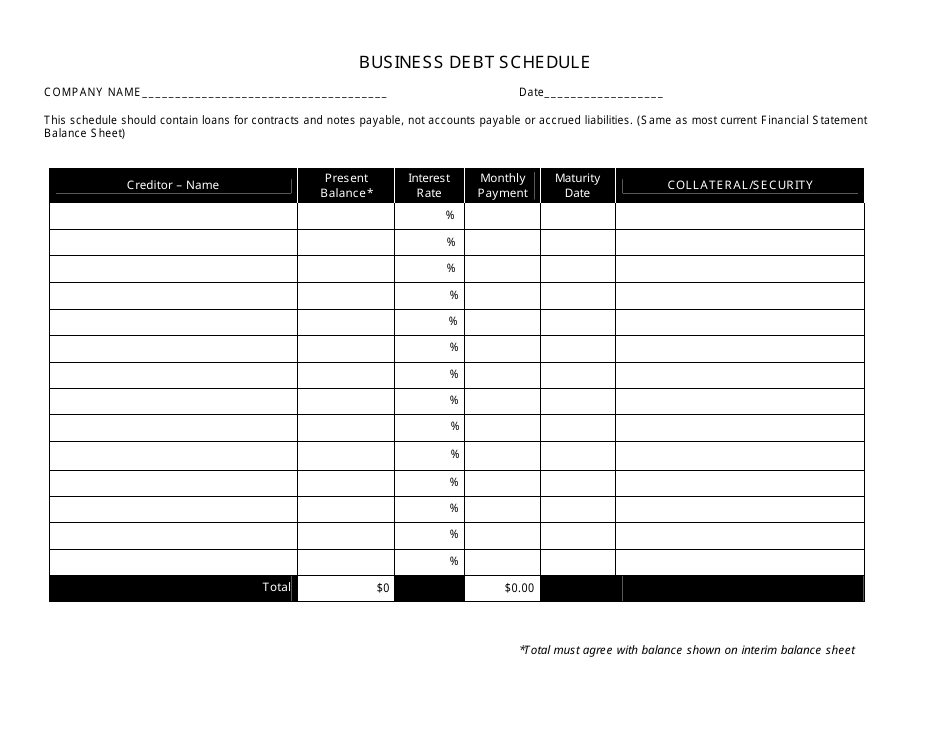

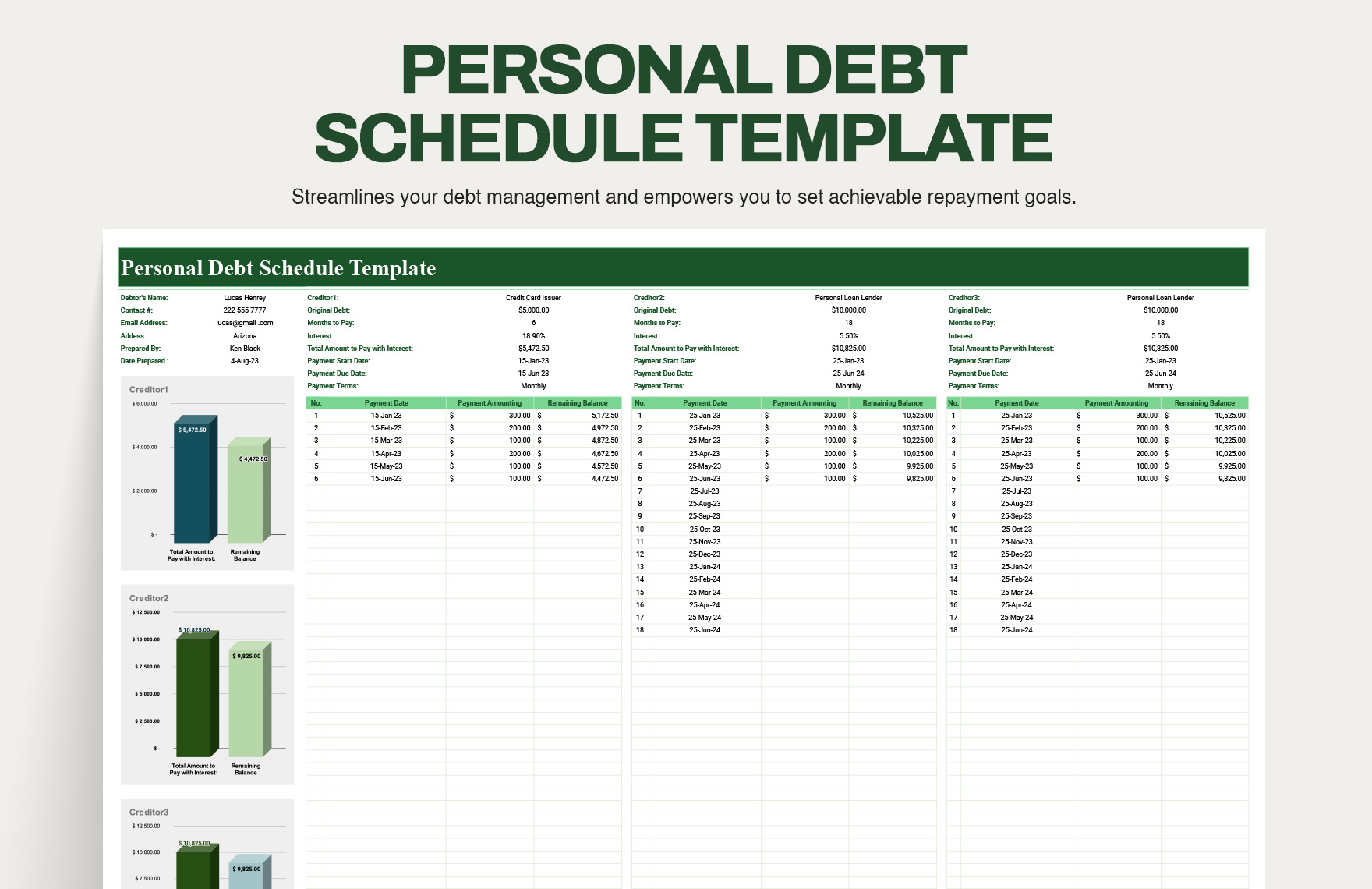

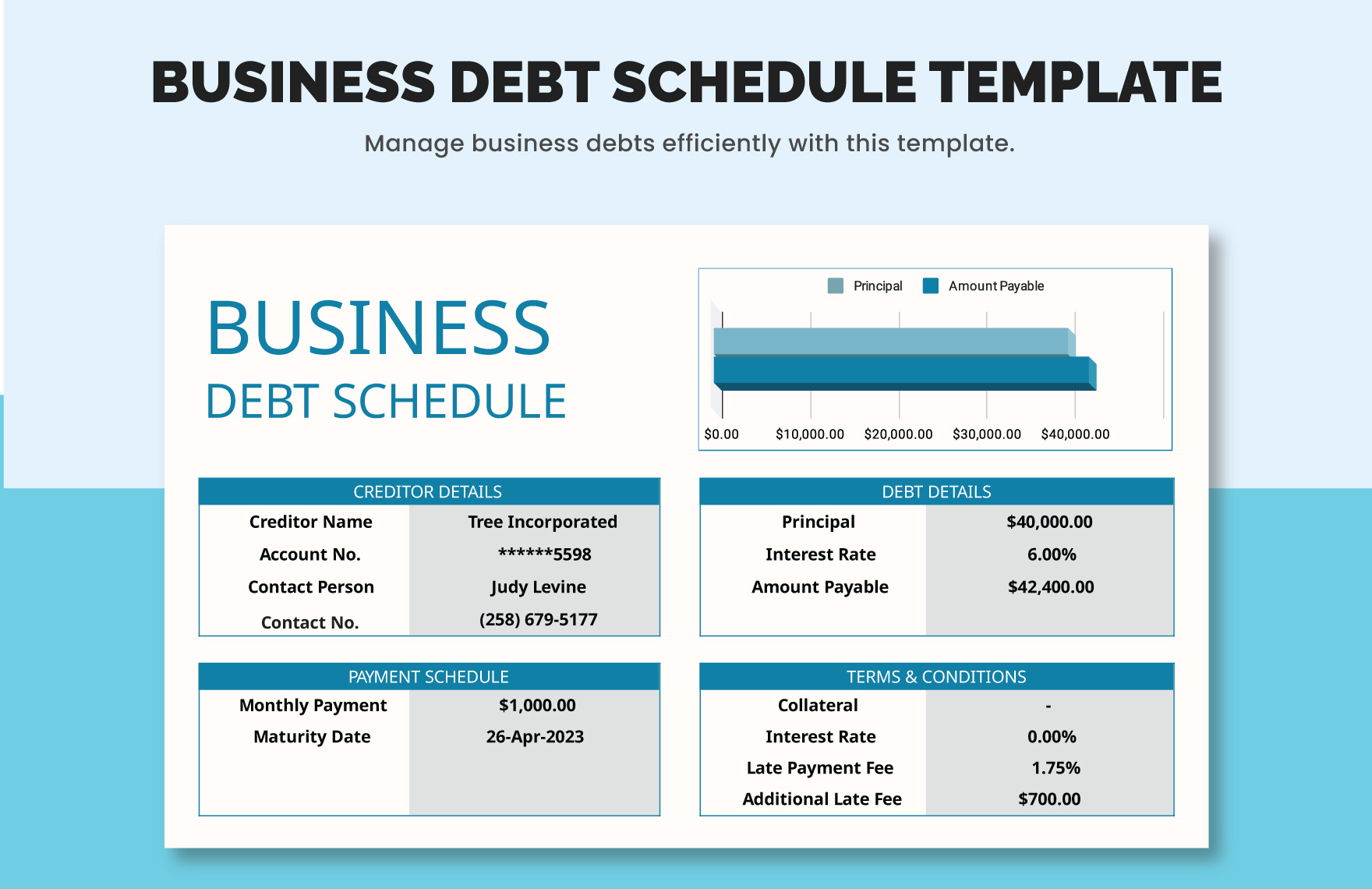

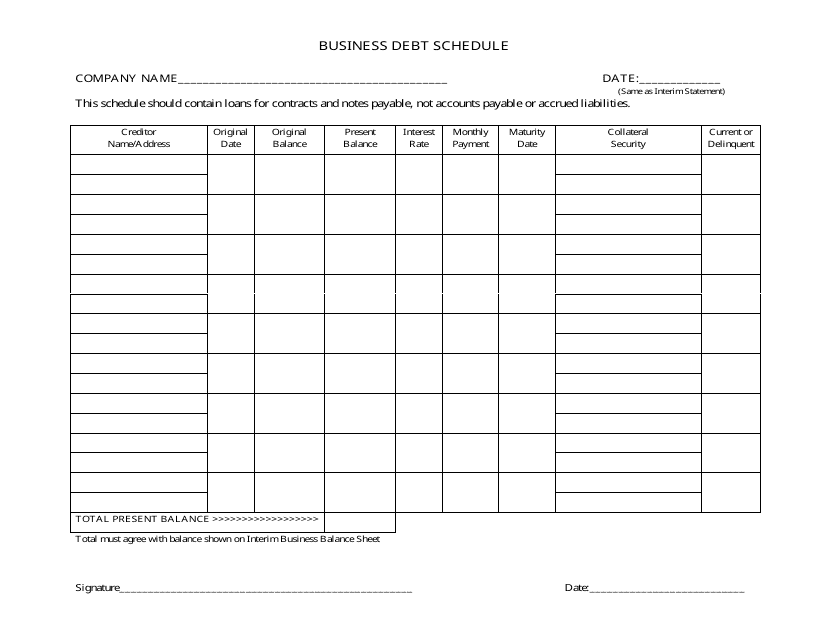

Web business debt schedule template. A business debt schedule keeps up with who your company owes money. You’ll be able to make informed decisions for business growth, daily improvements, and. Learn more and download a template. This schedule should list loans, contracts, capital leases and notes payable, not accounts payable or accrued liabilities.

Mandatory loan repayment percentage assumptions. Web download our debt schedule template and learn to effectively manage and analyze your company’s debt profile. Learn more and download a template. This schedule should list loans, contracts, capital leases and notes payable, not accounts payable or accrued liabilities. You’ll be able to make informed decisions for business growth, daily improvements, and.

