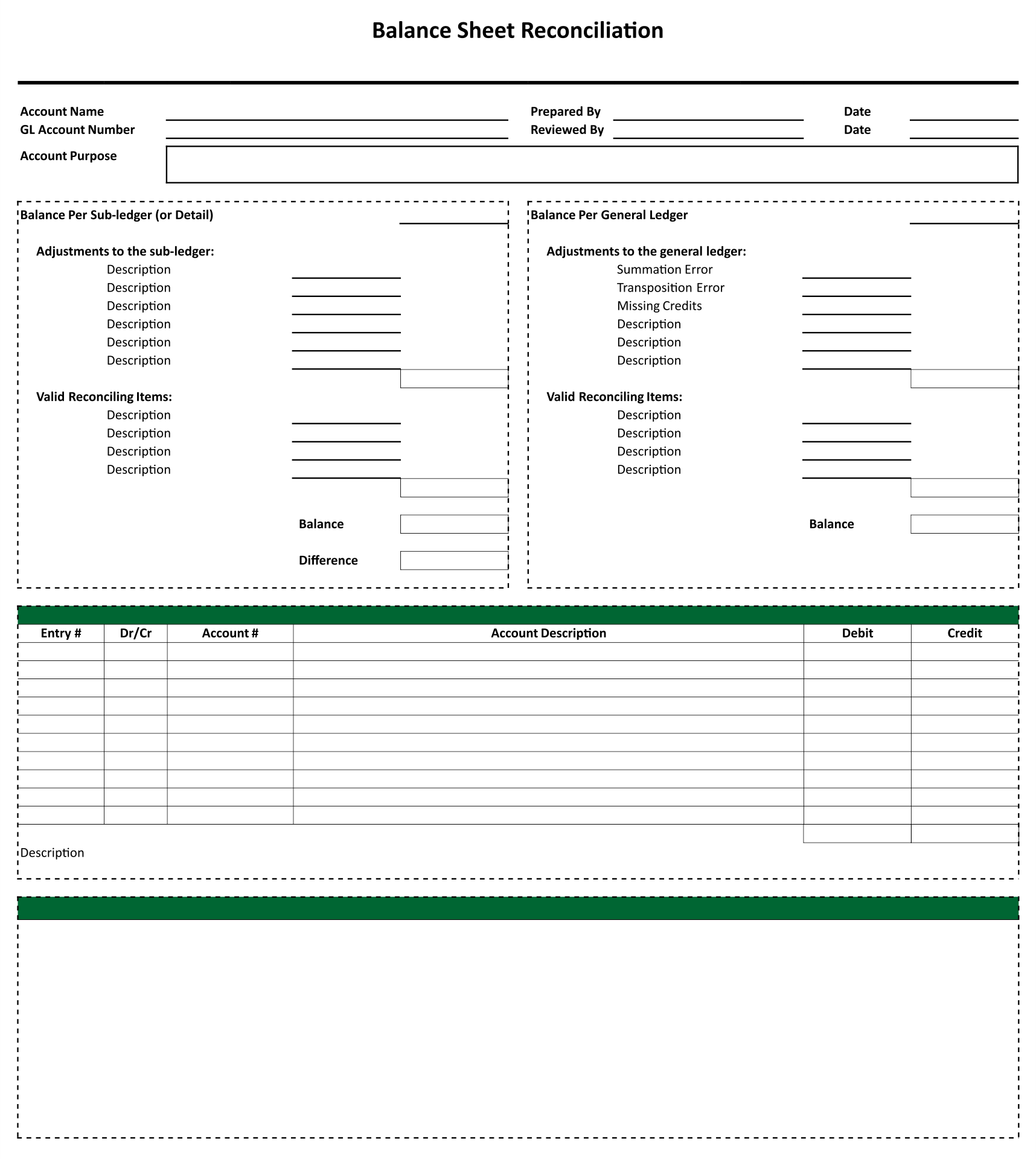

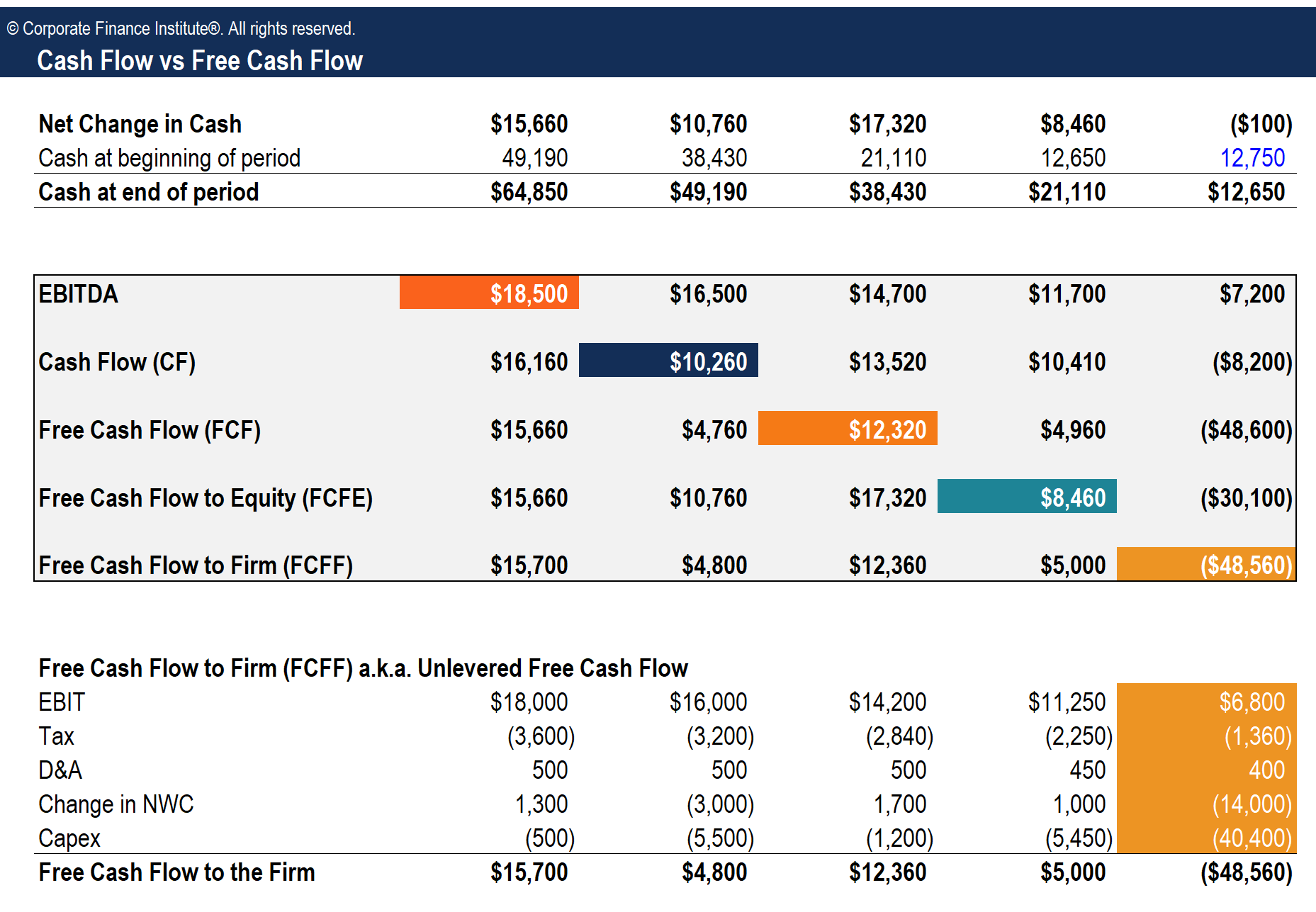

Summarize the ending balances in all revenue accounts and verify that the aggregate amount matches the revenue total in the income statement. Download accounting reconciliation templates for free. It involves comparing the account balances in the balance sheet with the general ledger and supporting documents such as bank statements, credit card statements, and invoices. This template enables you to enter the balance from your bank statement or subledger and from your general ledger to determine whether you need to adjust amounts. Businesses can also use it for reconciling balance sheet accounts, such as accounts payable, by editing the template to show the appropriate account information.

