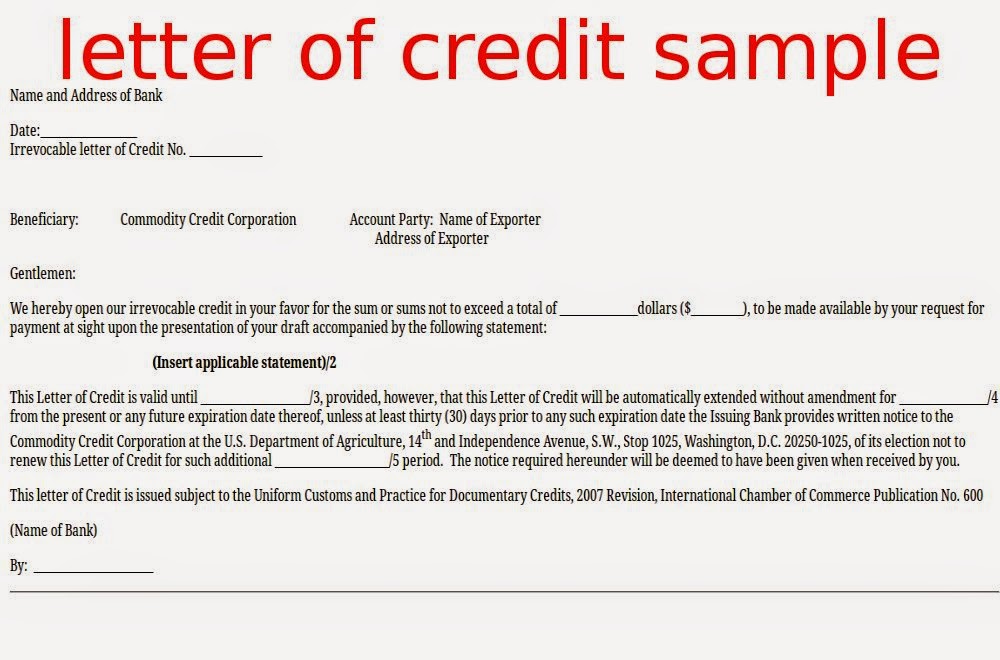

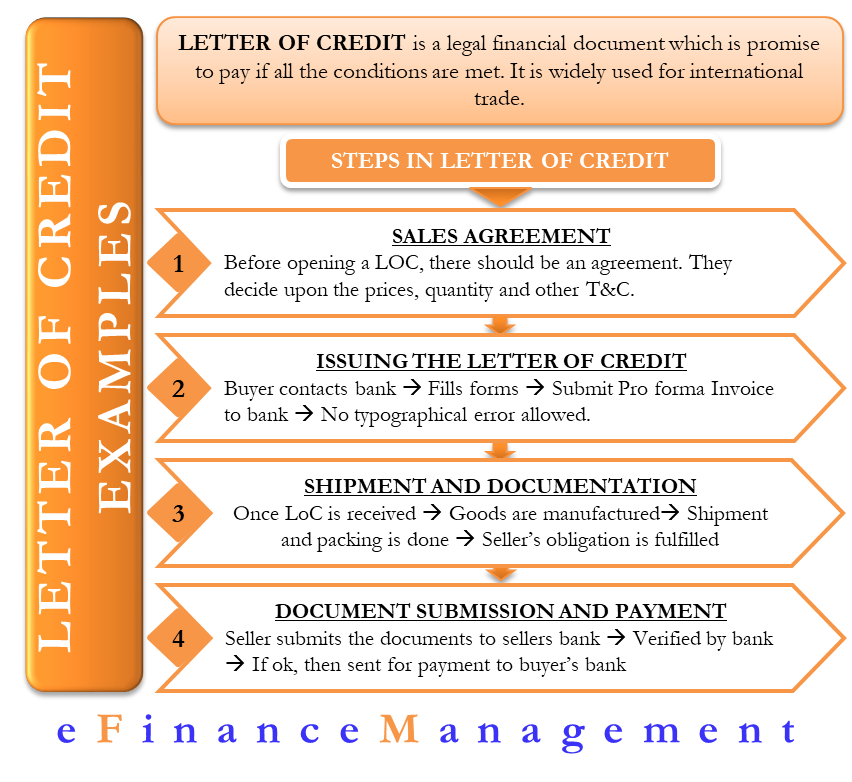

The primary purpose of writing a credit letter could be different. Letter of credit, as being defined by investopedia, is widely used for international exchanges as guarantees as well as an important assurance, particularly to the sellers that will be be paid for a large transaction.perhaps you can have a look and browse through these sample letters, which may be useful and helpful. This sample for letter of credit format serves as a structured request for an irrevocable letter of credit, providing a clear format with specified details to facilitate secure international transactions between the buyer and seller. As part of a sales agreement, a seller may require the buyer to deliver a letter of credit before a deal takes place. Credit is the trust that bridges the gap that exists between the creditor and the customer.

