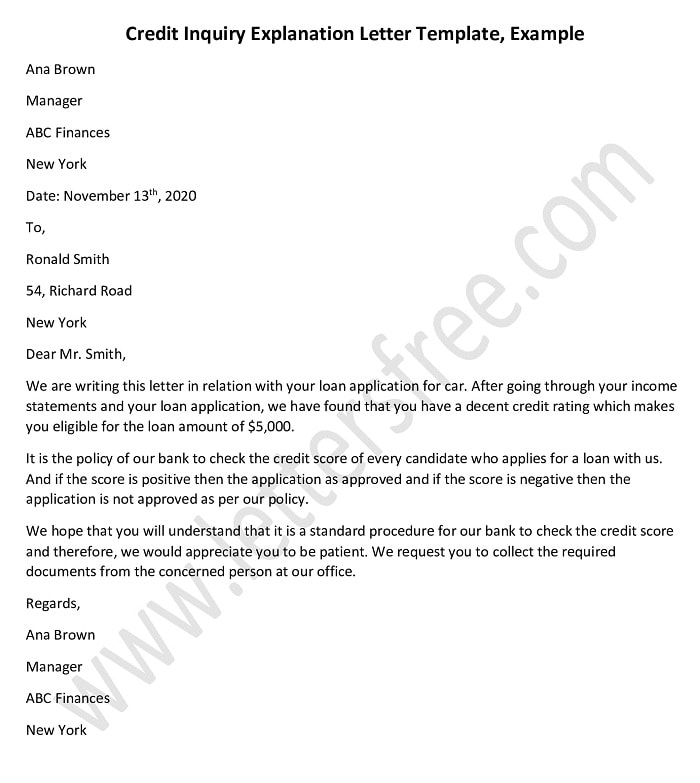

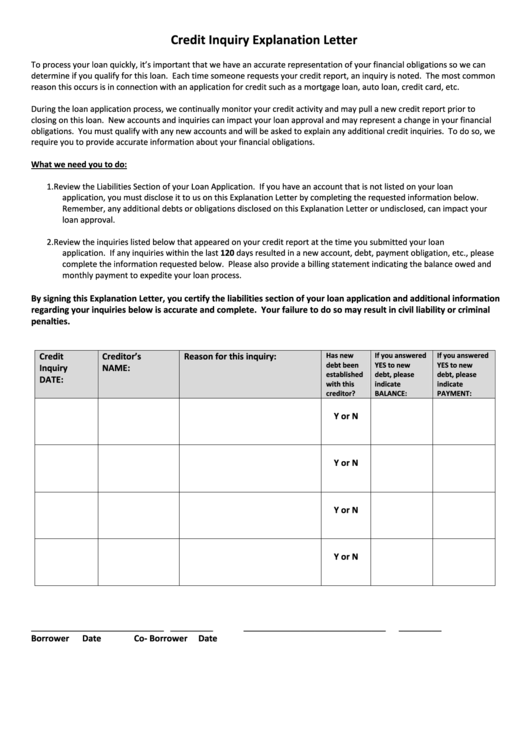

Sometimes, lenders also ask for a letter of explanation for mortgage to ask for clarification on issues such as insufficient funds charges on a checking account. I am writing to you in response to a recent inquiry about your credit status. Name and details of the creditor. Dear [recipient's name], i hope this letter finds you well. To process your loan quickly, it’s important that we have an accurate representation of your financial obligations so we can determine if you qualify for this loan.

For example, you may need to write a letter of explanation if you have unusual or sudden activity in your credit report or banking statements. Reason the inquiry was pulled. The letter of explanation addresses red. Free letter of explanation template. Why do lenders ask for a letter of explanation?

Sometimes, lenders also ask for a letter of explanation for mortgage to ask for clarification on issues such as insufficient funds charges on a checking account. Why do lenders ask for a letter of explanation? I am writing to provide an explanation for the recent credit inquiries that appear on my credit report. Reason the inquiry was pulled. Each time someone requests your credit report, an inquiry is noted.