A general ledger reconciliation is an activity performed by accountants to verify that information in the general ledger is accurate. This customizable template shows you exactly what you need to include on your ledger sheet. Get your accounts balanced in minutes! This template enables you to enter the balance from your bank statement or subledger and from your general ledger to determine whether you need to adjust amounts. Summarize the ending balances in all expense accounts and verify that the aggregate amount matches the expense total in the income statement.

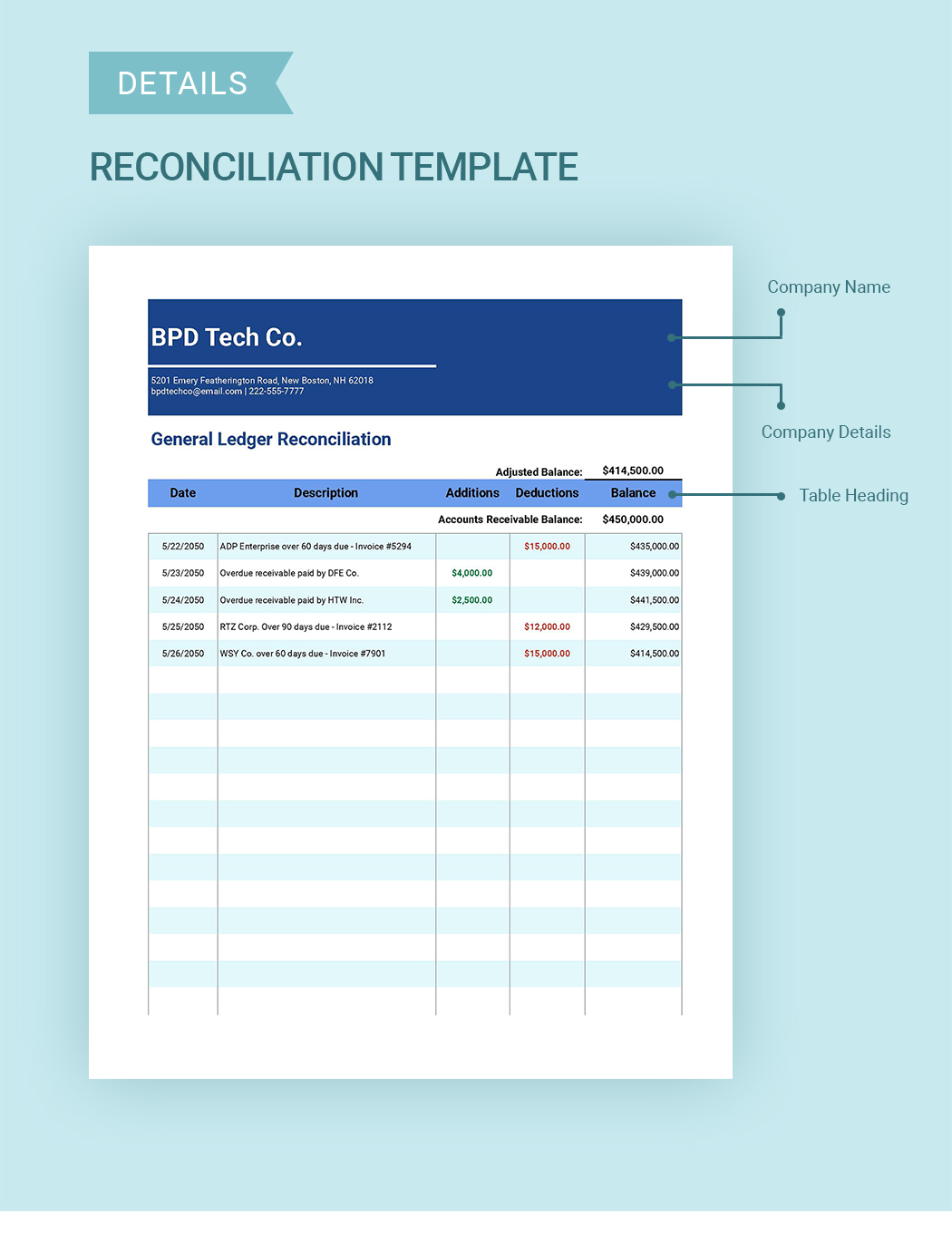

