70% is for monthly expenses ( anything you spend money on). Easily allocate funds to needs/wants, savings, and debt repayment. Adjust the rule to fit high living costs or to accelerate debt repayment, ensuring it aligns with your financial goals and life changes. 20% of your income towards your savings. Web streamline your financial planning with the 70/20/10 budget tracker notion template.

70% for living expenses, 20% for savings, and 10% for debt repayment or donations. 70% of your income covers living expenses, 20% goes to savings, and 10% is for debts or personal treats. Web 70 20 10 budget template. Web 70/20/10 monthly budget spreadsheet template for excel & google sheets, monthly budget planner spreadsheet, personal finance tracker. 70% of your income towards your monthly spending.

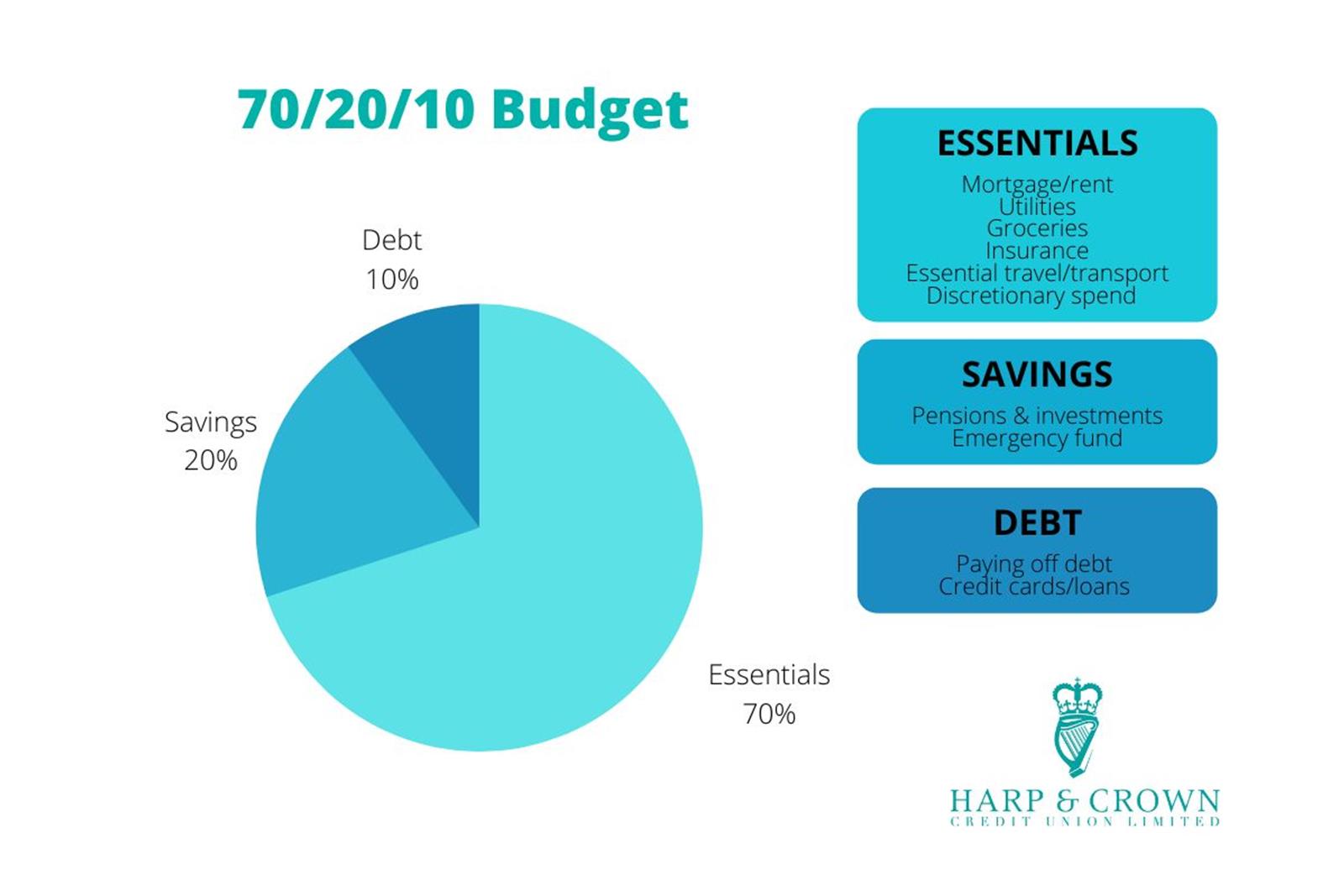

The budget method simplifies income distribution into daily expenses, savings for the future, and social responsibility activities, fostering financial freedom and flexible budgeting. With 70% allocated for daily living costs, 20% for savings and investment, and 10% for debt or giving, this method offers a balanced approach to managing your money. When learning about this rule, you may discover that there are a number of different variations to the rule. Adjust the rule to fit high living costs or to accelerate debt repayment, ensuring it aligns with your financial goals and life changes. 70% for living expenses, 20% for savings, and 10% for debt repayment or donations.

