Why your tin may be considered as incorrect. Check those out in irs publication 1281. Web take me out my misery, i bought heaven when it was up for sale and now i need a refund, bae ( yeah) [verse 3: Web any missing or incorrect information can trigger a “b” notice. Why your tin may be considered incorrect.

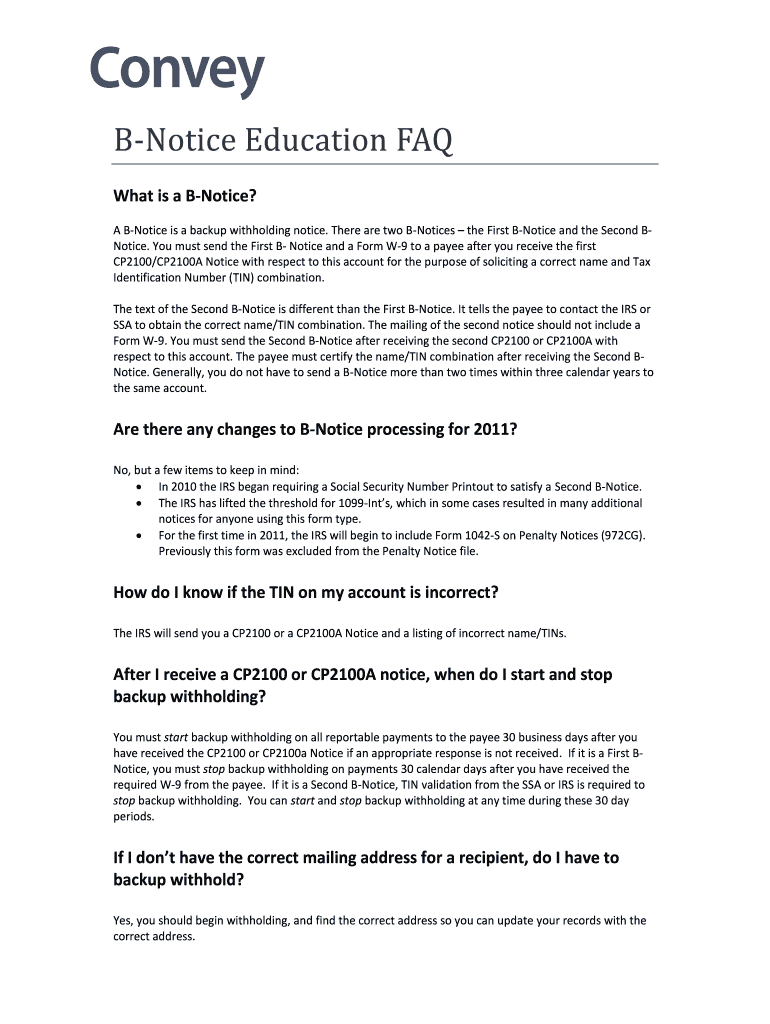

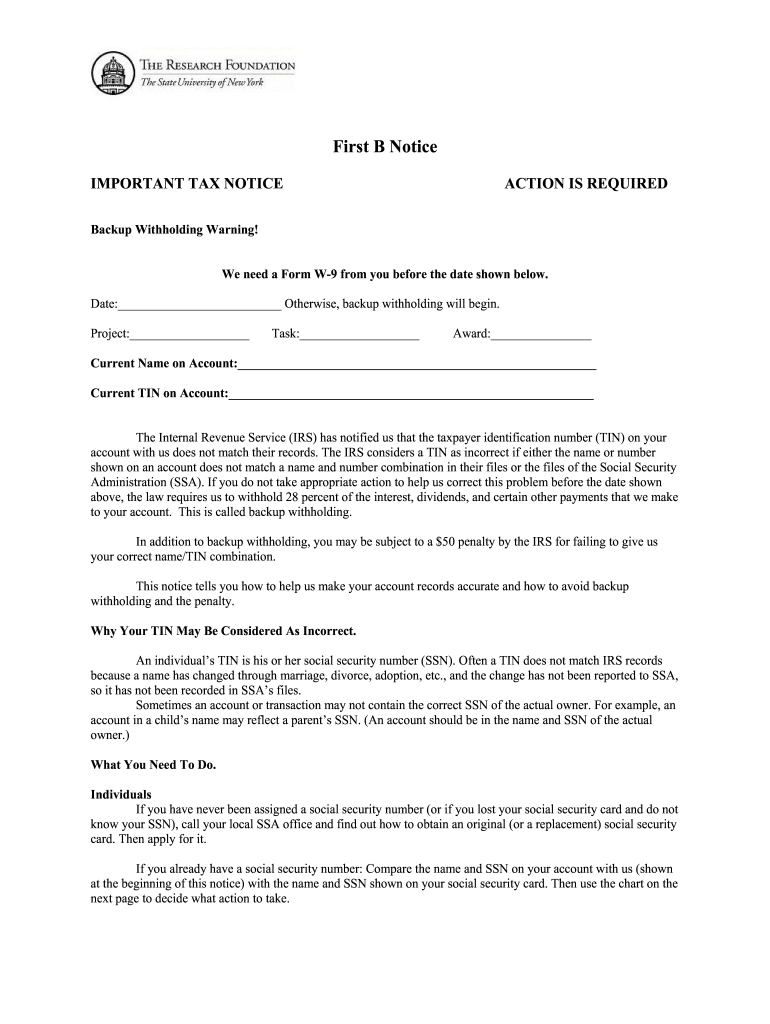

Include the date your resignation will take effect. Web a “b notice” is part of the irs’s backup withholding program, which provides notices to payers (such as businesses) who file certain information returns with incorrect taxpayer identification numbers (tins), which includes social security numbers (ssns) and employer identification numbers (eins). Web resignation notice letter format. Web a backup withholding notice, sometimes called a b notice, states that the nonemployee's taxpayer id number is either missing or incorrect. The doc or excel template has all of the design and format of the irs b notice sample, such as logos and tables, but you can modify content without altering the original style.

Payers that issue 1099s to freelance and gig workers (payees) may receive an irs b notice if the irs finds mismatches for taxpayer identification numbers (tin) and/or names in its database. Web what is a b notice (i.e., cp2100 or 972cg)? [your name] [your address] [city,. Why your tin may be considered incorrect. Why your tin may be considered as incorrect?