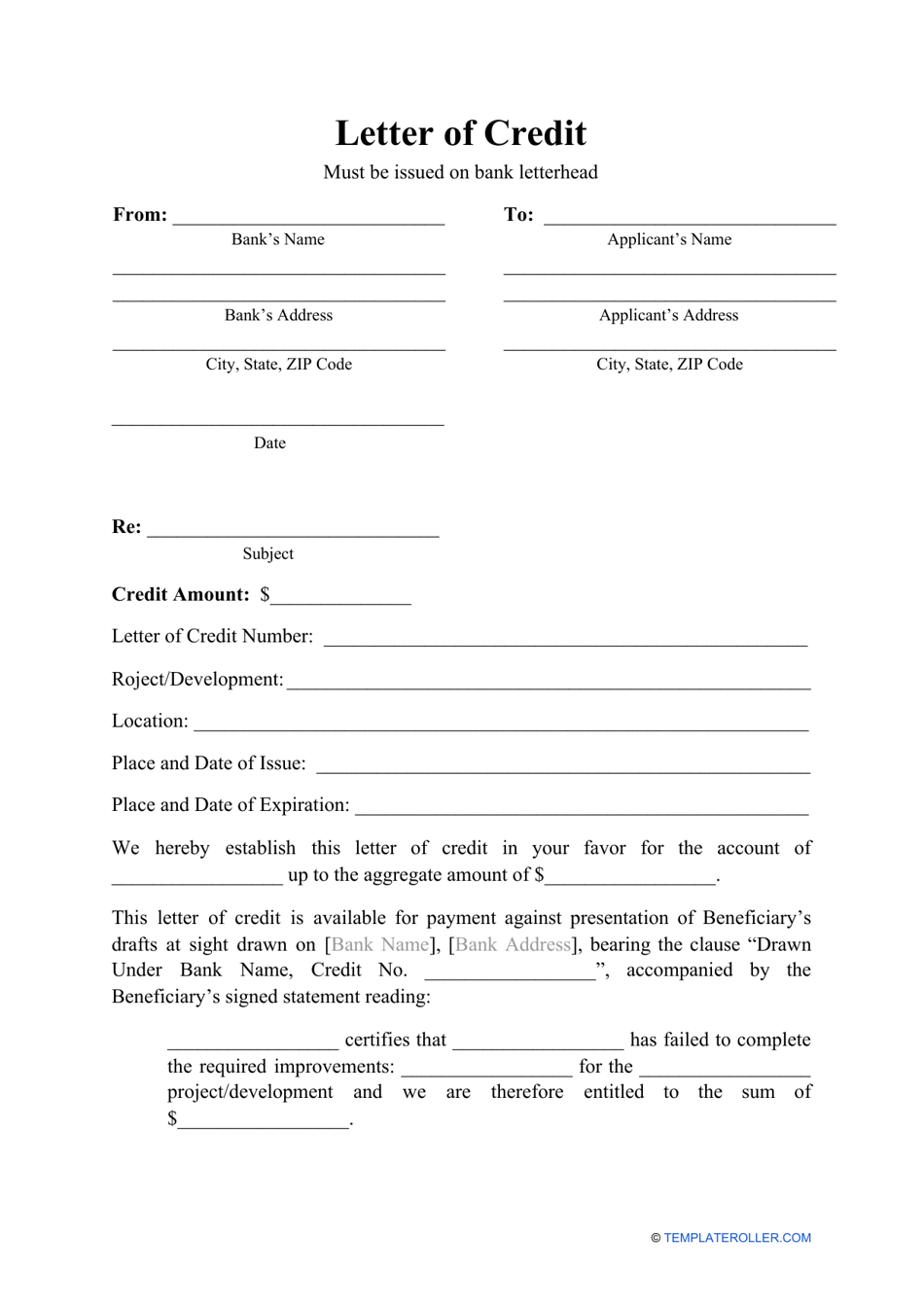

If you’re a successful small business, you’ll be getting paid by customers quite regularly. Use our free letter of credit template to help you get started. While a business is attempting to buy goods, services as well as technology to serve up their clients, a letter of credit is important. As a business owner, you may request a letter of credit from a customer to guarantee payment for products or services you’re providing. It ensures payment and delivery of goods by guaranteeing that the buyer will pay for the goods supplied by the seller within a specified time period.

