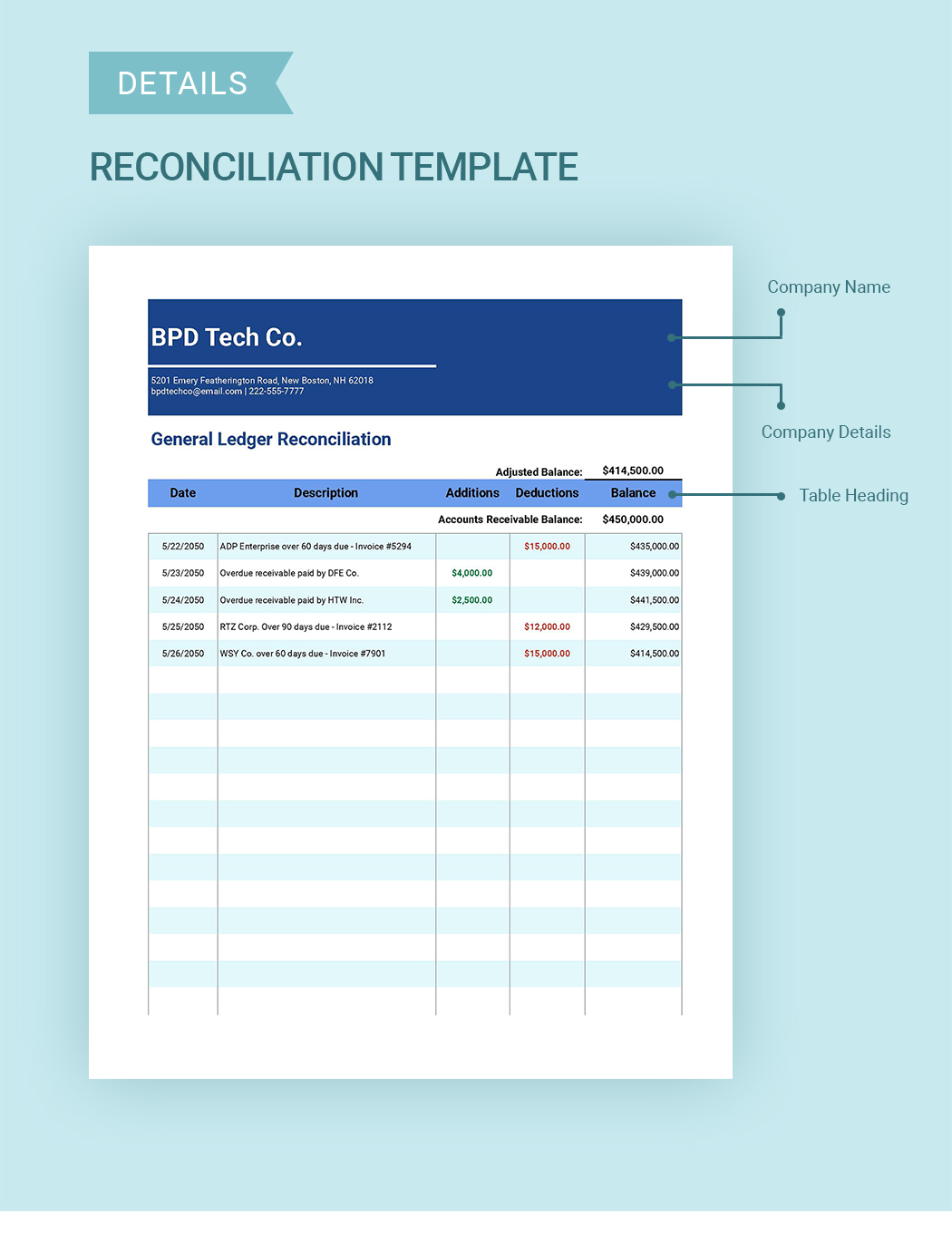

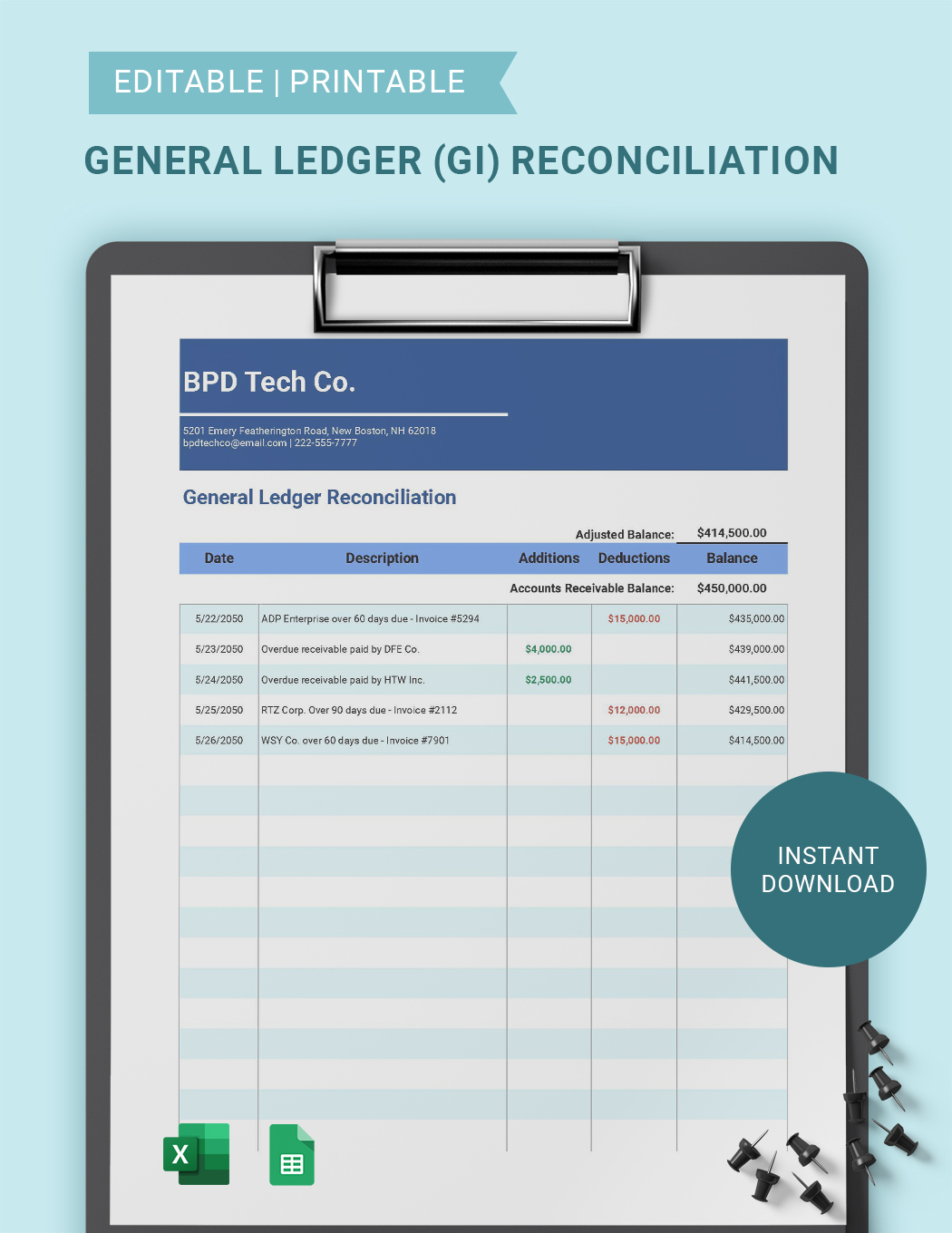

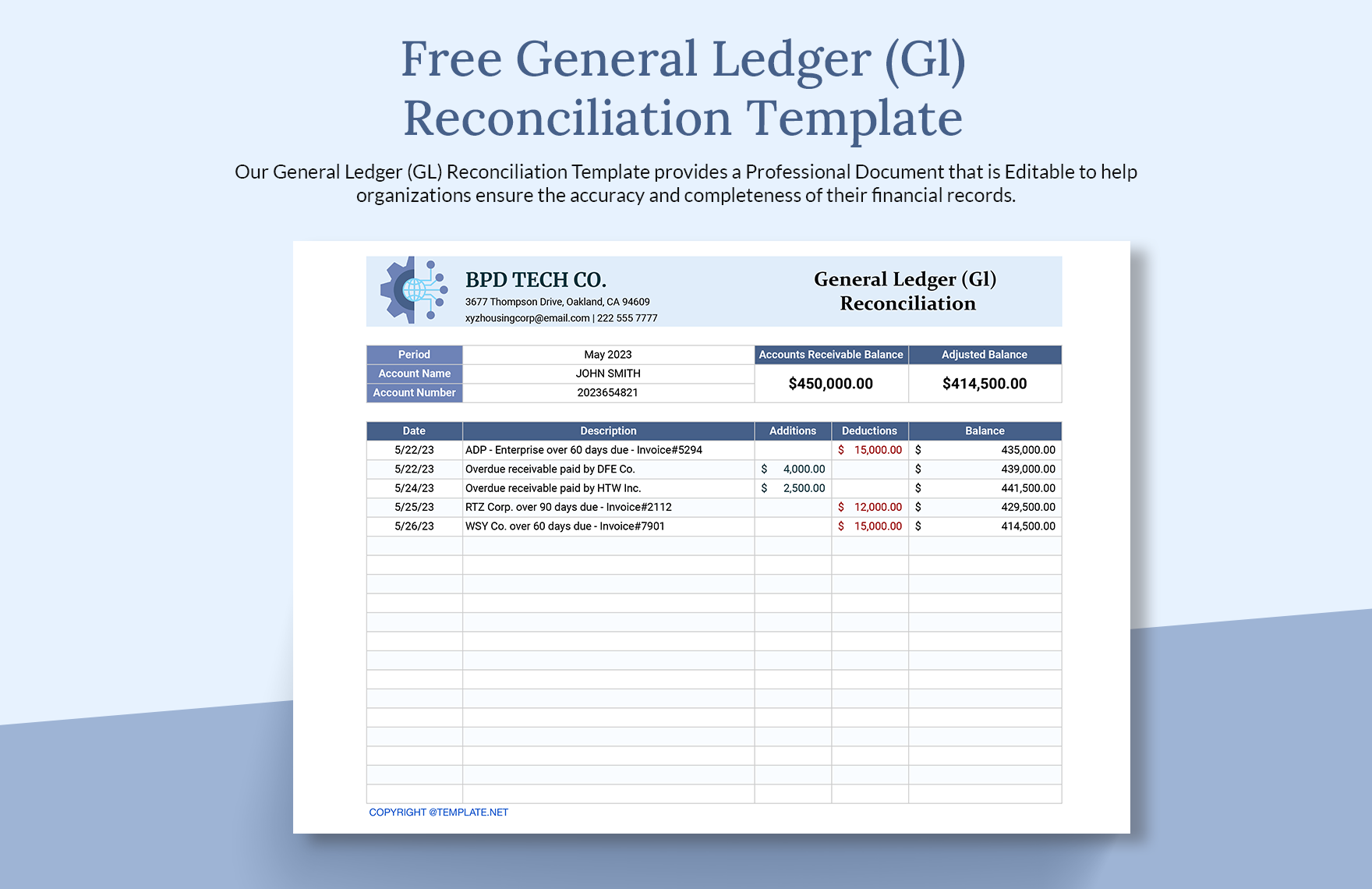

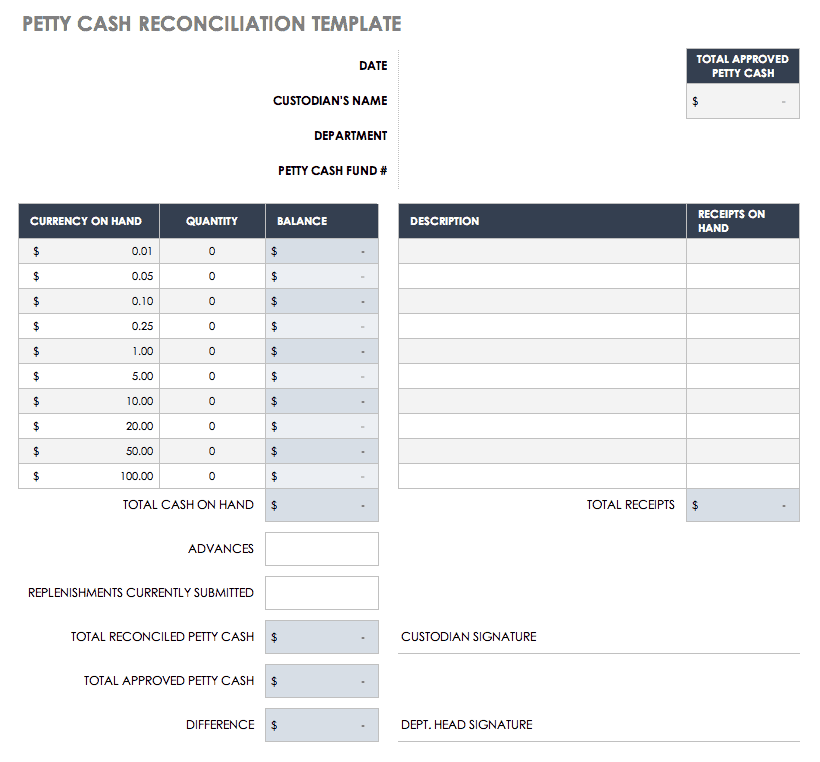

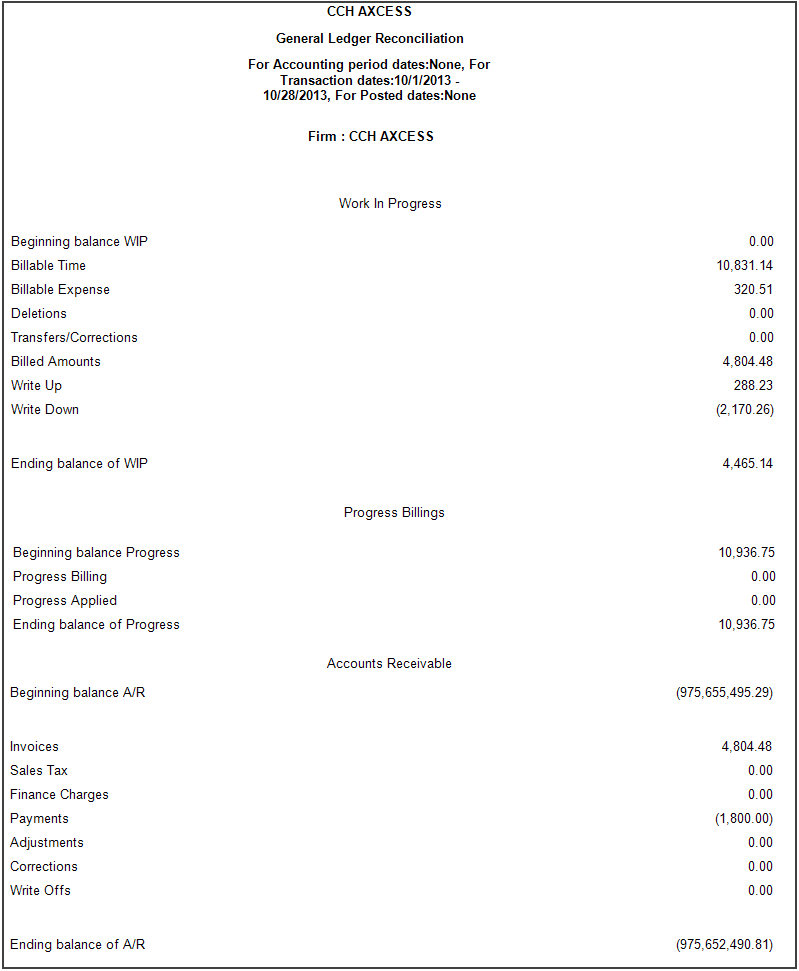

