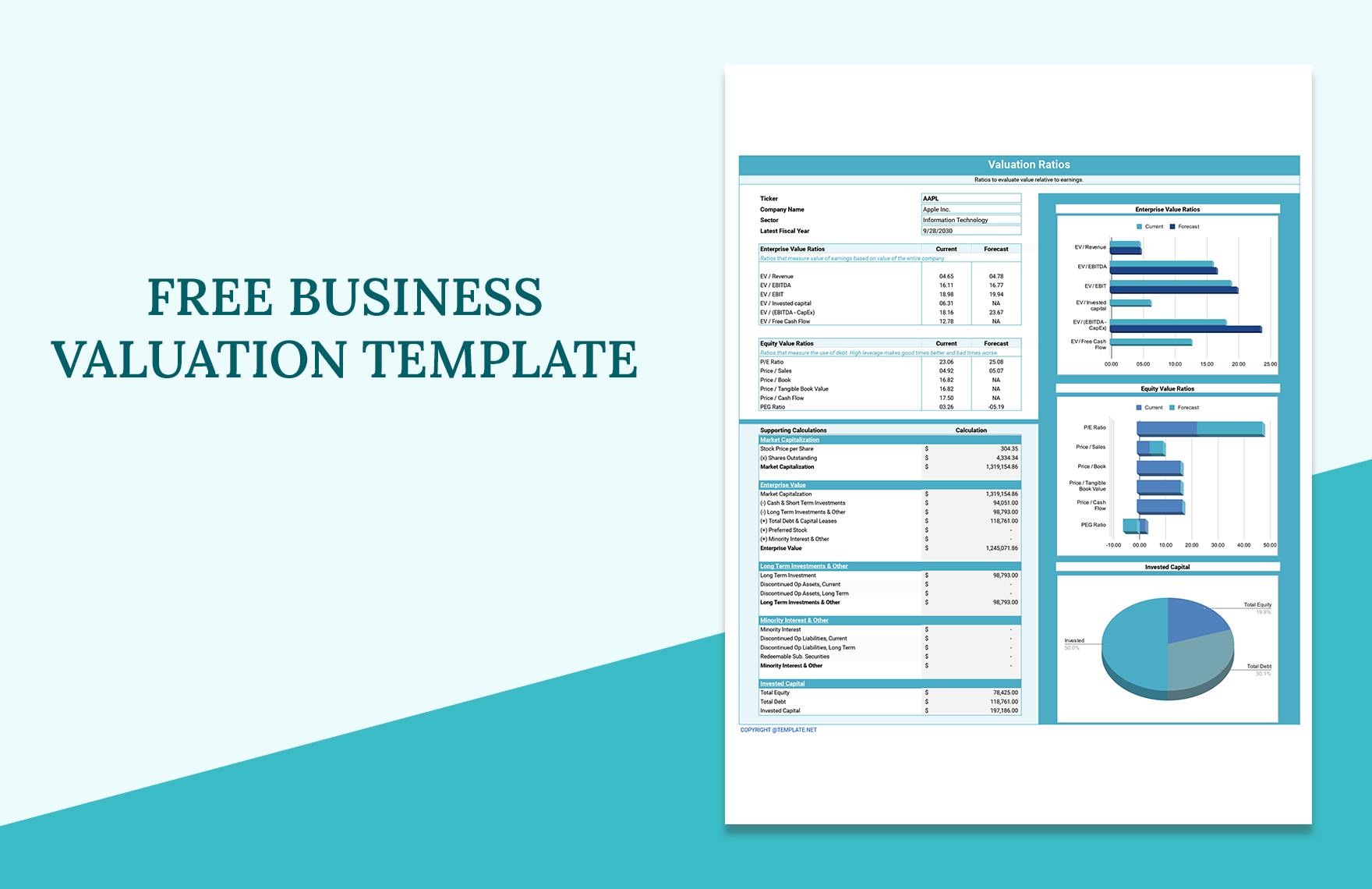

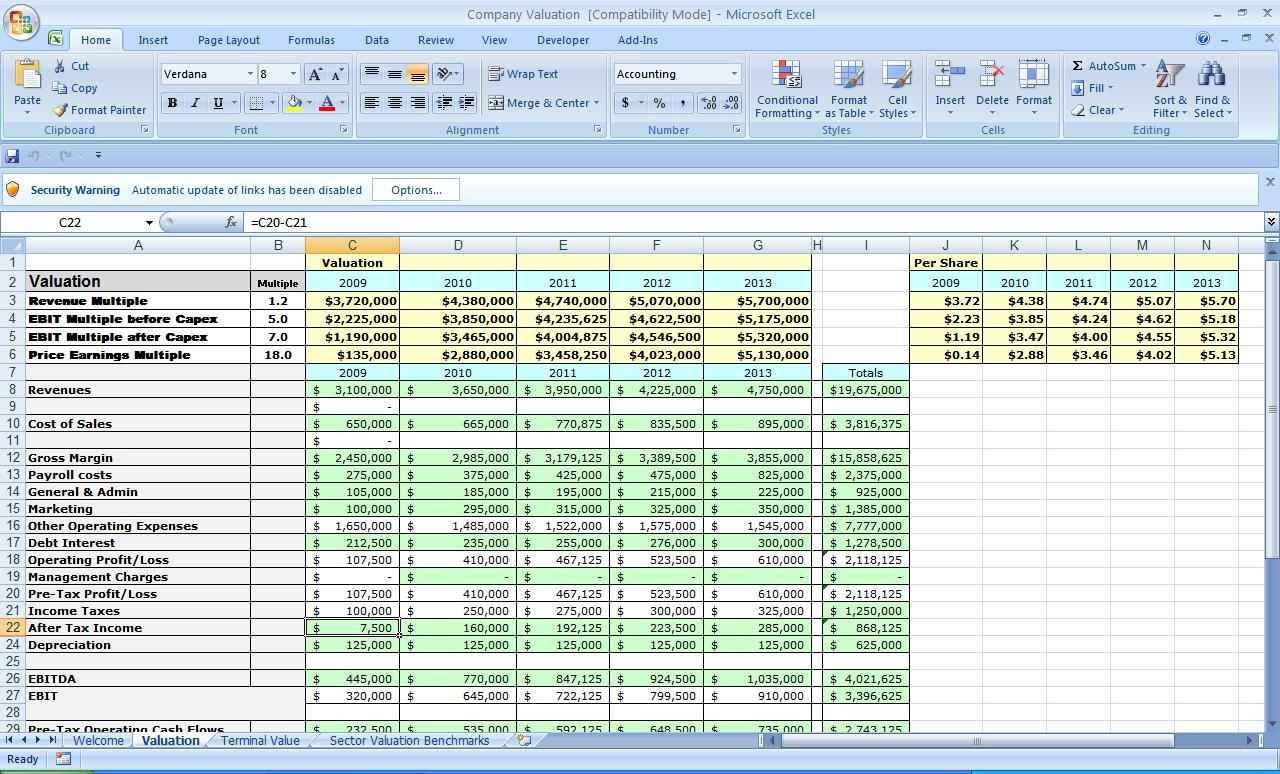

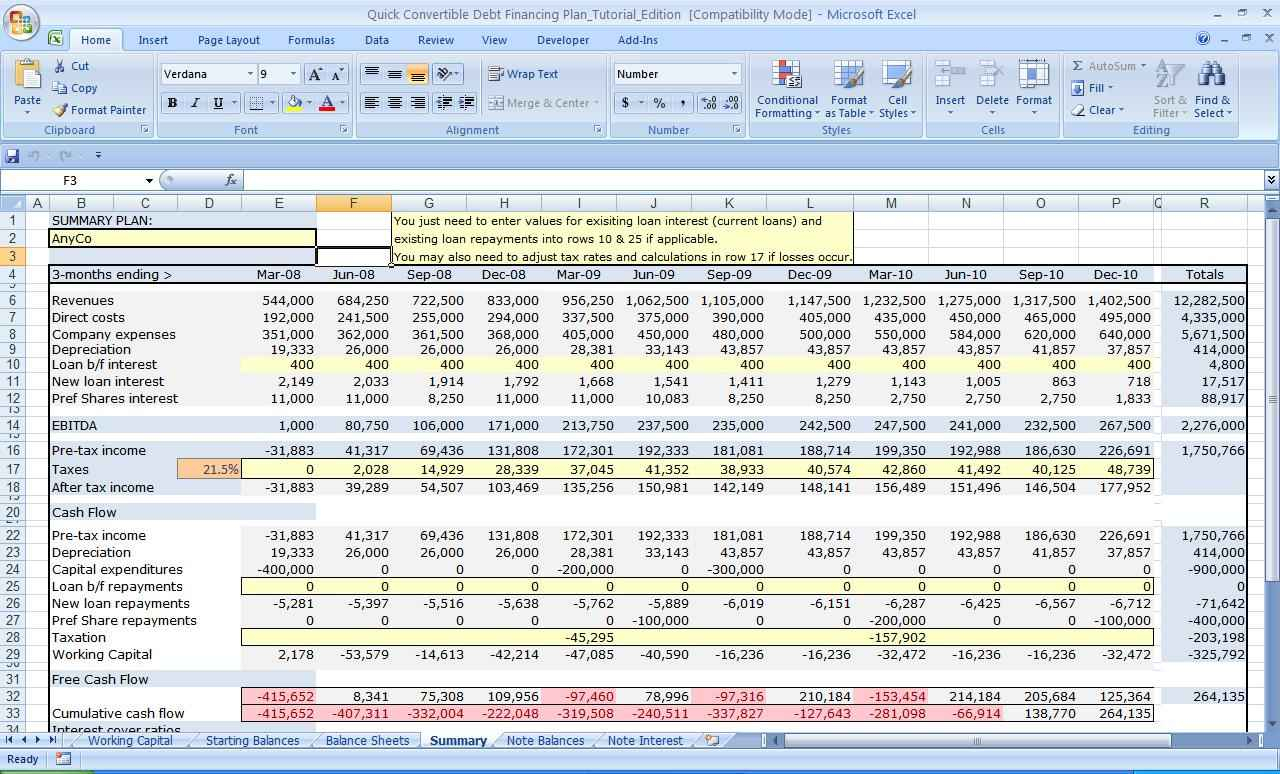

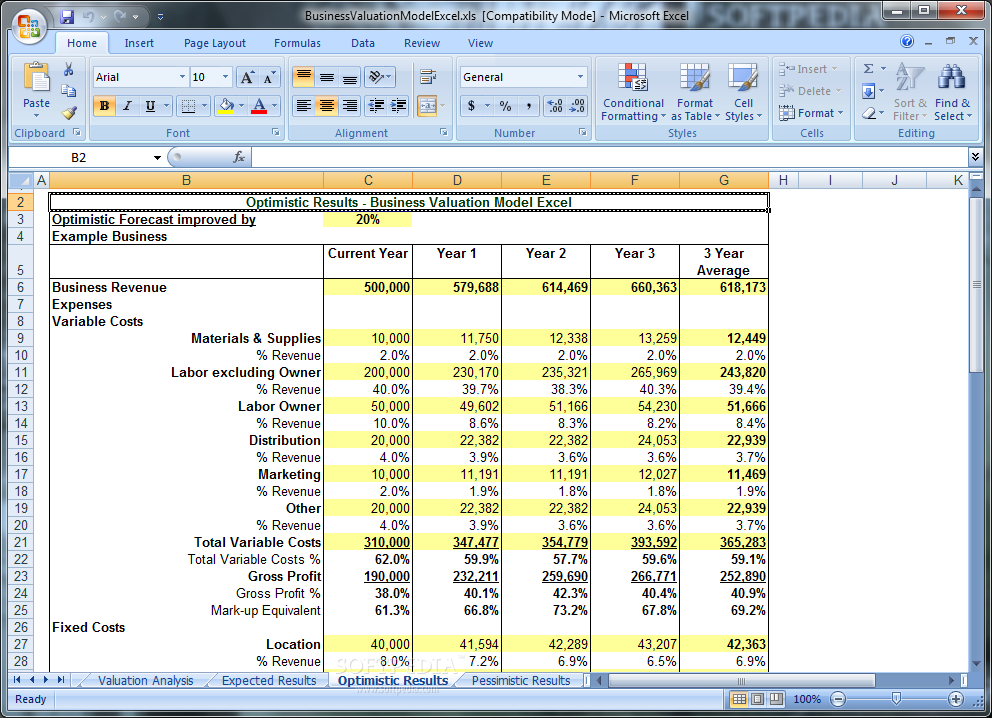

