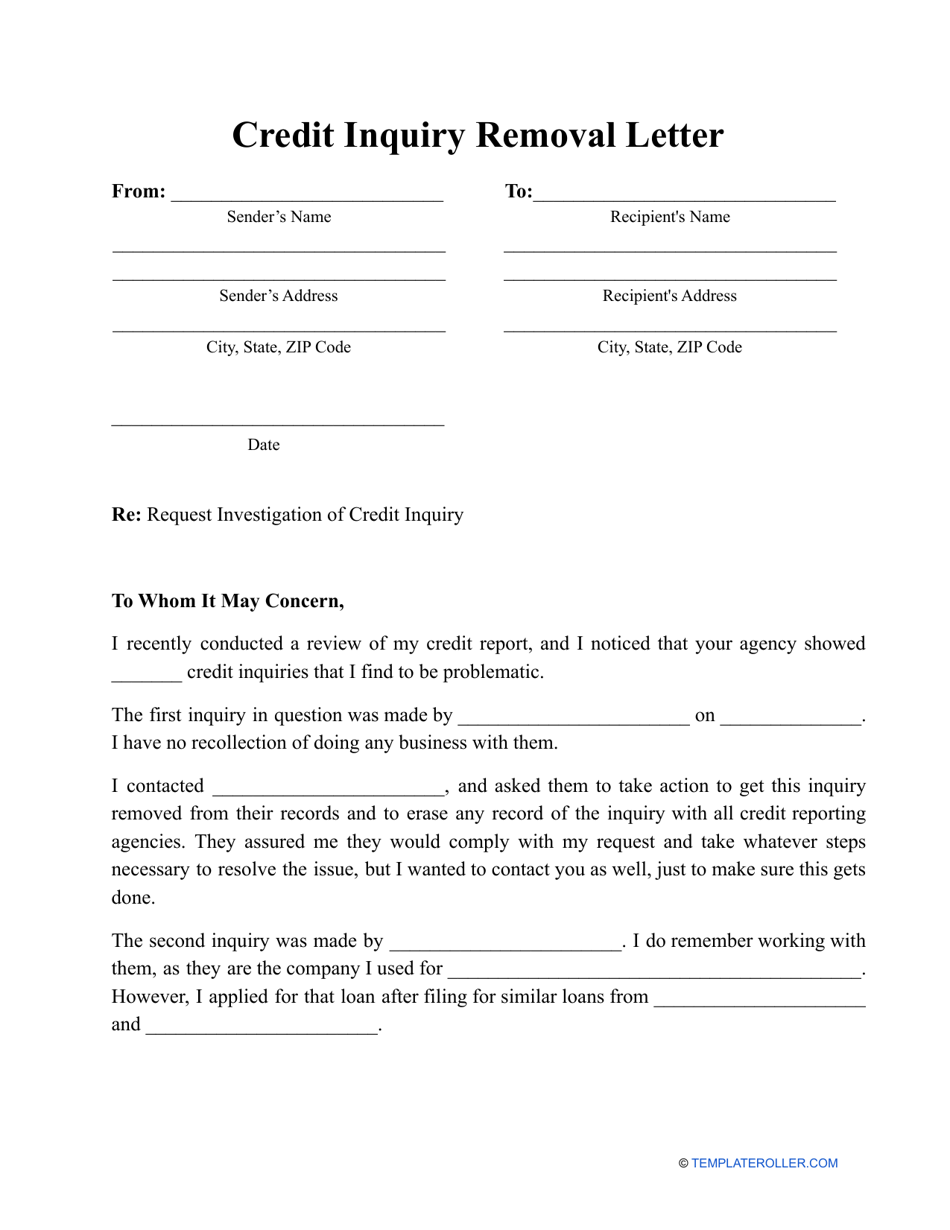

If you find hard inquiries on your credit report that you didn’t authorize, a credit inquiry removal letter can help you get rid of them and give your credit score a quick boost. Here’s how you can compose a credit inquiry removal letter that. Easily remove unwanted credit inquiries with our free credit inquiry removal letter template. However, there are some additional steps besides just filing your dispute letter that will make this process easier. Here are the errors to look out for and how to remove them.

