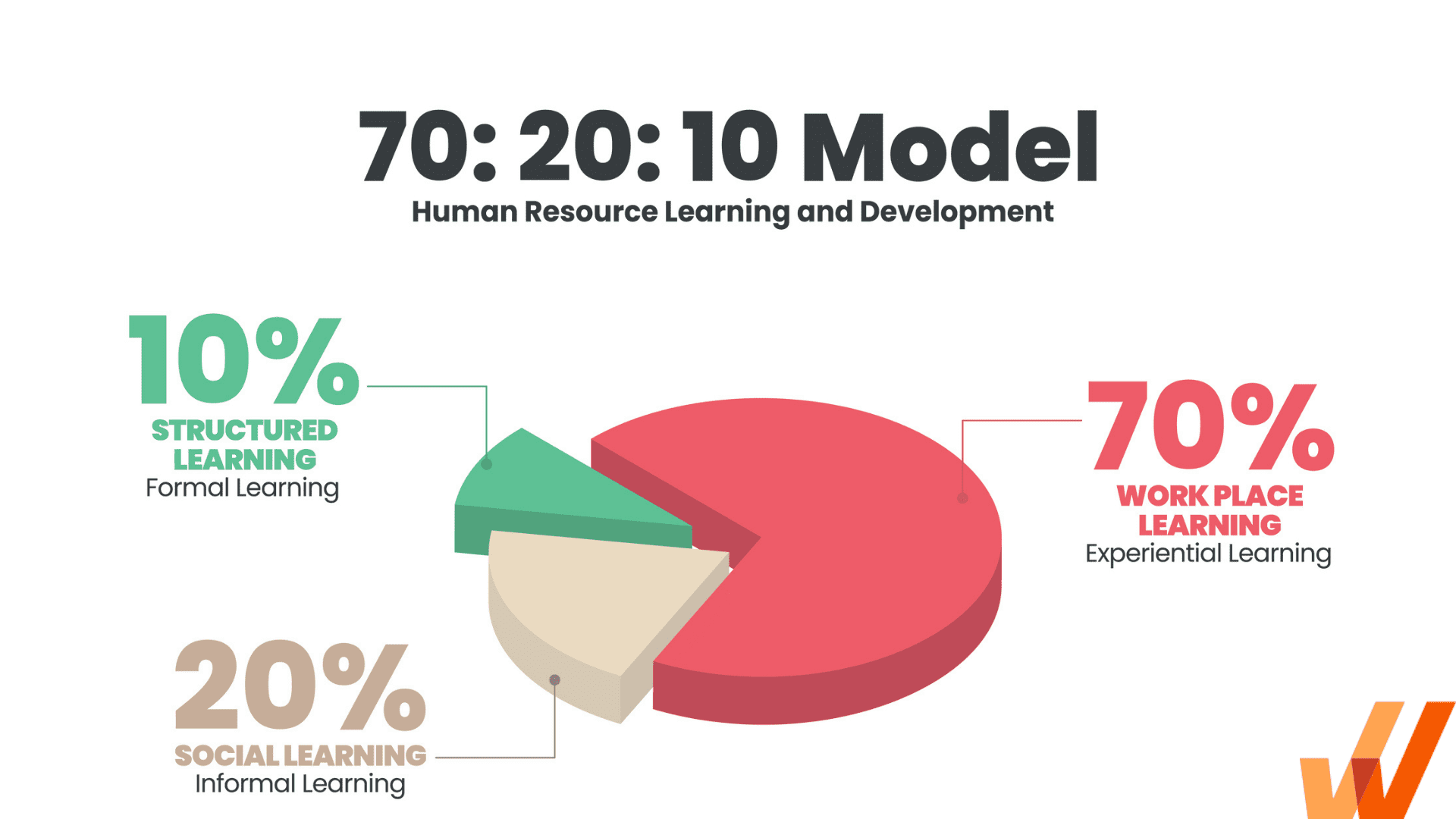

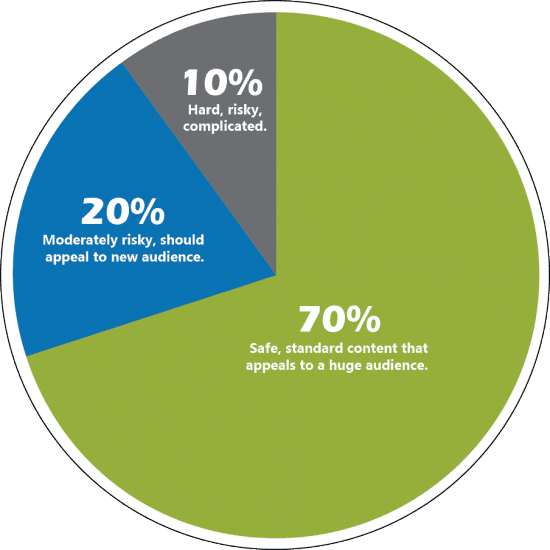

With this rule, you’ll see exactly where your money goes, and if you’re overextending in certain areas. Here’s how it works and how it helps you save and pay down debt. Use 70% of your income on wants and needs You'll use your net monthly income as the baseline for how to budget each month. Plus, you can tweak the percentages to match your needs.

