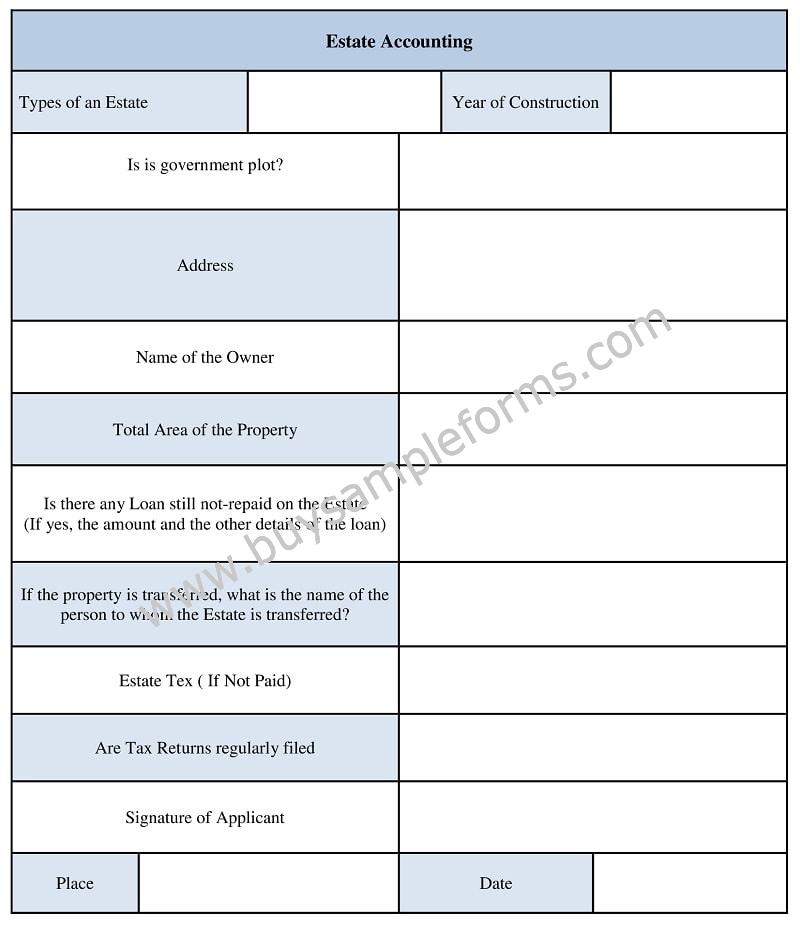

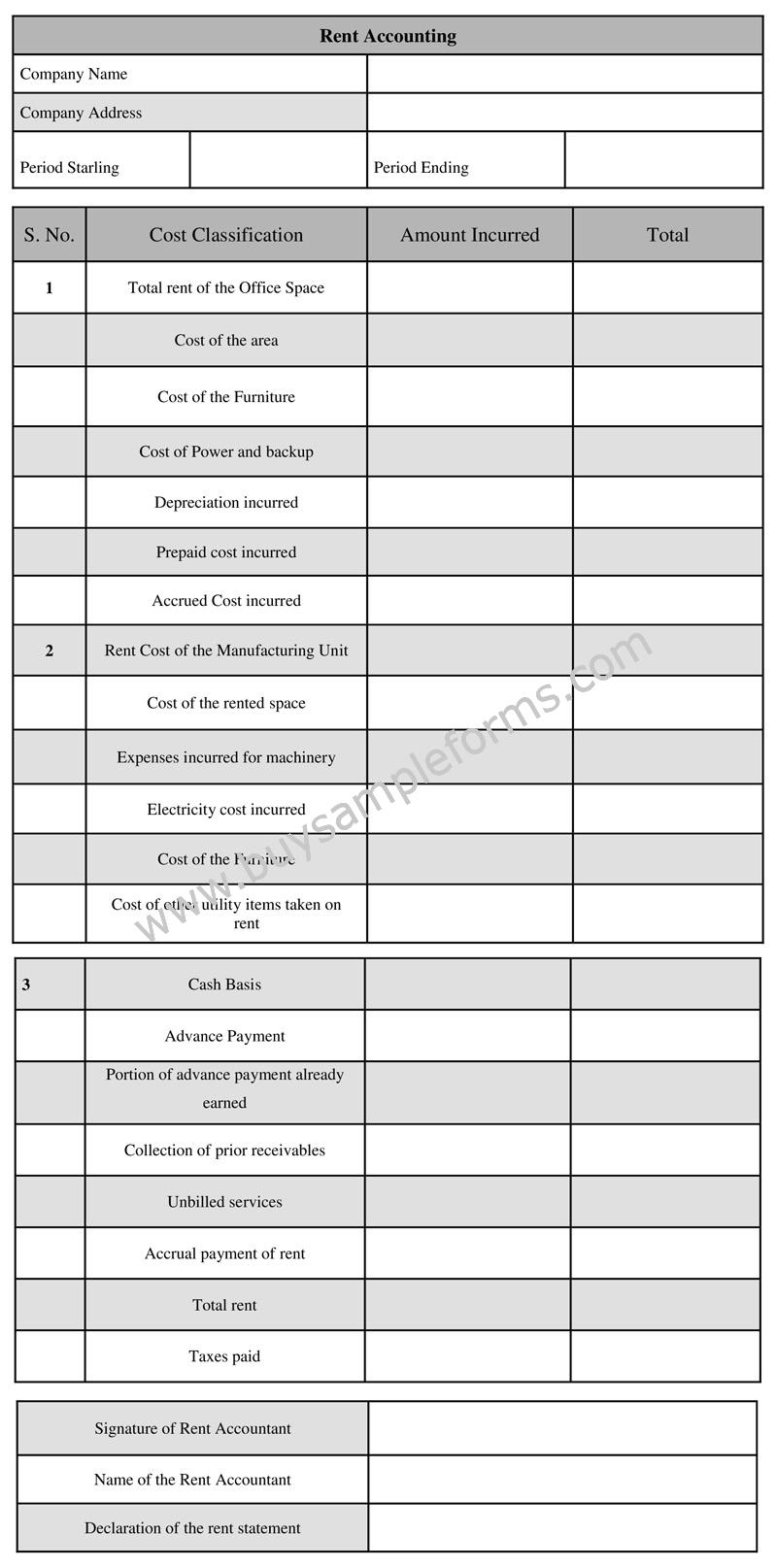

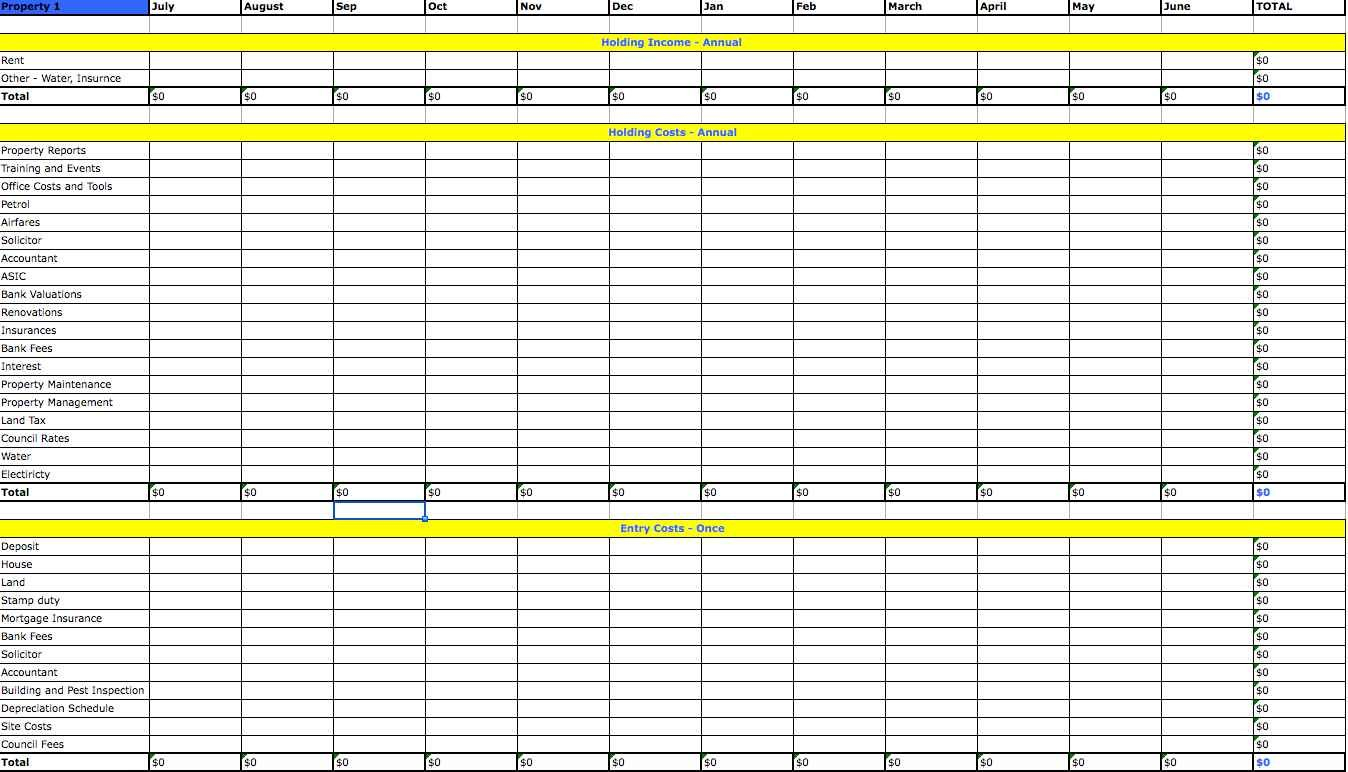

An estate accounting can be rendered in one of three ways: Accounts must be signed by each of the executors, administrators or curators. We look at what is included in estate accounts: After updating the estate account and completing