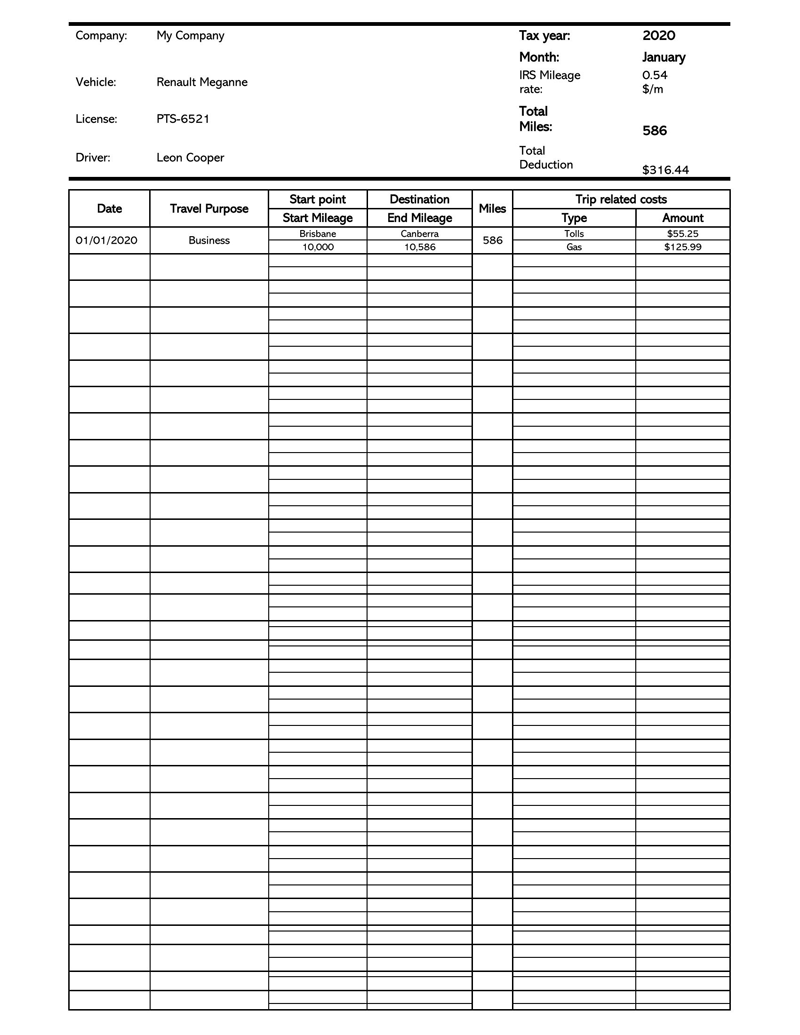

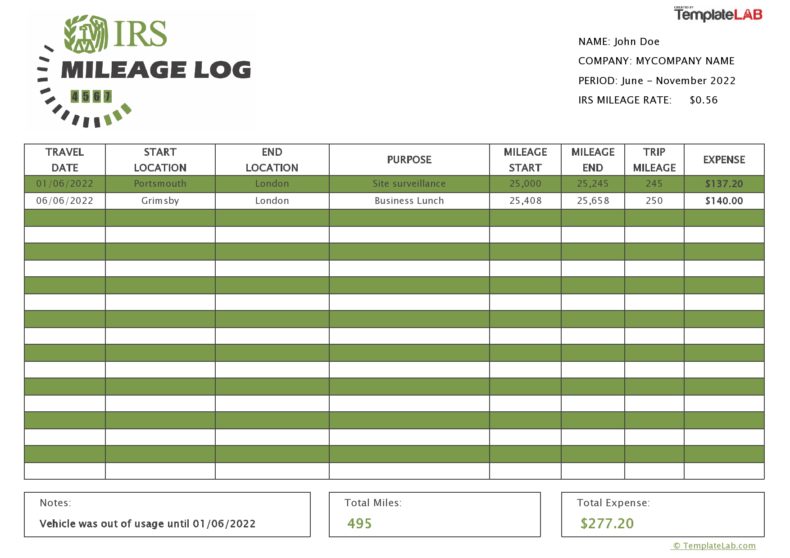

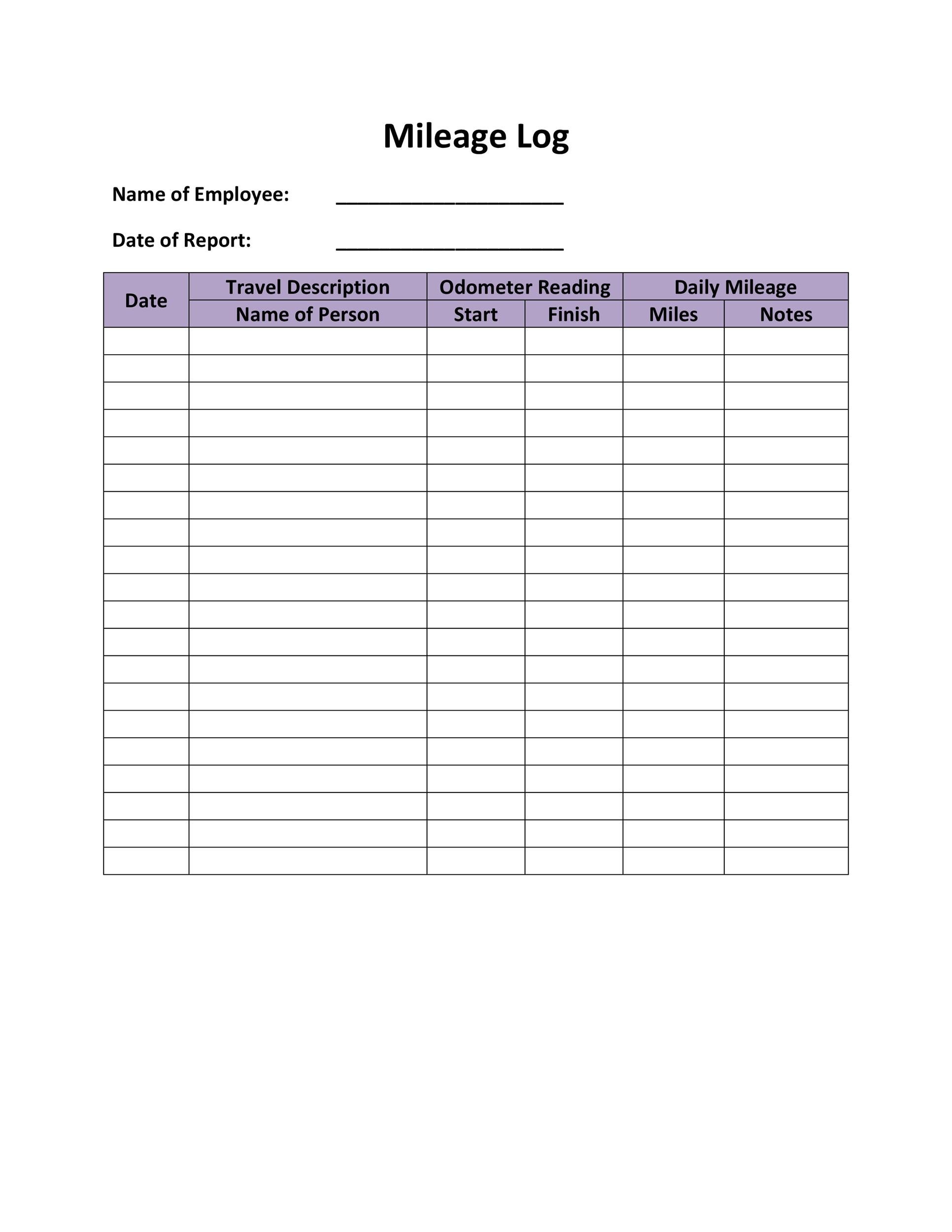

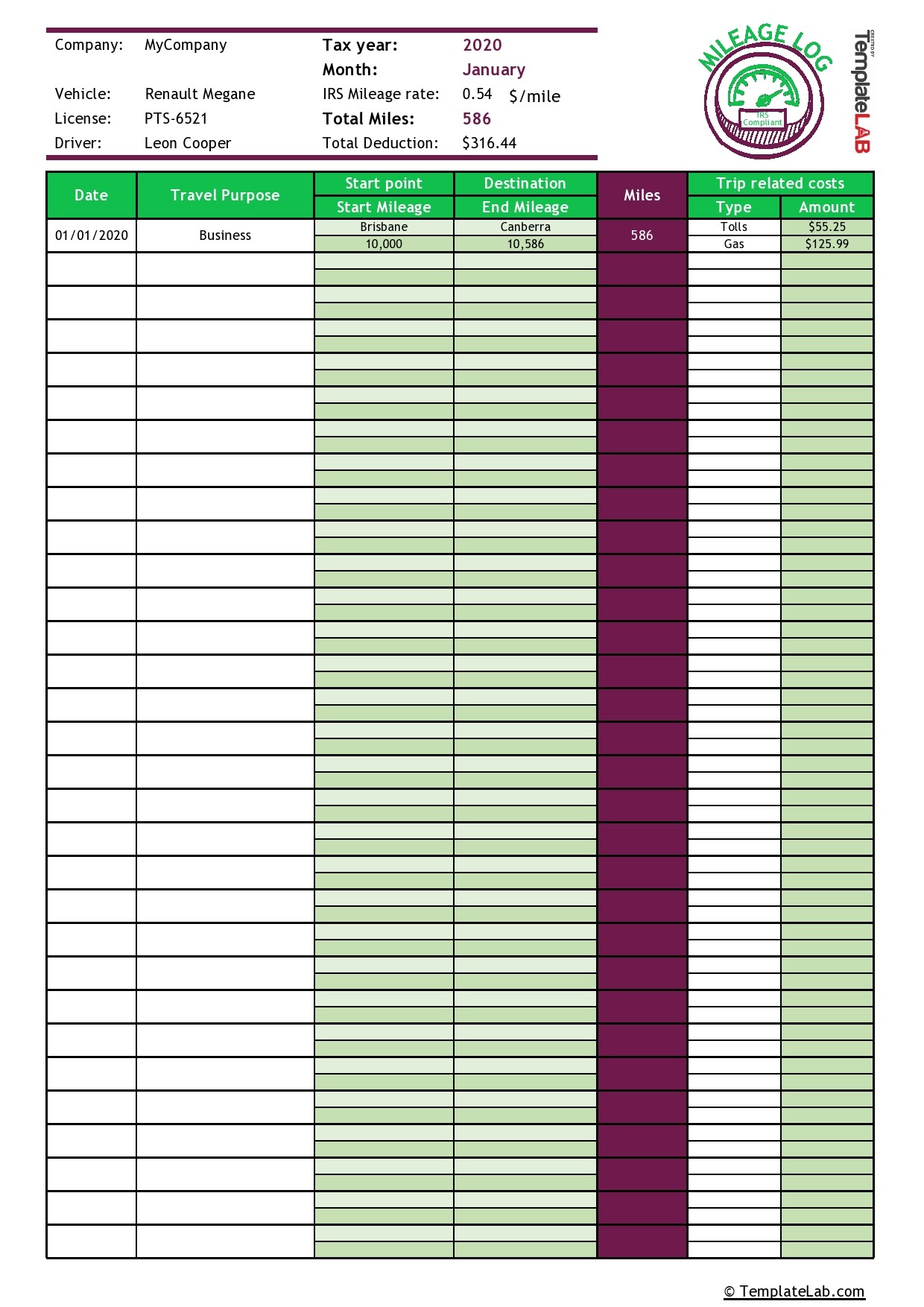

Date, destination, business purpose, odometer start, odometer. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Some people just prefer to input their trips manually. You can keep a mileage log in a notebook and update it by hand, or. Web the purpose of your trip.

Web 21+ free mileage log templates (for irs mileage tracking) whether you choose to claim your business auto expenses by submitting your total gas receipts or by claiming the. A paper log is a simple, written record of your business miles driven. Our online mileage log generator helps you make mileage logs in a matter of minutes. Web find out how to comply with irs regulations and legally deduct business mileage expenses with our free mileage log template. This is a set rate per mile that you can use to figure your deductible car expenses.

Web are you tracking your mileage for a federal tax deduction? Web find out how to comply with irs regulations and legally deduct business mileage expenses with our free mileage log template. Web these free excel mileage logs contain everything you need for a compliant irs mileage log. For drivers who chose aem (actual expense method), the single most important thing for their business mileage tax. Getting from one workplace to another in the course of your business or profession, visiting clients or customers, going to a business meeting away from your regular.

