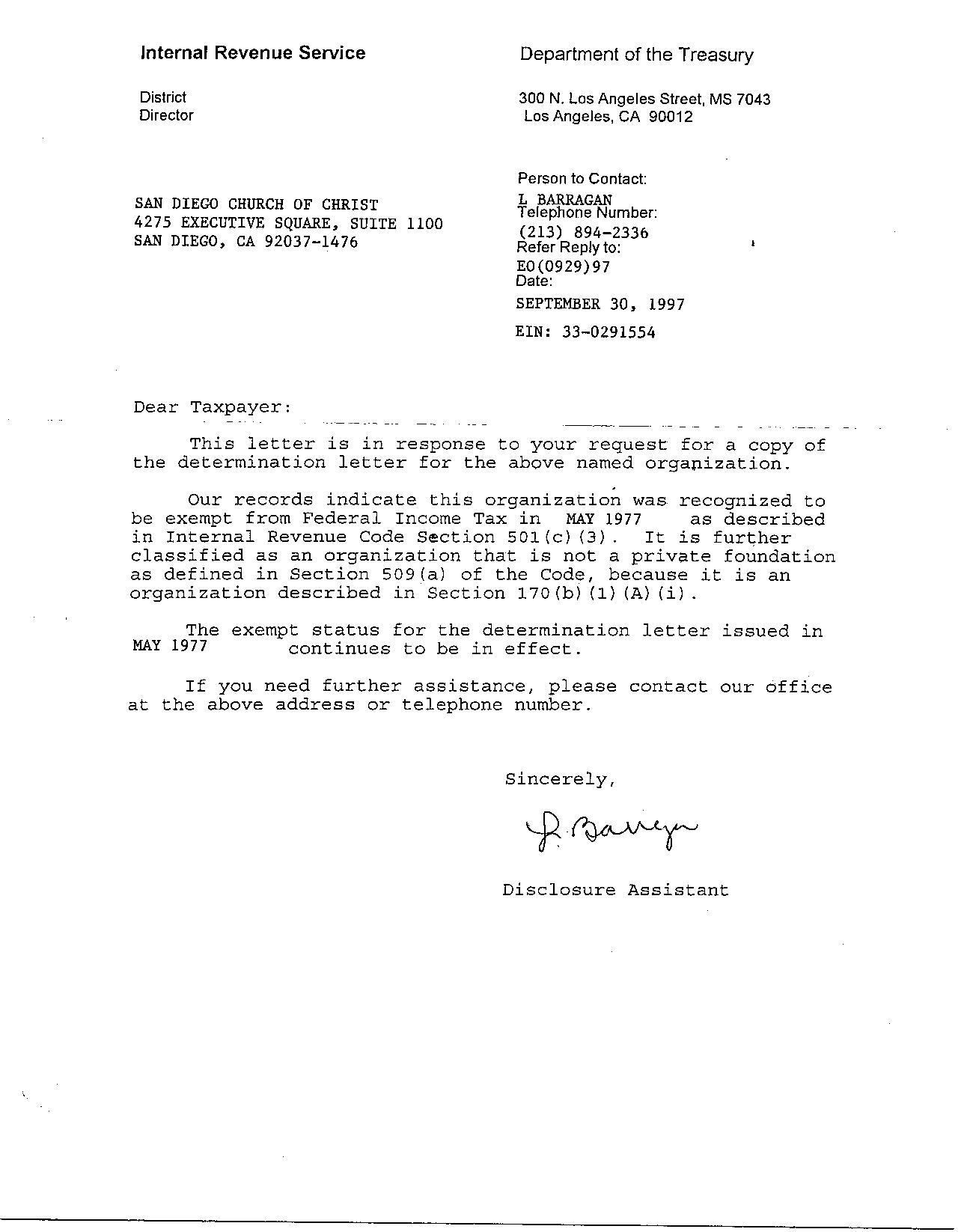

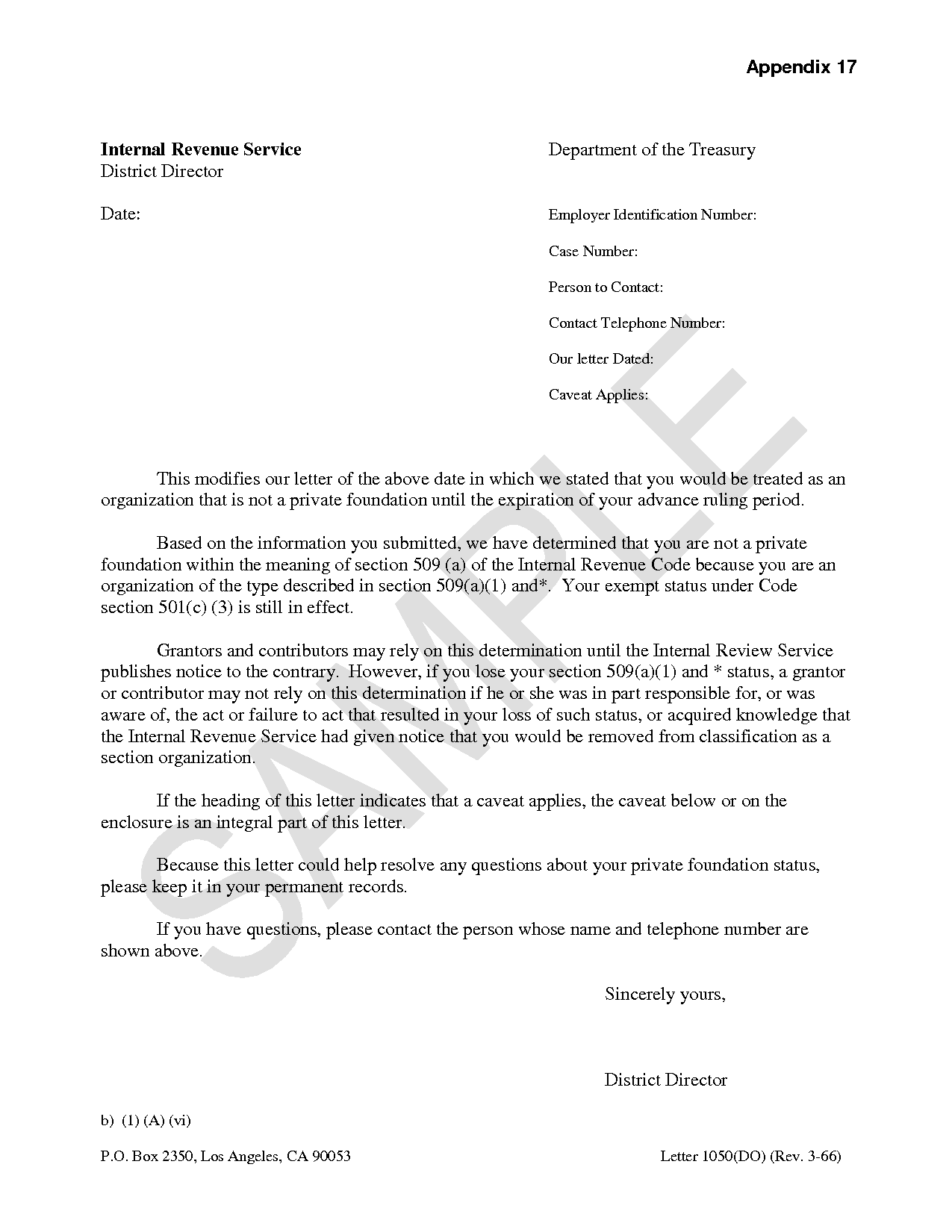

Web when writing a letter to the irs to request a penalty waiver, it is important to be clear, concise, and persuasive. However, you have nothing to fear when you need to write them a letter. Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. The letter serves as your opportunity to explain your circumstances, provide supporting evidence, and make a compelling case for a. Web fill out the template. Different formats and samples are available based on specific circumstances, and truthfully stating personal reasons is crucial. People usually write the irs to provide missing information, ask for an abatement, or appeal an irs decision. Web sample irs penalty abatement request letter. Web you can use this irs penalty response letter to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. A response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically to add items of. Web the irs is one of the most feared government agencies. Here are sample letters to request irs penalty abatement. Format a business letter and remember to get to the point. You can use these two templates as a guide to help you write a letter depending on your situation. An irs letter notifies the taxpayer about issues regarding their latest tax return, approves the retirement plan, or provides information requested by third parties.

Web When Writing A Letter To The Irs To Request A Penalty Waiver, It Is Important To Be Clear, Concise, And Persuasive.

Here are sample letters to request irs penalty abatement. Web the irs is one of the most feared government agencies. Format a business letter and remember to get to the point. Web you can use this irs penalty response letter to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled.

You Can Use These Two Templates As A Guide To Help You Write A Letter Depending On Your Situation.

The letter serves as your opportunity to explain your circumstances, provide supporting evidence, and make a compelling case for a. A response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically to add items of. Web fill out the template. However, you have nothing to fear when you need to write them a letter.

Different Formats And Samples Are Available Based On Specific Circumstances, And Truthfully Stating Personal Reasons Is Crucial.

Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Web sample irs penalty abatement request letter. People usually write the irs to provide missing information, ask for an abatement, or appeal an irs decision. An irs letter notifies the taxpayer about issues regarding their latest tax return, approves the retirement plan, or provides information requested by third parties.