the final inventory of assets, it was time to complete the final accounting. Managing estate financials is at the heart of the executor process, and involves a variety of elements:

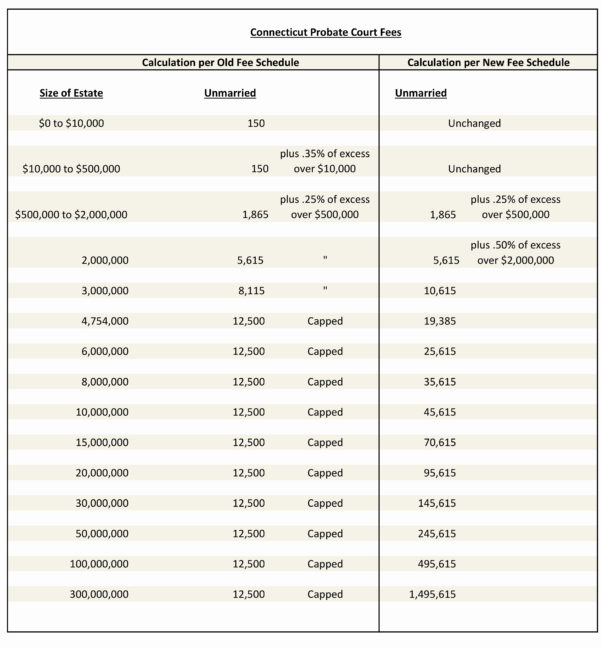

How do you open an estate account after a loved one dies? As mentioned in the article closing an estate in a formal probate process, the attorney sent me three schedules that made up the final account. It offers cost savings, higher flexibility, and the potential for faster process completion. To upload the pdf to the estate accounting section, follow the steps below. Informal estate accounting can be a beneficial option for executors and beneficiaries in certain circumstances.