An lc is used when trust between counterparties is hard to quantify. Letter of credit template template. A letter of credit, or credit letter, is a bank guarantee that a specific payment will be made. Request letters, application letters, credit letters, legal letters. One method that might be unfamiliar to many small business owners, however, is a letter of credit.

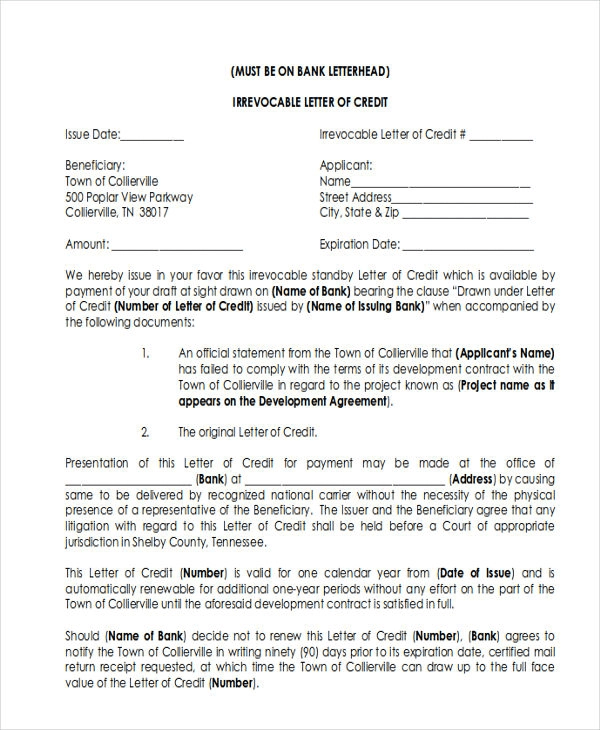

A letter of credit is a bank's written promise that it will make a customer's (the holder) payment to a vendor (called the beneficiary) if the customer does not. Request letters, application letters, credit letters, legal letters. Examples of letters of credit. Letter of credit, as being defined by investopedia, is widely used for international exchanges as guarantees as well as an important assurance, particularly to the sellers that will be be paid for a large transaction.perhaps you can have a look and browse through these sample letters, which may be useful and helpful. Letters of credit help to minimize risk for both the buyer and seller and are prevalent in international trade. Letter of credit template is often used in documentary credit, payment guarantee, debt letter template, letter of credit template, international trade and letters. A letter of credit (loc) serves as a critical tool in financial transactions, particularly in the domain of international trade. A credit line is a flexible funding option offered at financial institutions for revolving access to cash. Letter of credit template template. February 9, 2024 by prasanna. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Although this was not a microsoft incident, given it impacts our ecosystem, we want to provide an update on the steps we’ve taken with crowdstrike and others to remediate and support our customers. As a business owner, you may request a letter of credit from a customer to guarantee payment for products or services you’re providing. Use our free letter of credit template to help you get started. Letter of credit is a financial instrument that plays an important role in protecting both parties in a trade transaction.

Download, Fill In And Print Letter Of Credit Template Pdf Online Here For Free.

/ free 18+ sample letter of credit in pdf | word. Other types of letters of credit are irrevocable letters of credit. A credit line is a flexible funding option offered at financial institutions for revolving access to cash. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit.

A Letter Of Credit (Loc) Is A Promise From A Bank To Make A Payment After Verifying That Somebody Meets Certain Conditions.

Through its issuance, the exporter is assured that the issuing bank will make a payment to the exporter for the international trade conducted between both the. A letter of credit is a form of guarantee issued by a bank on behalf of its client. A letter of credit (loc) serves as a critical tool in financial transactions, particularly in the domain of international trade. Letters of credit are significant for business entities as well as individuals alike.

The Primary Purpose Of Writing A Credit Letter Could Be Different.

A letter of credit (lc) is a financial instrument that is widely used in international trade to facilitate transactions between buyers and sellers who are in different countries. A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. February 9, 2024 by prasanna. Letter of credit sample format.

This Sample For Letter Of Credit Format Serves As A Structured Request For An Irrevocable Letter Of Credit, Providing A Clear Format With Specified Details To Facilitate Secure International Transactions Between The Buyer And Seller.

If the buyer does not make the payment then the bank is liable for the outstanding amount still owing. Request letters, application letters, credit letters, legal letters. An lc is used when trust between counterparties is hard to quantify. A credit letter is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount.