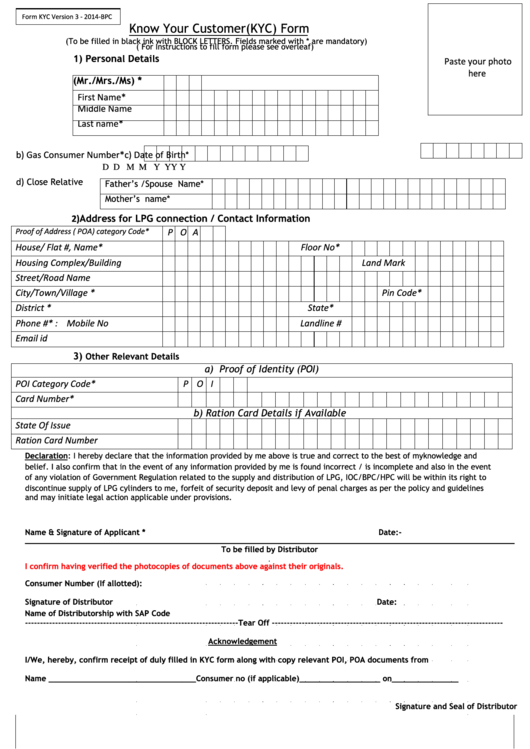

A kyc checklist is important because it helps you to verify that every customer is who they say they are. Find what you need with a kyc form. Explore our [product/service] & enjoy [discount). Want to get to know your client? Get instant access to a free, comprehensive library of thousands of business forms, templates, and contracts online today!

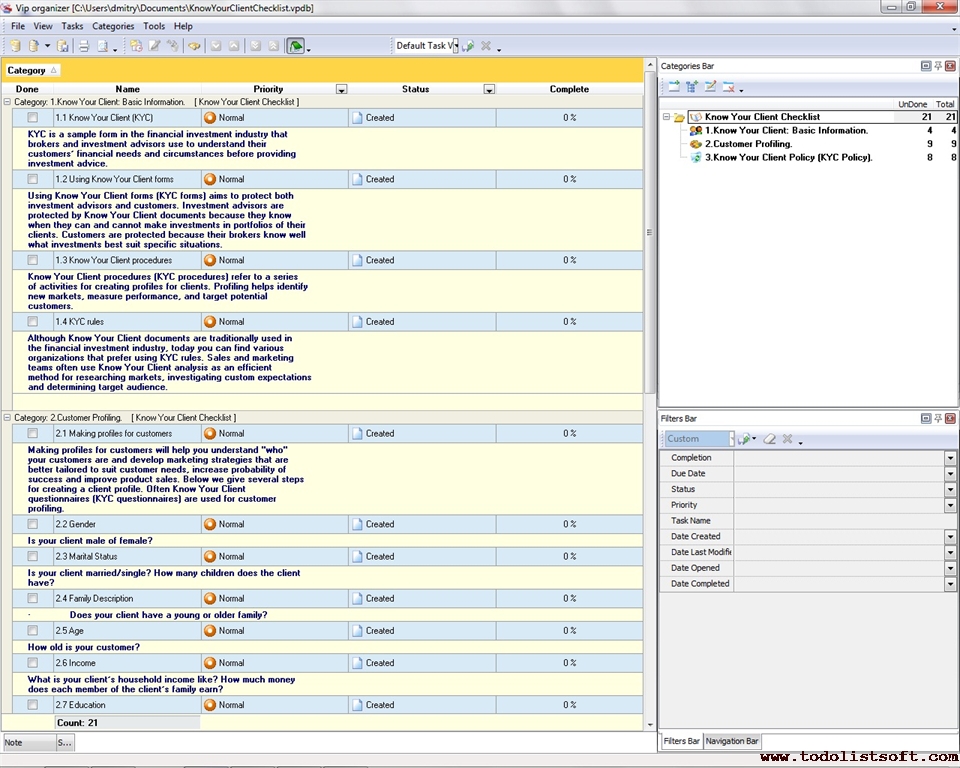

Know your customer (kyc) compliance is a set of procedures and protocols implemented by businesses and financial institutions to verify and authenticate the identity of their clients. It also helps to assess any risks associated with doing business with them. Taking on new clients can be risky—especially in industries like banking. Know your customer checklists (kyc checklists) are specifically designed to help with customer identification and screening. The questions posed are indicative only and not all will be applicable to all clients.