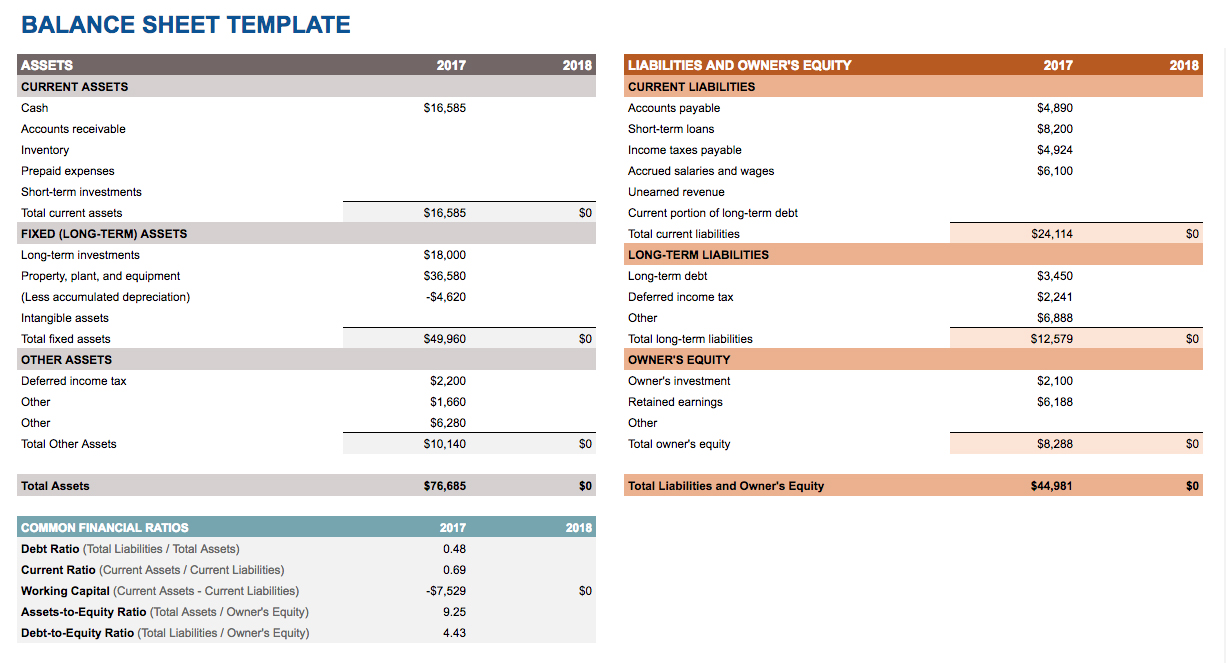

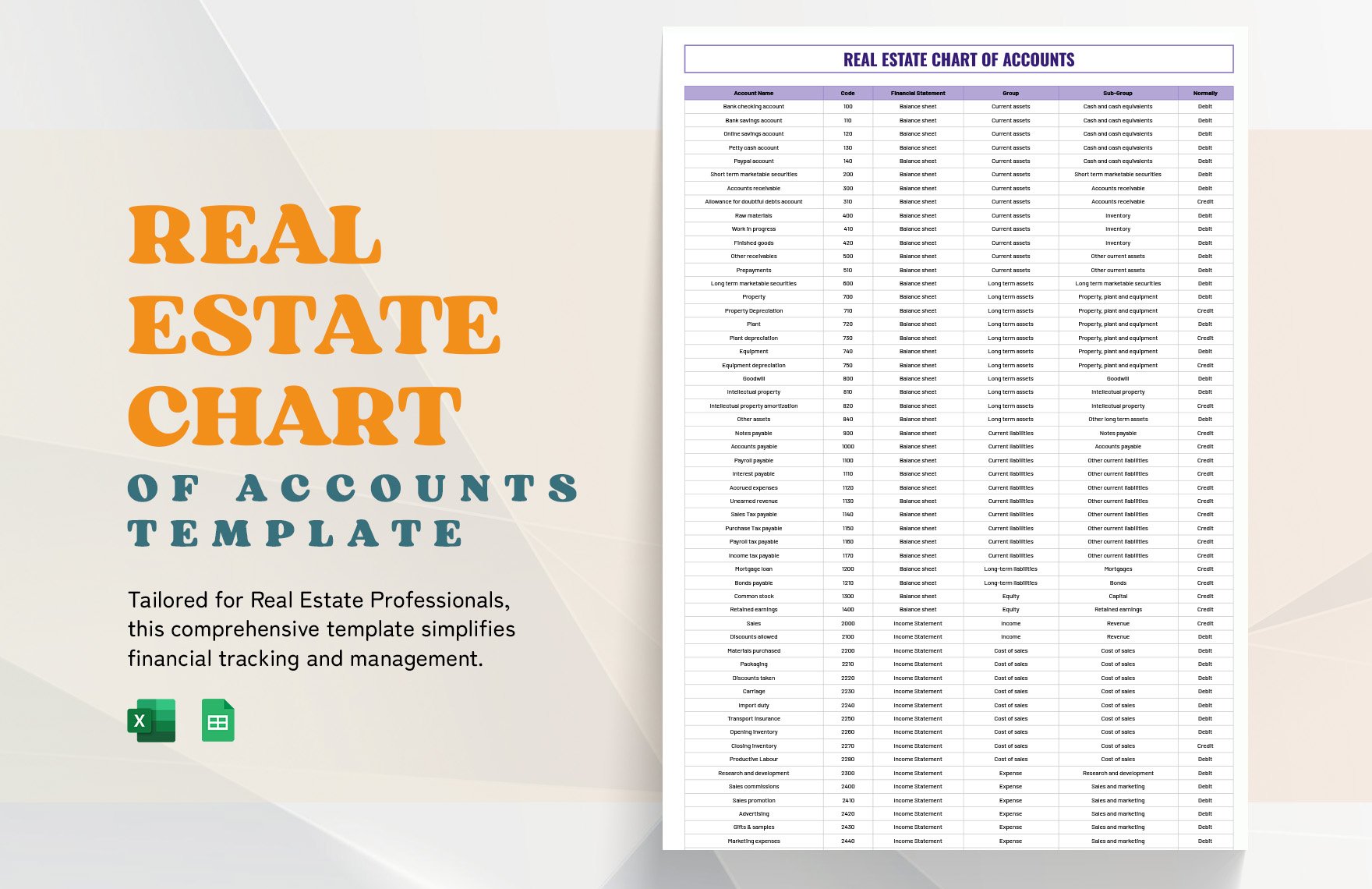

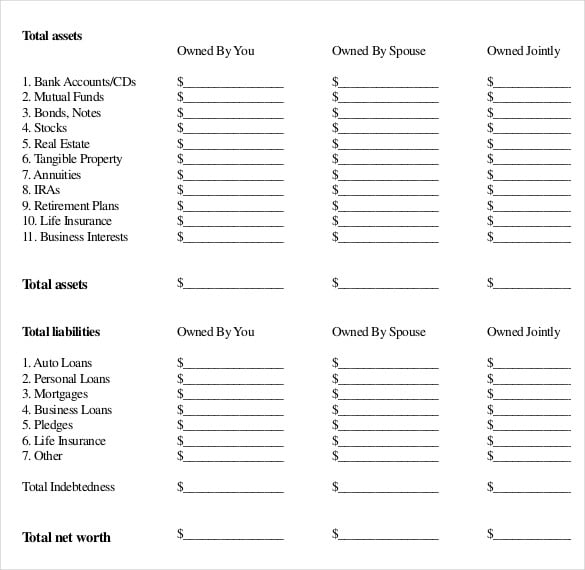

It is a normal bank account that is opened in the name of the deceased person’s. Instructions for account for decedent’s estate. Serving as an executor of an estate can be challenging. Accounts must be filed with the commissioner of accounts. Ideal for tracking assets and liabilities in detailed estate planning.

Ask the commissioner how many copies are required to be filed. How do you open an estate account after a loved one dies? What documents do you need to open an estate account? Instructions for account for decedent’s estate. Luckily, there are many great online resources you can access right from your computer. To upload the pdf to the estate accounting section, follow the steps below. When do you close an estate account? Speak to an estate specialist today. How to draft a set of estate accounts. Although estate law is different in many states, all states allow