Web it helps to personalize your debt snowball spreadsheet to fit your specific financial situation. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Web get the free debt snowball spreadsheet to quickly pay off small debts first. Web first things first. When a borrower returns money by putting emphasis on the smallest amount, we call this technique the “snowball” method.

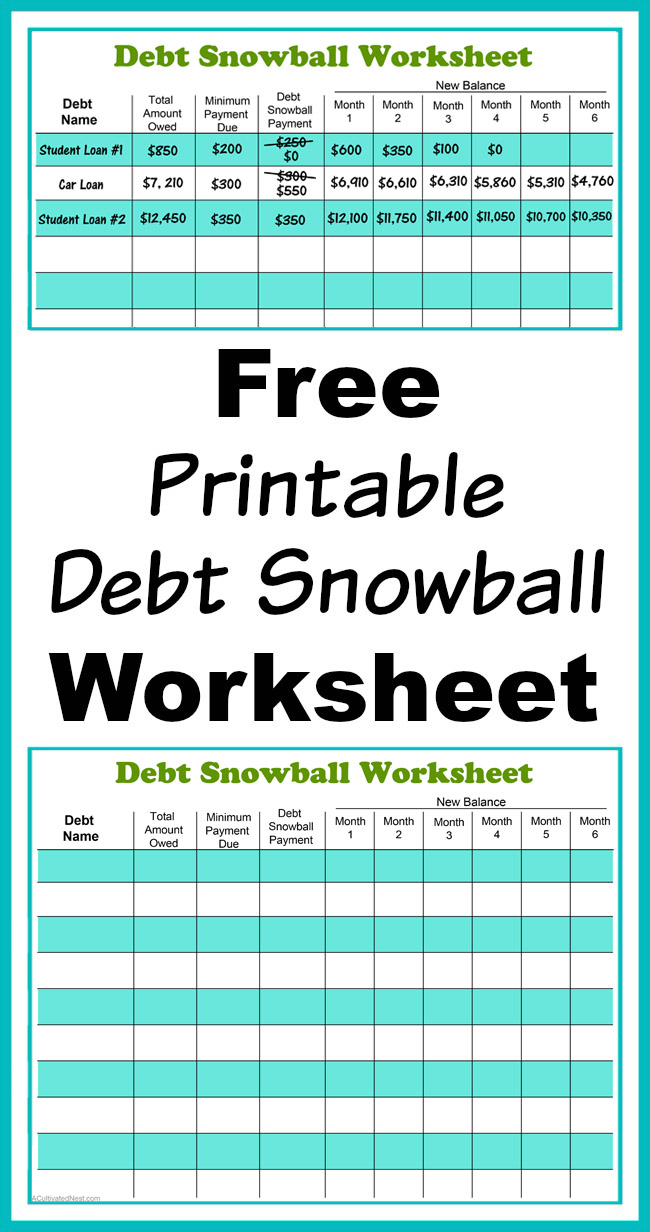

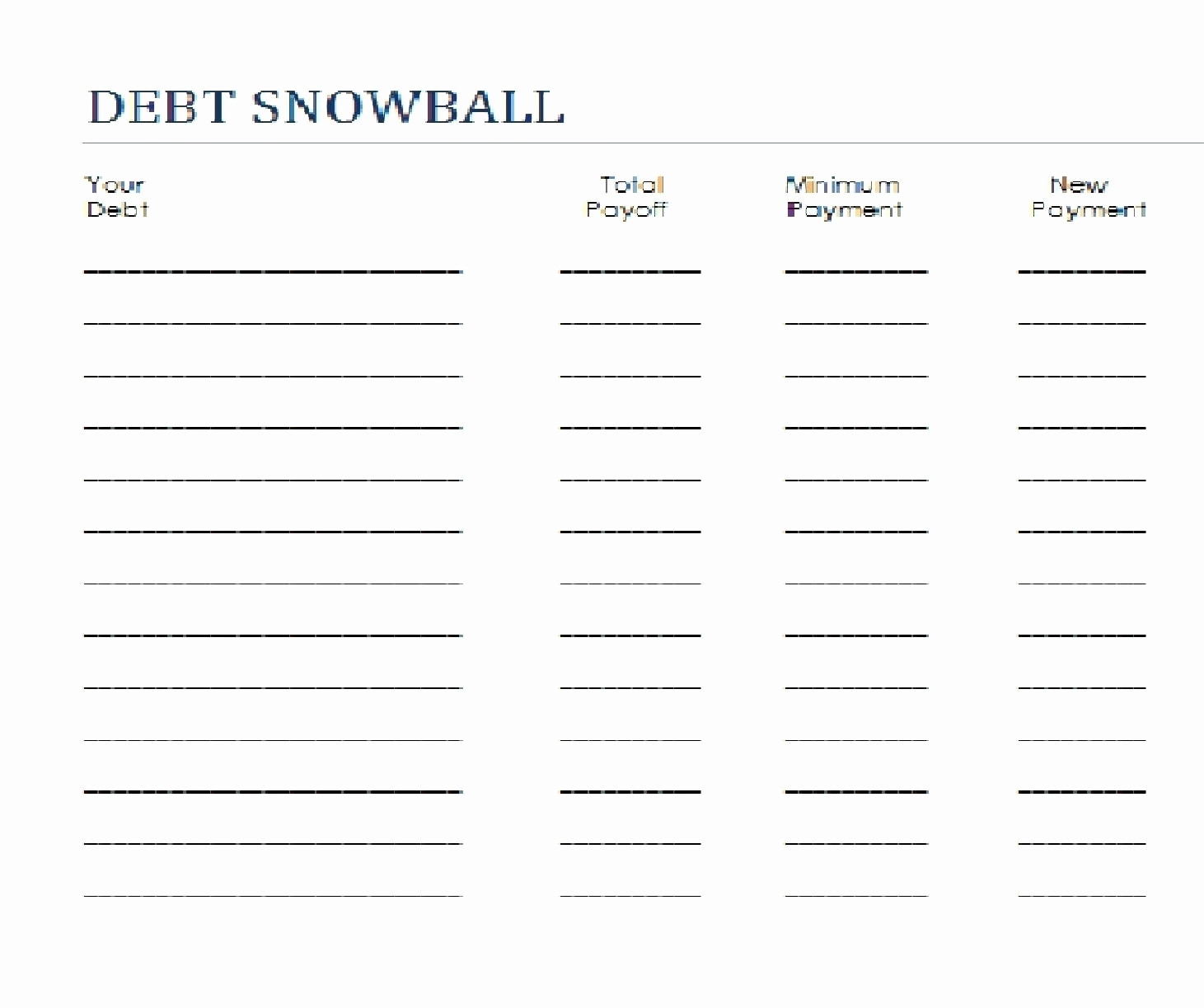

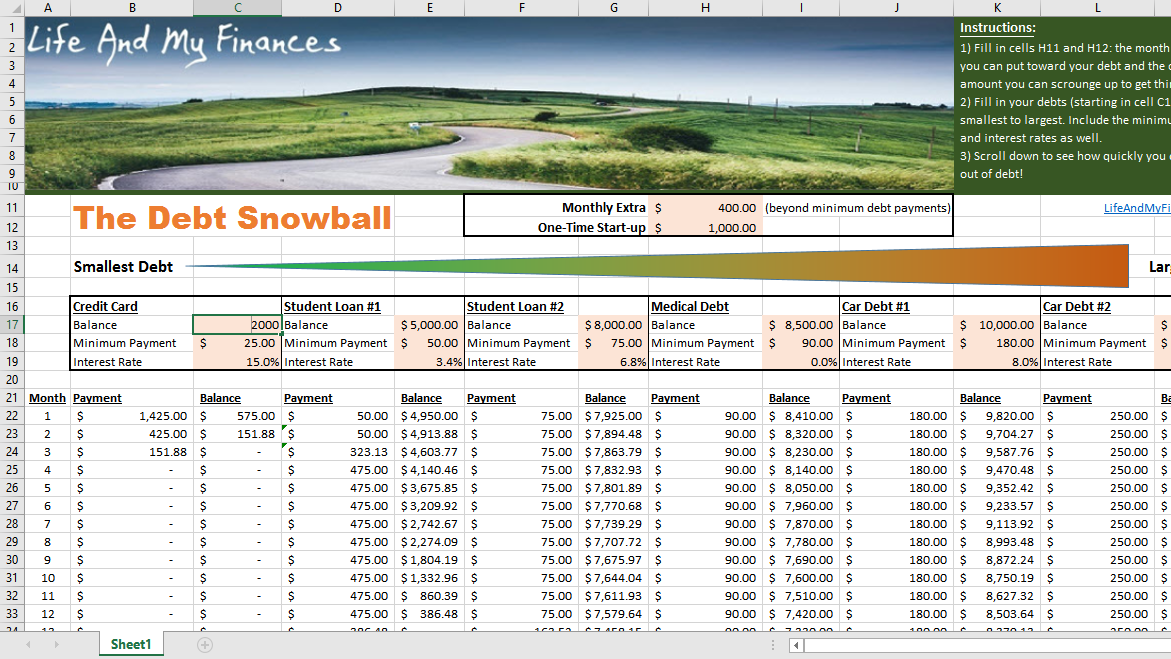

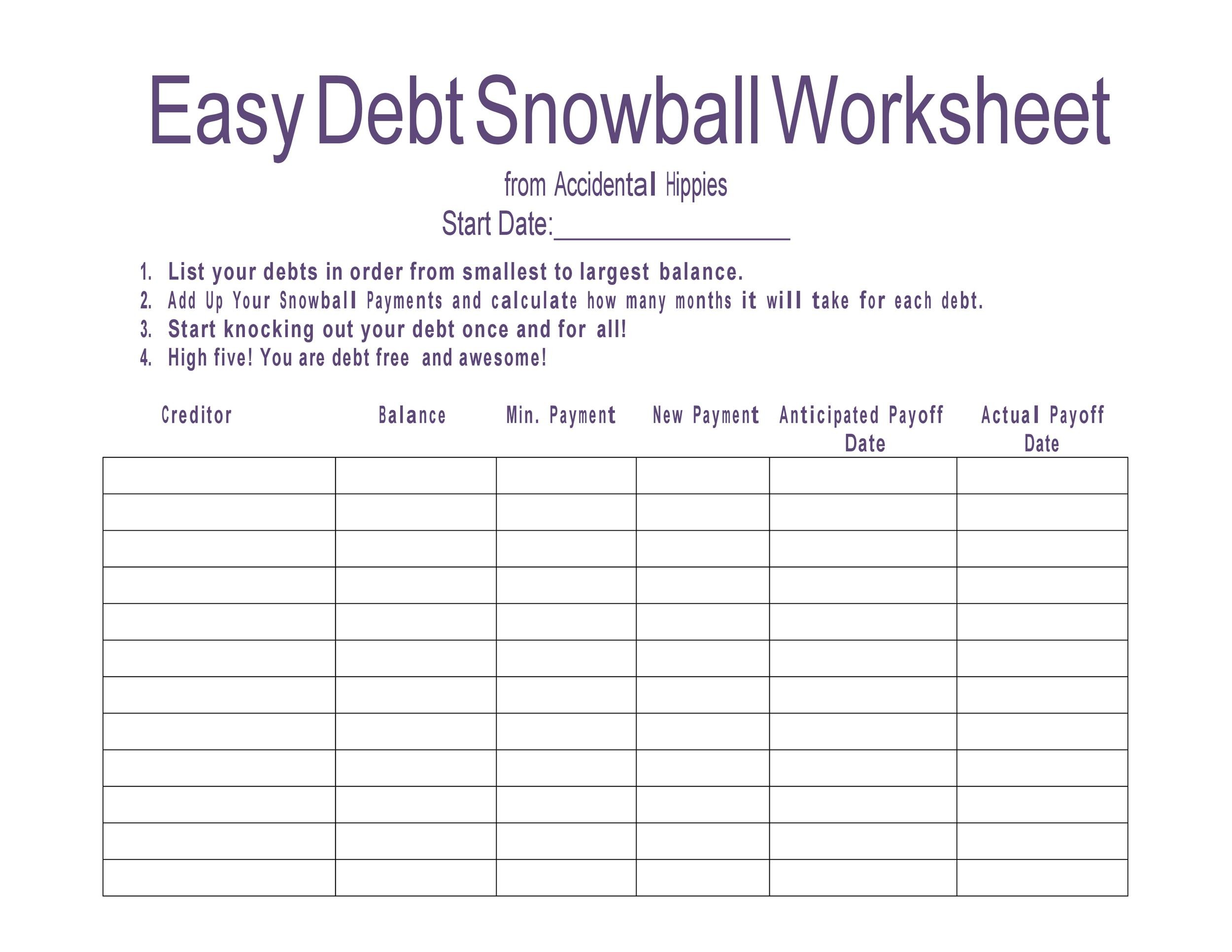

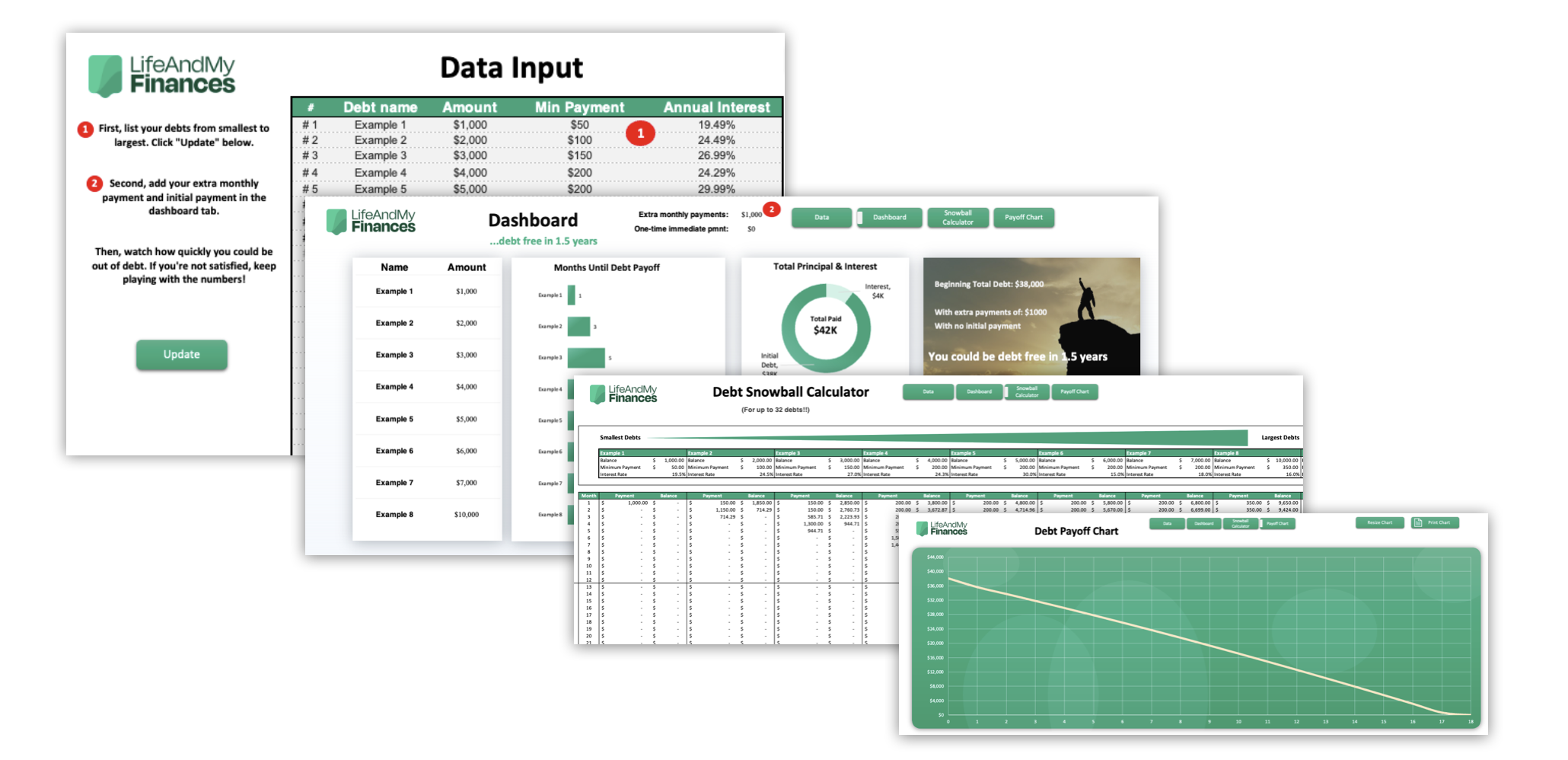

Debt snowball worksheet from template lab for excel; On the worksheet, you will list your debt from the smallest balance to the largest. The first step is to list all your debt in ascending order by the balance due, as the snowball method focuses on the smallest debt first. Written by iamadmin in excel. Check out the screenshots of the debt snowball calculator (excel) below:

Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Feb 17, 2017, 1:58 pm pst. It will allow you to forecast exactly how much longer it will take for you to achieve your goals. Which type of debt should you pay off first? You’ll pay off your debts in record time!

When a borrower returns money by putting emphasis on the smallest amount, we call this technique the “snowball” method. Debt payoff template from medium for google sheets; This debt spreadsheet template will help lay out your debts and motivate you to do more. Web in my opinion, the debt snowball excel spreadsheet is the most impactful tool out there. Written by bob lotich, cepf®| debt help. Debt snowball worksheet from template lab for excel; Web using a debt snowball worksheet helps you prioritize your debts and figure out your debt payoff plan (you can download ours below). List down all your debts and arrange them from the biggest to the smallest. It is also incredibly easy to use thanks to the brilliant software microsoft excel. Debt snowball spreadsheet from spreadsheet point for google sheets; Tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web free debt snowball spreadsheets for excel & google sheets. Web it helps to personalize your debt snowball spreadsheet to fit your specific financial situation. The general rule of thumb is to start with your consumer debt (i.e. Web with this snowball debt calculator spreadsheet, you can enter the rates (including teaser rates) and balances of all your debts, as well as change the order of your debt snowball plan to assess the best payoff times and least cumulative expenses.

Web Using A Debt Snowball Worksheet Helps You Prioritize Your Debts And Figure Out Your Debt Payoff Plan (You Can Download Ours Below).

Check out the screenshots of the debt snowball calculator (excel) below: The snowball debt means to pay off one debt at time with all the cash you have until the cash is fully paid off and the move to the next debt and. Web in my opinion, the debt snowball excel spreadsheet is the most impactful tool out there. Debt snowball worksheet from template lab for excel;

This Is Applicable When We Have More Than One Debt.

Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Web get the free debt snowball spreadsheet to quickly pay off small debts first. Debt snowball spreadsheet from spreadsheet point for google sheets; For beginners, we will also provide you with a simple, free debt tracker spreadsheet template to use.

Tiller Money Offers Several Types Of Spreadsheets Including A Debt Snowball Spreadsheet.

Feb 17, 2017, 1:58 pm pst. Debt reduction calculator from spreadsheet page for excel ; Web just use a debt payoff spreadsheet or a debt snowball worksheet. Instead of looking at the interest rate, you simply pay off the smallest debt first, and then move on to the next smallest.

Debt Payoff Template From Medium For Google Sheets;

Download your free copy of our debt snowball worksheet. What debts should you pay off first— your student loans? Tiller money is a budgeting tool that can help you manage your money and pay off your debt. Web first things first.

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/05/debt-snowball-excel.jpg?gid=443)

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/05/excel-debt-snowball-template.jpg?gid=443)