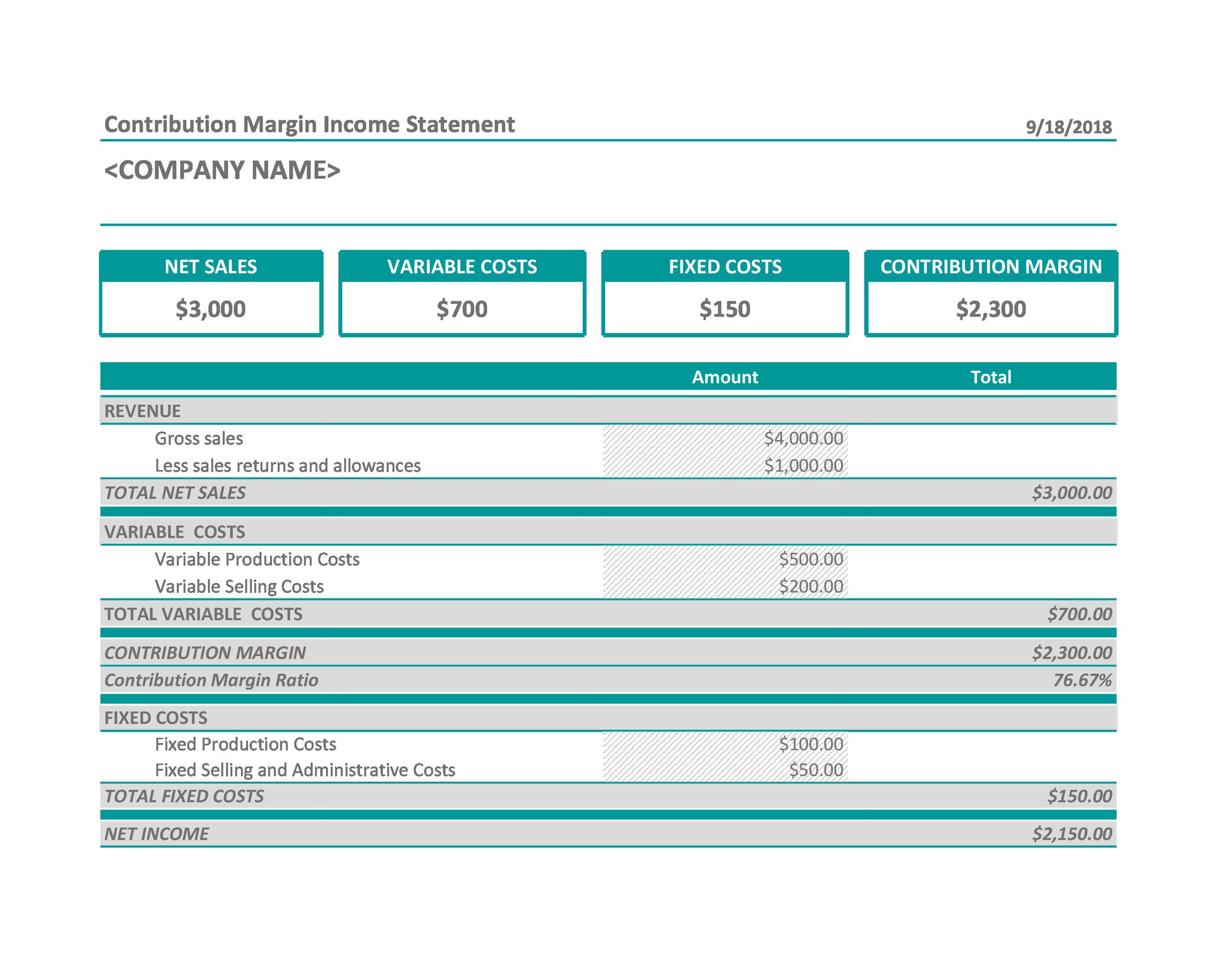

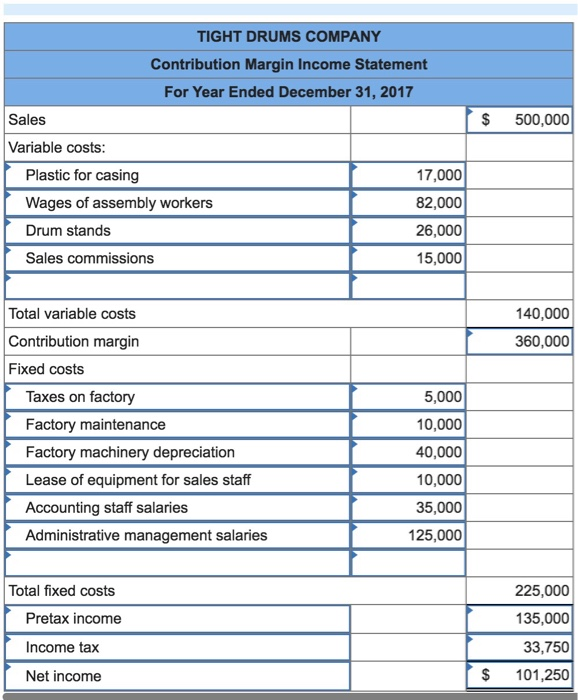

Web our contribution margin excel template equips analysts with a comprehensive tool for effortlessly conducting detailed contribution margin analysis. Then, all fixed expenses are subtracted to arrive at the net profit or net loss for the period. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. Web the contribution margin income statement shows fixed and variable components of cost information. Here we explain its format, examples, and their advantages and disadvantages.