beneficiaries access to a final accounting. It offers cost savings, higher flexibility, and the potential for faster process completion. The accounting process of an estate. The executor must show the settled values of all the estate assets and the estate property. Informal estate accounting can be a beneficial option for executors and beneficiaries in certain circumstances. It is a normal bank account that is opened in the name of the deceased person’s.

It Is A Normal Bank Account That Is Opened In The Name Of The Deceased Person’s.

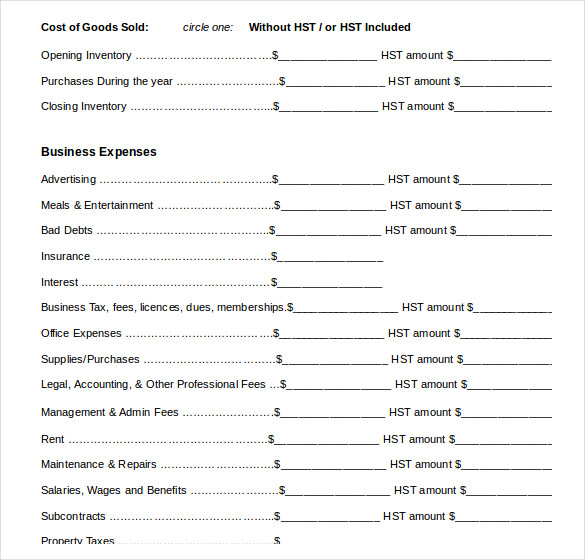

Or (c) an informal accounting with receipts and releases. All executors are required to keep accurate and detailed accounts setting out the assets that form part of the estate, details of estate debts and confirming what steps have been taken with assets throughout the estate administration. Click here for our excel estate accounting sample with examples. Accounts must be signed by each of the executors, administrators or curators.