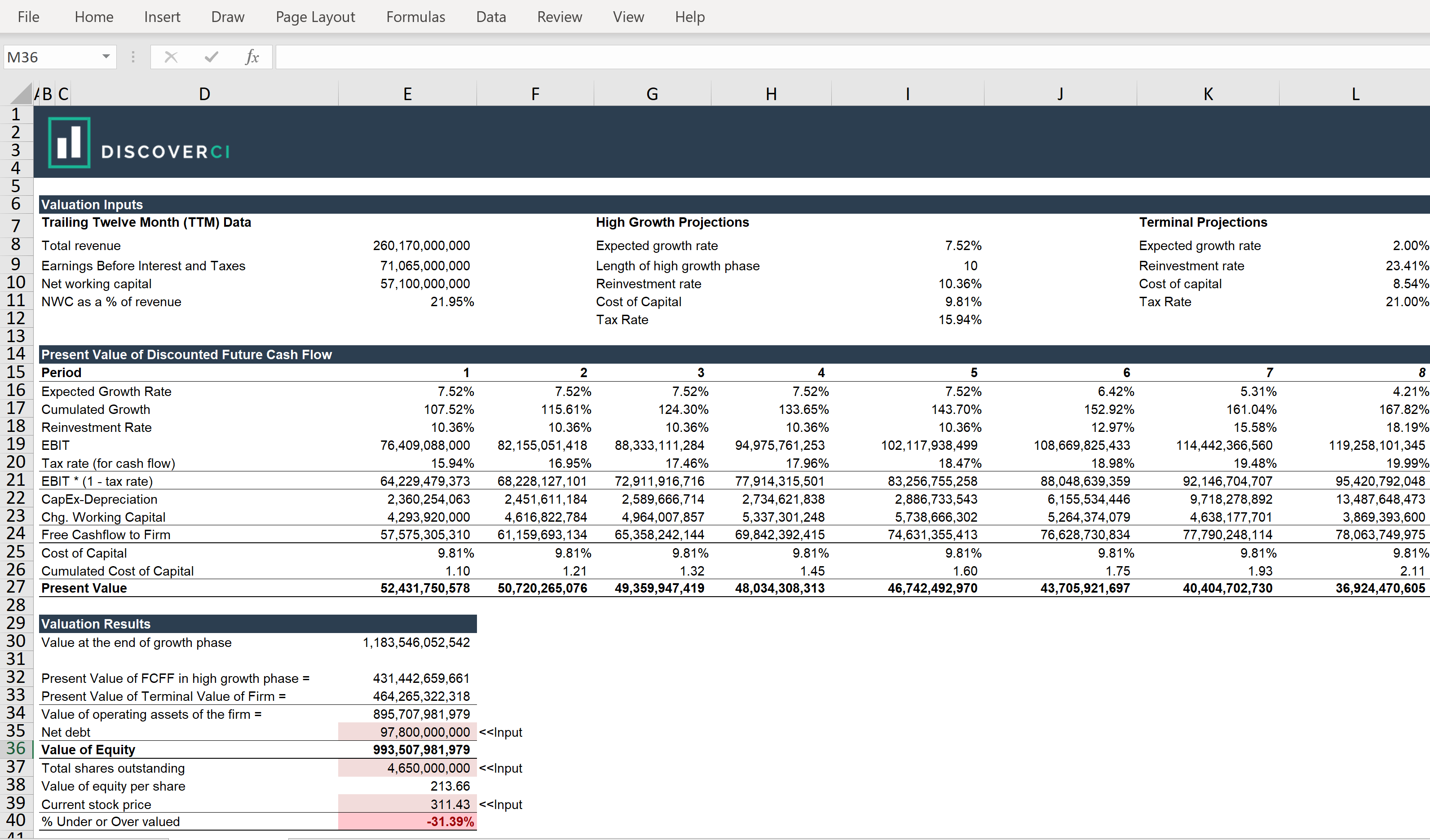

Web the excel business valuation template provides an adaptable framework for the valuation of proposed investments and business models by analyzing net present value, economic value added and accounting impact. No need to spend time or money on a business valuation firm. Web business valuation in excel. There are many ways to calculate the value, but no magic number will meet every investor’s needs. Here’s how to set up a simple valuation template in excel.