The form helps banks to avoid frauds, identity theft or funding for terrorism. Protect your business from fraud and financial crimes by verifying the identity of customers through thorough kyc checks. Looking for a know your customer form templates? In this article, you'll learn how to write the ultimate resume summary that will grab the attention of recruiters and hiring managers. This is where wpforms’ know your client form template comes in, which offers a good starting point for recording vital client details.

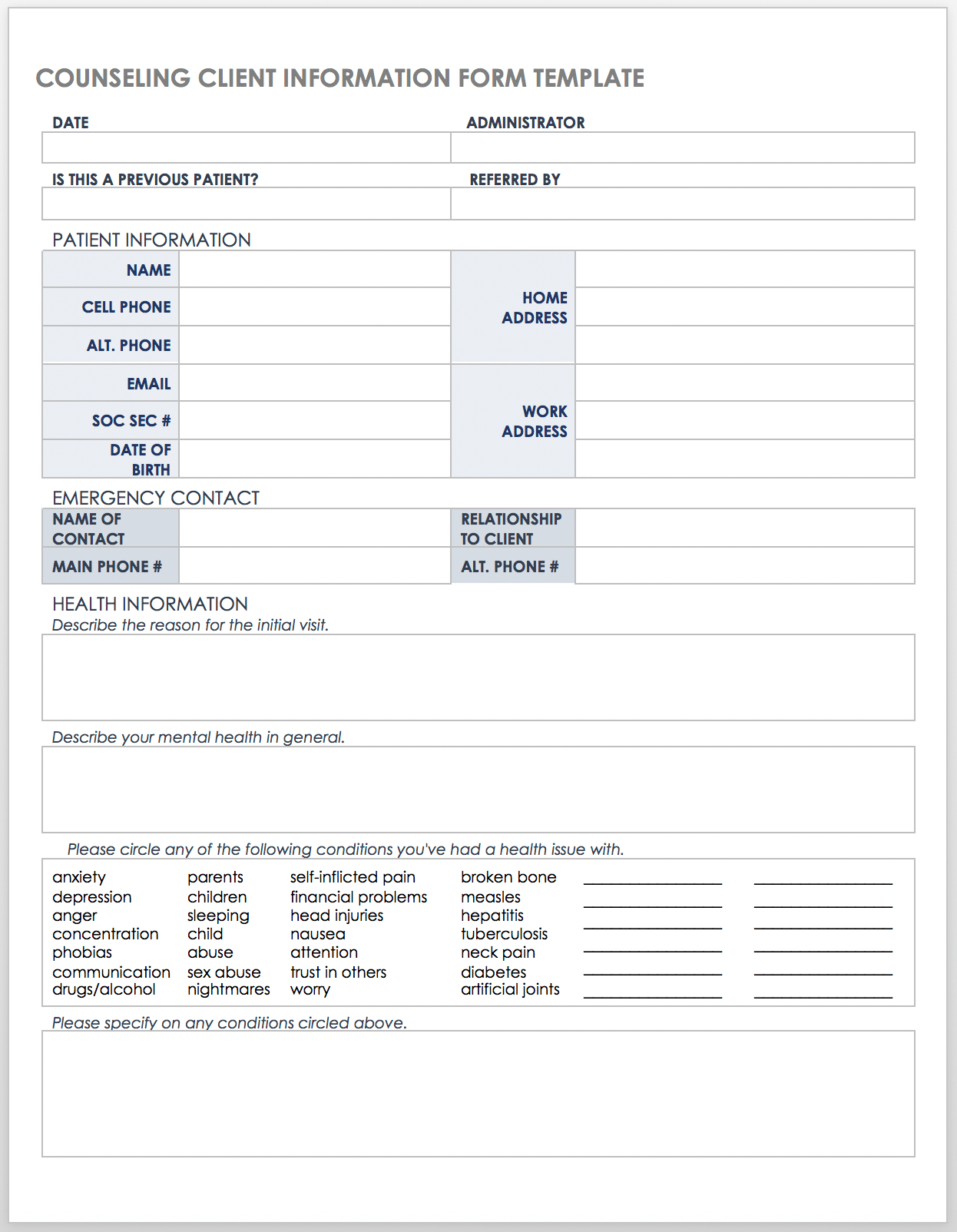

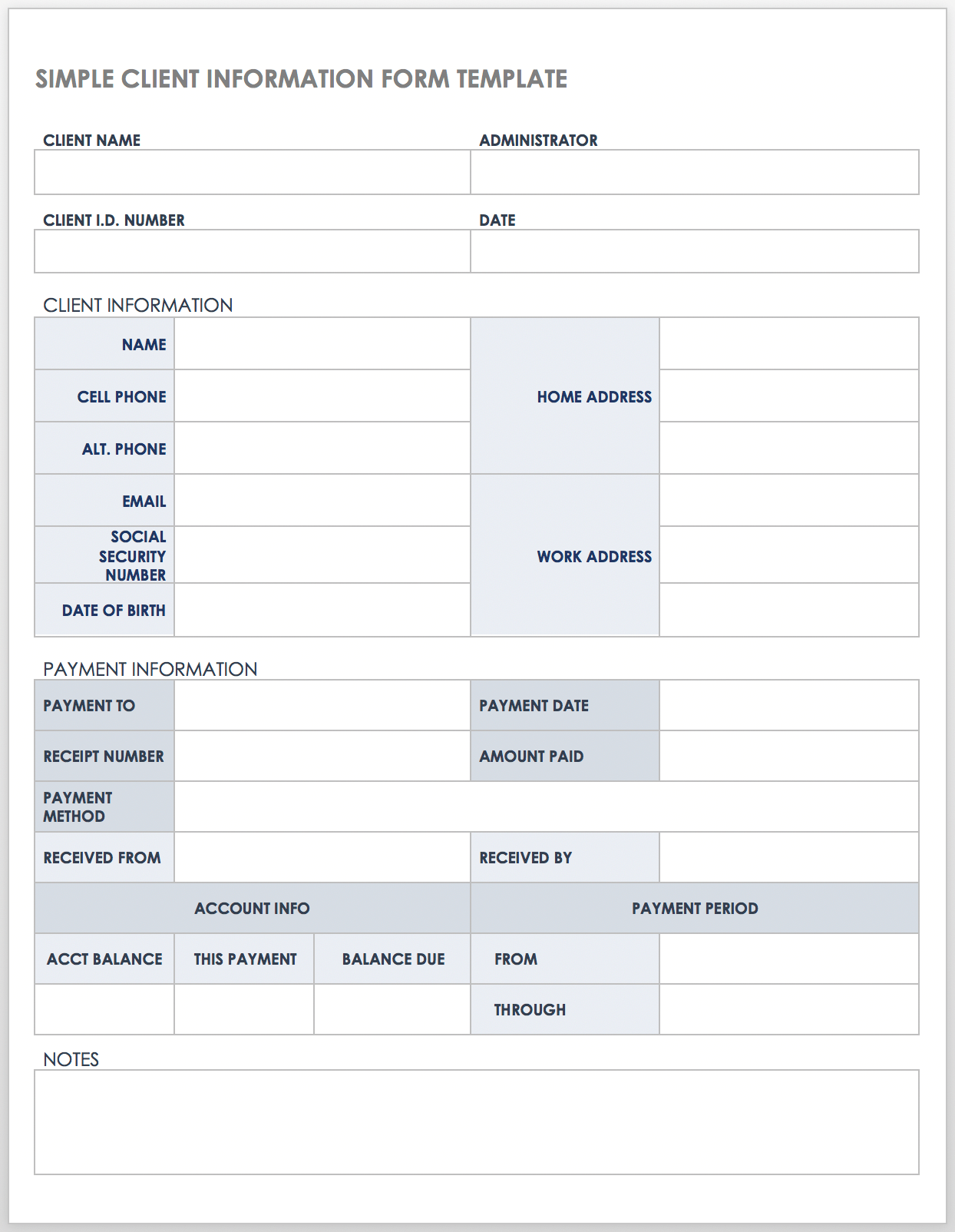

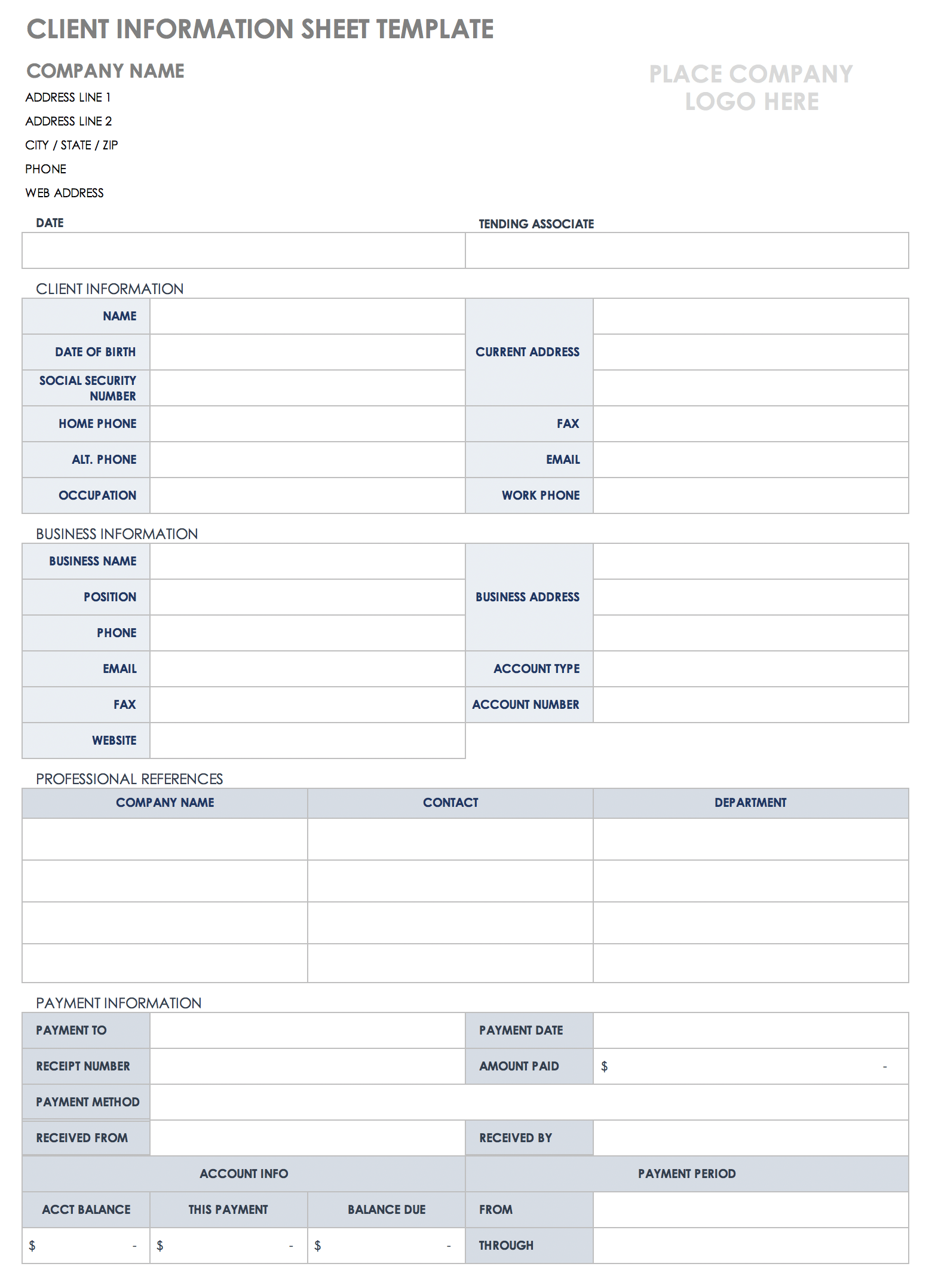

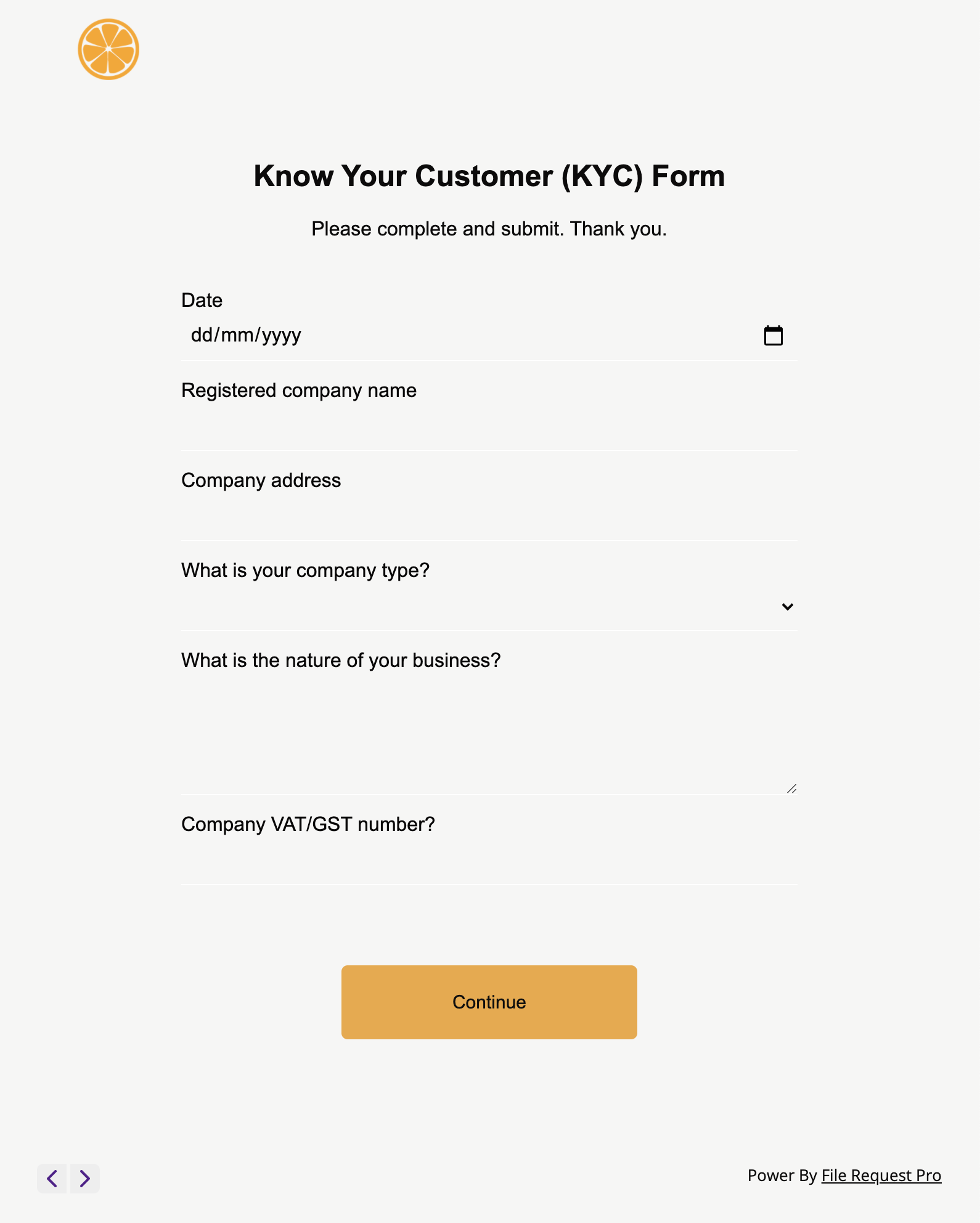

Know your client (kyc) is a standard used in the investment and financial services industry to verify customers and know their risk and financial profiles. Know your client is a sample form in the financial investment industry