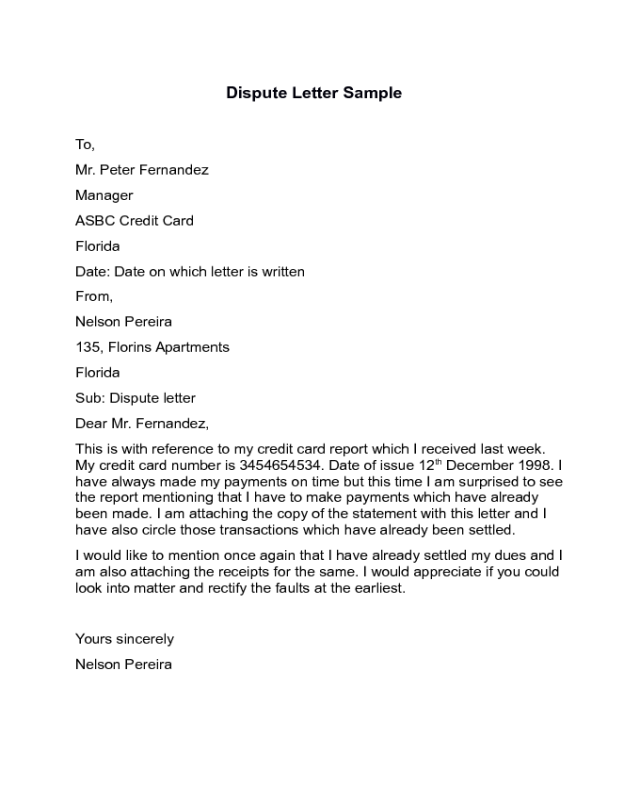

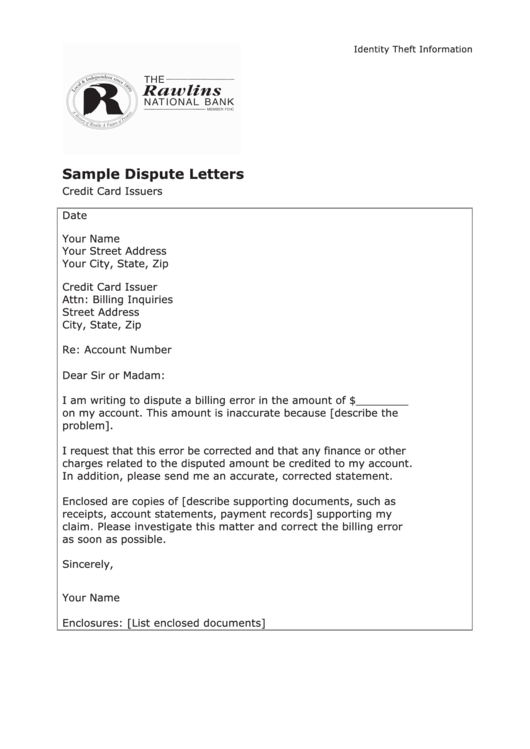

Below is a sample letter you can use when you need to dispute credit card charges. Download our sample letter and instructions to submit a dispute with an information furnisher. Free section 609 letter template. Here are two sample letters for disputing a credit card account with a credit reporting agency. This letter could also be used to dispute ach transfers, such as zelle or venmo.

Use our credit report dispute letter template to challenge any inaccurate or outdated items on your credit report and improve your financial situation. Use this template letter to make a claim. This guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate or incomplete, and you would like to submit a dispute of that information to the credit reporting company. In the letter, you can explain why you believe the items are inaccurate and provide any supporting documents. What happens to your dispute letter.

What is a 609 letter? This letter could also be used to dispute ach transfers, such as zelle or venmo. Here are two sample letters for disputing a credit card account with a credit reporting agency. Dear [bank/credit card company name], i am writing to formally dispute several unauthorized charges that have appeared on my credit card statement for the billing cycle of [statement date]. Here's a sample letter you can use to dispute billing errors.

If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. Disputing incorrect charges on your credit or debit card is crucial for maintaining your financial health. Free section 609 letter template. What happens to your dispute letter. A credit card dispute letter is a document that individuals can use when they would like to dispute and remove a charge from their credit card. Use this template letter to make a claim. A credit card dispute letter can help you clear up errors on your billing statement. One way to fix an error on your credit report is to write a credit dispute letter and mail it to one or more credit bureaus. [your address] [company address] reference: Here’s what to do and a sample letter to help get your money back. This guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate or incomplete, and you would like to submit a dispute of that information to the credit reporting company. [date] [your name] [your address, city, state, zip code] [name of credit or debit card company] attn: A credit dispute is a formal request to a credit bureau to investigate, update, or remove information on your credit report that you think is inaccurate or incorrect. Please remember that they are just examples. If you're disputing information on your experian credit report by mail, start the process of writing a credit dispute letter by filling out a dispute form—or follow the simple guidelines below for writing your own letter.

Disputing Incorrect Charges On Your Credit Or Debit Card Is Crucial For Maintaining Your Financial Health.

This letter should clearly identify the disputed transaction, explain why it is being disputed, and request an investigation and correction of the error. Documentation supporting the legitimacy of the disputed transactions, including any signed purchase receipts or digital transaction records. Understanding the importance of a dispute letter. A credit card dispute letter can help you clear up errors on your billing statement.

A Credit Card Dispute Letter Is A Document That Individuals Can Use When They Would Like To Dispute And Remove A Charge From Their Credit Card.

Without registration or credit card. Some businesses associated with the 609 letter strategy. Use our credit report dispute letter template to challenge any inaccurate or outdated items on your credit report and improve your financial situation. [address, city, state, zip code] re:

Here’s What To Do And A Sample Letter To Help Get Your Money Back.

In the letter, you can explain why you believe the items are inaccurate and provide any supporting documents. Use this template letter to make a claim. Below is a sample dispute letter that a consumer can use to dispute credit or debt card transactions that are fraudulent or inaccurate. [details of your complaint and card number xxx] dear.

Here's A Sample Letter You Can Use To Dispute Billing Errors.

Free section 609 letter template. A credit card dispute letter is a written communication from a cardholder to the credit card issuer, detailing a dispute over a credit card transaction. A credit card dispute letter is a formal communication sent by a cardholder to their credit card issuer to contest or question an incorrect or fraudulent charge on their credit card statement. Steps to submitting a dispute letter.

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-14-790x1022.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-16.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-41.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-07.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-31.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-19-790x1022.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-28.jpg)