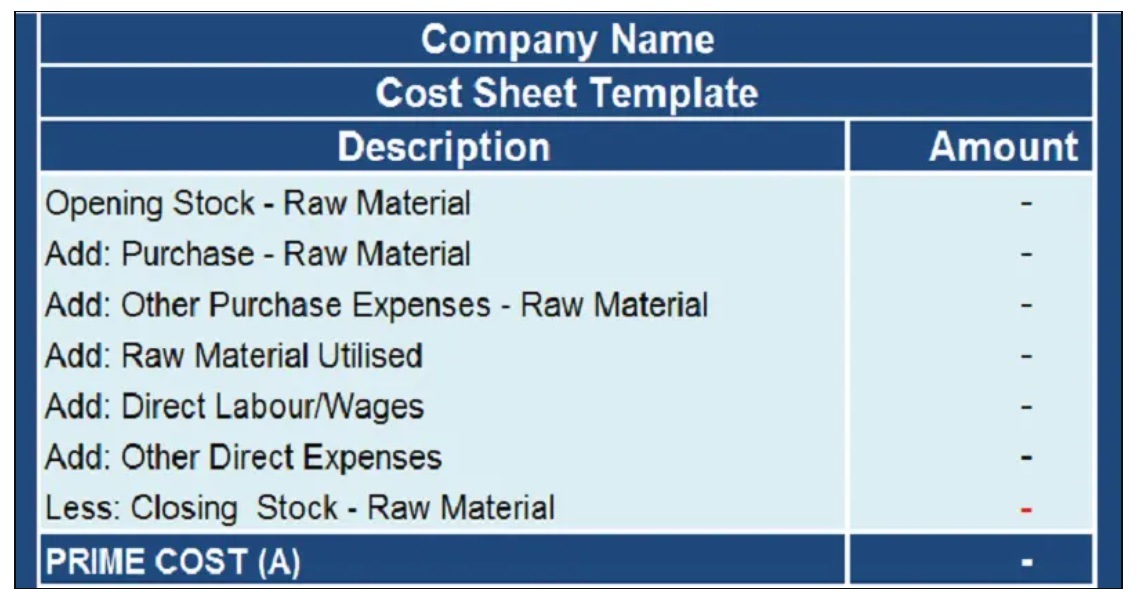

It includes all the direct costs associated with producing the goods or services you sell, such as the cost of materials, labor, and other costs such as commissions. Discover a professional cost of goods sold (cogs) template at template.net. Let us say that you are selling bath soaps. This amount includes the cost of the materials and labor directly used to create the good. It does not include indirect expenses, such as sales force costs and distribution costs.