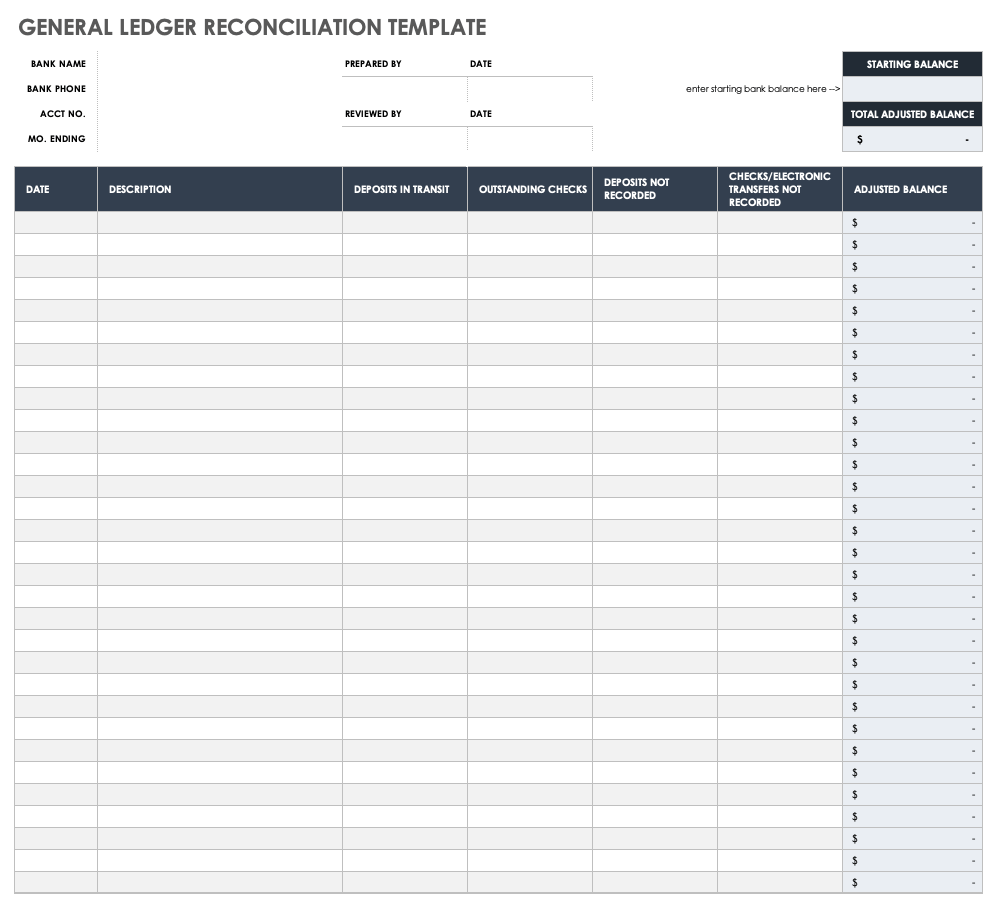

This includes cash accounts, accounts receivable, accounts payable, inventory accounts, and any other balance sheet accounts that require reconciliation. Why is reconciliation important in accounting? Still seeking for a better and fluent format to record and track numerous financial transactions and circumstances of the company or business? General ledger (gl) reconciliations work by comparing gl account balances for balance sheet accounts to supporting sets of records and maintaining rolling schedules with beginning balance, additions, reductions, and ending balance for specific accounts. Our general ledger (gl) reconciliation template provides a professional document that is editable to help organizations ensure the accuracy and completeness of their financial records.