that brokers and investment advisors use to understand their customers’ financial needs and circumstances before providing investment advice. This is where wpforms’ know your client form template comes in, which offers a good starting point for recording vital client details. What is know your client (kyc)? Perfect for companies, individuals, trustees, agents, and more. Find what you need with a kyc form. Includes examples of know your customer checklists and best practices. The submission can be either in electronic form or physical form. Looking for a know your customer form templates? Know your customer (kyc) compliance is a set of procedures and protocols implemented by businesses and financial institutions to verify and authenticate the identity of their clients. How does the know your client form template work? You can use this template and modify the fields to best ensure regulatory compliance for your organization or business entity. Explore our [product/service] & enjoy [discount). Three components of kyc include the. Collecting kyc documents from b2b clients isn’t easy.

This Is Where Wpforms’ Know Your Client Form Template Comes In, Which Offers A Good Starting Point For Recording Vital Client Details.

It involves accurately identifying the customer and the risks associated with conducting business with them. Perfect for companies, individuals, trustees, agents, and more. A know your client (kyc) form is used by banks and other financial institutions to collect information about the identities and addresses of their clients. Crowdstrike’s cybersecurity software — used by numerous fortune 500 companies, including major global banks, healthcare and energy companies — detects and blocks hacking threats.

Your Kyc Checklist Should Provide You With Everything You Need To Be Able To Confirm A Customer’s Identity, Learn More About The Legitimacy Of Their Financial Activities, Figure Out The Source Of Their Money And Their Potential Risk To Your Organization.

A good welcome message template for customers usually includes a warm greeting, a brief introduction to the brand/service, and an invitation for further engagement. Hey [customer name], welcome to [brand name]! Know your client (kyc) is a standard used in the investment and financial services industry to verify customers and know their risk and financial profiles. Protect your business from fraud and financial crimes by verifying the identity of customers through thorough kyc checks.

With This Online Kyc Form Template, Your Organization Can Seamlessly Collect This Information, As Well As Signed Declarations, Online.

It also helps to assess any risks associated with doing business with them. The submission can be either in electronic form or physical form. Know your customer checklists (kyc checklists) are specifically designed to help with customer identification and screening. In this article, you'll learn how to write the ultimate resume summary that will grab the attention of recruiters and hiring managers.

While Customers Are Always Busy, You Need To Collect And Process All The Necessary Information Without Skipping Any Minute Details.

An applicant or potential user of financial services is required to submit documents for the verification of their identity and residence status. A kyc checklist is important because it helps you to verify that every customer is who they say they are. Know your customer or kyc checklist is simply the series of actions that a business is mandated by law to take to satisfy anti money laundering compliance. The questions posed are indicative only and not all will be applicable to all clients.