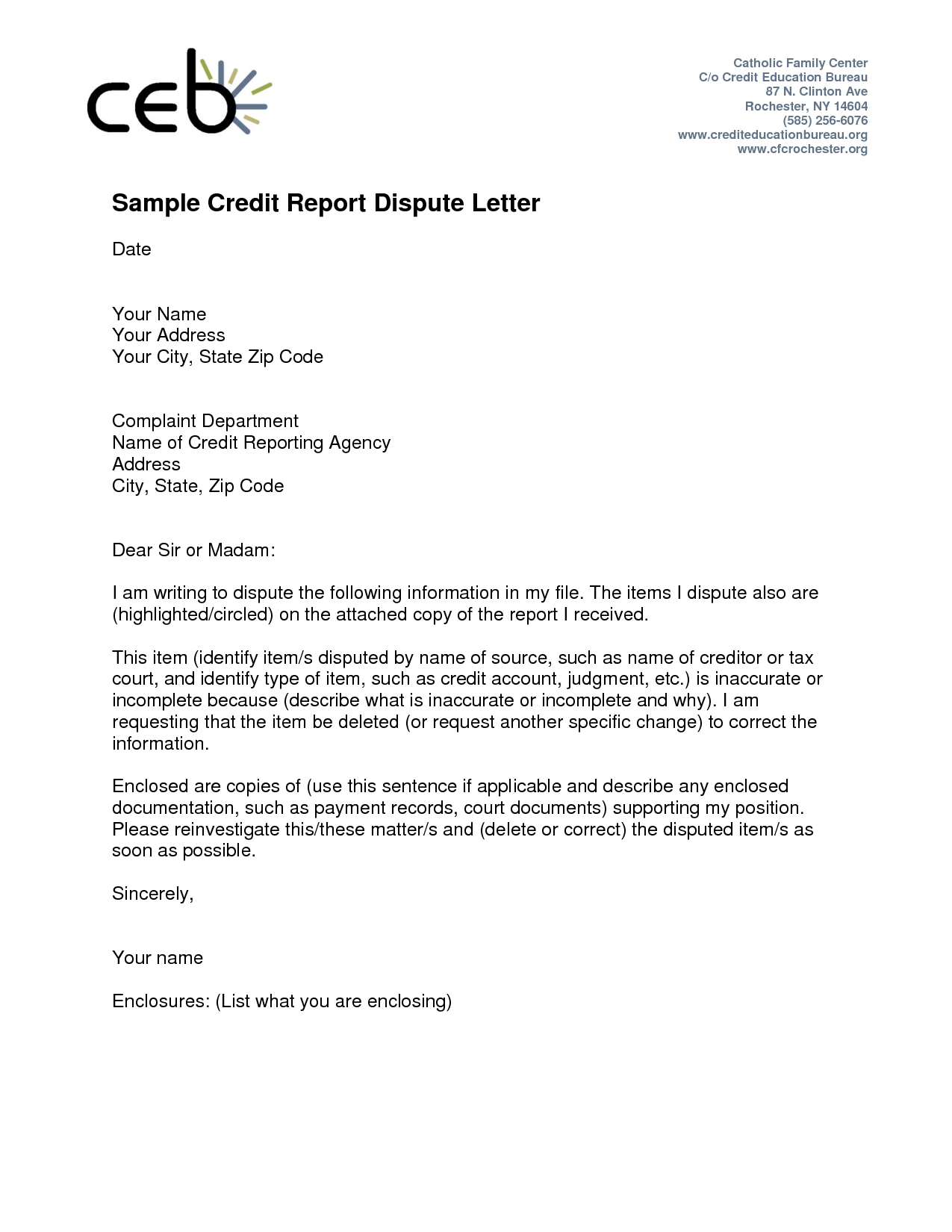

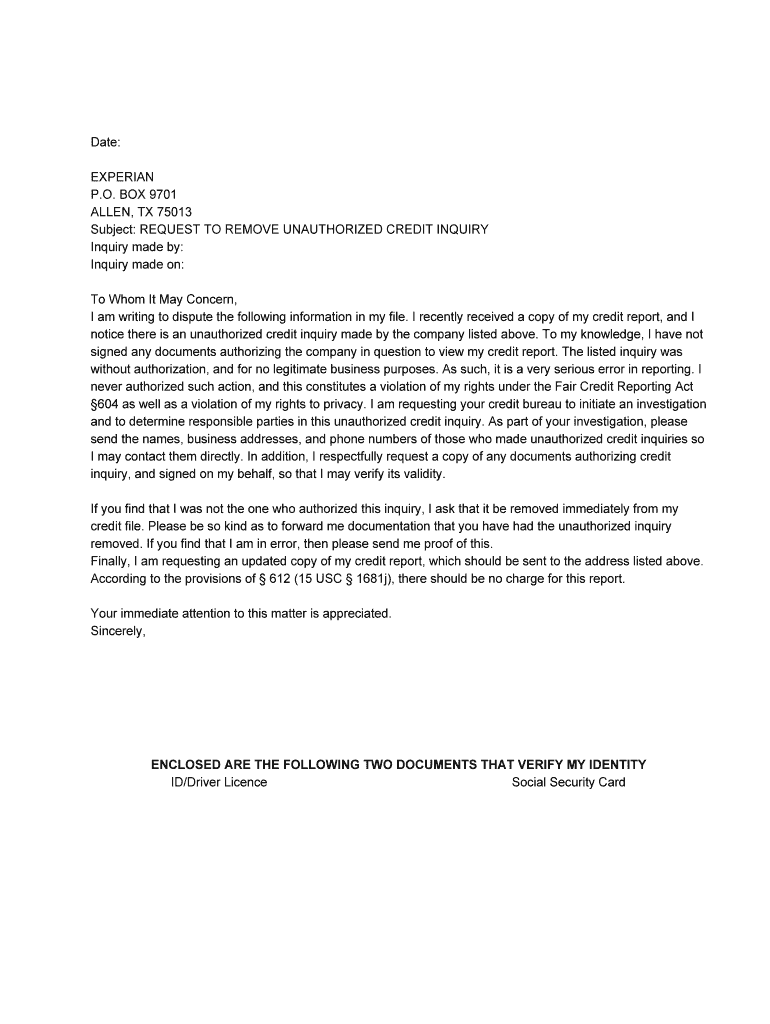

The inquiry in question was conducted by [creditor or lender name] on [date of inquiry] and appears on my credit report from your bureau. Here are the errors to look out for and how to remove them. Easily remove unwanted credit inquiries with our free credit inquiry removal letter template. Ensure that the inquiry is indeed incorrect or unauthorized. This guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate or incomplete, and you would like to submit a dispute of that information to the credit reporting company.

Here’s how you can compose a credit inquiry removal letter that. If you find hard inquiries on your credit report that you didn’t authorize, a credit inquiry removal letter can help you get rid of them and give your credit score a quick boost. Excessive hard inquiry sample letter: Read more about average credit score. Type text, add images, blackout confidential details, add comments, highlights and more.