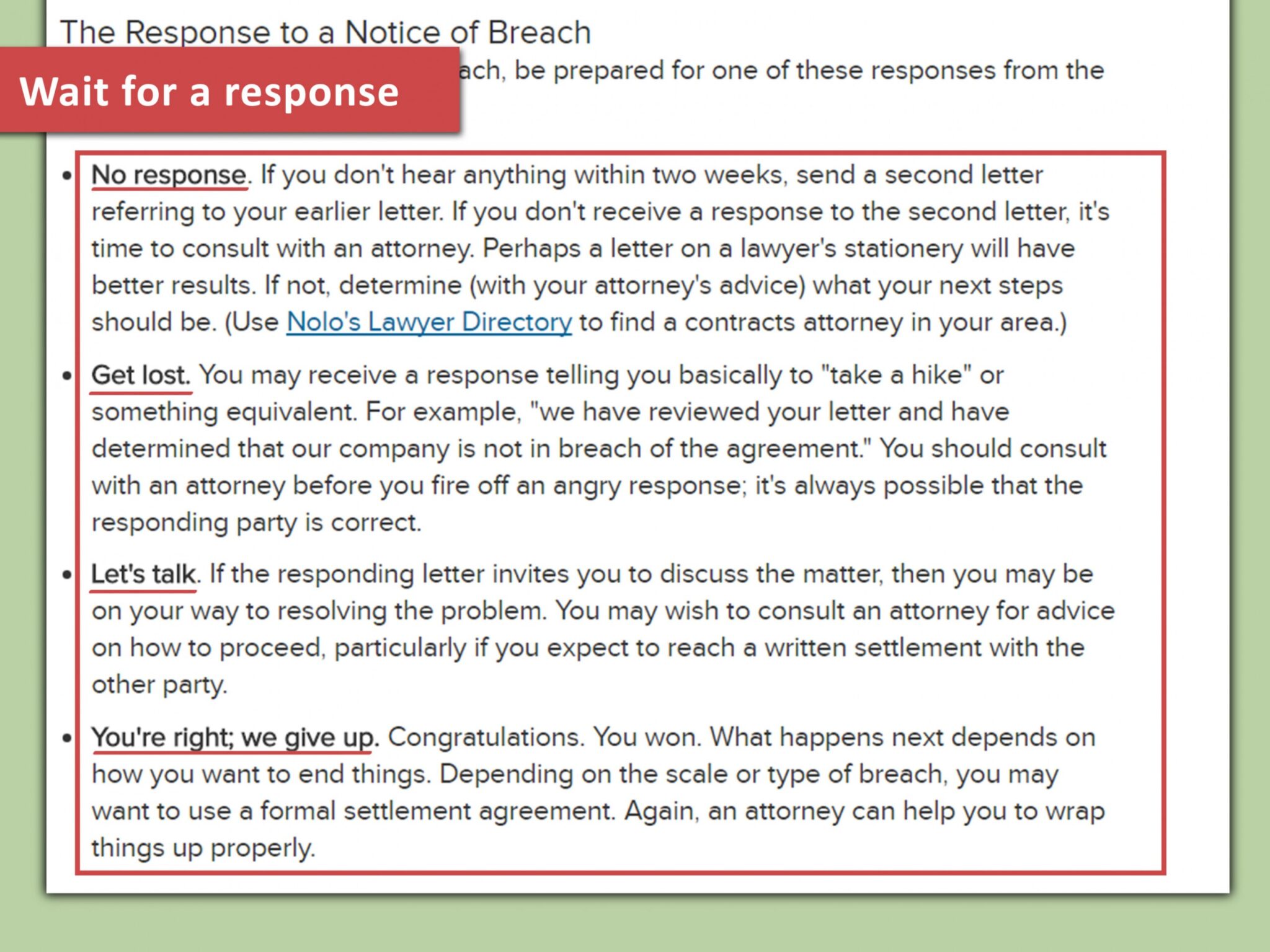

Web there’s a template letter provided in the publication that a filer can use to solicit the required b notice cure documents from payees. 24 hours notice resignation letter example. Failure to comply and rectify the 1099 filing can result in withholdings, penalties, or audits. Web what is a b notice (i.e., cp2100 or 972cg)? Web what is an irs b notice? meet the grahams is a diss track by american rapper kendrick lamar. Clearly state your intention to resign from your position as an administrative executive. Web you are required to visit an ssa office, take this notice, your social security card, and any other related documents with you. Compare this information with your records and with irs records. Web a “b” notice is a backup withholding notice. Web a irs b notice sample is a type of document that creates a copy of itself when you open it. Try taxrobot, get an r&d credit of up to $250,000. If the payee doesn’t respond, you must begin backup withholding from any future payments you make to them no later than 30 business days after you received the cp2100 or cp2100a notice. Web video instructions and help with filling out and completing irs b notice letter template. You must have the irs or ssa validate your taxpayer identification number and return it to us before _____.

The Irs Provides A Template Letter In Publication 1281 That Can Be Useful For This Purpose.

The cover art on streaming services is a plain black square. It was released on may 3, 2024, during his ongoing feud with canadian rapper drake. When a form 1099 is filed, the irs undergoes a process to match the recipient name and tin information listed on the form 1099 they receive with the irs database. Web a backup withholding notice, sometimes called a b notice, states that the nonemployee's taxpayer id number is either missing or incorrect.