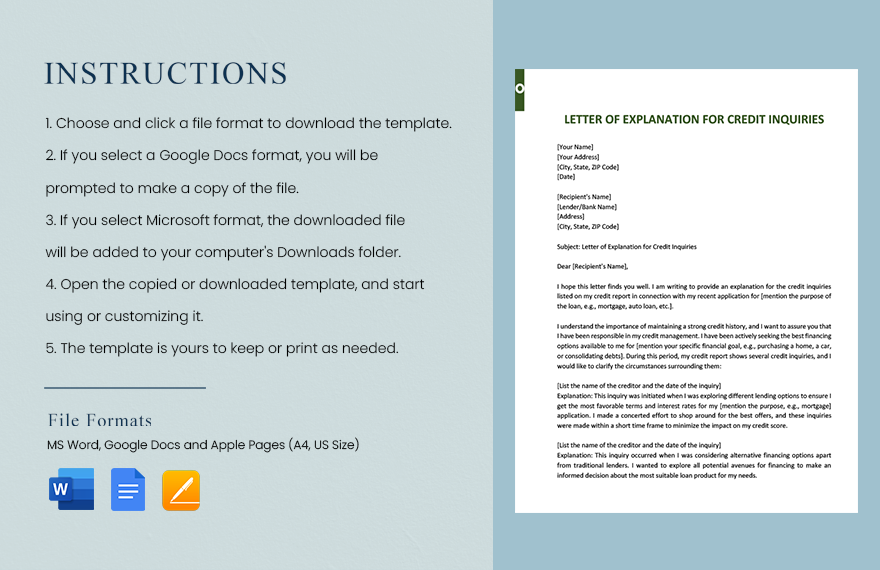

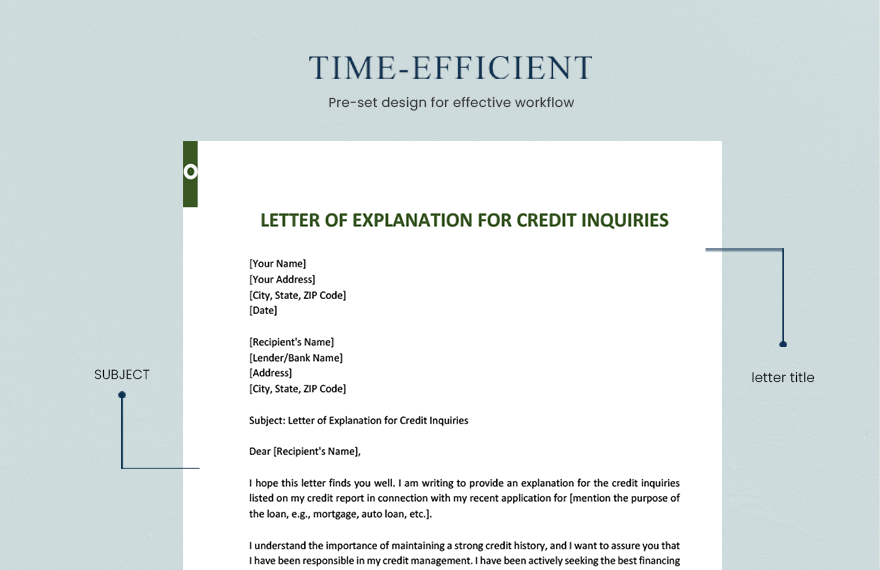

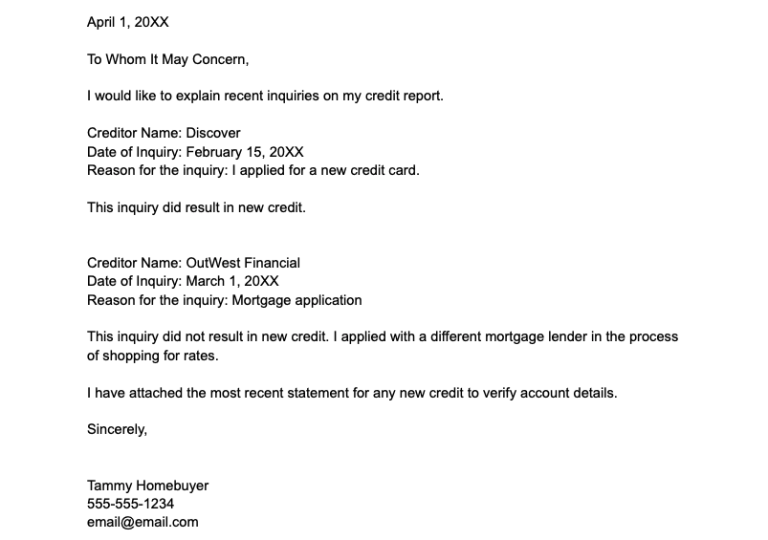

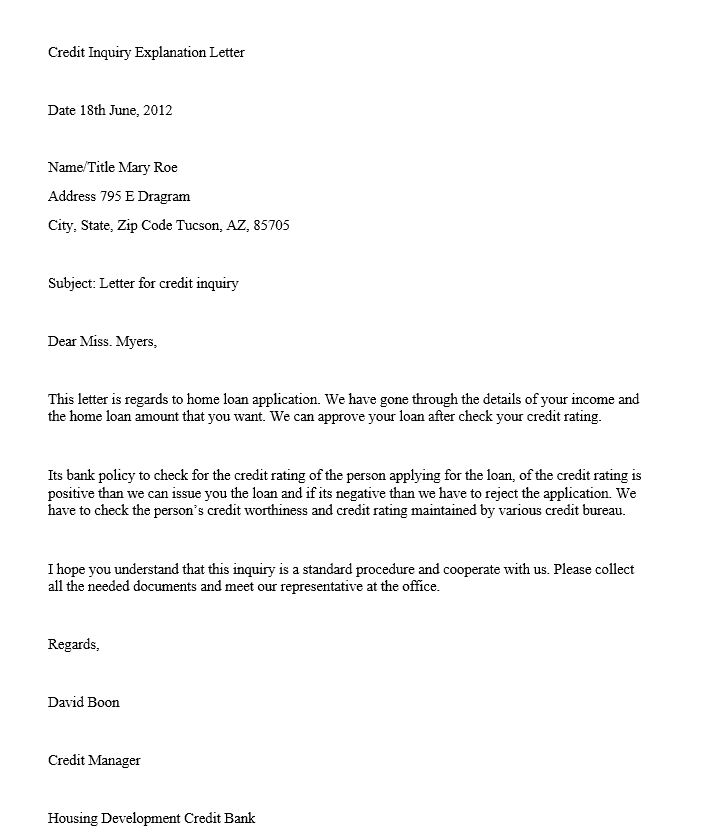

The letter of explanation addresses red. It includes the information including: What is a letter of explanation? Our free letter of explanation for credit inquiries template is a valuable tool for addressing credit inquiries on your credit report. I/we certify the information provided above is accurate. The content of a sample letter of explanation for credit inquiries usually includes the following information: Use a credit explanation letter if you need to address issues that come up during a credit check — late payments, unpaid bills and. This letter is to address all credit inquiries reporting on my credit report in the past 120 days. Hard inquiries no longer affect your credit score after a year and fall off your credit report. Write a credit inquiry letter if you’ve experienced multiple credit checks in a short timespan — say, a few months. Start your mortgage application today. A unique loan number that is issued to every borrower. A hard inquiry is a request from lenders to view your credit report when you apply for credit. Letter of explanation for credit inquiries. Free letter of explanation template.

I/We Certify The Information Provided Above Is Accurate.

Sample template letter of explanation for credit inquiries. Each time someone requests your credit report, an inquiry is noted. Letter of explanation for credit inquiries. This letter is to provide you with the necessary details about your credit information to help clear any doubts or misconceptions you may have.