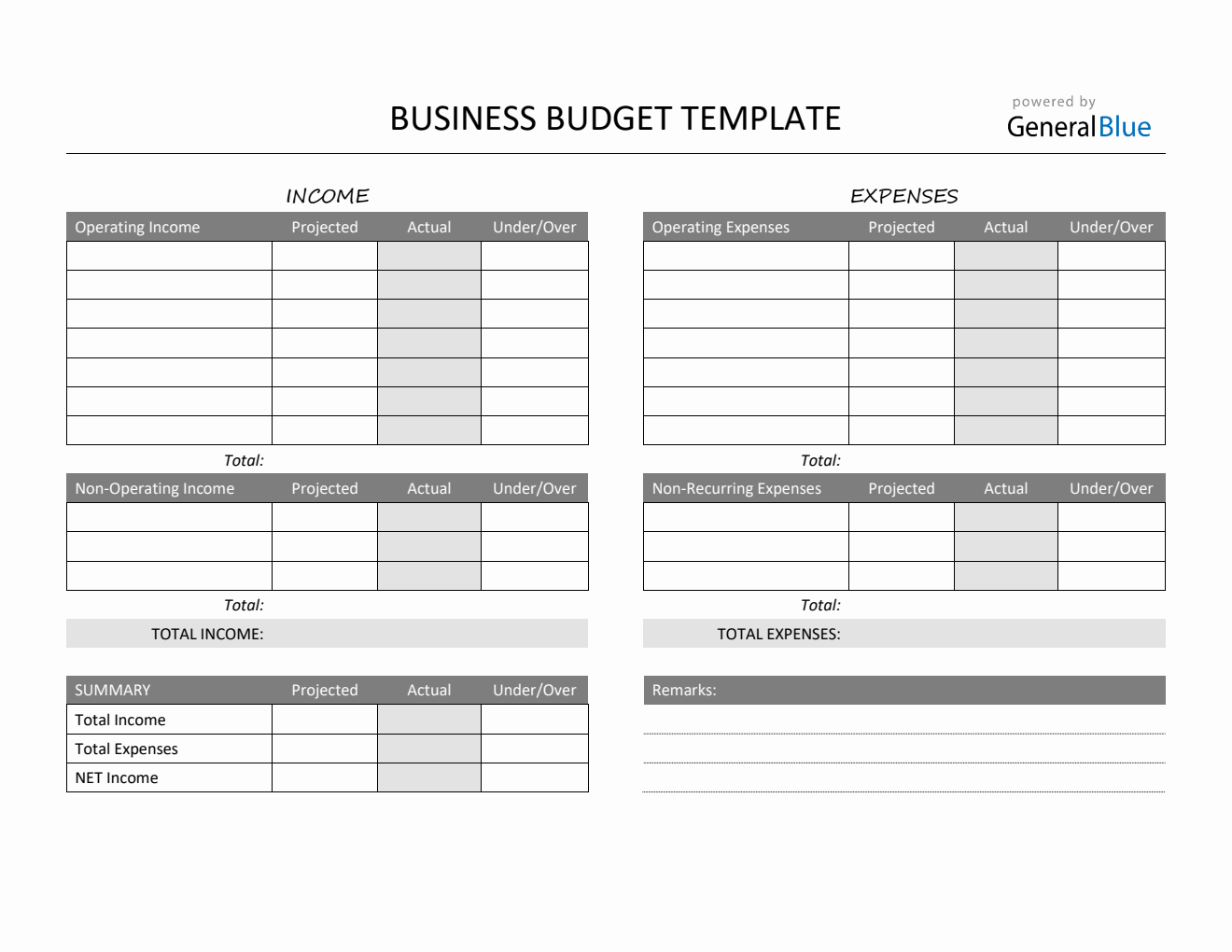

Web the 70/20/10 budget offers a simple solution to track expenses, regain control of finances, and achieve savings goals. Use 70% of your income on wants and needs Designate 70% for living expenses. It is a very simple way to allocate your. Web download free excel budget templates to manage your finances.