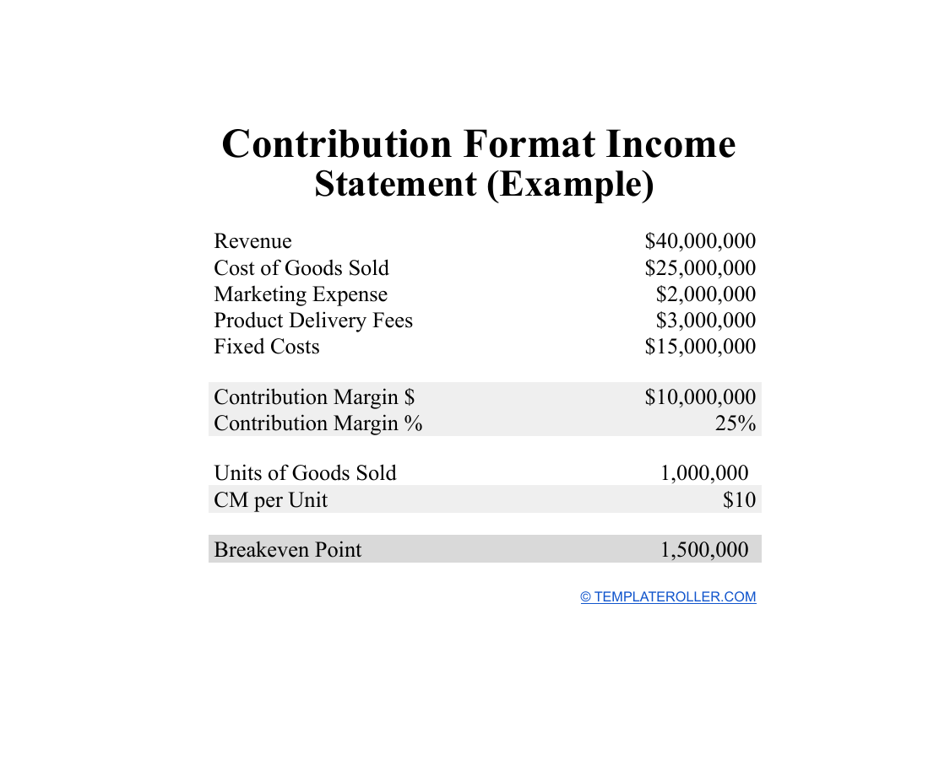

A product’s contribution margin is the unit price minus all associated variable costs per unit. Web what is the contribution margin income statement and what's the formula to calculate it? These are a few questions this article answers! Variable expenses can be compared year over year to establish a trend and show how profits are affected. The contribution margin minus fixed costs equals operating profit.