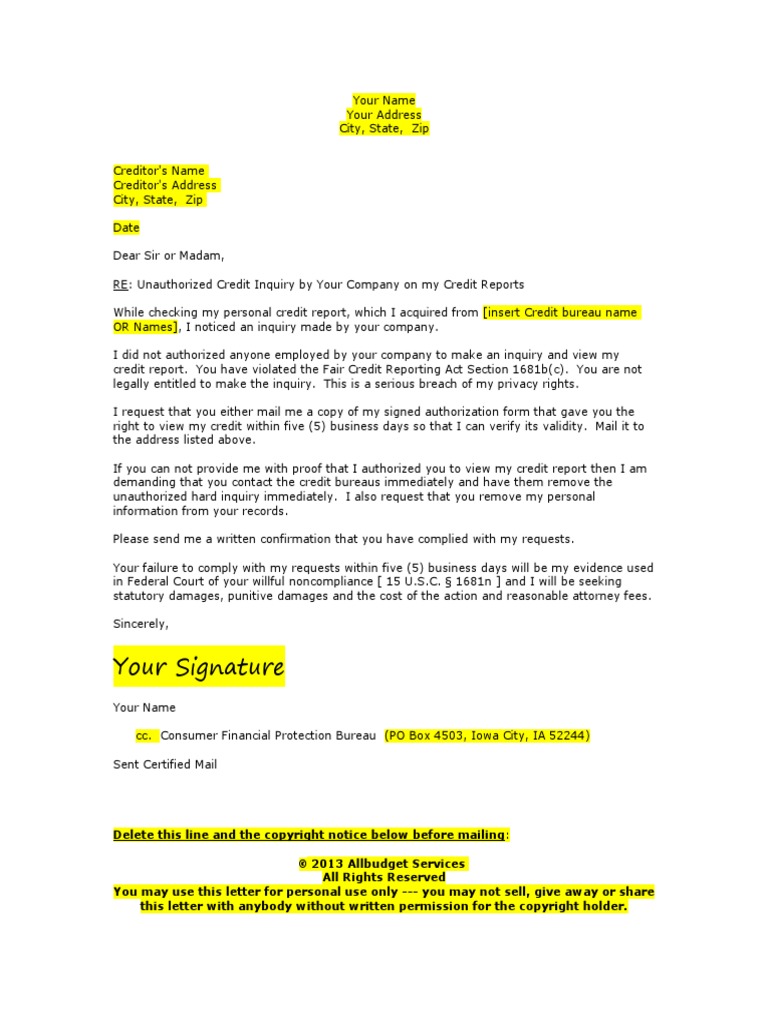

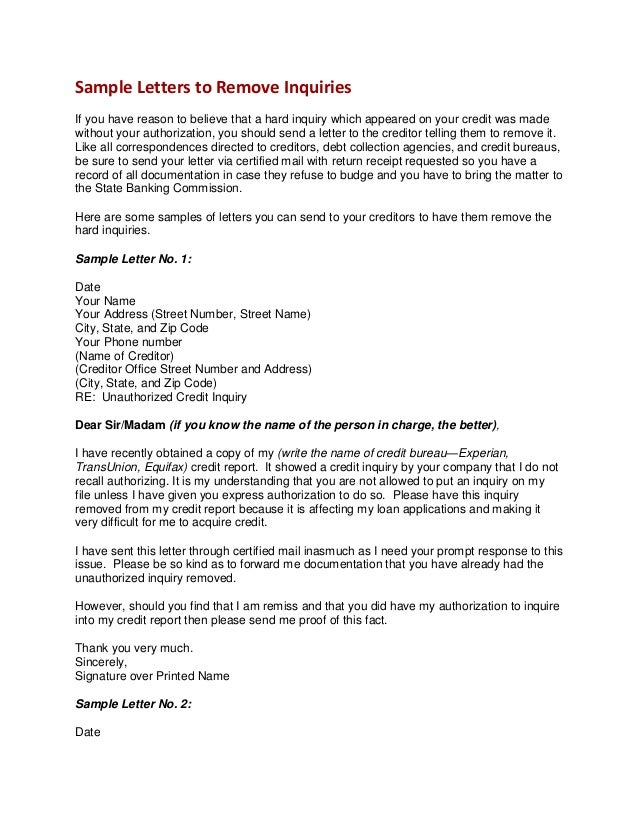

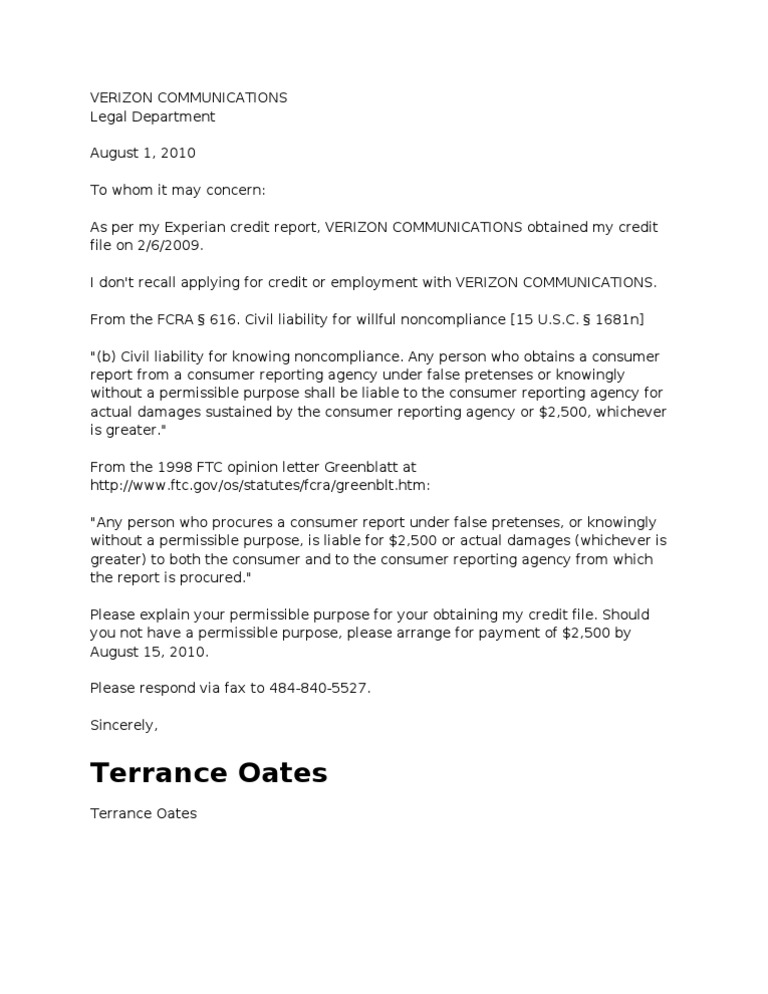

This letter argues that the excessive inquiries inaccurately reflect your creditworthiness, requesting their removal. However, there are some additional steps besides just filing your dispute letter that will make this process easier. I am writing to request the removal of an unauthorized hard inquiry from my credit report. It’s called a “credit inquiry removal letter” or a “credit inquiry dispute letter.” you can dispute a hard credit inquiry even if it’s “questionable”. Know which hard inquiries can cause problems. Easily remove unwanted credit inquiries with our free credit inquiry removal letter template. Here are the errors to look out for and how to remove them. Here’s how you can compose a credit inquiry removal letter that. You can also download it, export it or print it out. Download in pdf or word format and take control of your credit history now. This includes the date of the inquiry, the name of the creditor, and any supporting documents or evidence. In those cases, there is a way to remove the hard inquiry and improve your credit scores as a result. Read more about average credit score. Send how to remove hard inquiries in 15 minutes via email, link, or fax. A credit inquiry letter is really the only guaranteed way to remove a hard inquiry from your report.

A Hard Inquiry Removal Letter Template Is A Written Document Used To Dispute And Remove Unauthorized Or Erroneous Hard Inquiries From A Person's Credit Report.

