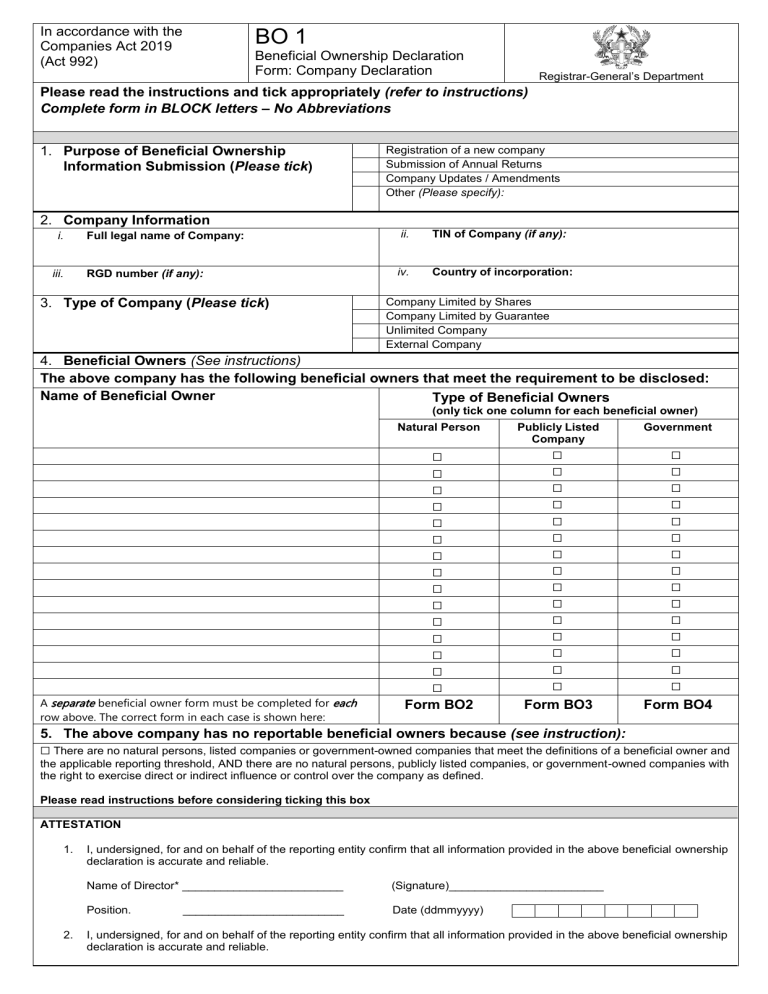

Complete and upload a pdf. Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Existing companies have one year to file; Source dividends received from a foreign corporation or interest trade or business of a foreign corporation and meets qualified resident status (see instructions). Prepare report offline at your own pace, save as you go.

(ii) a broker or dealer in. Web report beneficial ownership information to fincen by filing a true, correct, and complete boir. This section includes specific recommendations and instructions to assist in reporting beneficial ownership information to fincen by filing a boir. Federal government agency, to obtain beneficial ownership information for authorized activities related to national security, intelligence, and law enforcement. File the beneficial ownership information report (boir) select the filing method that works best for you:

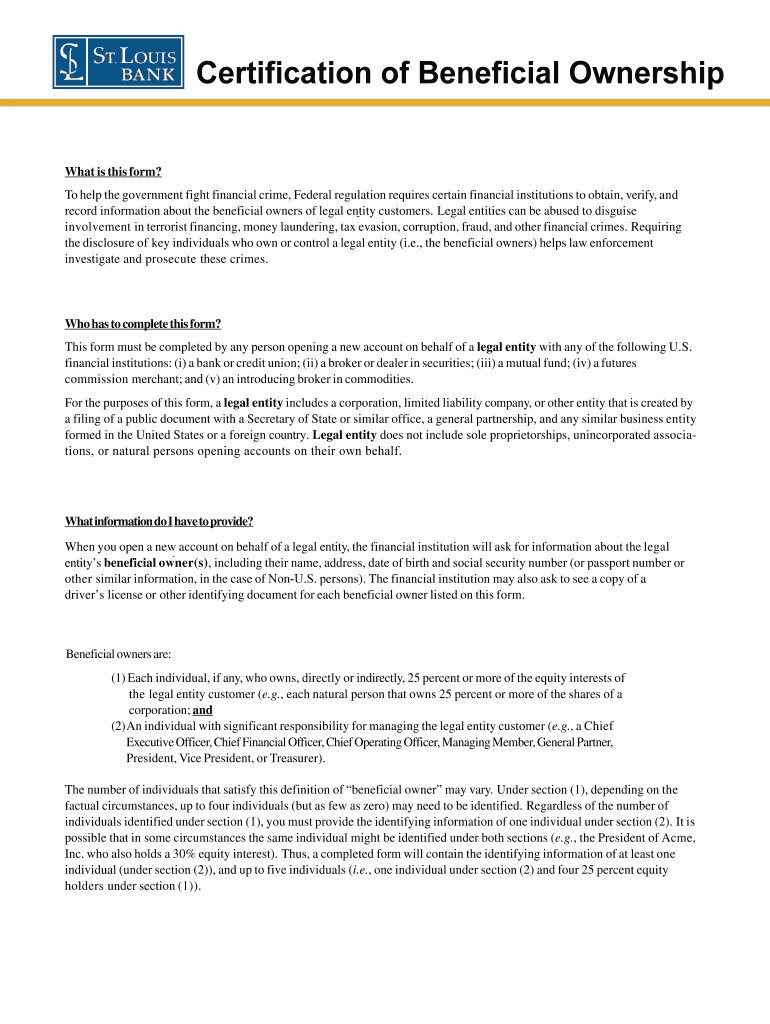

This information is vital for combating financial crimes, including money laundering and corruption. Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. (i) a bank or credit union; Beneficial owner information report (boir) pdf filing method. Web companies are required to file their beneficial ownership information to the cipc by 1 october 2023.