Identify And Review The Payee’s Name And Tin Listed On The Notice.

Web edit, sign, and share first b notice backup withholding notice online. Failure to comply and rectify the 1099 filing can result in withholdings, penalties, or audits. If the payee doesn’t respond, you must begin backup withholding from any future payments you make to them no later than 30 business days after you received the cp2100 or cp2100a notice. Compare this information with your records and with irs records.

Eminem & Sly Pyper] So Whether You Friend Or You Are Foe (Woah) Far As Bars Go, Even.

Why your tin may be considered incorrect. Web any missing or incorrect information can trigger a “b” notice. A “b” notice is a backup withholding notice and is sent to a filer of forms 1099. Web video instructions and help with filling out and completing irs b notice letter template.

Web This Notice Tells You How To Help Us Make Your Account Records Accurate And How To Avoid Backup Withholding And The Penalty.

[1] it is lamar's response to the release of drake's family matters , a diss track mainly. The internal revenue service (“irs”) is in the midst of an initiative of issuing cp2100 and cp2100a notices to taxpayers informing them that they may be responsible for backup withholding. Web templates should be created with approved messaging to send to b notice recipients that will request the proper information. Web a “b notice” is part of the irs’s backup withholding program, which provides notices to payers (such as businesses) who file certain information returns with incorrect taxpayer identification numbers (tins), which includes social security numbers (ssns) and employer identification numbers (eins).