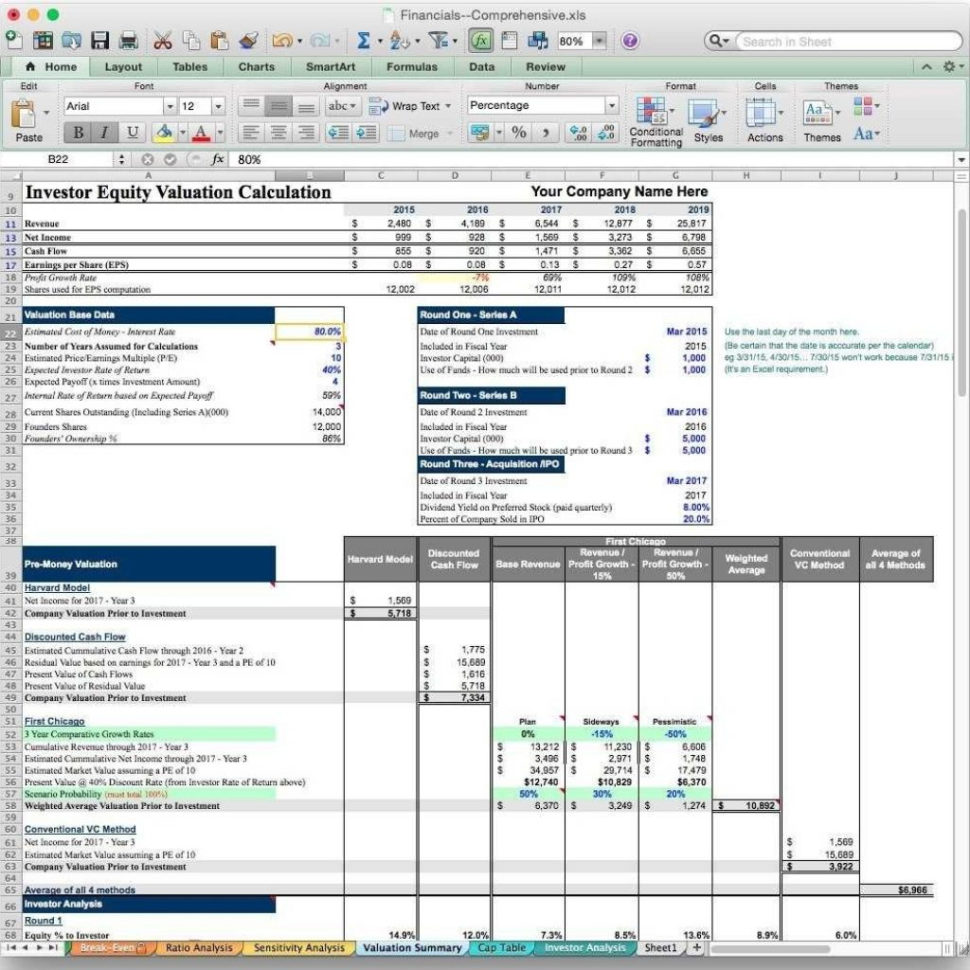

This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount rate for future cash flow projections over three and five year periods. Consequently, it will provide three specific (and very different) values that could be valid under different buy/sell situations. The calculations break down into two major categories: Web this template is designed to assist you in placing a specific dollar value on your business. Download the free dcf model template.

This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount rate for future cash flow projections over three and five year periods. Web this template is designed to assist you in placing a specific dollar value on your business. Enter your name and email in the form below and download the free template now! Web excel files and resources: This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions.