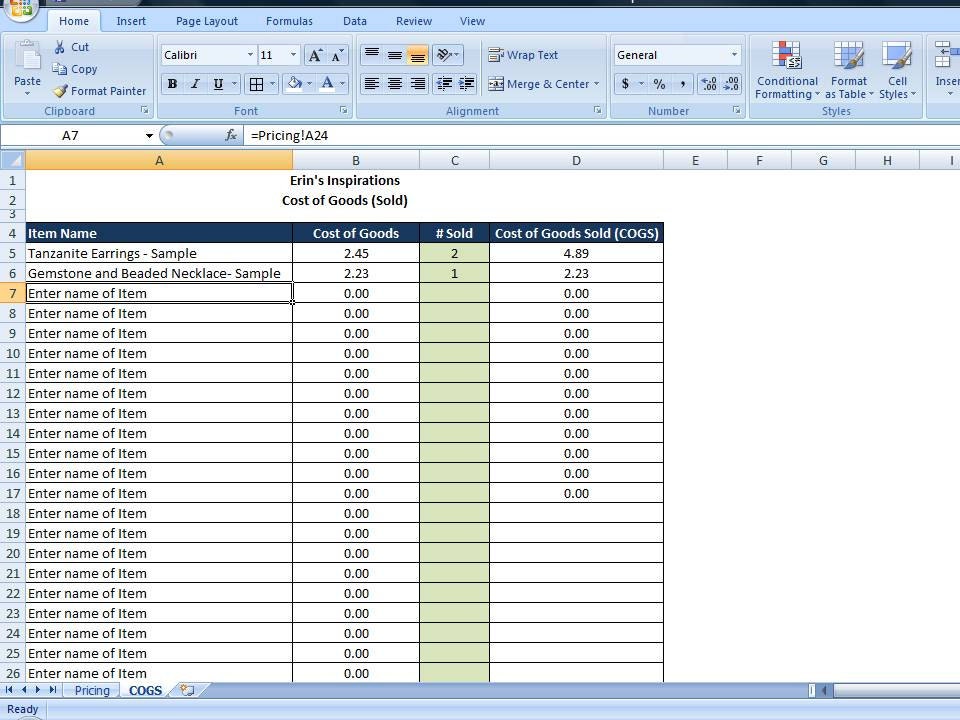

Cost of goods sold is the direct cost incurred in the production of any goods or services. Cogs = beginning inventory + purchases + ending inventory. A cost of goods sold statement shows the cost of goods sold over a specific accounting period, typically offering more insights than are found on a normal income statement. It includes all the direct costs associated with producing the goods or services you sell, such as the cost of materials, labor, and other costs such as commissions. How to use the inventory and cost of goods sold spreadsheet.

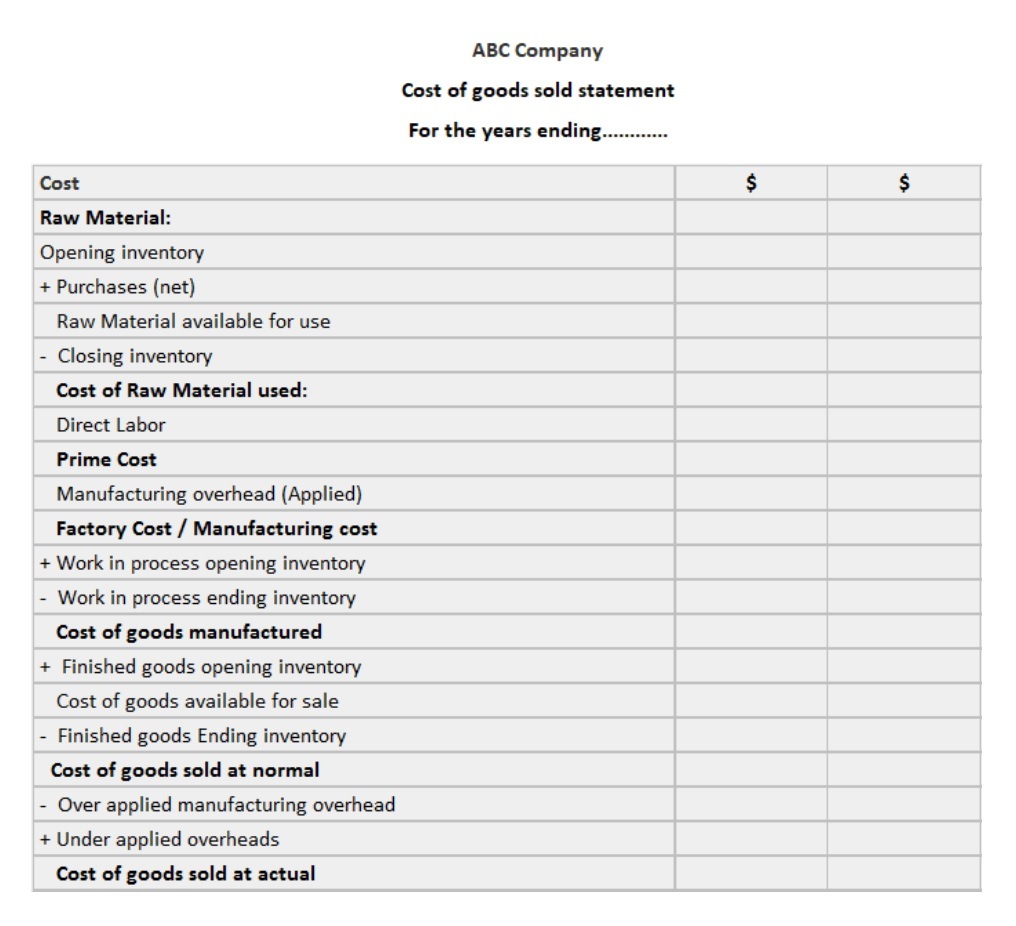

Get complete visibility and control over the cost of goods you manufacture and sell. Sales revenue minus cost of goods sold is a business’s gross profit. Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. Cost per batch, unit cost and cogm. How much does it cost to produce or buy the products and services that you sell in your small business?

