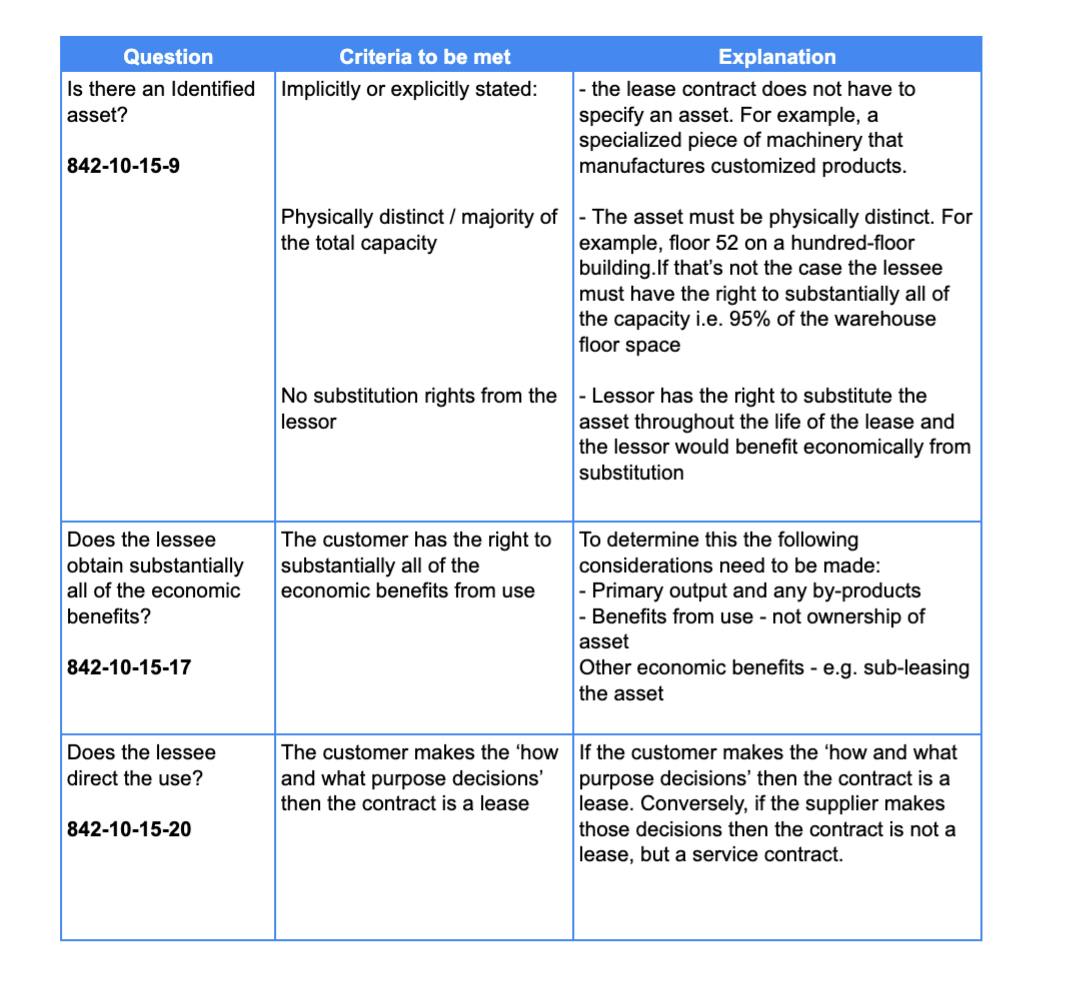

A lease liability is required to be calculated for both asc 842 & ifrs 16. Find hot topics, common pitfalls, and practical expedients for lease accounting. Web discover asc 842 journal entries with leasecrunch's guide. Asc 842 led to changes in the accounting of lease contracts and is a challenge for many companies. Web most companies have recently adopted asc 842, leases.