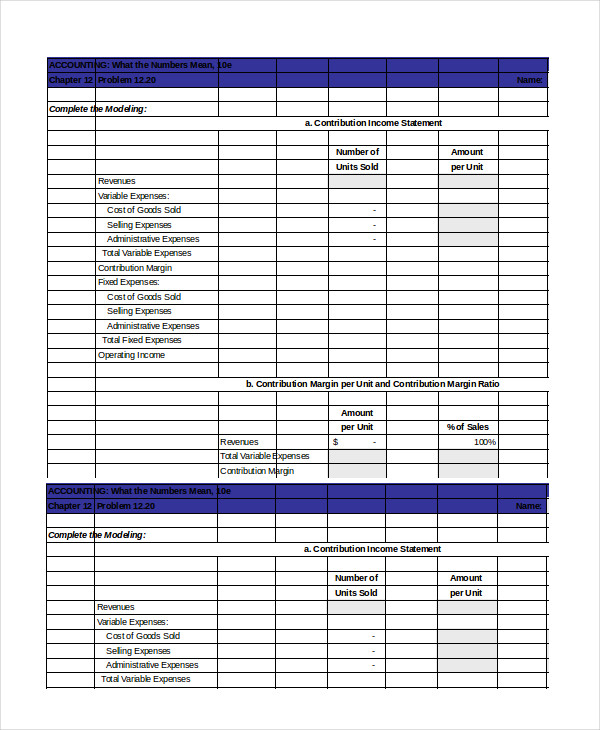

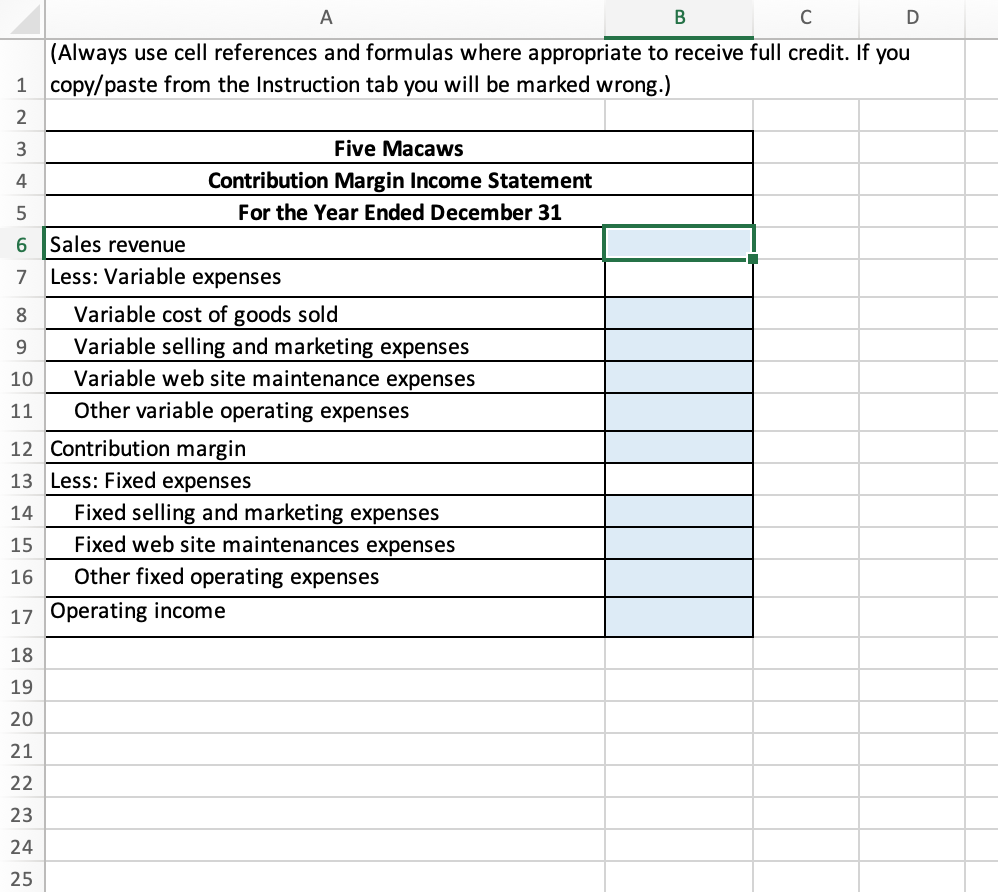

Web to calculate this figure, you start by looking at a traditional income statement and recategorizing all costs as fixed or variable. It separates fixed and variable costs to show which products or services contribute most to generating profit. Here we will learn how to calculate contribution margin with examples and downloadable excel template. Web the contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. Web a contribution income statement is an income statement that separates the variable expenses and fixed costs of running a business.

If there are any earnings remaining, the difference is considered profit. These are a few questions this article answers! Contribution margin can be presented as the total amount, amount for each product line, amount per unit, or as a percentage of net sales. Web guide to what is contribution margin income statement. Web a contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin. Web this type of income statement provides a clearer picture of profitability by focusing on variable costs and how they impact overall revenue. How to calculate your contribution margin. What is the business’s net profit, and how much did it earn. And the procedure based on which it is compiled allows you to calculate it accurately. What is contribution margin income statement? Web when you download our free contribution margin income statement excel template you’ll get a blank sheet that helps you calculate contribution margin and food cost percentage per dish, and a sheet filled in with a sample calculation. Web our contribution margin excel template equips analysts with a comprehensive tool for effortlessly conducting detailed contribution margin analysis. Web contribution margin income statement. It separates fixed and variable costs to show which products or services contribute most to generating profit. Web to calculate this figure, you start by looking at a traditional income statement and recategorizing all costs as fixed or variable.

A Traditional Income Statements Or Profit Or Loss Accounts Prepared For External Parties Like Govt.

A company’s total contribution margin includes all earnings available to pay for fixed expenses. These are a few questions this article answers! A variable cost changes with the amount of production, while a fixed cost stays constant regardless of the amount of production. Agencies, shareholders, auditors show gross profit and net profit and do not show contribution.

Web The Contribution Margin Income Statement Answers The Central Question:

Web contribution margin income statement is an income statement that is prepared to show the contribution margin figure in the income statement. This highlights the margin and helps illustrate where a company’s expenses. Web a contribution margin income statement allows a business to understand which profit center its contribution margin comes from. Contribution margin can be presented as the total amount, amount for each product line, amount per unit, or as a percentage of net sales.

Web A Contribution Income Statement Is An Income Statement That Separates The Variable Expenses And Fixed Costs Of Running A Business.

Components of contribution margin income statement. Web what is the contribution margin income statement and what's the formula to calculate it? Web here is an example of a contribution margin income statement illustrating breakeven in dollars. What is contribution margin income statement?

Web The Contribution Margin Income Statement Is How You Report Each Product's Contribution Margin—A Key Part Of Smart Operating Expense Planning.

Understanding its nuances can significantly improve strategic planning, cost control, and pricing decisions. Web the contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. Web to calculate this figure, you start by looking at a traditional income statement and recategorizing all costs as fixed or variable. Here we explain its format, examples, and their advantages and disadvantages.