Web by forming a 508 (c) (1) (a), you can exempt your business from some of the restrictions that may apply to other types of organizations. Web a nonprofit organization may be created as a corporation, a trust, or an unincorporated association. Save or instantly send your ready documents. Web how to create an esignature for the 508c1a trust template. Easily fill out pdf blank, edit, and sign them.

Save or instantly send your ready documents. Web by forming a 508 (c) (1) (a), you can exempt your business from some of the restrictions that may apply to other types of organizations. No need to install software, just go to dochub, and sign up instantly and for free. These include free speech restrictions, irs reporting requirements, and various rules and regulations of the irs. Web edit, sign, and share 508c1a trust template online.

Web complete 508c1a trust template online with us legal forms. Easily fill out pdf blank, edit, and sign them. No need to install software, just go to dochub, and sign up instantly and for free. Web by forming a 508 (c) (1) (a), you can exempt your business from some of the restrictions that may apply to other types of organizations. Web a nonprofit organization may be created as a corporation, a trust, or an unincorporated association.

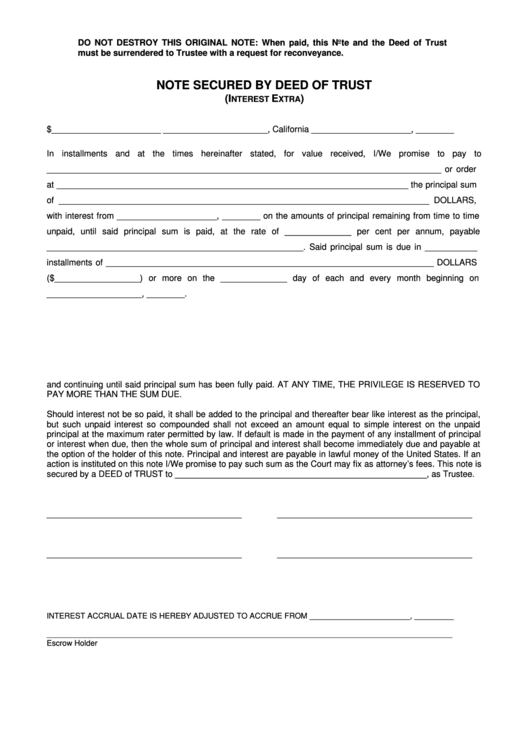

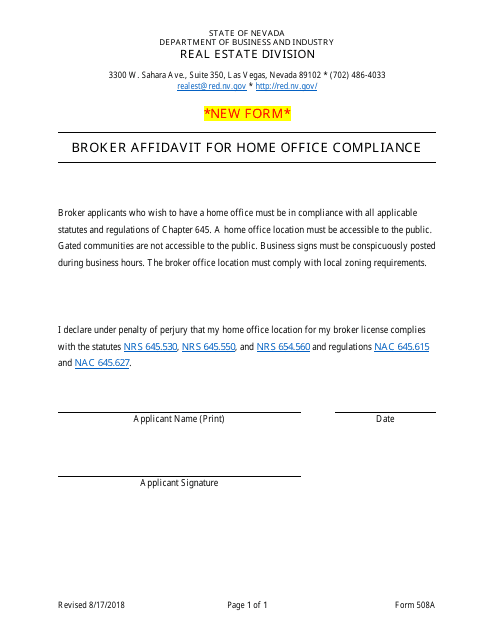

Any of these entities may qualify for exemption. Web if you're wondering the exact steps to take when opening your first 508c1a trust, then this video will break down exactly what to be aware of. Note, however, that a partnership generally may not qualify. Web edit, sign, and share 508c1a trust template online. Web complete 508c1a trust template online with us legal forms. Easily fill out pdf blank, edit, and sign them. No need to install software, just go to dochub, and sign up instantly and for free. Web how to create an esignature for the 508c1a trust template. Web a nonprofit organization may be created as a corporation, a trust, or an unincorporated association. Web by forming a 508 (c) (1) (a), you can exempt your business from some of the restrictions that may apply to other types of organizations. Save or instantly send your ready documents. These include free speech restrictions, irs reporting requirements, and various rules and regulations of the irs. Web the following are examples of a charter ( draft a) and a declaration of trust ( draft b) that contain the required information as to purposes and powers of an organization and disposition of its assets upon dissolution, in order to qualify for exemption under section 501 (c) (3).

Web Edit, Sign, And Share 508C1A Trust Template Online.

Web the following are examples of a charter ( draft a) and a declaration of trust ( draft b) that contain the required information as to purposes and powers of an organization and disposition of its assets upon dissolution, in order to qualify for exemption under section 501 (c) (3). Web how to create an esignature for the 508c1a trust template. No need to install software, just go to dochub, and sign up instantly and for free. Web a nonprofit organization may be created as a corporation, a trust, or an unincorporated association.

Web By Forming A 508 (C) (1) (A), You Can Exempt Your Business From Some Of The Restrictions That May Apply To Other Types Of Organizations.

Easily fill out pdf blank, edit, and sign them. Any of these entities may qualify for exemption. Note, however, that a partnership generally may not qualify. Save or instantly send your ready documents.

These Include Free Speech Restrictions, Irs Reporting Requirements, And Various Rules And Regulations Of The Irs.

Web if you're wondering the exact steps to take when opening your first 508c1a trust, then this video will break down exactly what to be aware of. Web complete 508c1a trust template online with us legal forms.