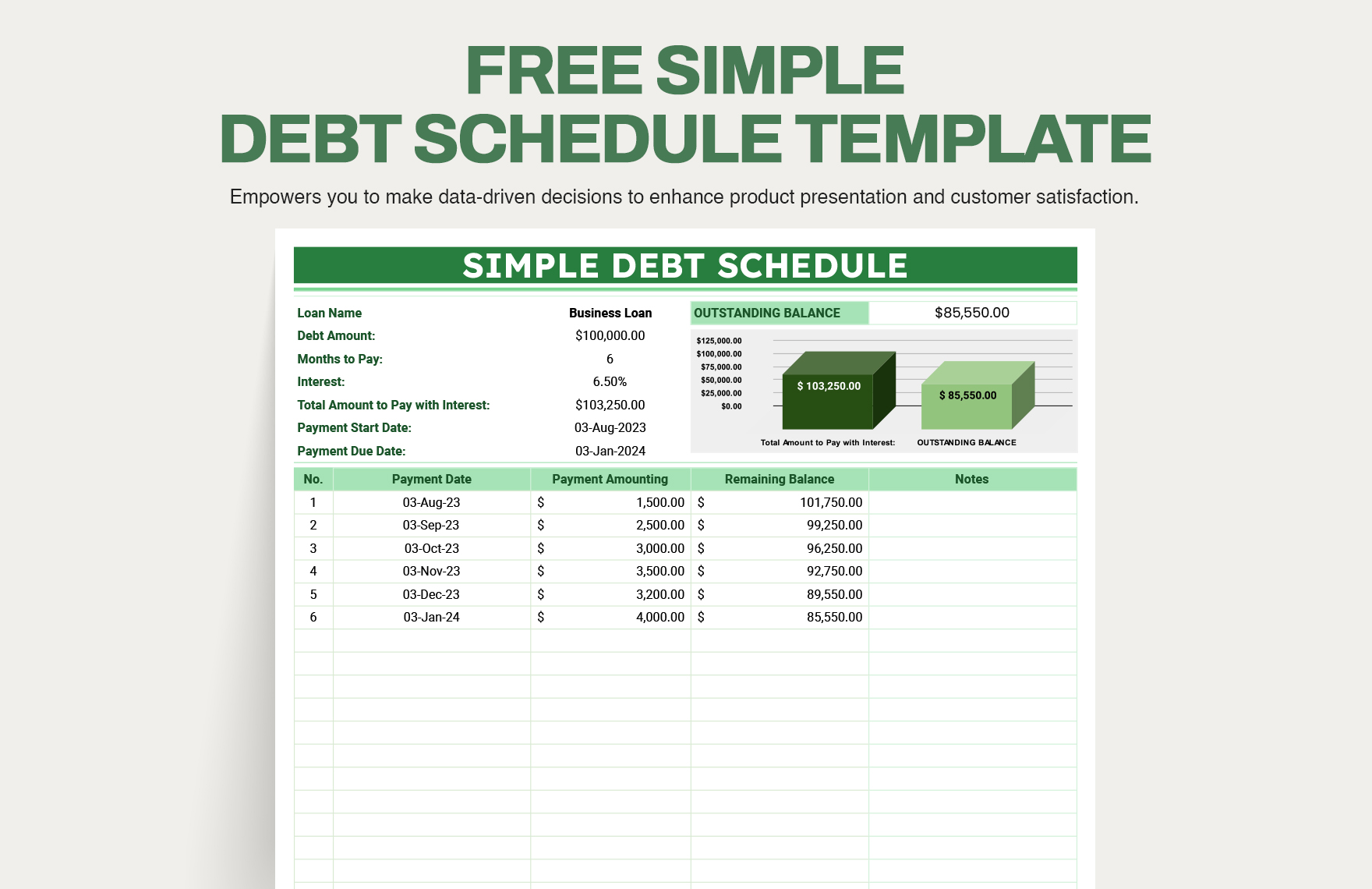

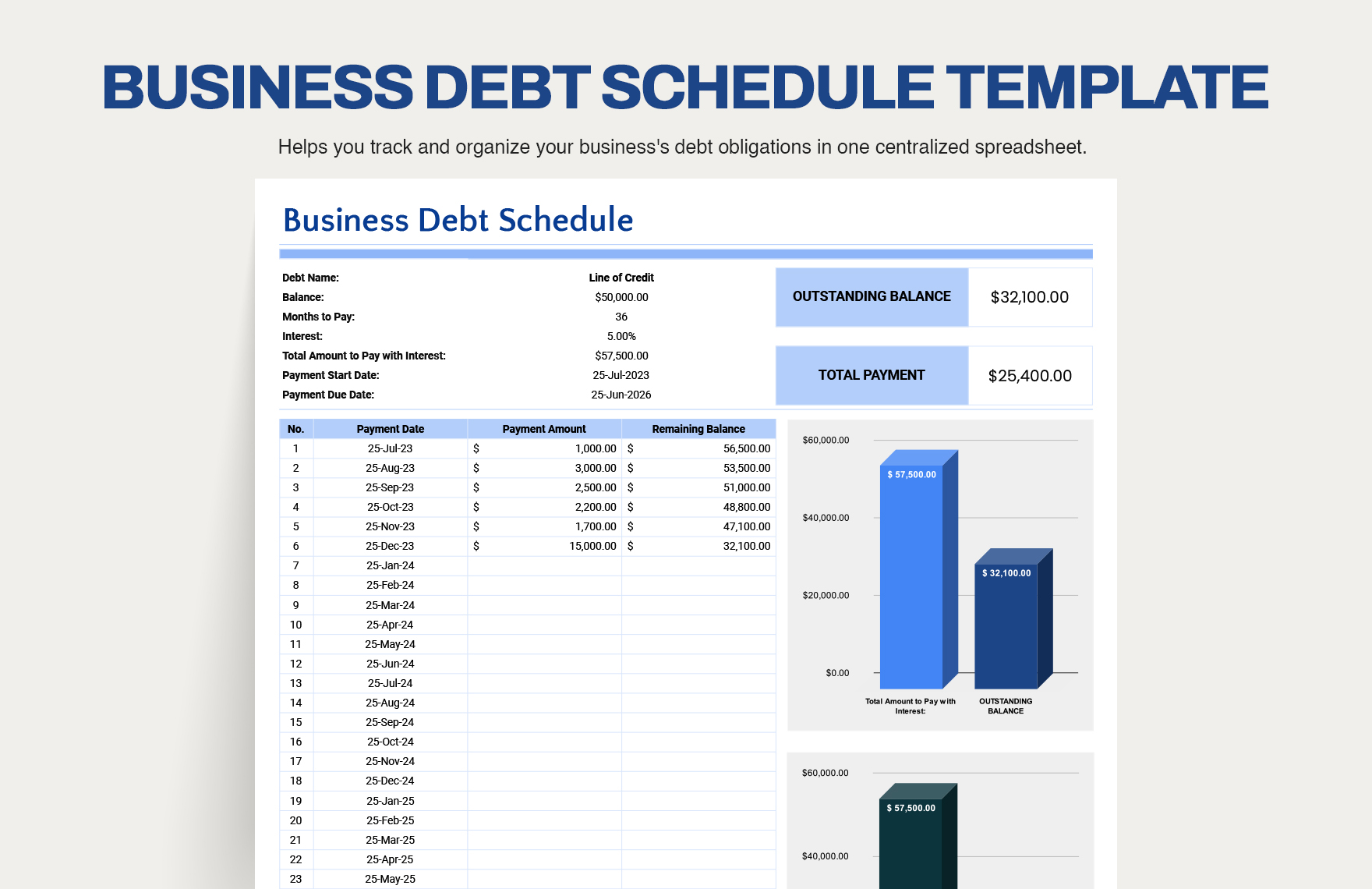

Web this schedule should list loans, contracts and notes payable, not accounts payable or accrued liabilities. Web a business debt schedule is an instrument that helps businesses analyze, evaluate, and envision debts. Optional repayment (cash sweep) step 6. Stay on top of payment schedules, interest rates, and creditor information, empowering you to make sound financial. A debt schedule permits businesses to make calculated decisions about paying off debt, gaining new debt, or designing long.