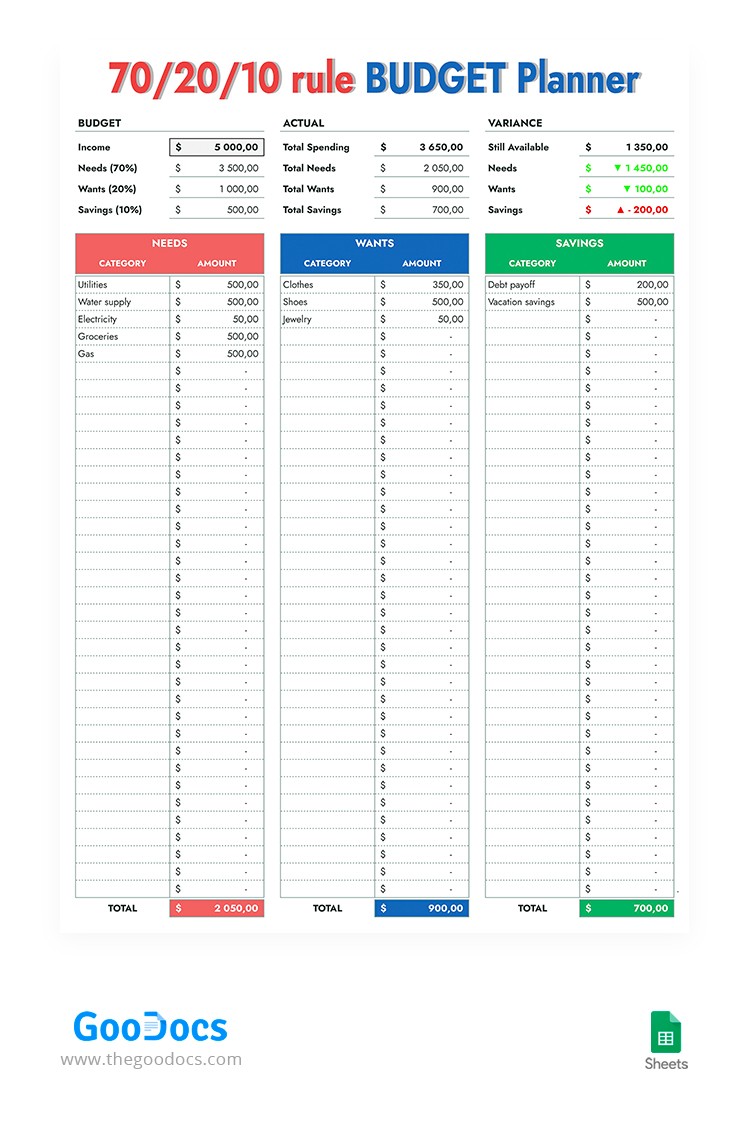

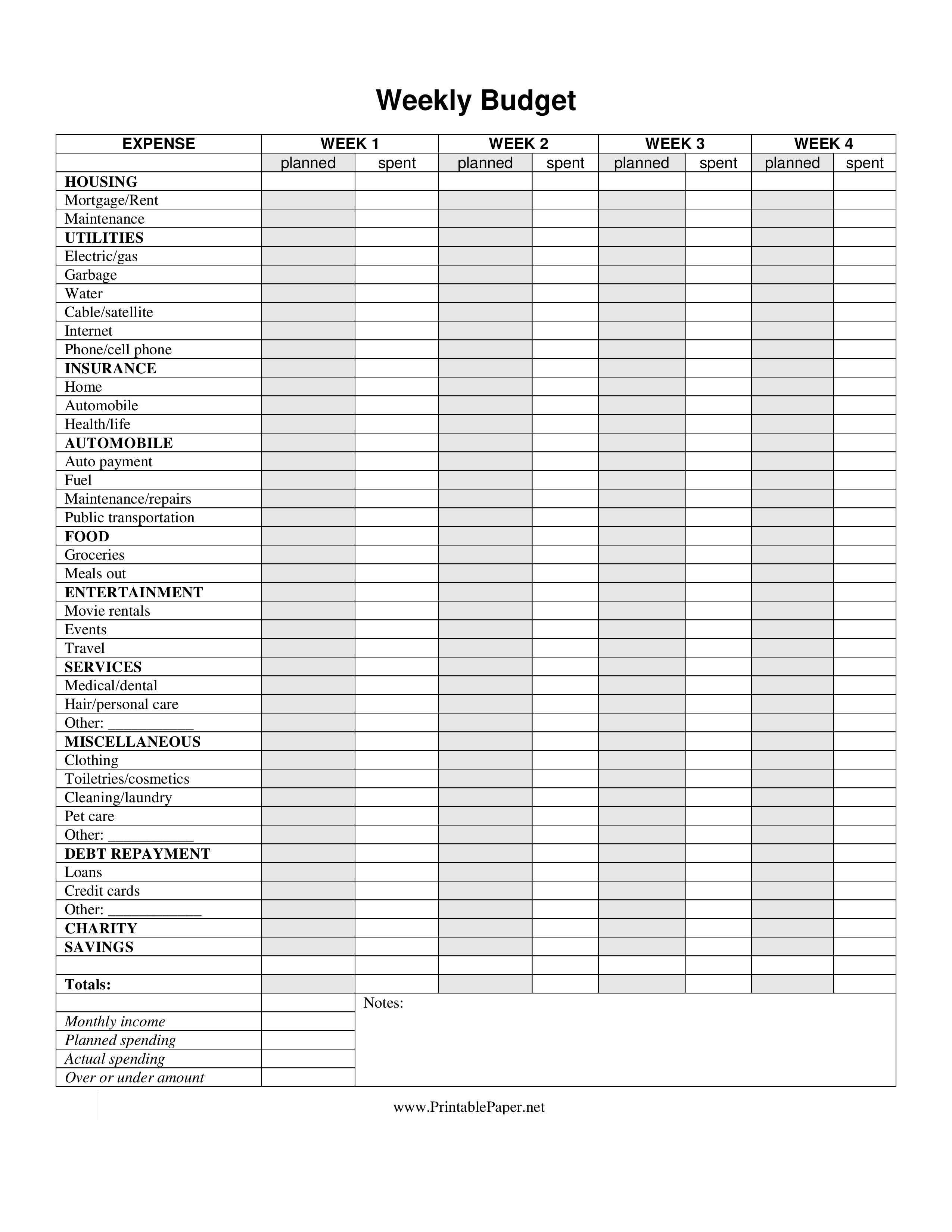

70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. 20 percent should be saved or put into investments, leaving 10 percent for debt repayment. Web the 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go. Web download free excel budget templates to manage your finances. Web get ahead in 2024 with our 70/20/10 monthly budget planner a free and editable google sheet and excel template.

Take control of your financial destiny by embracing intentional money management. This post may contain affiliate links. Web download free excel budget templates to manage your finances. Web take complete control of your finances, change your money habits and start your path toward financial freedom! You'll use your net monthly income as the baseline for how to budget each month. Web 70/20/10 monthly budget spreadsheet template for excel & google sheets, monthly budget planner spreadsheet, personal finance tracker. This includes your mortgage/rent, groceries, gas for the car, childcare, etc. Web welcome to the simple way to start budgeting with this annual and monthly budget tracker. 20% of your income towards your savings. This budgeting system makes it easy to create budget categories that you add money to each month. Kickstart your personal finance voyage with. Allocate your budget wisely into 3 main categories: Learn how the 70 20 10 rule for money works and how to use it to make a budget. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis. Designate 70% for living expenses.

Plus, You Can Tweak The Percentages To Match Your Needs.