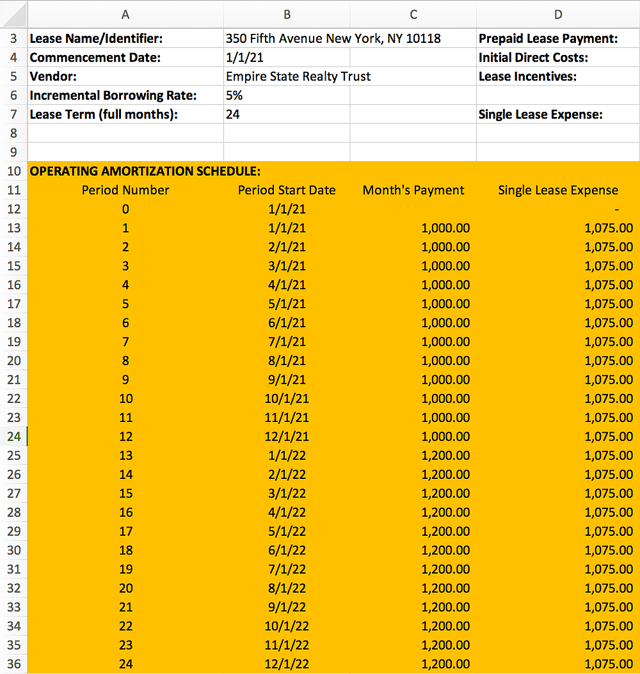

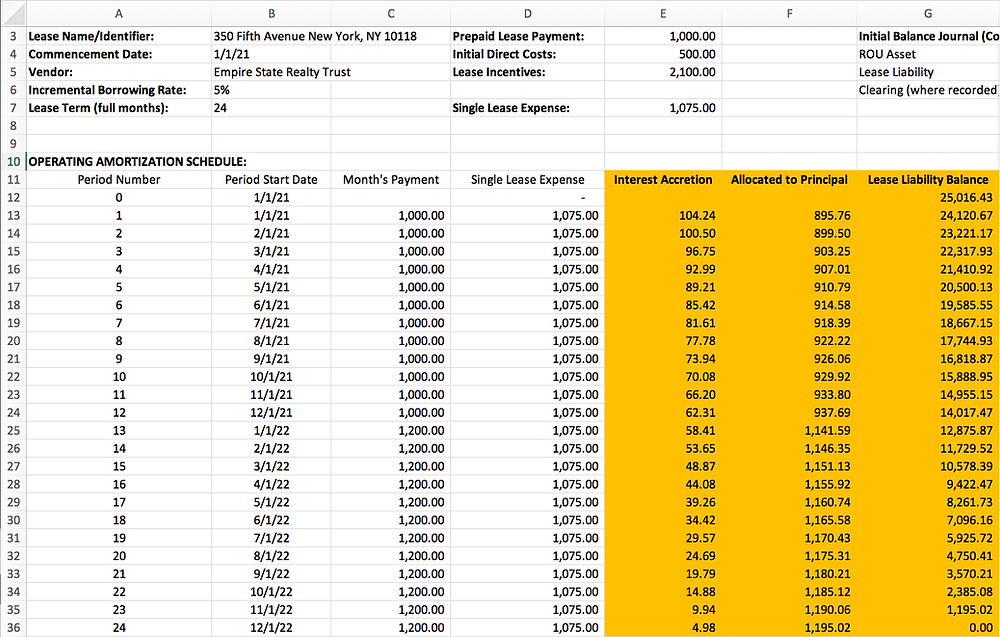

Web learn about the asc 842 disclosure requirements for finance (capital) leases and operating leases with a full example and explanation. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Web this article details how to calculate the lease expense the right of uf use asset classified as an operating lease under asc 842. This guide discusses lessee and lessor accounting under asc 842. Web asc 842 leases calculation template.

Learn more about the challenges of using excel templates for asc 842 compliance and our solutions. Web read a full guide on asc 842, the new lease accounting standard, including a full example of an operating lease for lessees. The level of effort applied to. Asc 842 led to changes in the accounting of lease contracts and is a challenge for many companies. Learn about operating and finance lease entries, equity impact, and cash flow requirements!