Learn how to organize, update, and store your mileage records securely for irs. Its role is to keep travel records for. Web looking for a solution for mileage tracking? Web track your business mileage and calculate your deduction with this free spreadsheet. Web for actual expense method: Getting from one workplace to another in the course of your business or profession, visiting clients or customers, going to a business meeting away from your regular. Web download and use this free 2024 mileage log template to track and claim your business miles. Web a mileage log is an essential tool for any driver who intends to get a tax deduction or employee reimbursement based on their car usage. Download for free and track your miles easily with this irs compliant excel mileage log template. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. This is a set rate per mile that you can use to figure your deductible car expenses. Web download and print various irs compliant templates to record your business mileage and expenses for tax deductions or reimbursements. With the help of this. Some business owners don’t track their mileage. Our online mileage log generator helps you make mileage logs in a matter of minutes.

Web The Irs Requires This Mileage Log Template To Ensure That Individuals And Businesses Have Accurate Details Of Their Travel Expenses, Such As Fuel Costs, Vehicle Maintenance, And.

Getting from one workplace to another in the course of your business or profession, visiting clients or customers, going to a business meeting away from your regular. For drivers who chose aem (actual expense method), the single most important thing for their business mileage tax. Some people just prefer to input their trips manually. Its role is to keep travel records for.

You Can Keep A Mileage Log In A Notebook And Update It By Hand, Or.

A paper log is a simple, written record of your business miles driven. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Read our article to understand the irs requirements for mileage logs importance. Learn how to organize, update, and store your mileage records securely for irs.

If Your Company Has A Specific Reimbursement Form For You To Use, Then Keep A Copy Of Vertex42'S Mileage.

Web 21+ free mileage log templates (for irs mileage tracking) whether you choose to claim your business auto expenses by submitting your total gas receipts or by claiming the. Web do you need a mileage log for reimbursement or irs tax purposes? Web these free excel mileage logs contain everything you need for a compliant irs mileage log. With the help of this.

Web Looking For A Solution For Mileage Tracking?

Date, destination, business purpose, odometer start, odometer. Web a mileage log template for excel: Web find free mileage log templates for various types of business driving and tax deductions. Learn the pros and cons of different.