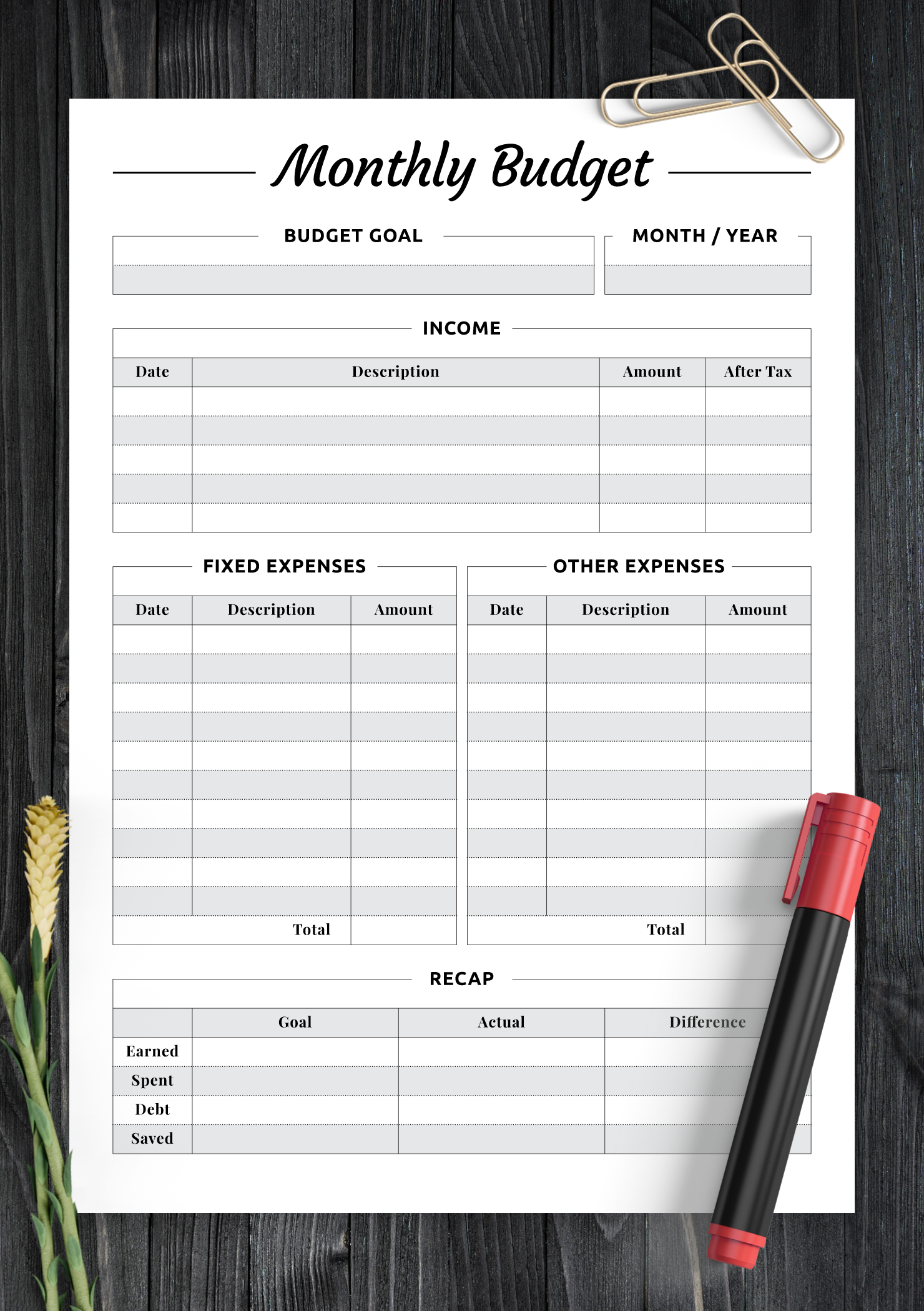

Web welcome to the simple way to start budgeting with this annual and monthly budget tracker. Web upgrade your money management game with our 50/30/20 budget spreadsheet! Here’s how it works and how it helps you save and pay down debt. With this rule, you’ll see exactly where your money goes, and if you’re overextending in certain areas.

By Allocating Your Available Income Into These Three Distinct Categories, You Can Better Manage Your Money On A Daily Basis.

Then, divide the money into 70% for needs and wants, 20% for savings, and 10% for debt repayment or donations. This post may contain affiliate links. You can print 12 copies and make a diy budget book for an entire year to create a monthly budget planner. Monthly spending, saving, and debt repayment and donating.

Download Now For Seamless Financial Planning!

Web download free excel budget templates to manage your finances. 70% of your income towards your monthly spending. Web get ahead in 2024 with our 70/20/10 monthly budget planner a free and editable google sheet and excel template. This includes your mortgage/rent, groceries, gas for the car, childcare, etc.

Expenses, Savings And Debt Payoff.

Web the 70/20/10 budget offers a simple solution to track expenses, regain control of finances, and achieve savings goals. We offer a simple monthly budget template in different formats, including excel, google sheets, word, google docs, pdf, or as an image. Choose from annual, business, event, family, monthly, personal, project, student, weekly, simple budget templates. Take control of your financial destiny by embracing intentional money management.