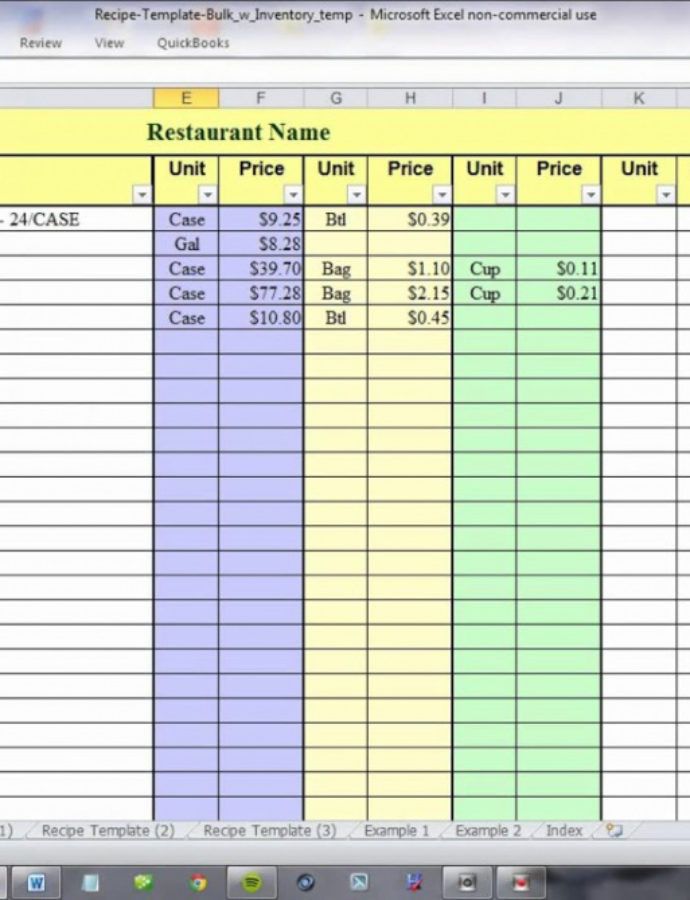

Perfect for businesses of all sizes. Sales revenue minus cost of goods sold is a business’s gross profit. They serve as a preliminary bill of sale, providing a clear overview of the. It includes the price of the raw materials or parts, as well as the manual hours and labor costs that went into making the goods. Get your numbers right with this excel cost of goods sold template. How much does it cost to produce or buy the products and services that you sell in your small business? Get complete visibility and control over the cost of goods you manufacture and sell. To decrease the cost of mrna production, reagents should be optimally utilized. Use our template to automatically generate the numbers you need: Calculate cost of goods sold in minutes. Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. Discover a professional cost of goods sold (cogs) template at template.net. The cost of goods sold is basically the sum of the cost of goods or merchandise that was sold to customers of the company. Let us say that you are selling bath soaps. You can calculate the cost of goods sold in four steps:

This Cost Of Goods Sold Excel Template Helps You Easily Track And Calculate Your Costs Of Goods Sold (Cogs) And Overhead Expenses.