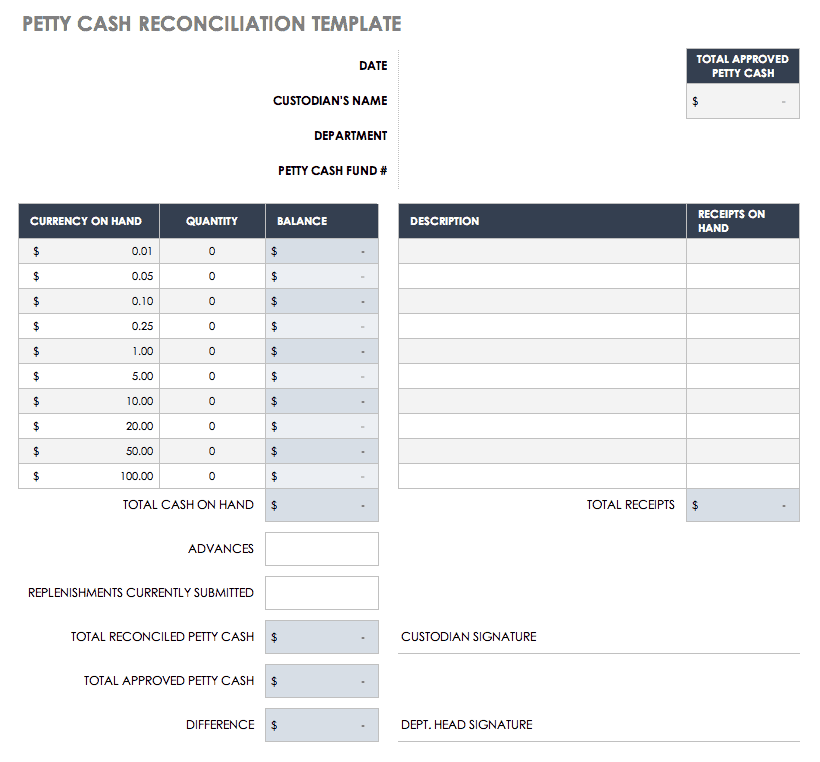

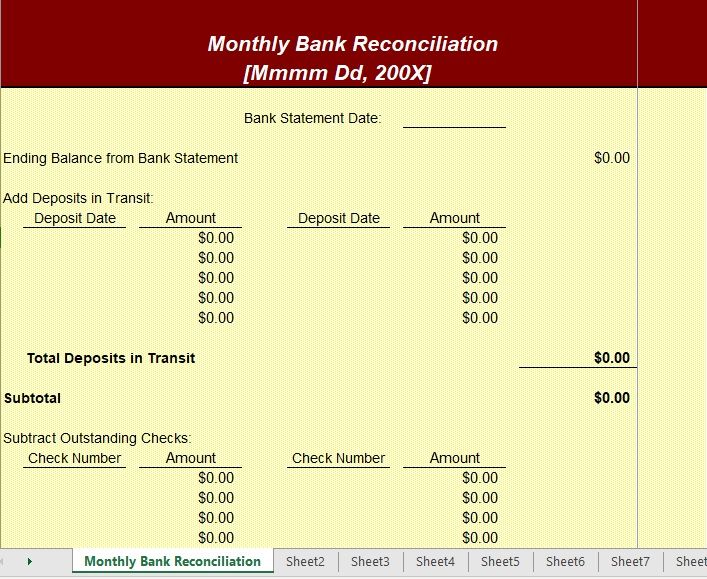

General ledger reconciliation is pivotal for ensuring financial accuracy by comparing ledger balances with external documents like bank statements and invoices. We offer a selection of four distinct bank reconciliation sheet templates, each designed to meet specific needs. This excel template helps you to quickly reconcile your balance sheet accounts. A general ledger template in google sheets is a digital tool for tracking financial transactions. Balance sheet reconciliation is the process that ensures the accuracy of a company’s financial statements.

