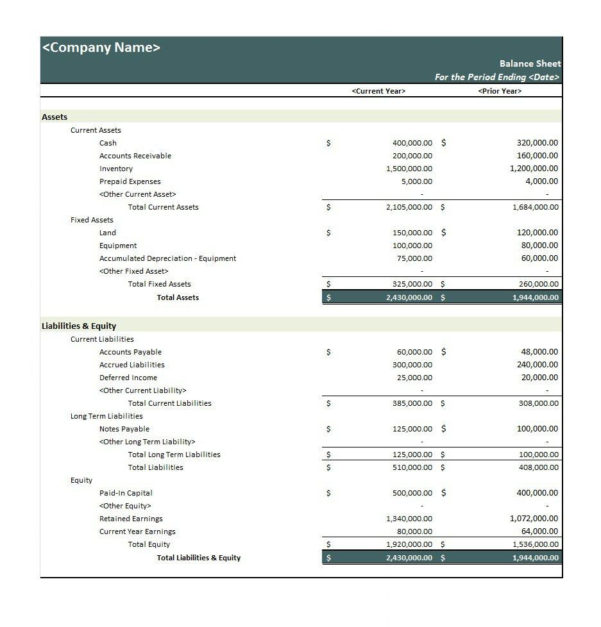

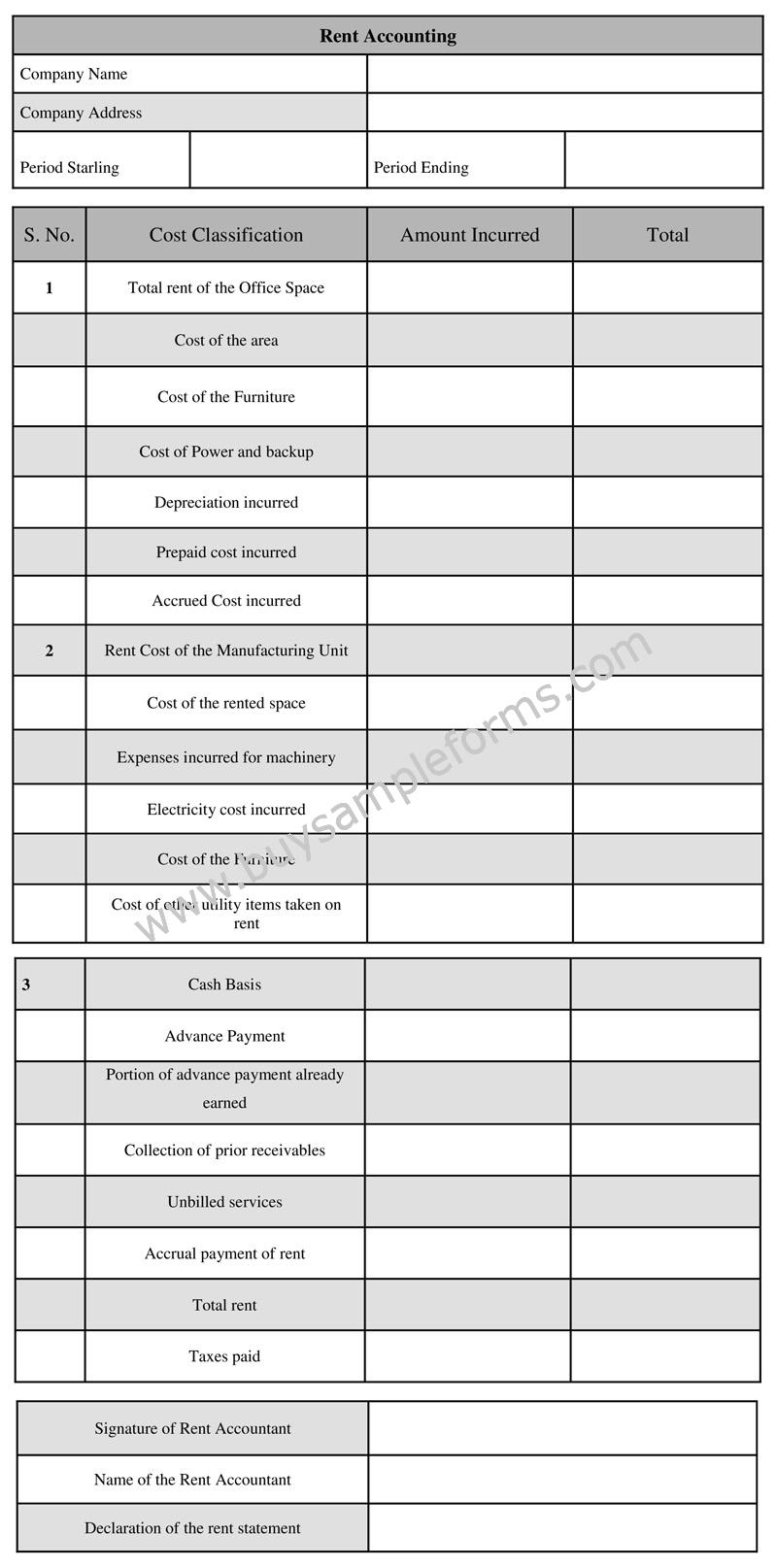

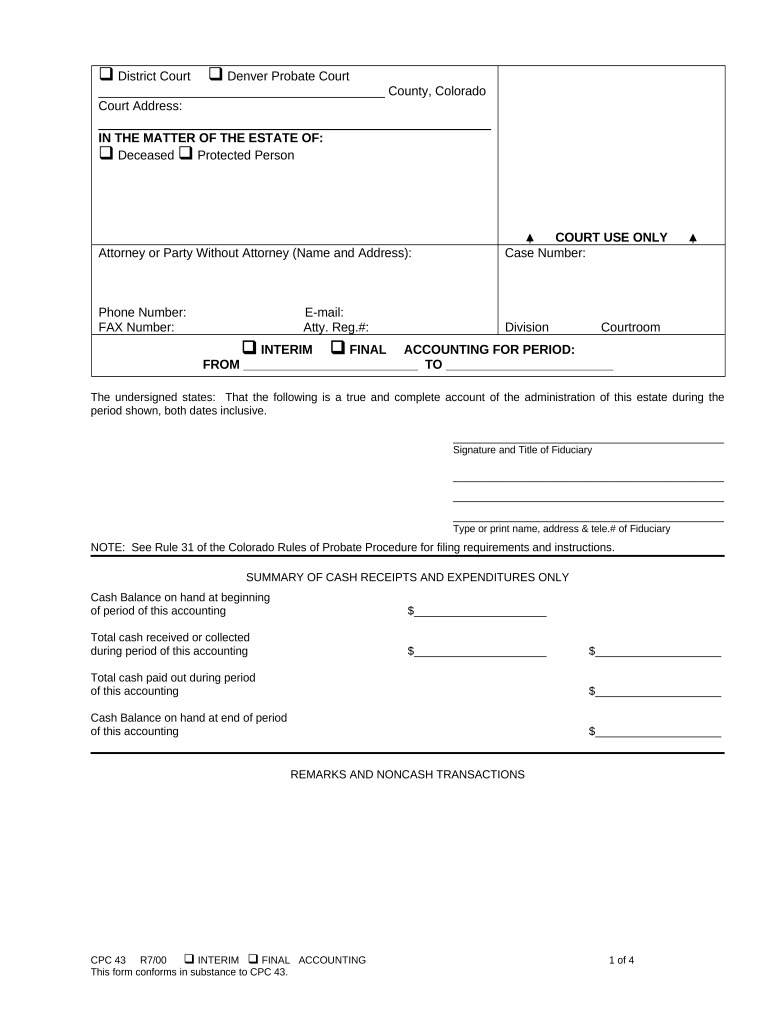

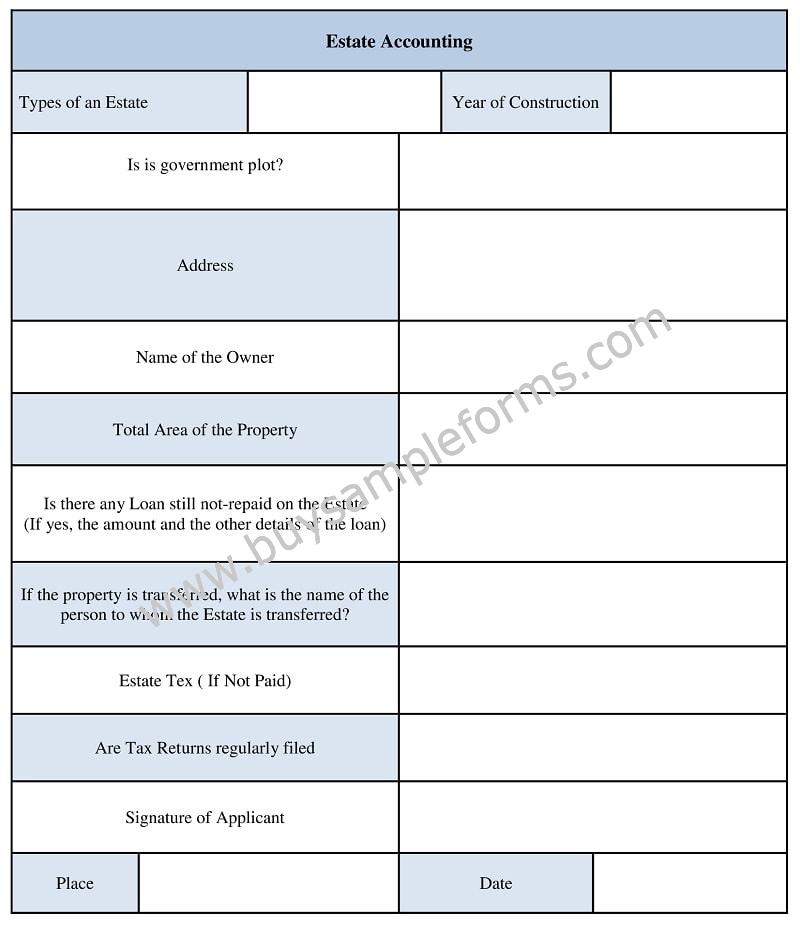

Web managing estate financials is at the heart of the executor process, and involves a variety of elements: No need to install software, just go to dochub, and sign up instantly and for free. Web we look at what is included in estate accounts: Accounts must be filed with the commissioner of accounts. Web this guide lists the information necessary to complete a final accounting, including funds received since the estate was opened, any gains or losses from assets of the estate, money spent, and value of property held in the estate at the time of the final accounting.

No need to install software, just go to dochub, and sign up instantly and for free. In general, the accounting should present a complete picture of the financial status of the estate. Web first and final account of william c. Doe, executor for estate of john doe, deceased Web the final accounting.

In general, the accounting should present a complete picture of the financial status of the estate. Accounts must be filed with the commissioner of accounts. This document provides a comprehensive summary of all financial activities related to the estate, including asset inventory and valuation, debts, and taxes paid, and distribution of assets. These are your last steps, usually completed after distributing the final income amounts, paying the last expenses, and filing the final tax returns. Web by creating an income and expense report on the estate account, the final accounting becomes an easier task for the executor.