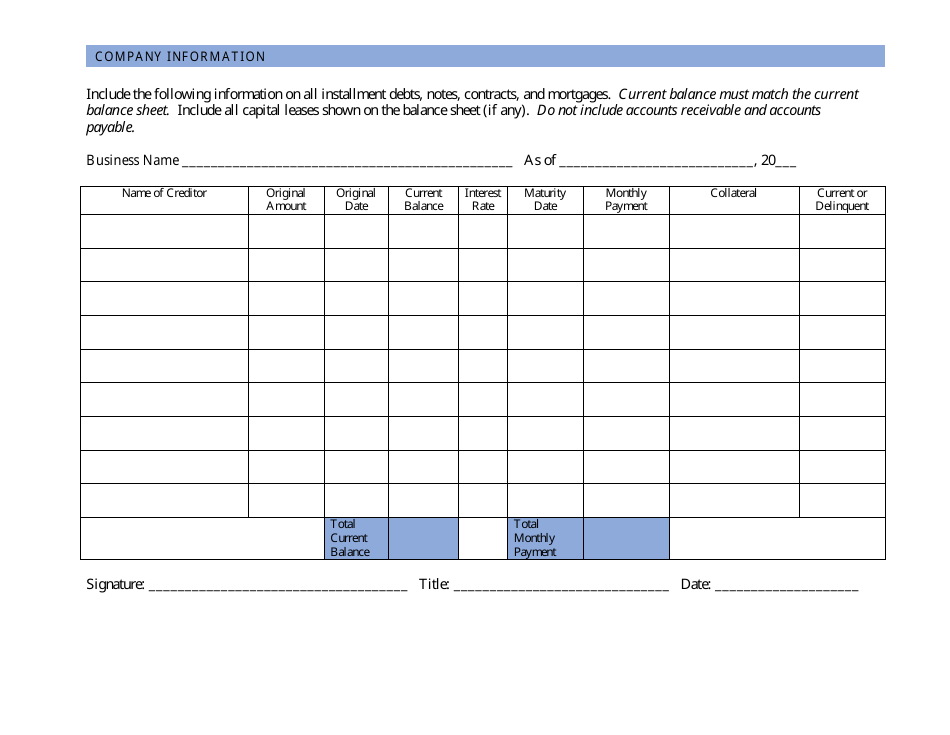

Learn more and download a template. Web what is a debt schedule? Web business debt schedule template. Web about this document and download. No matter how you create a. Operating assumptions and financial forecast. A debt schedule lays out all of the debt a business has in a schedule based on its maturity. This form is provided for your convenience in responding to filing requirements in item 2 on the application, sba form 5. It helps to provide a clear overview of the debt structure, repayment terms, and outstanding balances of the business. This template will guide you in detailing a company’s outstanding debts, their respective interest rates, and repayment schedules. Alternatively, you can create a table similar to the following to. Web easily track and manage your business debts with our free business debt schedule template. Web download our debt schedule template and learn to effectively manage and analyze your company’s debt profile. Web the business debt schedule template is designed for small businesses to maintain accurate tracking of those debts. It should correspond to the balances on the company's interim balance sheet.

Web We’ll Review What A Business Debt Schedule Is, Why You Need One For Your Business And How To Make A Debt Schedule Of Your Own.

Operating assumptions and financial forecast. Stay on top of payment schedules, interest rates, and creditor information, empowering you to make sound financial. Web the business debt schedule template is designed for small businesses to maintain accurate tracking of those debts. A debt schedule permits businesses to make calculated decisions about paying off debt, gaining new debt, or designing long.

Web Business Debt Schedule Template.

Web business debt schedule template. It allows you to structure and manage your company's debt obligations efficiently. This template will guide you in detailing a company’s outstanding debts, their respective interest rates, and repayment schedules. Debt tranches table and financing assumptions.

If You’re Applying For A Loan, Lenders May Ask You To Prepare One.

So, what is a debt schedule for a business? Web a business debt schedule lists the pertinent information about all your business’s outstanding debts. Get it for free right here! If no debt, fill out the top portion and write “none” in the section below and sign it at the bottom.

Web A Business Debt Schedule Is An Instrument That Helps Businesses Analyze, Evaluate, And Envision Debts.

Web this schedule should list loans, contracts and notes payable, not accounts payable or accrued liabilities. For example, the sba has a free online template available to download. Web easily track and manage your business debts with our free business debt schedule template. Web about this document and download.