Learn The Reasons Why Employers Might Request A Credit Check.

This letter is to address all credit inquiries reporting on my credit report in the past 120 days. The above explanation(s) are to address the inquiries on the credit report associated with my/our loan application. Why do lenders ask for a letter of explanation? Free letter of explanation template.

Late Payments, Collections And Major Derogatory Credit Problems Like Foreclosures Or Bankruptcies Almost Always Require A Letter Of Explanation.

Underwriters look at how you’ve managed credit in the past to determine if you’ll be able to afford a new loan. A letter of explanation for a mortgage is a document that provides further details about an applicant's creditworthiness or financial circumstances. An underwriter may request a letter of explanation if they run into questions about your finances during the mortgage approval process. Name and details of the creditor.

Hard Inquiries No Longer Affect Your Credit Score After A Year And Fall Off Your Credit Report.

Sample letter of explanation and template. A unique loan number that is issued to every borrower. The content of a sample letter of explanation for credit inquiries usually includes the following information: A letter of explanation (loe or lox) is a letter you draft in response to a mortgage lender’s request to explain ambiguous or derogatory information in your credit history, income background, or other application documentation.

![Free Printable Letter Of Explanation Templates [PDF, Word] Mortgage](https://www.typecalendar.com/wp-content/uploads/2023/05/letter-of-explanation-credit-inquiry-sample.jpg?gid=453)