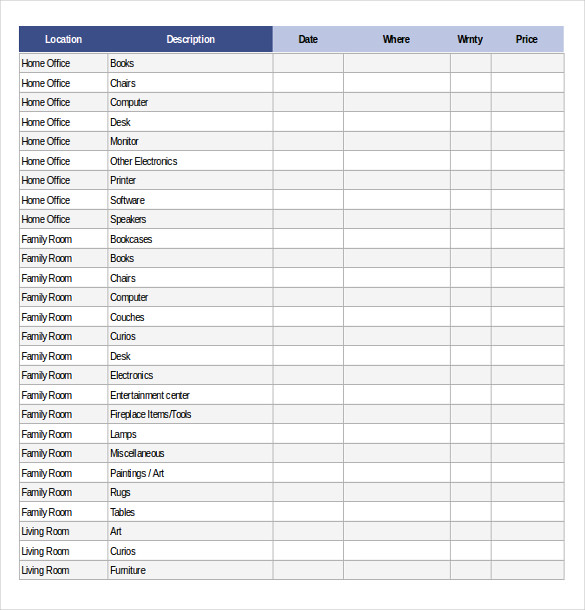

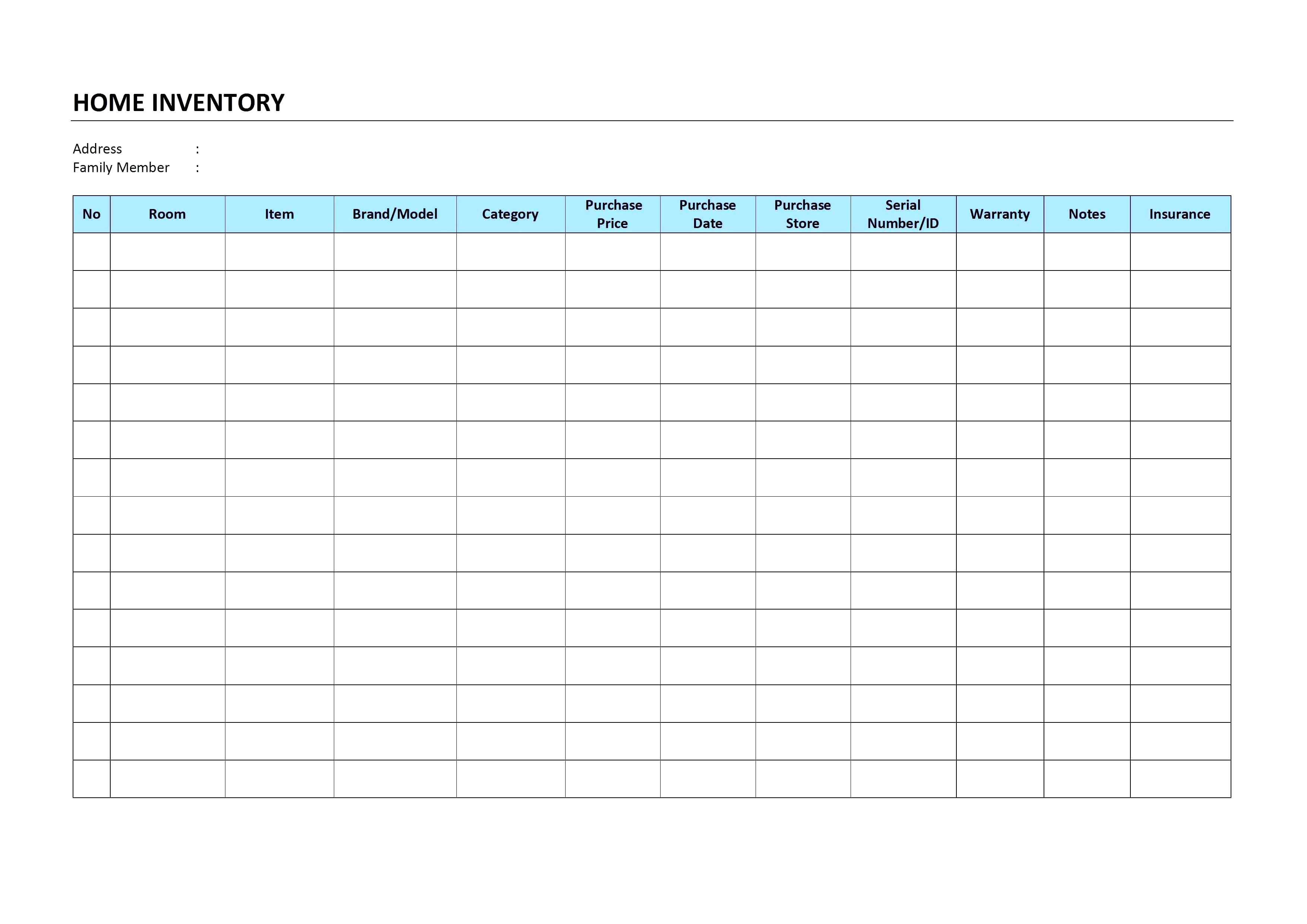

Accounts must be signed by. Relatively simple estate, no debts except possibly utilities etc., executor's expenses. The final account must be presented to the court for approval and. No need to install software, just go to dochub, and sign up instantly and for free. The last step in the process is to prepare a final estate account. Doe, executor for estate of john doe, deceased These three schedules make up the final accounting for massachusetts estates. Web by creating an income and expense report on the estate account, the final accounting becomes an easier task for the executor. Web instructions for account for decedent’s estate. The exact procedure, and the specific forms used, will vary from state to state. Testatrix was sole surviving parent, only beneficiaries three children (one of whom executor). It involves organizing and calculating all income, expenses, taxes, and distributions related to the estate. Accounts must be filed with the commissioner of accounts. Web the final accounting of an estate depends on the specific property owned by the estate. Web edit, sign, and share final accounting form online.

It Can Help You Gather Information, Figure Out Who Should Be Involved, And Find The Right Documents.

No need to install software, just go to dochub, and sign up instantly and for free. Web instructions for account for decedent’s estate. In a common estate, the executor must reveal the following in the final accounting: Web after updating the estate account and completing the final inventory of assets, it was time to complete the final accounting.

Web Can Anybody Direct Me To A Suitable Account Template/Guide Etc.?

The last step in the process is to prepare a final estate account. Web this guide lists the information necessary to complete a final accounting, including funds received since the estate was opened, any gains or losses from assets of the estate, money spent, and value of property held in the estate at the time of the final accounting. Web as an executor, you must provide a final accounting of the estate and have it approved by all the beneficiaries. Web managing estate financials is at the heart of the executor process, and involves a variety of elements:

Relatively Simple Estate, No Debts Except Possibly Utilities Etc., Executor's Expenses.

Web final estate accounting instruction sheet and checklist [all forms available at: The final account must be presented to the court for approval and. First, the accounting should describe the assets of. These are your last steps, usually completed after distributing the final income amounts, paying the last expenses, and filing the final tax returns.

In General, The Accounting Should Present A Complete Picture Of The Financial Status Of The Estate.

Ask the commissioner how many copies are required to be filed. Web closing an estate and the final accounting. Estate income and expenses, state and federal taxes, asset liquidation, debt resolution, and more. Testatrix was sole surviving parent, only beneficiaries three children (one of whom executor).