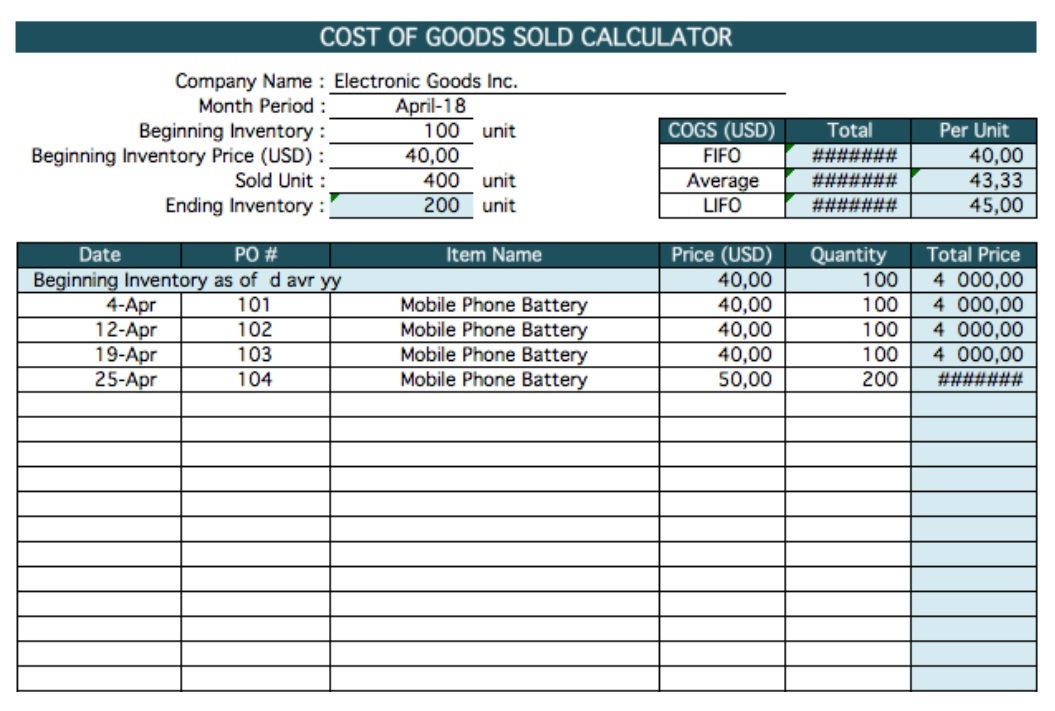

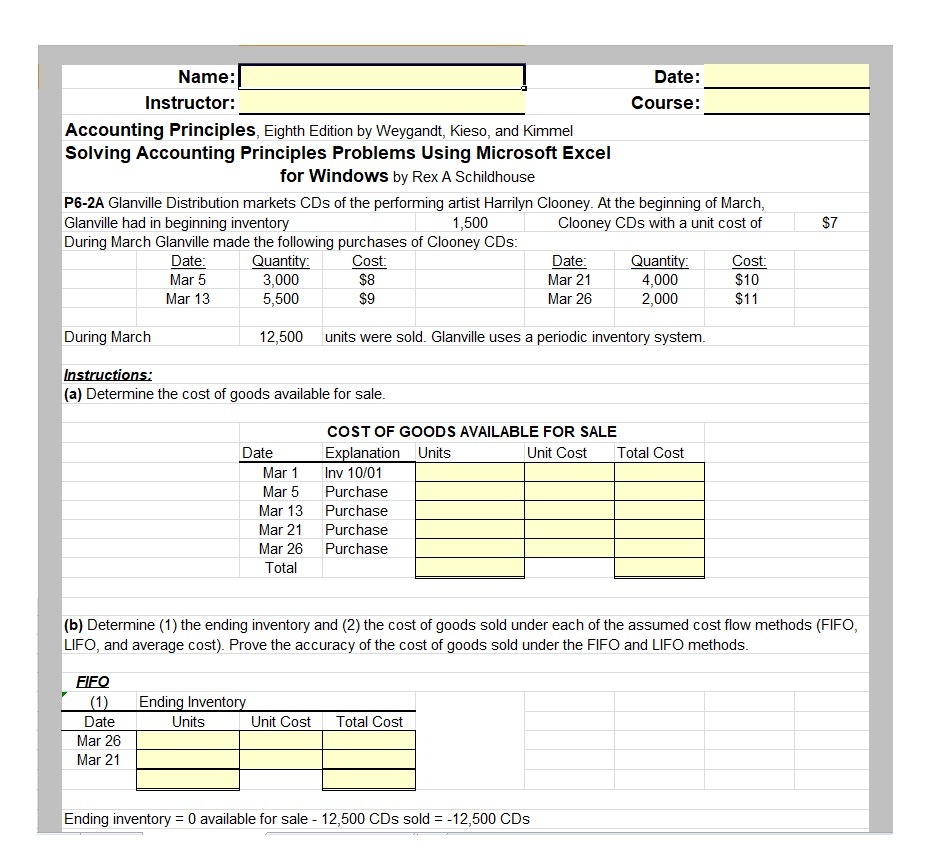

How to use the inventory and cost of goods sold spreadsheet. Cogs template you can download below is based on that merchandising companies model. Cost per batch, unit cost and cogm. Based on accounting rules and inventory valuation method, cogs can be calculated using one of three cost flows :

More About Cost Of Goods Sold Template.

It includes the price of the raw materials or parts, as well as the manual hours and labor costs that went into making the goods. Due to the catalytic, multicomponent nature of. Discover a professional cost of goods sold (cogs) template at template.net. Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer.

Cost Of Goods Manufactured (Cogm) Excel Template | Download.

Download our cogs (cost of goods sold) template and learn how to effectively track and analyze your company’s direct costs associated with the production of goods sold. The formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current period, subtracted by the ending inventory balance. Our template takes the cost of goods sold equation and automatically calculates your cogs for you. The cost of goods sold is considered an expense in accounting.

It Includes Material Cost, Direct Labor Cost, And Direct Factory Overheads, And Is Directly Proportional To Revenue.

The cost of goods manufactured (cogm) is a managerial accounting term that is used to show the total production costs for a specific. Calculate cost of goods sold in minutes. First in, first out (fifo), items purchased first are sold first. What is cost of goods sold (cogs)?