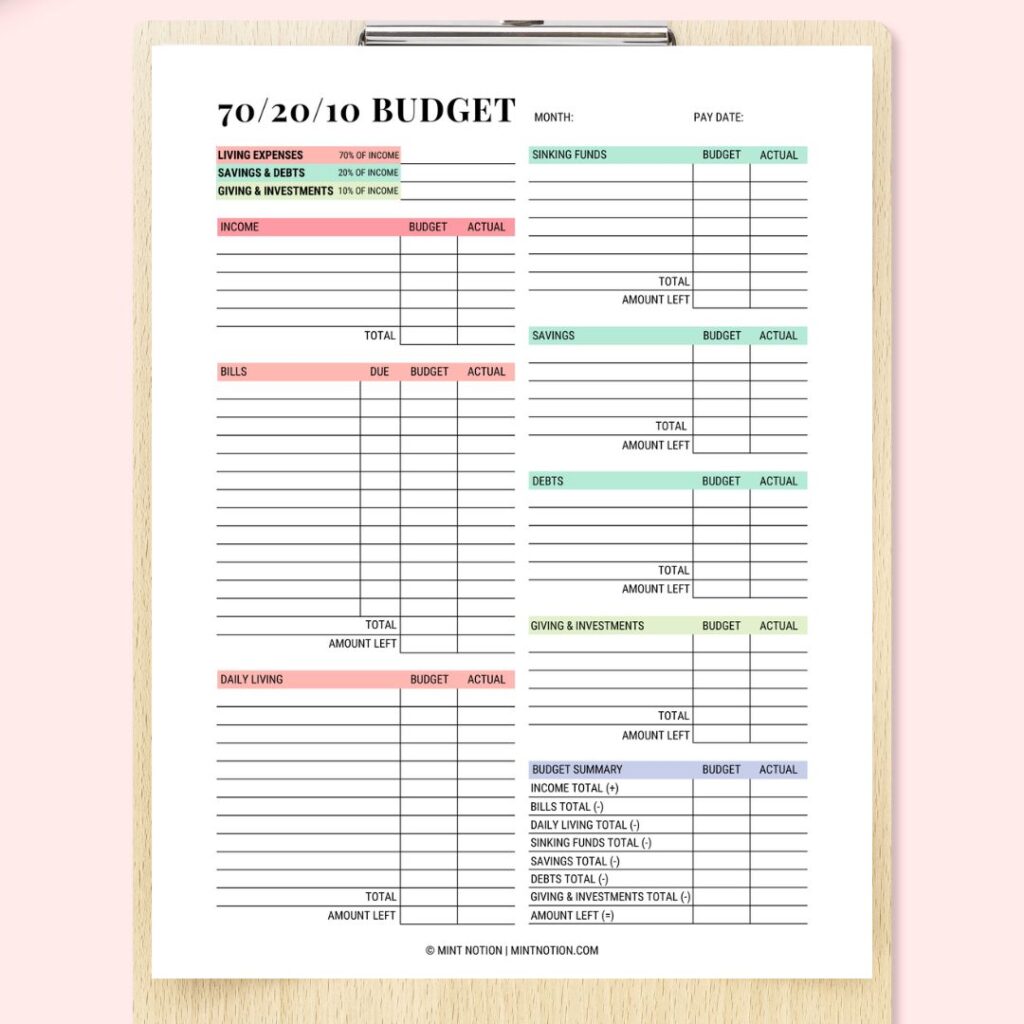

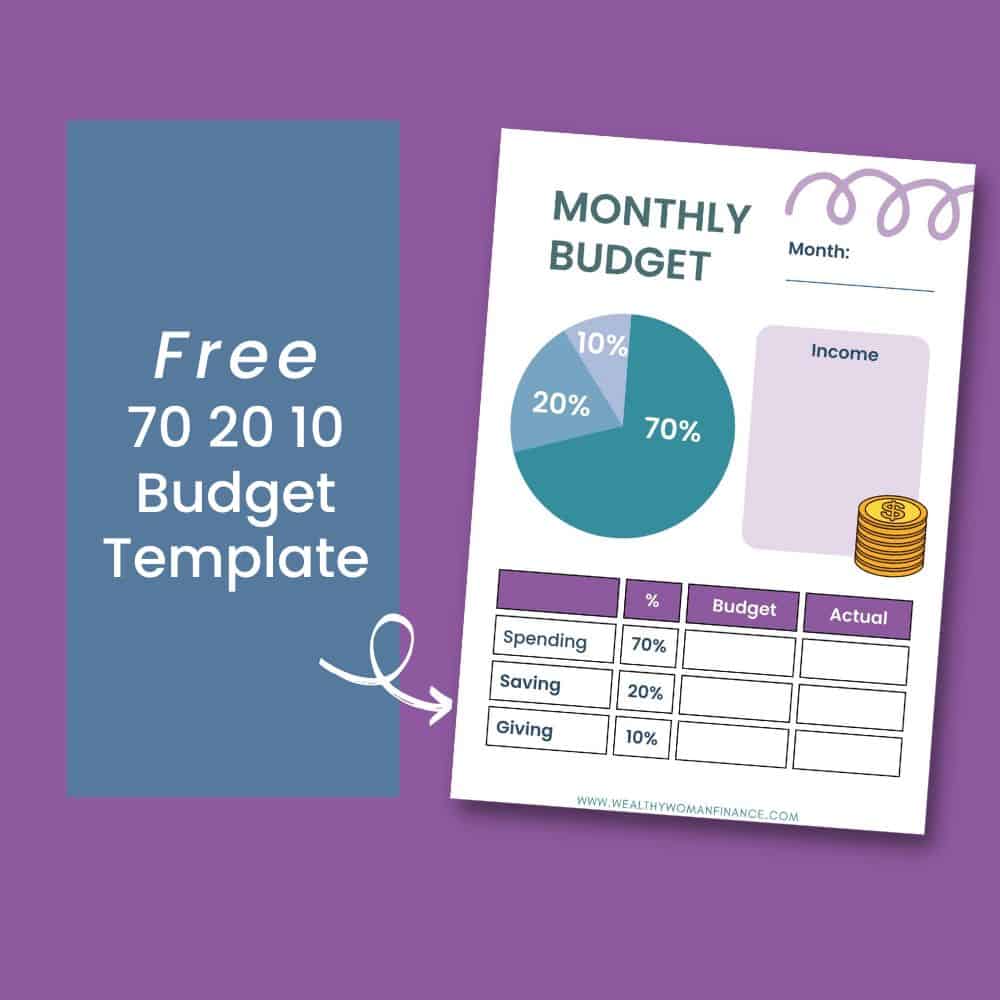

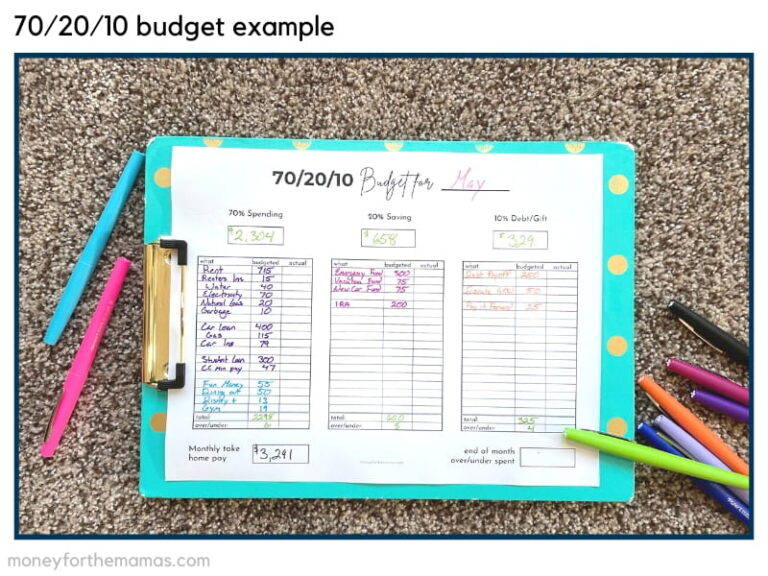

Adjust the rule to fit high living costs or to accelerate debt repayment, ensuring it aligns with your financial goals and life changes. 70% for living expenses, 20% for savings, and 10% for debt repayment or donations. Ready to try the 70/20/10 system for budgeting? The budget method simplifies income distribution into daily expenses, savings for the future, and social responsibility activities, fostering financial freedom and flexible budgeting. Allocate your budget wisely into 3 main. Here's how the 70% budget rule works. Web the 70:20:10 rules works by allocating percentages of your money into three categories. Web 70/20/10 monthly budget spreadsheet template for excel & google sheets, monthly budget planner spreadsheet, personal finance tracker. Web 70 20 10 budget template. This post may contain affiliate links. 