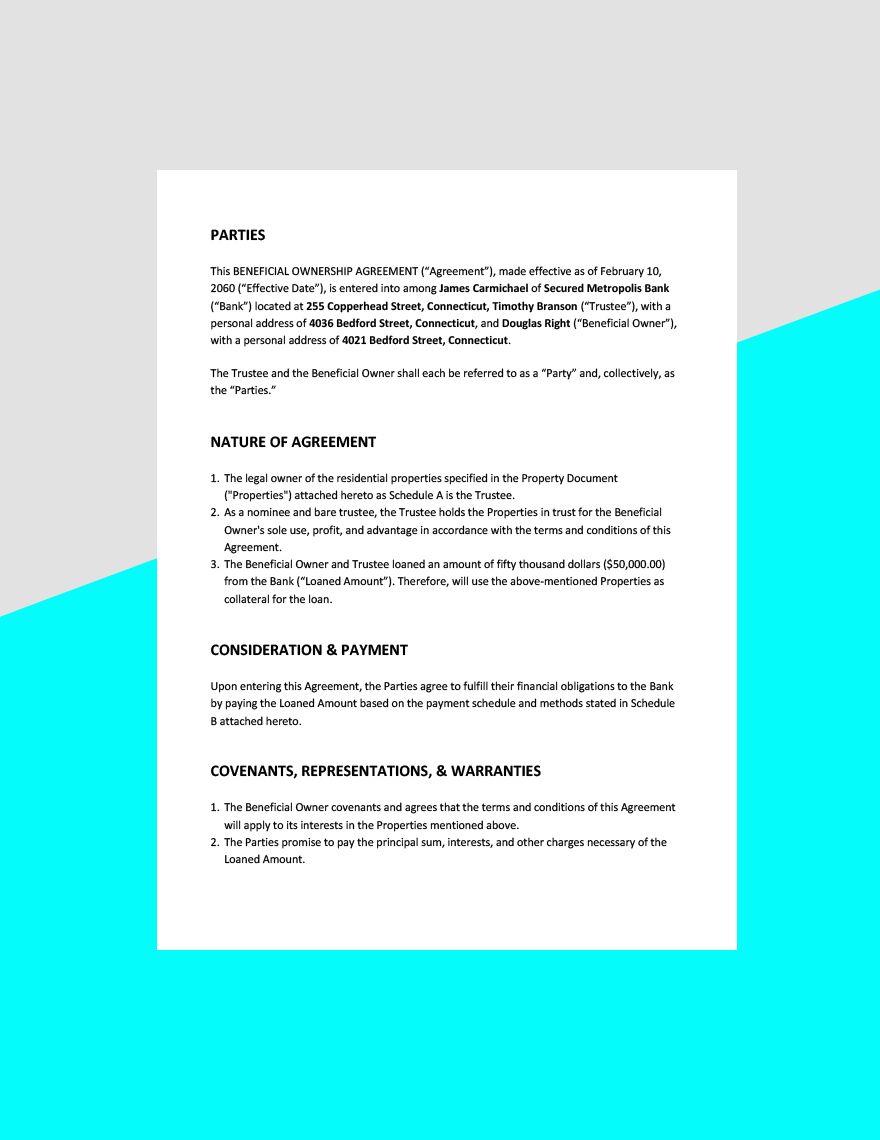

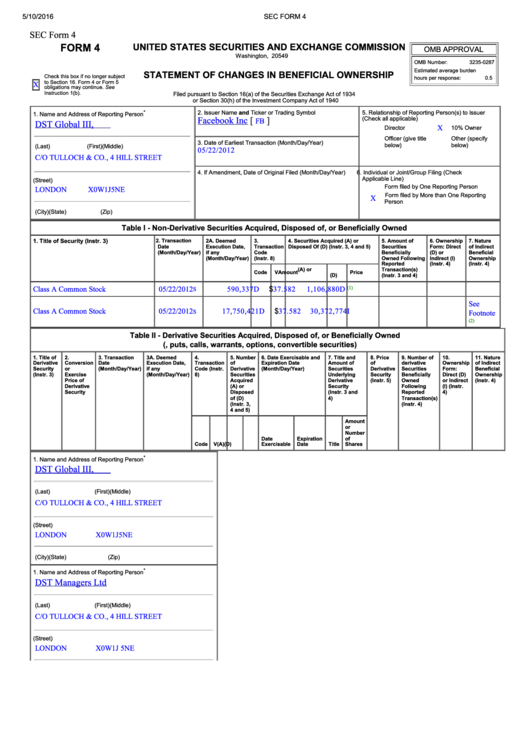

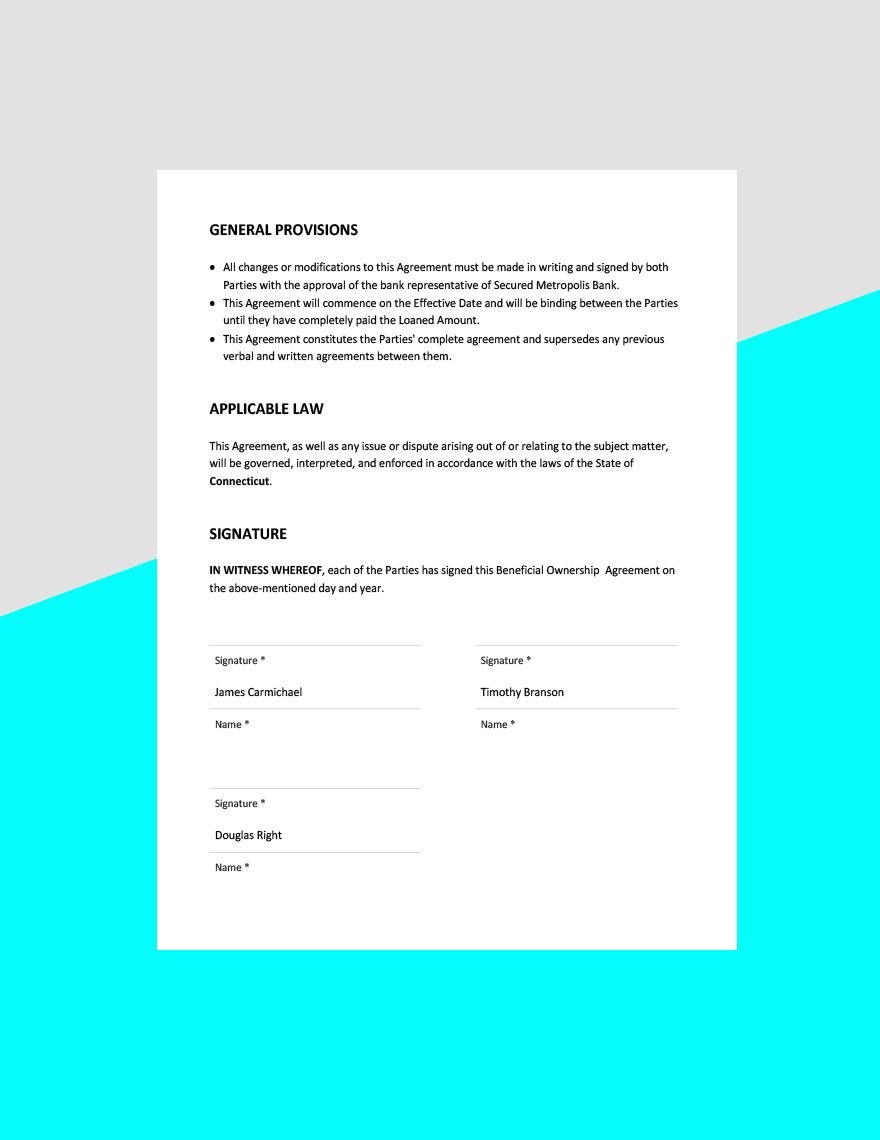

File the beneficial ownership information report (boir) select the filing method that works best for you: Web beneficial ownership involves identifying the natural persons who ultimately own or control a legal entity, such as a company. Web report beneficial ownership information to fincen by filing a true, correct, and complete boir. Boi includes an individual’s full legal name, date of birth, street address and a unique id number. (ii) a broker or dealer in securities; Beneficial ownership information registry now accepting reports. Web companies are required to file their beneficial ownership information to the cipc by 1 october 2023. Fincen began accepting reports on january 1, 2024. The following documents are required documents when filing your beneficial ownership information: Web this form requires you to provide the name, address, date of birth and social security number (or passport number or other similar information, in the case of foreign persons) for the following individuals (i.e., the beneficial owners): New companies must file within 90 days of creation or registration. Web a beneficial ownership information report is a report submitted to the financial crimes enforcement network (fincen) under the corporate transparency act. All companies required to submit beneficial ownership information reports must file online via fincen. The report contains information about the company and identifies the individuals who own or control it, either directly or indirectly. Download a copy of the blank boir form as a pdf here and fill in the information.

Beneficial Owner Information Report (Boir) Pdf Filing Method.

