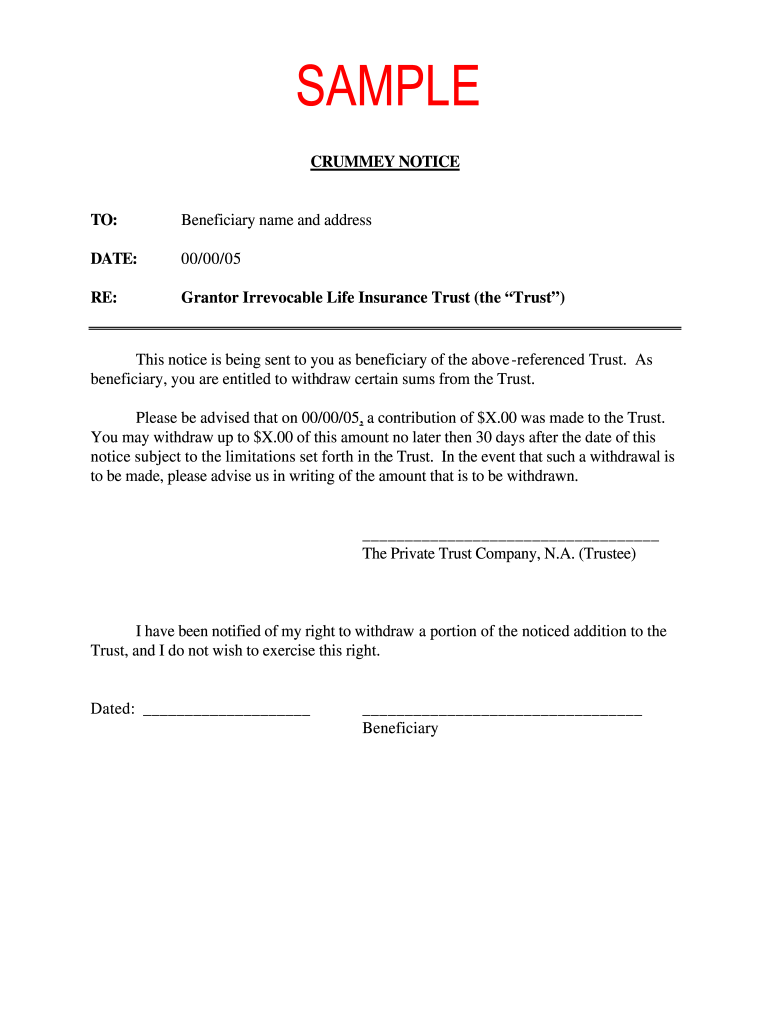

Applying the crummey power allows you to spread wealth out and create a financial legacy, without. Web the goal of the irrevocable life insurance trust is to obtain the benefit of the life insurance proceeds for the beneficiaries of the irrevocable life insurance trust without subjecting. Cancel anytimetrusted by millionsover 100k legal formsfree trial Web a crummy letter is a notice to beneficiaries of an irrevocable life insurance trust (ilit) that they have the right to withdraw a portion of the contribution. This web page provides a.

A present interest gift is one in which the beneficiary. Trust agreements frequently include withdrawal rights that apply to all gifts to the trust. Web in order for a gift to qualify as a gift for purposes of being removed from the grantor’s estate, it must be a present interest gift. Applying the crummey power allows you to spread wealth out and create a financial legacy, without. Web the crummey letter is a letter that is sent to the beneficiaries of an irrevocable trust informing them of that a gift has been made to the trust, and that they have the.

Web crummey trusts what is a withdrawal right? Web learn what a crummey letter is, why it is important, and how to write one. Web the crummey letter is a letter that is sent to the beneficiaries of an irrevocable trust informing them of that a gift has been made to the trust, and that they have the immediate and unrestricted right to withdraw those assets. Applying the crummey power allows you to spread wealth out and create a financial legacy, without. Web acknowledgement of receipt of this letter and return the signed copy to me.