70% is for monthly expenses ( anything you spend money on). Expenses, savings and debt payoff. This free budgeting template can help you get started! The 70 20 10 budget rule simplifies money management: 70% of your income towards your monthly spending.

Allocate Your Budget Wisely Into 3 Main.

Monthly spending, saving, and debt repayment and donating. Then, divide the money into 70% for needs and wants, 20% for savings, and 10% for debt repayment or donations. We’re going to walk you through everything you need to know (and a free printable budget template) about how to use the 70/20/10 budget. The budget method simplifies income distribution into daily expenses, savings for the future, and social responsibility activities, fostering financial freedom and flexible budgeting.

Web 70/20/10 Monthly Budget Spreadsheet Template For Excel & Google Sheets, Monthly Budget Planner Spreadsheet, Personal Finance Tracker.

Web it's simple, really. Web streamline your financial planning with the 70/20/10 budget tracker notion template. (if you’d like an even more streamlined budget plan, you could check out the 80/20 budget and apply it to your budget instead.) Budgeting doesn’t have to be complicated—you can take control of your finances and afford that vacation if you do it right.

Here's How The 70% Budget Rule Works.

The 70 20 10 budget rule simplifies money management: Web the 70:20:10 rules works by allocating percentages of your money into three categories. 20% of your income towards your savings. Web the 70/20/10 budget rule is a money management strategy you can use to dictate where you want your income to go.

Here’s How It Works And How It Helps You Save And Pay Down Debt.

This free budgeting template can help you get started! Expenses, savings and debt payoff. 70% for living expenses, 20% for savings, and 10% for debt repayment or donations. In this article, we explore the benefits of the 70/20/10 budget and outline strategies to implement it.