Hard inquiries can't be removed, however, unless they're the result of identity theft. Send how to remove hard inquiries in 15 minutes via email, link, or fax. This includes the date of the inquiry, the name of the creditor, and any supporting documents or evidence. Collect all relevant information about the credit inquiry you wish to remove.

Edit Your Hard Inquiry Removal Letter Pdf Online.

Before you send your hard inquiry dispute letter, you should notify the lender and let them know that you are actively disputing the inquiry. A useful template for addressing multiple hard inquiries made within a short timeframe. Check your credit reports for free. In those cases, there is a way to remove the hard inquiry and improve your credit scores as a result.

However, There Are Some Additional Steps Besides Just Filing Your Dispute Letter That Will Make This Process Easier.

Keywords relevant to this topic include hard inquiries, removal letter, template, dispute,. This letter argues that the excessive inquiries inaccurately reflect your creditworthiness, requesting their removal. Disputing hard inquiries on your credit report involves working with the credit reporting agencies and possibly the creditor that made the inquiry. In order to dispute your inquiry, send a credit inquiry removal letter following the steps below.

If You Want To Dispute Information On A Credit Report, You May Need To Send A Dispute Letter To Both The Institution That Provided The Information, Called The Information Furnisher, As Well As The Credit Reporting Company.

You can also download it, export it or print it out. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. Download in pdf or word format and take control of your credit history now. A credit inquiry letter is really the only guaranteed way to remove a hard inquiry from your report.