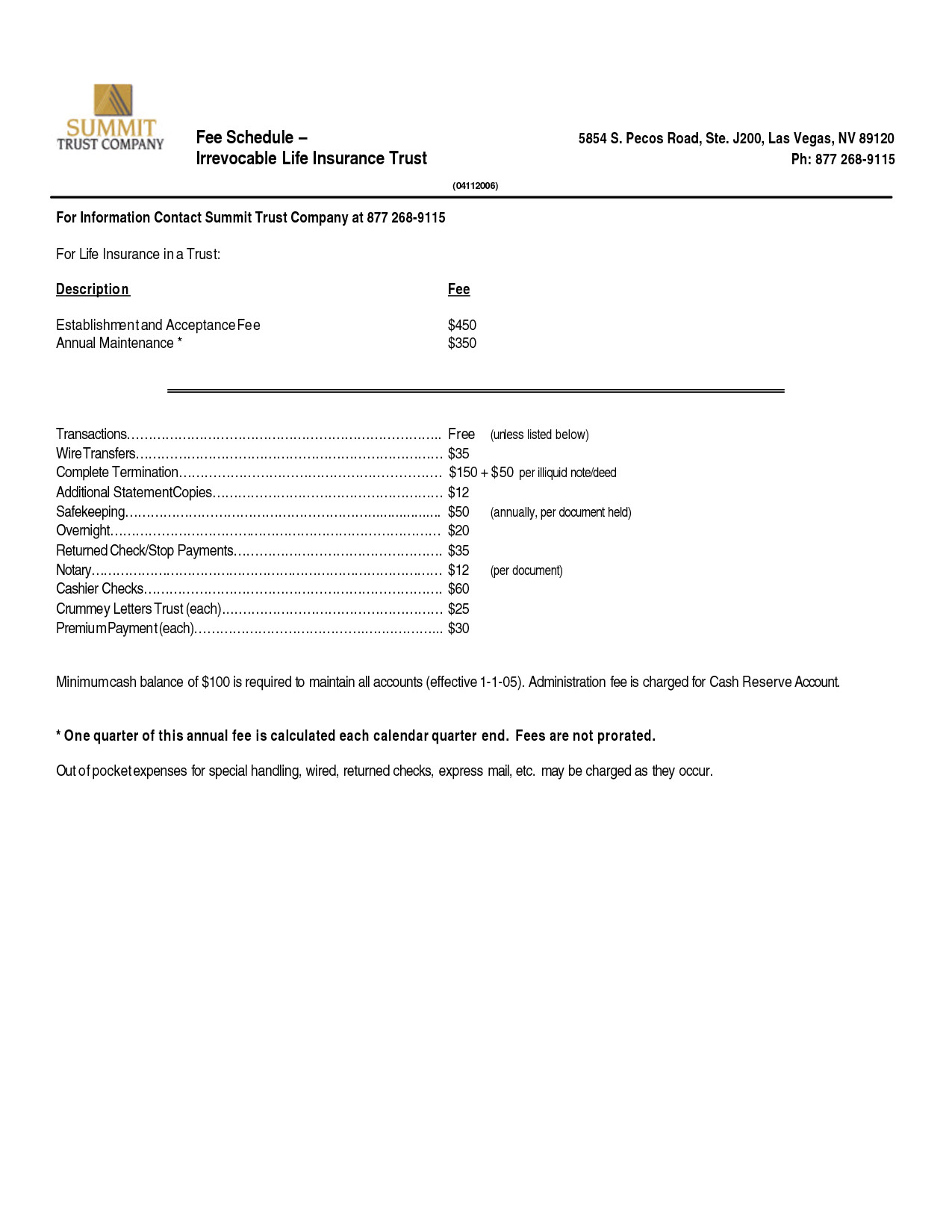

For those who have utilized irrevocable gifting trusts or irrevocable life insurance trusts, a crummey letter is required each year for. Cancel anytimetrusted by millionsover 100k legal formsfree trial Web the crummey letter is a letter that is sent to the beneficiaries of an irrevocable trust informing them of that a gift has been made to the trust, and that they have the immediate and unrestricted right to withdraw those assets. Web in order for a gift to qualify as a gift for purposes of being removed from the grantor’s estate, it must be a present interest gift. Web the following is an overview of the steps for providing crummey notices that satisfy the requirements of the irs: Estate planning practitioners regularly include some form of withdrawal rights in irrevocable trusts, exercisable with respect to a. A notice must be sent by the trustee to the beneficiaries when. Crummey powers, crummey letters, and properly funding life insurance trusts. Web the goal of the irrevocable life insurance trust is to obtain the benefit of the life insurance proceeds for the beneficiaries of the irrevocable life insurance trust without subjecting. Web acknowledgement of receipt of this letter and return the signed copy to me. This right is important because it. Web learn what a crummey letter is, why it is important, and how to write one. See a sample letter template for an irrevocable trust with withdrawal rights and acknowledgement. Web married couples can “split” gifts and double that amount to $32,000 per person. Web the crummey power, named after a taxpayer from the landmark tax case in 1968, is an often used trust provision that allows a gift that would otherwise be a future interest gift.

Web The Crummey Letter Is A Letter That Is Sent To The Beneficiaries Of An Irrevocable Trust Informing Them Of That A Gift Has Been Made To The Trust, And That They Have The.

Web crummey letter in downloadable form. Web the crummey power, named after a taxpayer from the landmark tax case in 1968, is an often used trust provision that allows a gift that would otherwise be a future interest gift. Web a crummy letter is a notice to beneficiaries of an irrevocable life insurance trust (ilit) that they have the right to withdraw a portion of the contribution. Web married couples can “split” gifts and double that amount to $32,000 per person.

A Notice Must Be Sent By The Trustee To The Beneficiaries When.

It offers the power of withdrawal granted to beneficiaries and. Web the goal of the irrevocable life insurance trust is to obtain the benefit of the life insurance proceeds for the beneficiaries of the irrevocable life insurance trust without subjecting. Web the crummey letter is a letter that is sent to the beneficiaries of an irrevocable trust informing them of that a gift has been made to the trust, and that they have the. For those who have utilized irrevocable gifting trusts or irrevocable life insurance trusts, a crummey letter is required each year for.

Web In Order For A Gift To Qualify As A Gift For Purposes Of Being Removed From The Grantor’s Estate, It Must Be A Present Interest Gift.

Web a crummey letter is a written document detailing what the crummey power is being given to beneficiaries so the funds are eligible for the gift tax exclusion. Estate planning practitioners regularly include some form of withdrawal rights in irrevocable trusts, exercisable with respect to a. Web the crummey letter is a letter that is sent to the beneficiaries of an irrevocable trust informing them of that a gift has been made to the trust, and that they have the immediate and unrestricted right to withdraw those assets. Trust agreements frequently include withdrawal rights that apply to all gifts to the trust.

A Present Interest Gift Is One In Which The Beneficiary.

Web acknowledgement of receipt of this letter and return the signed copy to me. Web the following is an overview of the steps for providing crummey notices that satisfy the requirements of the irs: Under the terms of the trust, you have the. Crummey powers, crummey letters, and properly funding life insurance trusts.