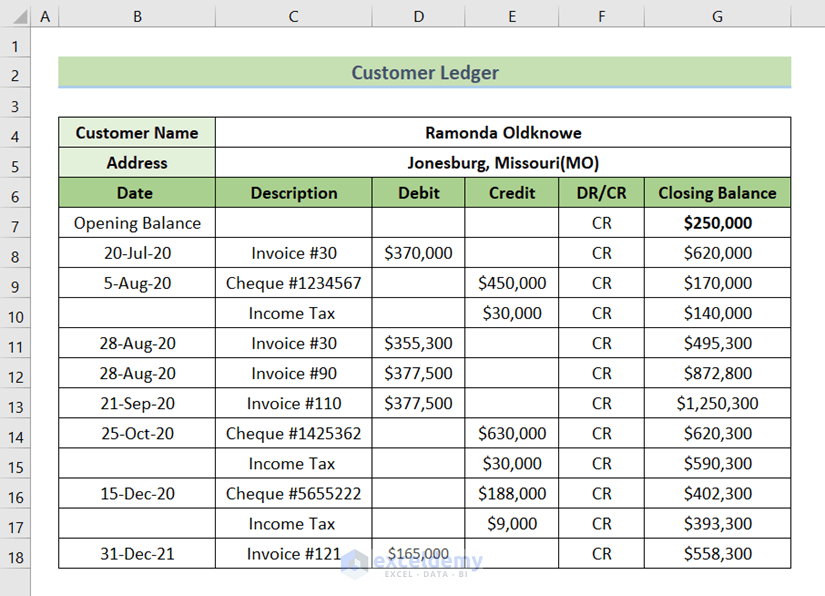

It eliminates manual data entry and simplifies the process of checking for accuracy, reducing the risk of errors. With it, you can identify and resolve discrepancies, maintain compliance, and improve financial reporting. A general ledger template in google sheets is a digital tool for tracking financial transactions. What is balance sheet reconciliation? Get started by downloading the free general ledger template from freshbooks as your guide. Get your accounts balanced in minutes! Download accounting reconciliation templates for free. Use this general ledger reconciliation template to record your company’s financial data and reconcile all accounts. Automate financial workflows, transaction matching, and account reconciliation in compliance with jurisdictional requirements, so you can manage your law firm’s bookkeeping—and limit manual data entry—with confidence. Download our template right now; Account reconciliation is a critical process for ensuring the accuracy of financial records. General ledger (gl) reconciliations work by comparing gl account balances for balance sheet accounts to supporting sets of records and maintaining rolling schedules with beginning balance, additions, reductions, and ending balance for specific accounts. Insert the bank statement for the month of july in a sheet titled “ inserting bank statement.” insert dates in column b, transaction descriptions in column c, and transaction amounts in column d. It involves comparing the account balances in the general ledger with supporting documentation, such as bank statements, invoices, receipts, and other financial records. Download your desired template in word or excel format!

Use This General Ledger Reconciliation Template To Record Your Company’s Financial Data And Reconcile All Accounts.

A general ledger reconciliation is an activity performed by accountants to verify that information in the general ledger is accurate. Get started by downloading the free general ledger template from freshbooks as your guide. This template enables you to enter the balance from your bank statement or subledger and from your general ledger to determine whether you need to adjust amounts. General ledger (gl) reconciliation template.

Get An Accurate View Of Your Finances With These General Ledger Templates.

Summarize the ending balances in all revenue accounts and verify that the aggregate amount matches the revenue total in the income statement. Insert the bank statement for the month of july in a sheet titled “ inserting bank statement.” insert dates in column b, transaction descriptions in column c, and transaction amounts in column d. With it, you can identify and resolve discrepancies, maintain compliance, and improve financial reporting. Optimize account reconciliation by identifying and resolving variances for general ledger accounts through configurable matching rules and algorithms

Insert Or Delete Columns As Needed For The Number Of Accounts Used By Your Agency.

Reconciliation worksheet of the template. Row 13 contains a vlookup formula to pull the ending balance for each account from the. This excel template helps you to quickly reconcile your balance sheet accounts. Download our template right now;

Summarize The Ending Balances In All Expense Accounts And Verify That The Aggregate Amount Matches The Expense Total In The Income Statement.

Balance sheet reconciliation is the process that ensures the accuracy of a company’s financial statements. Reconciliations can be completed manually using excel spreadsheets or by using blackline accounting software. Account reconciliation is a critical process for ensuring the accuracy of financial records. Our general ledger (gl) reconciliation template provides a professional document that is editable to help organizations ensure the accuracy and completeness of their financial records.

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-17.jpg?w=320)