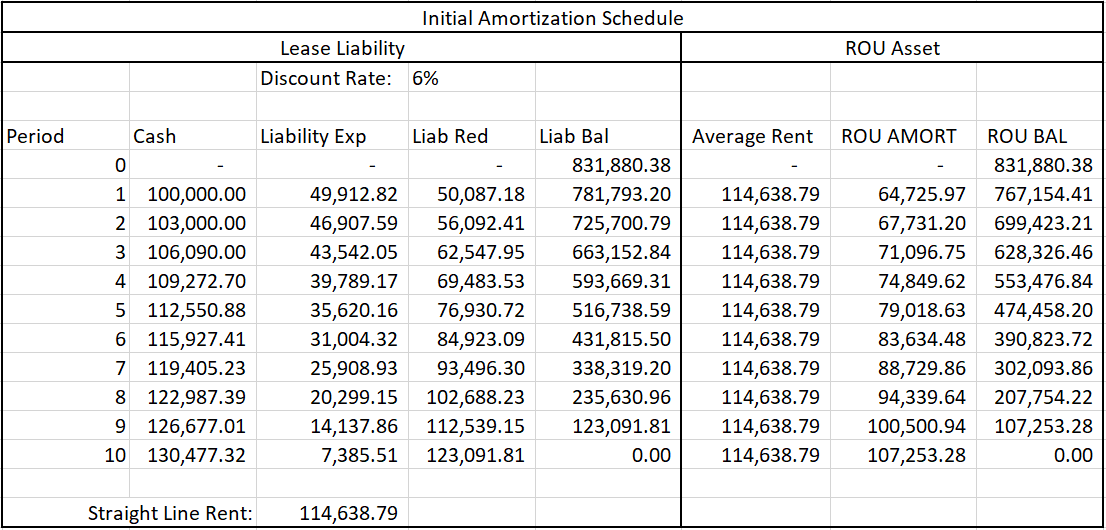

Web the fasb’s new standard on leases, asc 842, is effective for all entities. Find hot topics, common pitfalls, and practical expedients for lease accounting. Web with this lease amortization schedule you will be able to : Web this article details how to calculate the lease expense the right of uf use asset classified as an operating lease under asc 842. Web most companies have recently adopted asc 842, leases. Web under asc 842, operating leases and financial leases have different amortization calculations. Web on february 25, 2016, the fasb issued accounting standards update no. With our excel template, you will be guided on how to. A lease liability is required to be calculated for both asc 842 & ifrs 16. Asc 842 led to changes in the accounting of lease contracts and is a challenge for many companies. Web learn about the asc 842 disclosure requirements for finance (capital) leases and operating leases with a full example and explanation. This guide discusses lessee and lessor accounting under asc 842. Web a detailed calculation example of how to calculate a lease liability and right of use asset for a finance lease in compliance with asc 842. Web the lease liability is defined as the present value of your future lease payments. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842).

Learn About Operating And Finance Lease Entries, Equity Impact, And Cash Flow Requirements!

A lease liability is required to be calculated for both asc 842 & ifrs 16. Web asc 842 leases calculation template. This is calculated as the initial step in accounting for a lease under asc 842,. Web the fasb’s new standard on leases, asc 842, is effective for all entities.

Web Download Our Free Asc 842 Lease Accounting Calculator And Calculate The Accounting Impact Of Leases Under New Lease Accounting Standard Us Gaap (Topic 842).

Web learn how to apply asc 842, the lease accounting standard, to commercial real estate entities. Web the overall disclosure objective for lessees in fasb asc 842 is to provide information that enables users of the financial statements to assess the effects leases. With our excel template, you will be guided on how to. Web the lease liability is the present value of the known future lease payments at a point in time.

Web Read A Full Guide On Asc 842, The New Lease Accounting Standard, Including A Full Example Of An Operating Lease For Lessees.

Web with this lease amortization schedule you will be able to : Web cross reference report and archive to locate and access legacy standards. The level of effort applied to. Learn more about the challenges of using excel templates for asc 842 compliance and our solutions.

This Guide Discusses Lessee And Lessor Accounting Under Asc 842.

Web on february 25, 2016, the fasb issued accounting standards update no. Web under asc 842, operating leases and financial leases have different amortization calculations. Web learn about the asc 842 disclosure requirements for finance (capital) leases and operating leases with a full example and explanation. Find hot topics, common pitfalls, and practical expedients for lease accounting.