Web best practice sample data collection forms, useful to guide officials who need to collect beneficial ownership information. Web this form must be completed by the person opening a new account or maintaining business relationships on behalf of a legal entity with any of the following u.s. The following documents are required documents when filing your beneficial ownership information: Web what is this form?

Or (V) An Introducing Broker In Commodities.

(ii) a broker or dealer in. Web many companies are required to report information to fincen about the individuals who ultimately own or control them. If you do not already have adobe reader, download it (get.adobe.com/reader/) and install it on your device. Complete and upload a pdf.

(I) A Bank Or Credit Union;

Web this document is to guide filers and users on the steps for filing beneficial ownership details via the online automated process of filing, and also to provide legislative and practical guidelines (explanatory notes) on the purpose of filing. Web beneficial ownership involves identifying the natural persons who ultimately own or control a legal entity, such as a company. Web a beneficial ownership information report is a report submitted to the financial crimes enforcement network (fincen) under the corporate transparency act. Learn more about reporting deadlines.

Web Report Beneficial Ownership Information To Fincen By Filing A True, Correct, And Complete Boir.

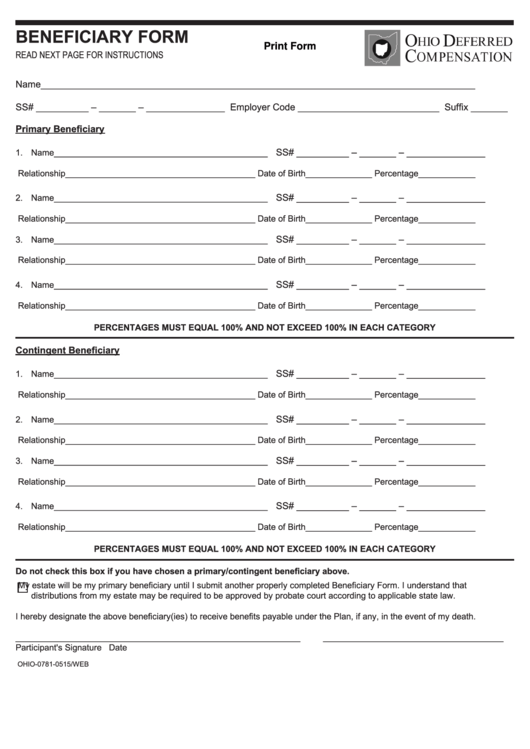

To help the government fight financial crime, federal regulation requires certain financial institutions to obtain, verify, and record information about the beneficial owners of legal entity customers. Web beneficial ownership information (boi) must be reported for the reporting company’s beneficial owners and (for entities formed or registered after 2023) company applicants. Prepare report offline at your own pace, save as you go. Web this form requires you to provide the name, address, date of birth and social security number (or passport number or other similar information, in the case of foreign persons) for the following individuals (i.e., the beneficial owners):