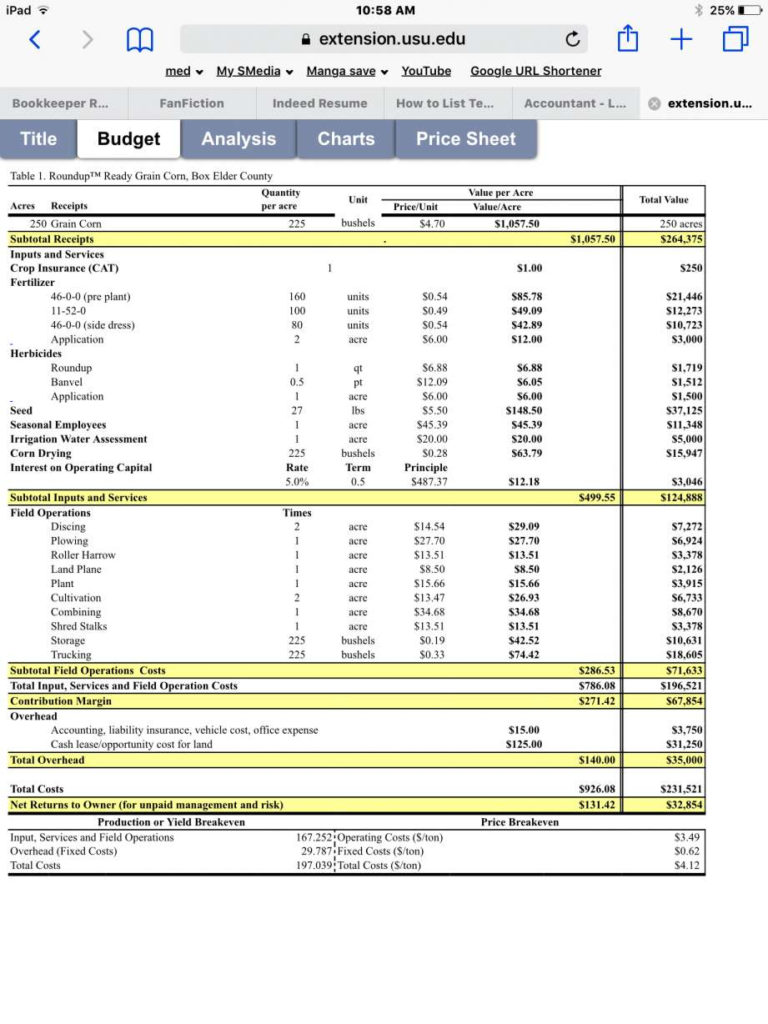

There are many ways to calculate the value, but no magic number will meet every investor’s needs. 59€ calculator for business valuation. Dcf analysis is a staple of financial modeling and can be performed with a basic template. The capitalized earnings valuation method offers a simple way to quickly estimate the value of your business. Web business valuation in excel. How to value a startup. Web to value a company in excel, choose a valuation method (dcf, comparables, or precedent transactions), gather financial data, input into excel, apply chosen model calculations, and analyze the output to estimate the company’s worth. Note that the examples here come from an older version of our financial modeling courses. Web business valuation excel template: Excel models for business valuation. Web valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples. Just enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. Web excel files and resources: This template simplifies the complex process by incorporating vital financial metrics. The calculations break down into two major categories:

Valuing Your Business With Our Comprehensive Templates Should Not Be Complicated.

Just enter in the information on our valuation spreadsheet and our software will calculate the value of your small business. Web this unique business valuation template is based on discounted cash flow projections, weighted average cost of capital (wacc) and internal rate of return (irr). Web valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples. Web to value a company in excel, choose a valuation method (dcf, comparables, or precedent transactions), gather financial data, input into excel, apply chosen model calculations, and analyze the output to estimate the company’s worth.

Dcf Analysis Is A Staple Of Financial Modeling And Can Be Performed With A Basic Template.

Here’s how to set up a simple valuation template in excel. Download the free dcf model template. Web maximize your business value with our comprehensive free business valuation template, a strategic tool for reliable financial analysis & forecasting. 10 simple steps to success.

It Will Do So By Using These Three Most Commonly Discussed Valuation Methods.

Enter your name and email in the form below and download the free template now! This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount rate for future cash flow projections over three and five year periods. This file enables you to effortlessly compute the estimated business valuation using net present value (npv) and projected annual cash flow. Web ever wonder what your business is worth?

59€ Calculator For Business Valuation.

Below is a preview of the dcf model template: Web identify a business' health and future based on profitability and other key metrics with our business valuation excel template. Press the links below in order to learn more about each model. Web valuation modeling in excel may be performed by using existing templates or by creating a model from scratch.