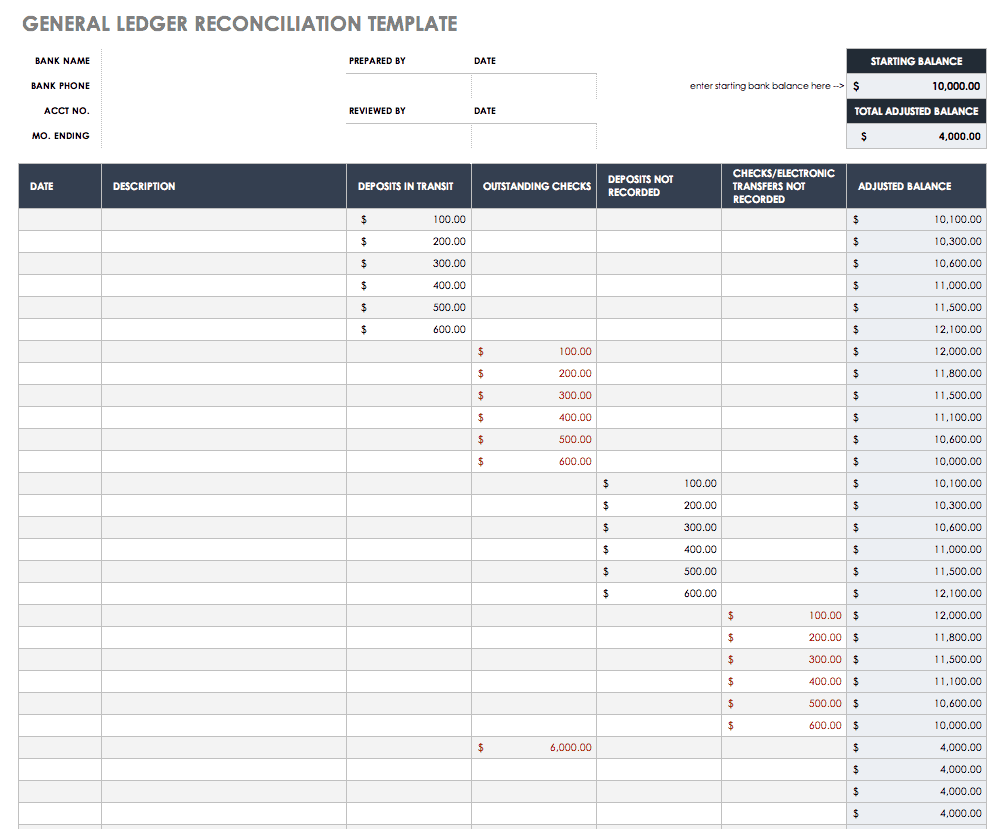

The reconciliation process for the general ledger requires investigations of the beginning balance, current period, adjustments, and reversals. Reconciliations can be completed manually using excel spreadsheets or by using blackline accounting software. Gather the necessary account information. This template enables you to enter the balance from your bank statement or subledger and from your general ledger to determine whether you need to adjust amounts. Freshbooks has created a general ledger template to guide you in creating the perfect statement.

General ledger reconciliation is pivotal for ensuring financial accuracy by comparing ledger balances with external documents like bank statements and invoices. What are the benefits of account reconciliation? With it, you can identify and resolve discrepancies,. Freshbooks has created a general ledger template to guide you in creating the perfect statement. Just like the bank reconciliation template, this balance sheet reconciliation template gives the user a quick understanding of what’s happening to the account.

Use this general ledger reconciliation template to record your company’s financial data and reconcile all accounts. A general ledger reconciliation is an activity performed by accountants to verify that information in the general ledger is accurate. Are varying degrees of complexity in agencies and their respective transactions, so this procedure The following instructions provide best practice guidance for individuals responsible for reconciling balance sheet account balances on a quarterly basis. General ledger reconciliation is pivotal for ensuring financial accuracy by comparing ledger balances with external documents like bank statements and invoices. Download accounting reconciliation templates for free. This template enables you to enter the balance from your bank statement or subledger and from your general ledger to determine whether you need to adjust amounts. What are the differences in account reconciliation? Balance sheet account reconciliation protects a company from reporting errors on the company financial statements, which can lead to errors when preparing the company's federal tax return. It’ll help you maintain compliance, identify and resolve discrepancies, and become your company’s financial reporting superhero. It's a cornerstone of accurate financial reporting and sound financial management. Download embark’s ultimate account reconciliation template & best practices to quickly address accounting discrepancies and keep your financials aligned and on track. Many accountants create microsoft excel spreadsheets to assist with reconciling general ledger (gl) accounts to external documentation. Just like the bank reconciliation template, this balance sheet reconciliation template gives the user a quick understanding of what’s happening to the account. Gather the necessary account information.

This Includes Cash Accounts, Accounts Receivable, Accounts Payable, Inventory Accounts, And Any Other Balance Sheet Accounts That Require Reconciliation.

General ledger (gl) reconciliations work by comparing gl account balances for balance sheet accounts to supporting sets of records and maintaining rolling schedules with beginning balance, additions, reductions, and ending balance for specific accounts. Still seeking for a better and fluent format to record and track numerous financial transactions and circumstances of the company or business? Why is reconciliation important in accounting? 37 perfect general ledger templates [excel, word] when you adopt a holistic point of view, it becomes easier to identify any advantages or issues that affect your whole organization.

Reconciliations Can Be Completed Manually Using Excel Spreadsheets Or By Using Blackline Accounting Software.

Identify the accounts to be reconciled. How often should i complete account reconciliations? Ms excel account ledger template. This template enables you to enter the balance from your bank statement or subledger and from your general ledger to determine whether you need to adjust amounts.

Gather The Necessary Account Information.

Just like the bank reconciliation template, this balance sheet reconciliation template gives the user a quick understanding of what’s happening to the account. The google sheets general ledger reconciliation template by sample templates is designed to ensure the accuracy of your financial records at every turn. It ensures the reliability of financial documents, supports informed analyses, and underpins credit risk management. Companies or individuals can use this general ledger (gl) reconciliation template for bank reconciliation.

It’ll Help You Maintain Compliance, Identify And Resolve Discrepancies, And Become Your Company’s Financial Reporting Superhero.

We offer a selection of four distinct bank reconciliation sheet templates, each designed to meet specific needs. General ledger reconciliation is more than a best practice; General ledger reconciliation is pivotal for ensuring financial accuracy by comparing ledger balances with external documents like bank statements and invoices. Are varying degrees of complexity in agencies and their respective transactions, so this procedure