Make A List Of All Your Significant Assets, Including Real Estate And Land, Jewelry, Artwork, Cars, And Bank Accounts That Don't Name A Beneficiary.

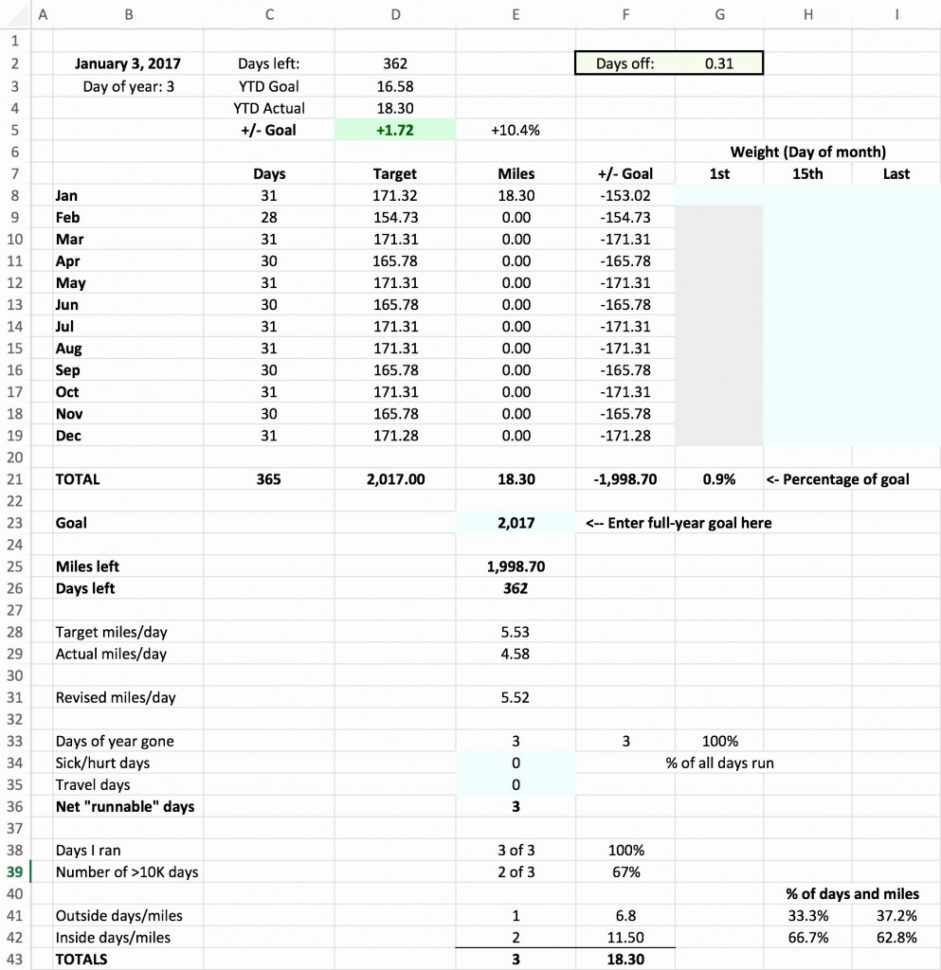

Manage estate finances effortlessly with our free estate accounting template. Use our probate inventory template spreadsheet to record the details you need to settle an estate. The accounting process of an estate is an integral part of the probate process. To upload the pdf to the estate accounting section, follow the steps below.

Can Anybody Direct Me To A Suitable Account Template/Guide Etc.?

If you are the administrator or executor of a probate estate for a deceased friend or relative, an important part of your duties is to provide a probate accounting to the court. It offers cost savings, higher flexibility, and the potential for faster process completion. Accounts must be filed with the commissioner of accounts. Managing estate financials is at the heart of the executor process, and involves a variety of elements:

What Is An Estate Account?

If you’re wondering how to set up an estate account, check out these basic guidelines to help you get started. Learn how to gather documents and fulfill your executor duties. With instructions to review the schedules, i began to look them over. By creating an income and expense report on the estate account, the final accounting becomes an easier task for the executor.